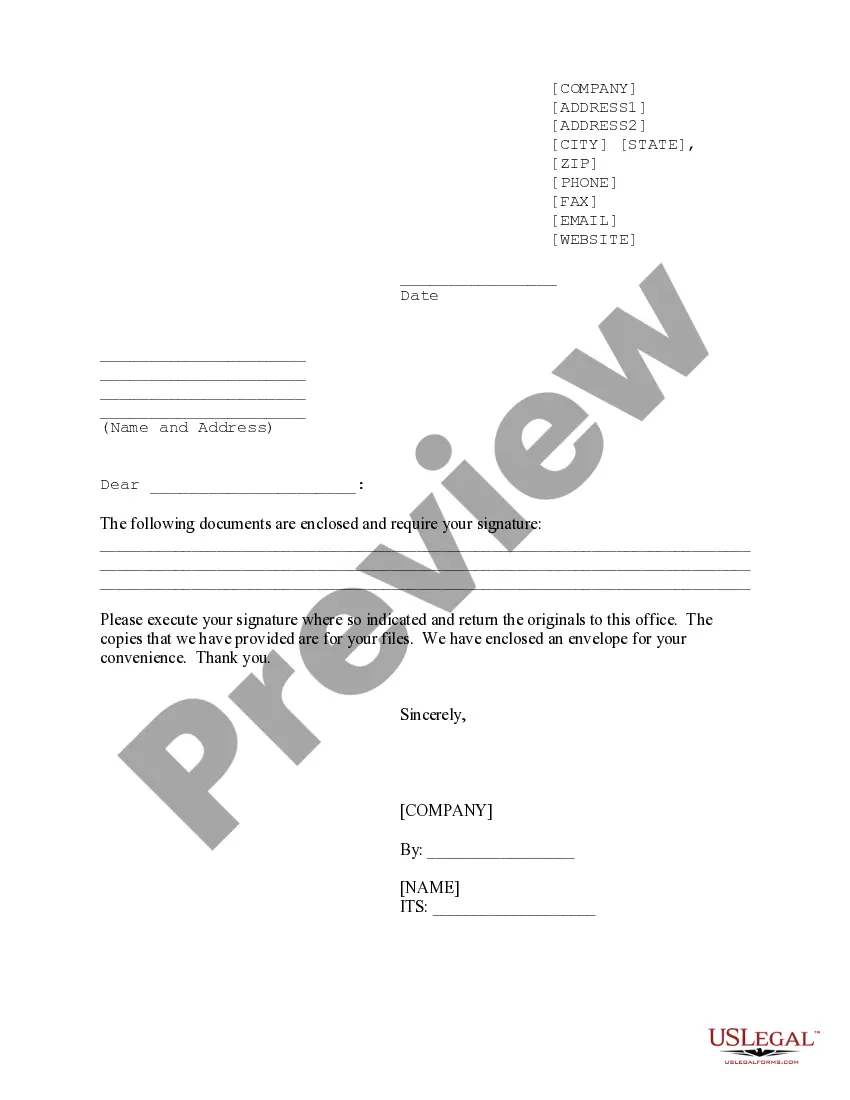

Kansas Director Option Agreement

Description

How to fill out Director Option Agreement?

If you wish to complete, acquire, or print authorized record themes, use US Legal Forms, the largest collection of authorized kinds, which can be found online. Take advantage of the site`s simple and handy look for to get the papers you will need. Different themes for business and person purposes are sorted by categories and suggests, or search phrases. Use US Legal Forms to get the Kansas Director Option Agreement in a couple of mouse clicks.

When you are presently a US Legal Forms consumer, log in in your profile and then click the Download switch to have the Kansas Director Option Agreement. You can even access kinds you earlier acquired in the My Forms tab of your own profile.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for your correct town/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s content. Do not neglect to read through the outline.

- Step 3. When you are unsatisfied with the develop, use the Search industry at the top of the monitor to discover other types in the authorized develop template.

- Step 4. Upon having discovered the form you will need, click on the Get now switch. Choose the rates plan you choose and put your qualifications to sign up for an profile.

- Step 5. Method the deal. You can utilize your charge card or PayPal profile to perform the deal.

- Step 6. Pick the formatting in the authorized develop and acquire it on your gadget.

- Step 7. Total, change and print or sign the Kansas Director Option Agreement.

Each authorized record template you get is your own forever. You possess acces to every develop you acquired in your acccount. Click on the My Forms segment and select a develop to print or acquire again.

Be competitive and acquire, and print the Kansas Director Option Agreement with US Legal Forms. There are thousands of expert and condition-distinct kinds you may use for the business or person needs.

Form popularity

FAQ

The state of Kansas does not require an LLC Operating Agreement, but it may still be recommended for many LLCs. Without an Operating Agreement, disputes are governed by the default LLC operating rules outlined in Kansas law (KS Stat § 17-7662 through 17-76,155).

That is, even if you are the only Member (sole owner) of your Kansas Limited Liability Company (a Single-Member LLC), you should have a written Operating Agreement. If you go to court, a Single-Member Operating Agreement helps prove that your Single-Member LLC is being run as a separate legal entity. Kansas LLC Operating Agreement (Free 2023 Template) LLC University ? Kansas LLC LLC University ? Kansas LLC

How to start a Kansas LLC Name your Kansas LLC. Create a business plan. Get a federal employer identification number (EIN) File Kansas LLC Articles of Organization. Choose a registered agent in Kansas. Obtain a business license and permits. Understand Kansas state tax requirements. Prepare an operating agreement. How To Start an LLC in Kansas in 11 Steps (2023) - Shopify shopify.com ? blog ? how-to-start-an-llc-in-... shopify.com ? blog ? how-to-start-an-llc-in-...

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ... Do's and Don'ts: Operating Agreements bhgrlaw.com ? 2020/08/24 ? dos-and-donts-opera... bhgrlaw.com ? 2020/08/24 ? dos-and-donts-opera...

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement. Missouri Small Business Startup Guide mo.gov ? business ? outreach ? startup_... mo.gov ? business ? outreach ? startup_...

What Must Be Included in a Kansas Real Estate Contract? Party information. The names and addresses of the parties involved in the transaction, including the buyer, seller, and any agents or brokers involved. Property description. ... Purchase price. ... Contingencies. ... Closing date. ... Disclosures.