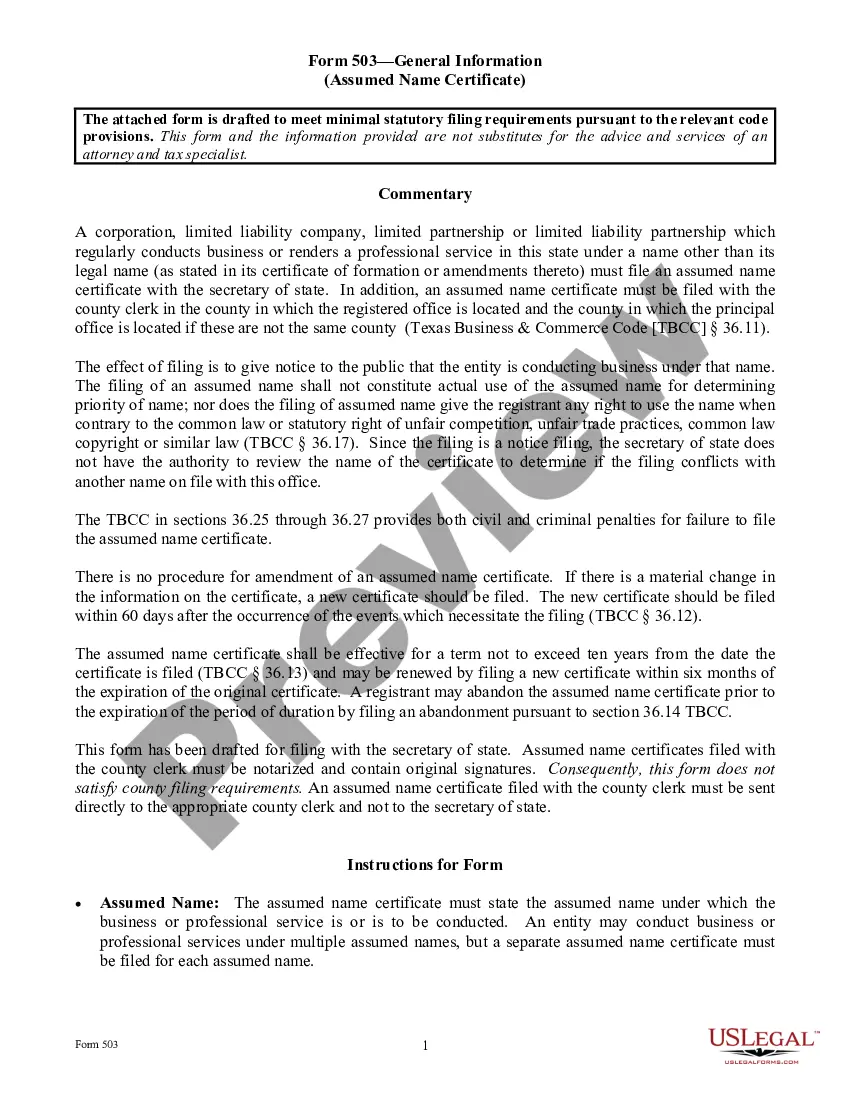

This form is a due diligence checklist that outlines information pertinent to non-employee directors in a business transaction.

Kansas Nonemployee Director Checklist

Description

How to fill out Kansas Nonemployee Director Checklist?

US Legal Forms - among the largest libraries of legal kinds in the States - provides a wide array of legal record web templates you may download or print out. Making use of the internet site, you can get 1000s of kinds for company and individual functions, sorted by groups, states, or search phrases.You can get the latest variations of kinds just like the Kansas Nonemployee Director Checklist within minutes.

If you have a registration, log in and download Kansas Nonemployee Director Checklist from your US Legal Forms collection. The Down load switch can look on each and every develop you view. You get access to all in the past acquired kinds in the My Forms tab of your respective bank account.

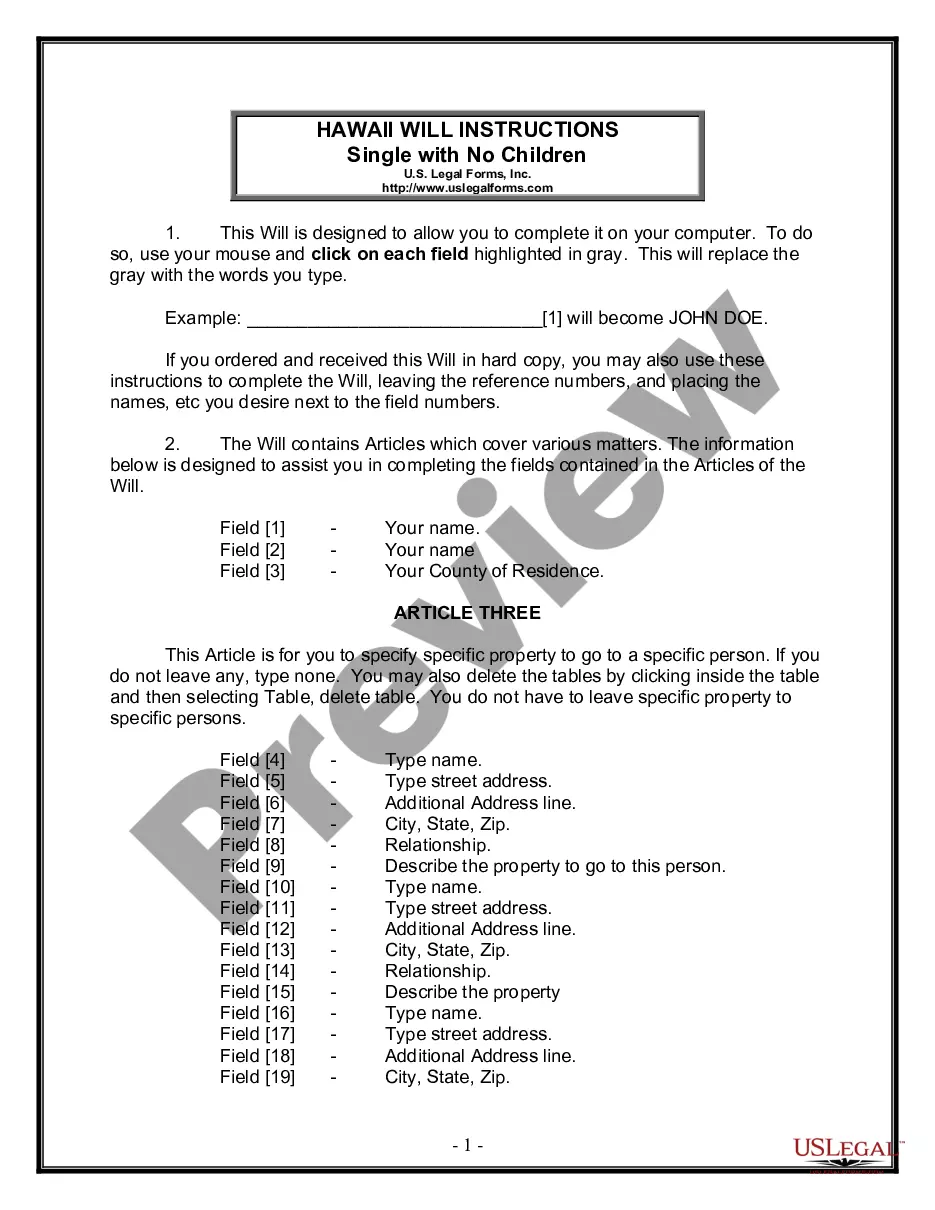

If you would like use US Legal Forms the very first time, allow me to share basic recommendations to help you get started off:

- Make sure you have chosen the best develop to your area/state. Click the Preview switch to analyze the form`s information. Read the develop outline to actually have chosen the right develop.

- When the develop does not fit your needs, make use of the Lookup field towards the top of the screen to get the one who does.

- In case you are content with the form, affirm your decision by simply clicking the Purchase now switch. Then, choose the pricing program you prefer and supply your qualifications to sign up for an bank account.

- Procedure the purchase. Use your Visa or Mastercard or PayPal bank account to finish the purchase.

- Choose the format and download the form on the device.

- Make changes. Fill up, edit and print out and indication the acquired Kansas Nonemployee Director Checklist.

Each web template you put into your account does not have an expiry time and it is your own eternally. So, in order to download or print out one more duplicate, just visit the My Forms area and click on in the develop you want.

Gain access to the Kansas Nonemployee Director Checklist with US Legal Forms, the most considerable collection of legal record web templates. Use 1000s of expert and express-certain web templates that meet your small business or individual demands and needs.

Form popularity

FAQ

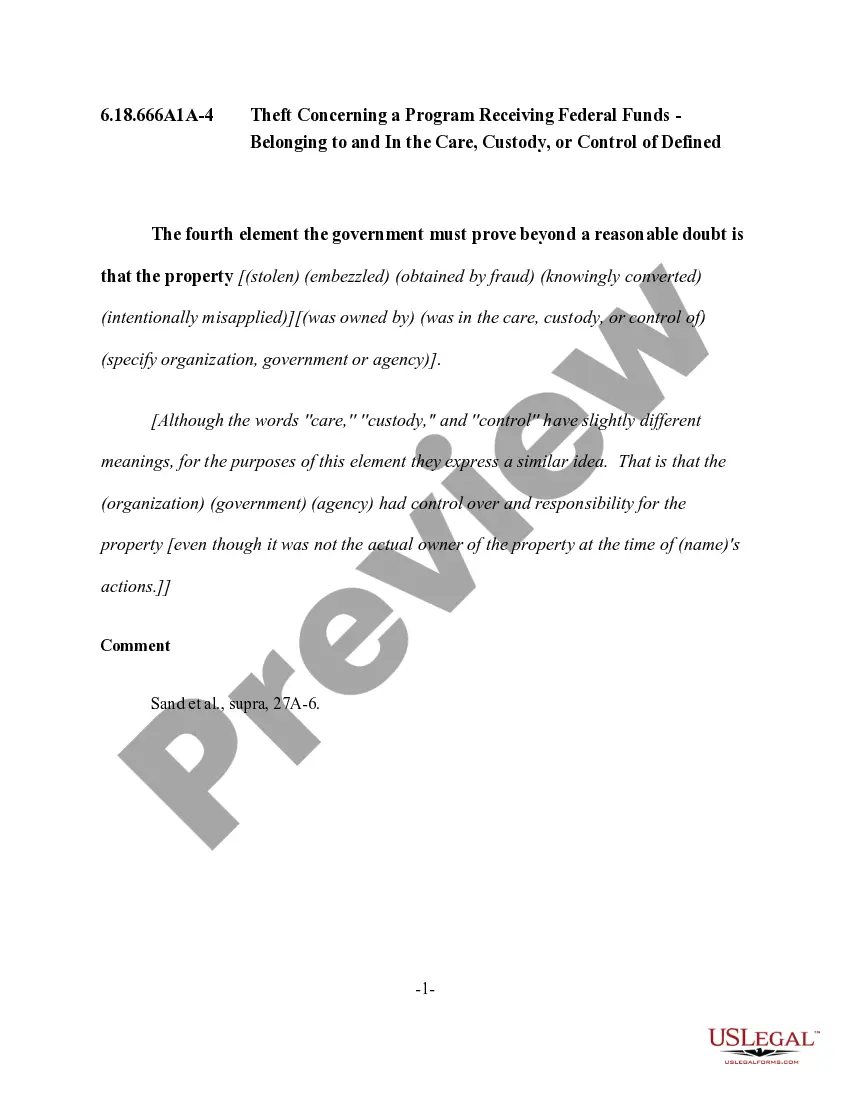

The nonemployee compensation reported in Box 1 of Form 1099-NEC is generally reported as self-employment income and likely subject self-employment tax. Payments to individuals that are not reportable on the 1099-NEC form, would typically be reported on Form 1099-MISC.

You'll use the amount in Box 1 on your Form(s) 1099-NEC to report your self-employment income. Instead of putting this information directly on Form 1040, you'll report it on Schedule C.

California requires you to file 1099-NEC forms with the California Franchise Tax Board.

There are two methods to enter the Non-employee compensation and have it flow to the 1040, Line 21:Code the 1099-MISC with the Non-employee Compensation as Non-SE income. Or,Move the income from the 1099-MISC, Line 7 - Nonemployee compensation to 1099-MISC, Line 3 - Other income.

Starting in tax year 2020, nonemployee compensation may be reported to your client on Form 1099-NEC. In previous years, this type of income was typically reported on Form 1099-MISC, box 7.

Form 1099-MISC is used to report miscellaneous income. Before 2020, the 1099-MISC box 7 was used to report non-employee compensation. The forms 1099-MISC was provided instead of a Form W-2 to independent contractors who provided services but were not considered employees of the payer.

The 1099-NEC is now used to report independent contractor income. But the 1099-MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney. Although the 1099-MISC is still in use, contractor payments made in 2020 and beyond will be reported on the form 1099-NEC.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Kansas requires 1099-NEC filing. Recommended filing method: Electronic.

When filing federal copies of forms 1099 with the IRS from the state of Kansas the mailing address is: Department of the Treasury , Internal Revenue Service Center , Kansas City, MO 64999.