Kansas Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.

Description

How to fill out Revolving Credit Loan And Security Agreement Between Dixon Ticonderoga Co. And Dixon Ticonderoga, Inc.?

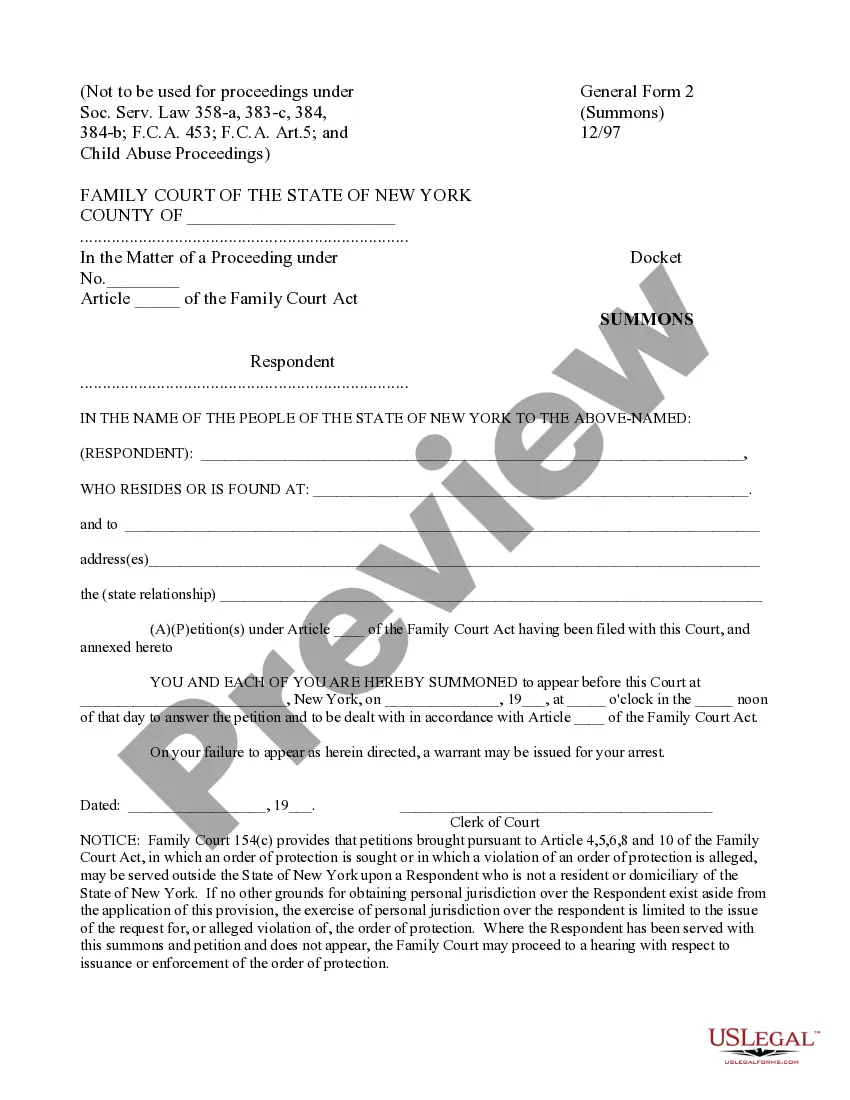

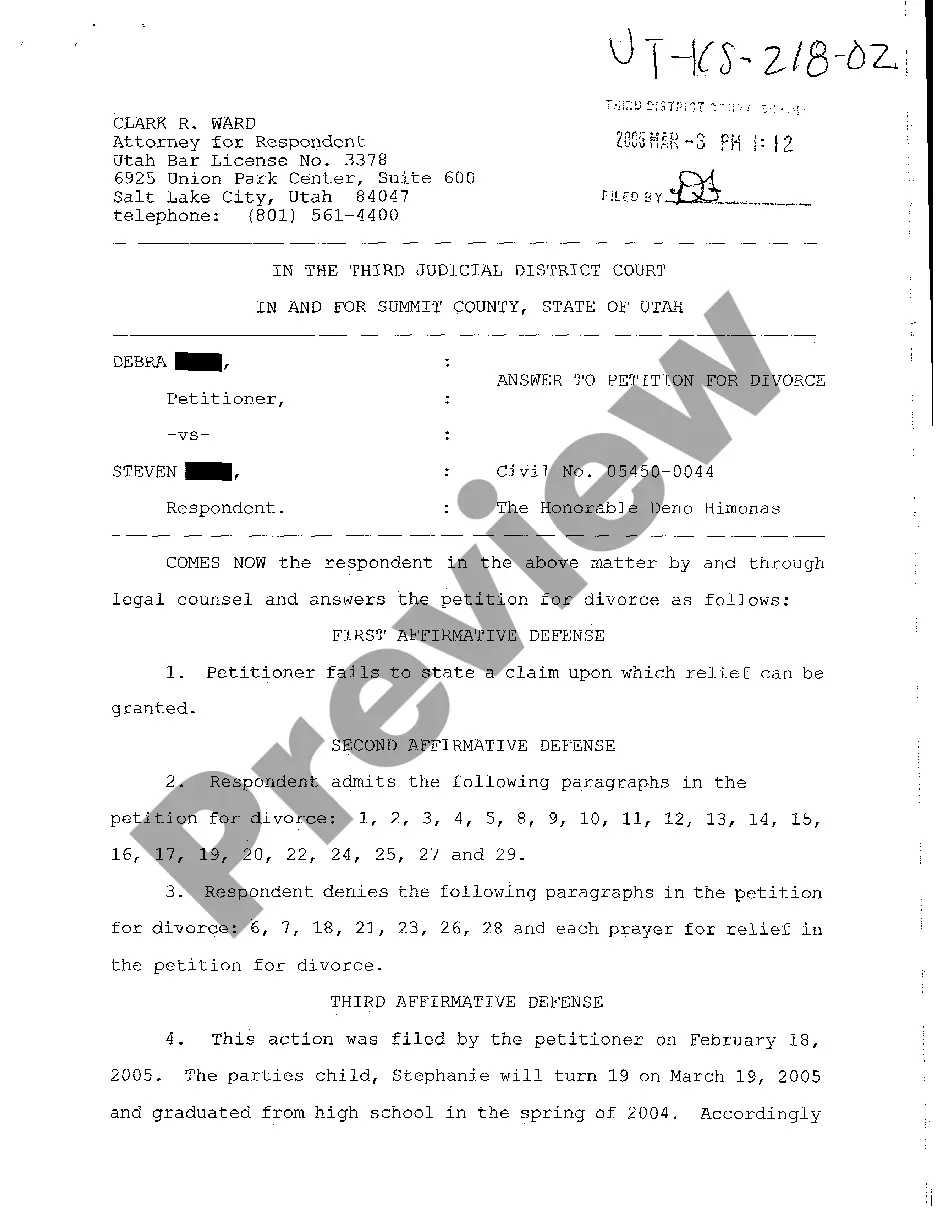

You are able to commit hours online attempting to find the authorized record web template that meets the state and federal demands you will need. US Legal Forms gives thousands of authorized types that are evaluated by specialists. You can actually acquire or print out the Kansas Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc. from your support.

If you already have a US Legal Forms profile, you can log in and then click the Down load button. Following that, you can full, edit, print out, or sign the Kansas Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc.. Every single authorized record web template you buy is the one you have eternally. To acquire another backup for any obtained form, check out the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site for the first time, keep to the simple instructions under:

- Initially, make certain you have selected the correct record web template for the state/town that you pick. Browse the form description to make sure you have picked out the correct form. If available, utilize the Review button to appear through the record web template as well.

- If you would like get another model from the form, utilize the Look for area to get the web template that meets your requirements and demands.

- Once you have discovered the web template you desire, simply click Acquire now to move forward.

- Select the costs plan you desire, type in your references, and register for an account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal profile to fund the authorized form.

- Select the formatting from the record and acquire it to the gadget.

- Make modifications to the record if necessary. You are able to full, edit and sign and print out Kansas Revolving Credit Loan and Security Agreement between Dixon Ticonderoga Co. and Dixon Ticonderoga, Inc..

Down load and print out thousands of record themes making use of the US Legal Forms website, that offers the largest variety of authorized types. Use specialist and status-certain themes to handle your business or personal demands.