The Kansas Registration Rights Agreement is a crucial legal document that outlines the rights and obligations of Trident Group, Inc. and its stockholders regarding the registration of securities in the state of Kansas. This agreement ensures that the stockholders have the opportunity to register their shares for public sale under certain circumstances, providing them with liquidity and investment options. The Kansas Registration Rights Agreement between Trident Group, Inc. and Trident Stockholders is structured to protect the interests of both parties involved. It sets forth the rules and procedures governing the registration process, as well as the responsibilities of the company and stockholders. By having a clear agreement in place, any potential disputes or conflicts can be resolved in an orderly manner. Key terms relevant to the Kansas Registration Rights Agreement include: 1. Trident Group, Inc: This refers to the company that is offering and issuing securities to its stockholders. Trident Group, Inc. may include specific obligations and disclosures related to its registration requirements. 2. Trident Stockholders: These are the individuals or entities that hold shares of Trident Group, Inc. and are granted specific registration rights as outlined in the agreement. 3. Registration of Securities: This pertains to the process of filing the necessary documentation with the appropriate regulatory authorities to make the securities available for public sale. Registration allows potential buyers to gain access to essential information about the securities being offered. 4. Stockholder Rights: The agreement specifies the rights granted to the Trident Stockholders, which may include demand rights, piggyback rights, and shelf registration rights. These provisions ensure that the stockholders have opportunities to register their shares under certain conditions. Different types of Kansas Registration Rights Agreements include: 1. Demand Registration Rights: These rights allow stockholders to request that Trident Group, Inc. register their shares for public sale at any time. There may be specific conditions or requirements that need to be met prior to exercising this right. 2. Piggyback Registration Rights: With these rights, stockholders have the option to "piggyback" on any registration statement filed by Trident Group, Inc. for its own securities. This allows them to include their shares in the registration and potentially sell them alongside the company's securities. 3. Shelf Registration Rights: In certain cases, Trident Group, Inc. may provide stockholders with the ability to register their shares for sale on a delayed basis. This allows them to have greater flexibility in timing the sale of their securities. It is essential for both Trident Group, Inc. and its stockholders to thoroughly understand the Kansas Registration Rights Agreement to ensure compliance with all applicable laws and regulations. This agreement serves as a vital tool in promoting transparency, fairness, and the smooth functioning of the capital markets.

Kansas Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders

Description

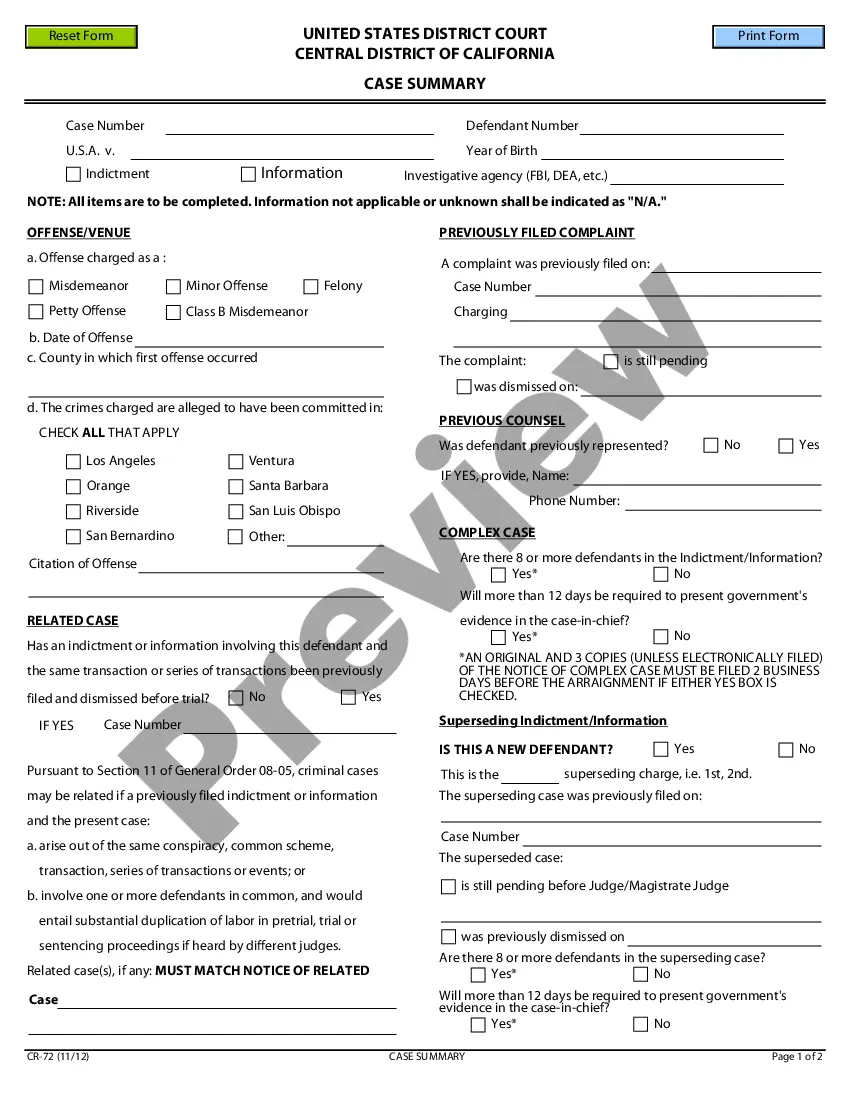

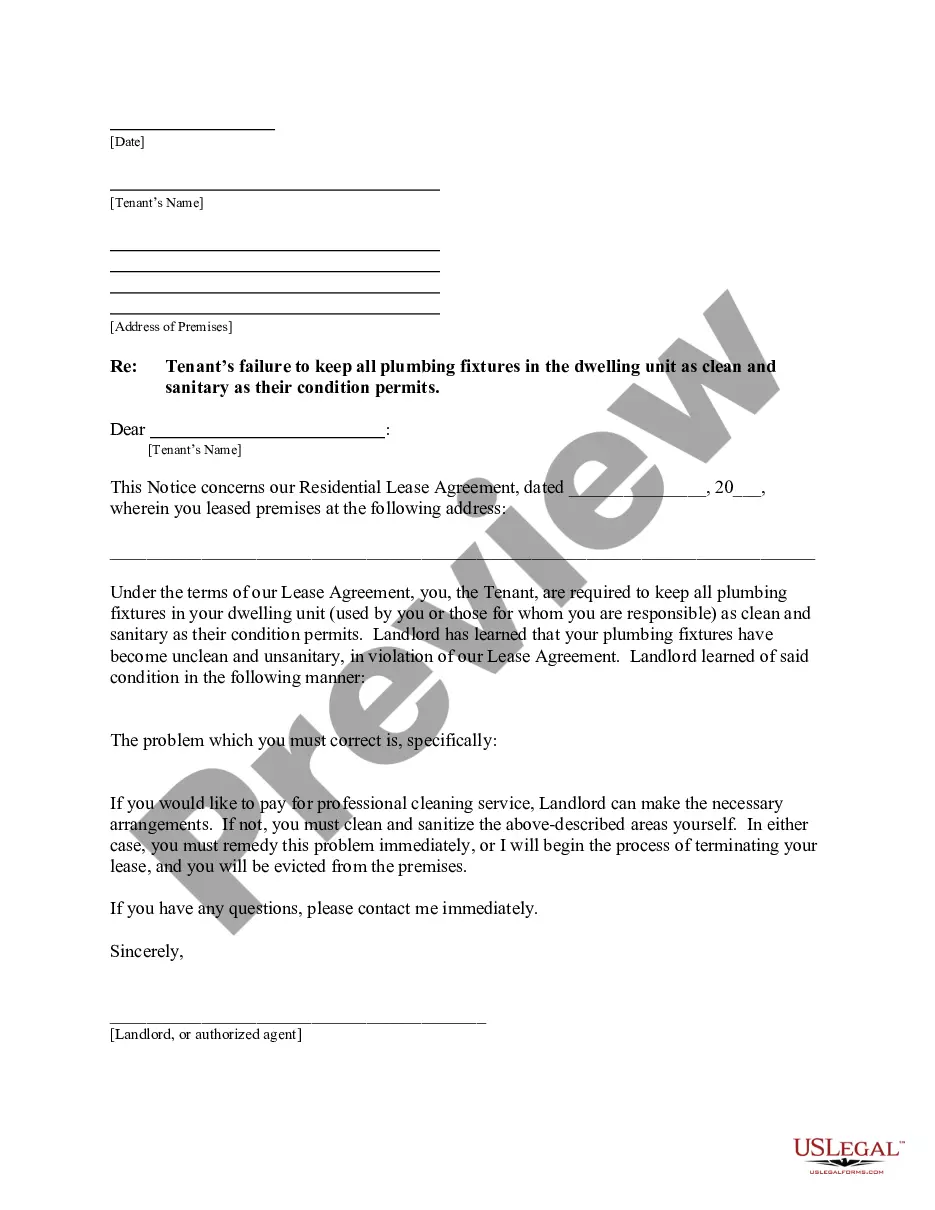

How to fill out Registration Rights Agreement Between TriZetto Group, Inc. And TriZetto Stockholders?

You can invest hrs online attempting to find the authorized file format that suits the state and federal specifications you want. US Legal Forms gives a large number of authorized kinds which can be analyzed by specialists. It is simple to obtain or print the Kansas Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders from the support.

If you have a US Legal Forms profile, you can log in and then click the Acquire option. Afterward, you can full, modify, print, or indication the Kansas Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders. Every single authorized file format you purchase is yours forever. To get an additional duplicate of the acquired type, go to the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms web site for the first time, keep to the easy recommendations listed below:

- Initially, make certain you have selected the right file format for the region/city of your choosing. Browse the type explanation to ensure you have picked the right type. If available, make use of the Review option to check from the file format also.

- If you want to locate an additional edition of the type, make use of the Look for industry to get the format that meets your needs and specifications.

- When you have found the format you want, simply click Buy now to carry on.

- Choose the costs strategy you want, key in your credentials, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal profile to purchase the authorized type.

- Choose the formatting of the file and obtain it for your product.

- Make changes for your file if possible. You can full, modify and indication and print Kansas Registration Rights Agreement between TriZetto Group, Inc. and TriZetto Stockholders.

Acquire and print a large number of file layouts using the US Legal Forms web site, which offers the largest variety of authorized kinds. Use expert and state-certain layouts to handle your small business or individual demands.