Kansas Plan of Merger between The Trident Group, Inc., Finger Acquisition Corp., Finger Health Care Says., Inc. The Kansas Plan of Merger is a strategic agreement between The Trident Group, Inc., Finger Acquisition Corp., and Finger Health Care Says., Inc. This merger plan outlines the details and steps involved in combining these three entities to create a unified and comprehensive healthcare solutions company. The Trident Group, Inc. is a leading provider of healthcare IT solutions, specializing in healthcare management and administration systems. Finger Acquisition Corp. is a financial services company, focused on facilitating mergers and acquisitions in various industries. Finger Health Care Says., Inc. is a healthcare system management company, offering a wide range of services to healthcare providers. The Kansas Plan of Merger aims to leverage the strengths and expertise of these three entities to create a powerful healthcare solutions company that can address the evolving needs of the industry. By combining technology, financial resources, and healthcare management capabilities, the newly merged entity will be well-positioned to deliver innovative and efficient solutions to healthcare providers and payers. The Kansas Plan of Merger outlines the legal and financial aspects of the merger, including the exchange ratio for the shareholders of each company and the governance structure of the new entity. It also details the integration process, including the consolidation of operations, systems, and personnel, as well as the timeline for implementation. The merger plan emphasizes the commitment of the newly merged entity to customer satisfaction, innovation, and growth. It highlights the synergies that will be achieved through combining the technical expertise of The Trident Group, Inc., the financial capabilities of Finger Acquisition Corp., and the healthcare system management experience of Finger Health Care Says., Inc. Different types or variations of the Kansas Plan of Merger may include specific details depending on the specific merger agreement between the companies involved. These details may encompass financial terms, restructuring plans, organizational changes, and any other considerations unique to the merger in question.

Kansas Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc

Description

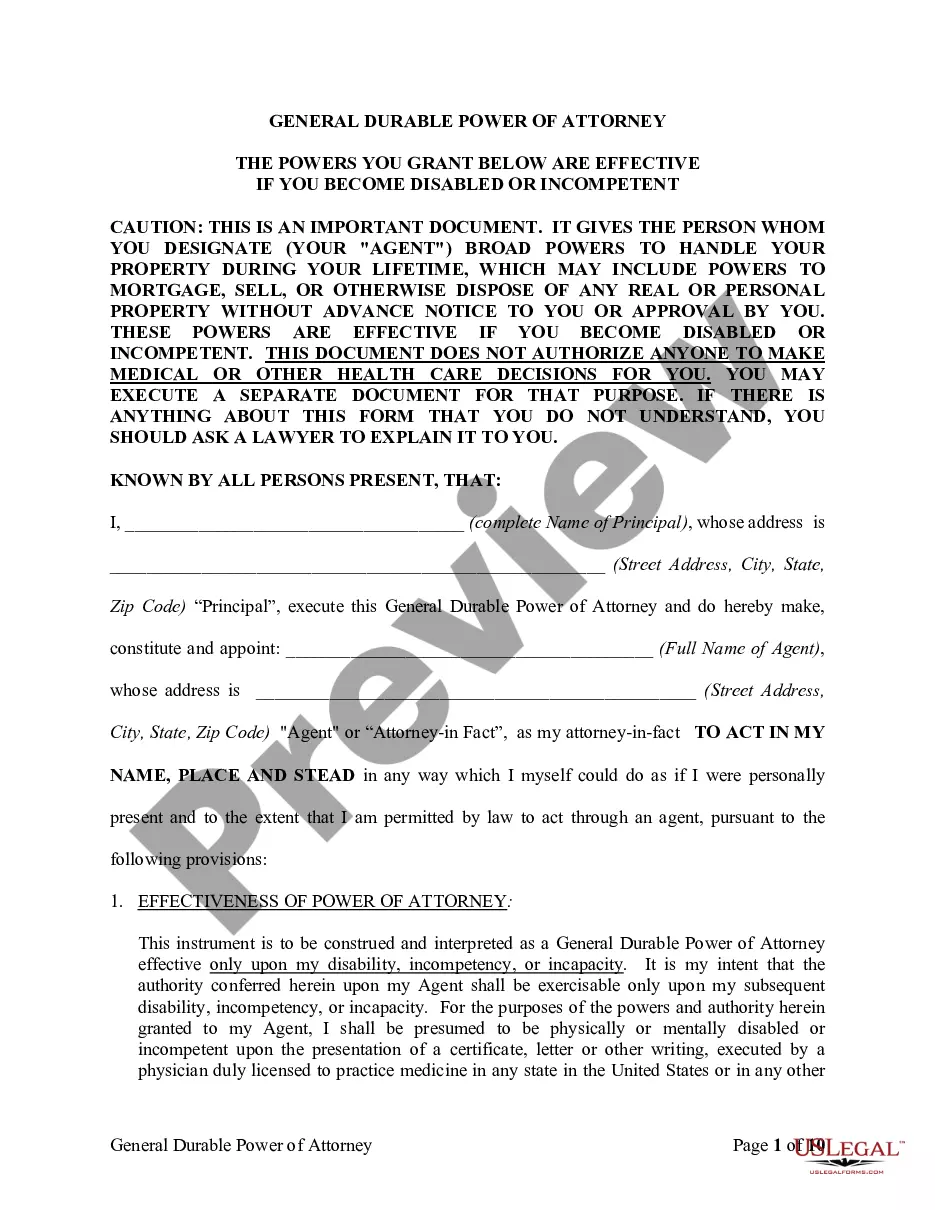

How to fill out Kansas Plan Of Merger Between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc?

You can spend time online attempting to find the lawful document web template that suits the state and federal requirements you need. US Legal Forms provides 1000s of lawful varieties that happen to be evaluated by specialists. It is possible to download or printing the Kansas Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc from my support.

If you already have a US Legal Forms account, you are able to log in and then click the Acquire switch. Afterward, you are able to comprehensive, change, printing, or signal the Kansas Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc. Every single lawful document web template you get is yours for a long time. To get one more version of the acquired type, check out the My Forms tab and then click the related switch.

If you are using the US Legal Forms web site the very first time, follow the basic recommendations below:

- Initial, make certain you have selected the best document web template to the county/city of your choosing. Read the type outline to make sure you have selected the right type. If accessible, use the Review switch to search through the document web template as well.

- If you want to discover one more version of the type, use the Search discipline to discover the web template that meets your needs and requirements.

- After you have found the web template you would like, simply click Acquire now to continue.

- Choose the prices program you would like, key in your credentials, and sign up for an account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal account to cover the lawful type.

- Choose the formatting of the document and download it in your system.

- Make adjustments in your document if required. You can comprehensive, change and signal and printing Kansas Plan of Merger between The TriZetto Group, Inc., Finserv Acquisition Corp., Finserv Health Care Sys., Inc.

Acquire and printing 1000s of document layouts while using US Legal Forms Internet site, that provides the largest selection of lawful varieties. Use specialist and status-certain layouts to handle your small business or individual needs.

Form popularity

Interesting Questions

More info

... Systems Ltd., a private UK-based company and< ...