Title: Understanding the Kansas Post-Petition Loan and Security Agreement for Revolving Line of Credit Introduction: A Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit (also referred to as PPP Loan Agreement) is a legally binding contract between multiple financial institutions that provides borrowers with access to a revolving line of credit after filing for bankruptcy. This article aims to provide a detailed description of what the agreement entails, its purpose, and its different types. 1. What is a Kansas Post-Petition Loan and Security Agreement? The Kansas Post-Petition Loan and Security Agreement allows financially distressed entities, typically those undergoing bankruptcy proceedings, to obtain post-petition financing in the form of a revolving line of credit. It outlines the terms, conditions, and obligations that borrowers and lenders must abide by during the loan agreement period. 2. Purpose of the Kansas Post-Petition Loan and Security Agreement: a. Bridge Financing: This agreement serves as a financial bridge, offering struggling businesses the necessary funds to sustain their operations during the bankruptcy process. b. Reorganization and Restructuring: The revolving line of credit can empower the borrower to restructure their debts, manage expenses, and work towards financial recovery. c. Enhancement of Business Value: By securing post-petition financing, the borrower aims to maintain the value of their business, reorganize effectively, and potentially attract potential buyers or investors. 3. Key Components of the Kansas Post-Petition Loan and Security Agreement: a. Loan Amount and Interest rates: The agreement specifies the total amount available to the borrower and the applicable interest rates, which can be either fixed or variable. b. Revolving Line of Credit: Borrowers are granted access to a predetermined credit limit, allowing them to withdraw and repay funds as needed during the agreement's term. c. Loan Terms and Conditions: The agreement outlines the repayment period, frequency of payments, default consequences, and other rules and regulations governing the loan. d. Collateral and Security Interest: Lenders may require specific collateral or security interests to mitigate their risk. This could include assets, real estate, or other forms of collateral. e. Reporting and Auditing: Borrowers may be obligated to provide regular financial statements and reports to the lenders, ensuring transparency and accountability. Types of Kansas Post-Petition Loan and Security Agreement: 1. Unsecured Agreement: This type of agreement does not involve any specific collateral or security interests from the borrower. Lenders typically rely on the borrower's creditworthiness and the overall viability of their business. 2. Secured Agreement: In this type, lenders require borrowers to provide collateral or security interests. It offers enhanced security for lenders but may involve a more rigorous due diligence process. Conclusion: A Kansas Post-Petition Loan and Security Agreement provides financially distressed entities with a potentially crucial lifeline during bankruptcy proceedings. By understanding its purpose and key components, borrowers can leverage this agreement to secure post-petition financing that aids in reorganization and financial recovery.

Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit

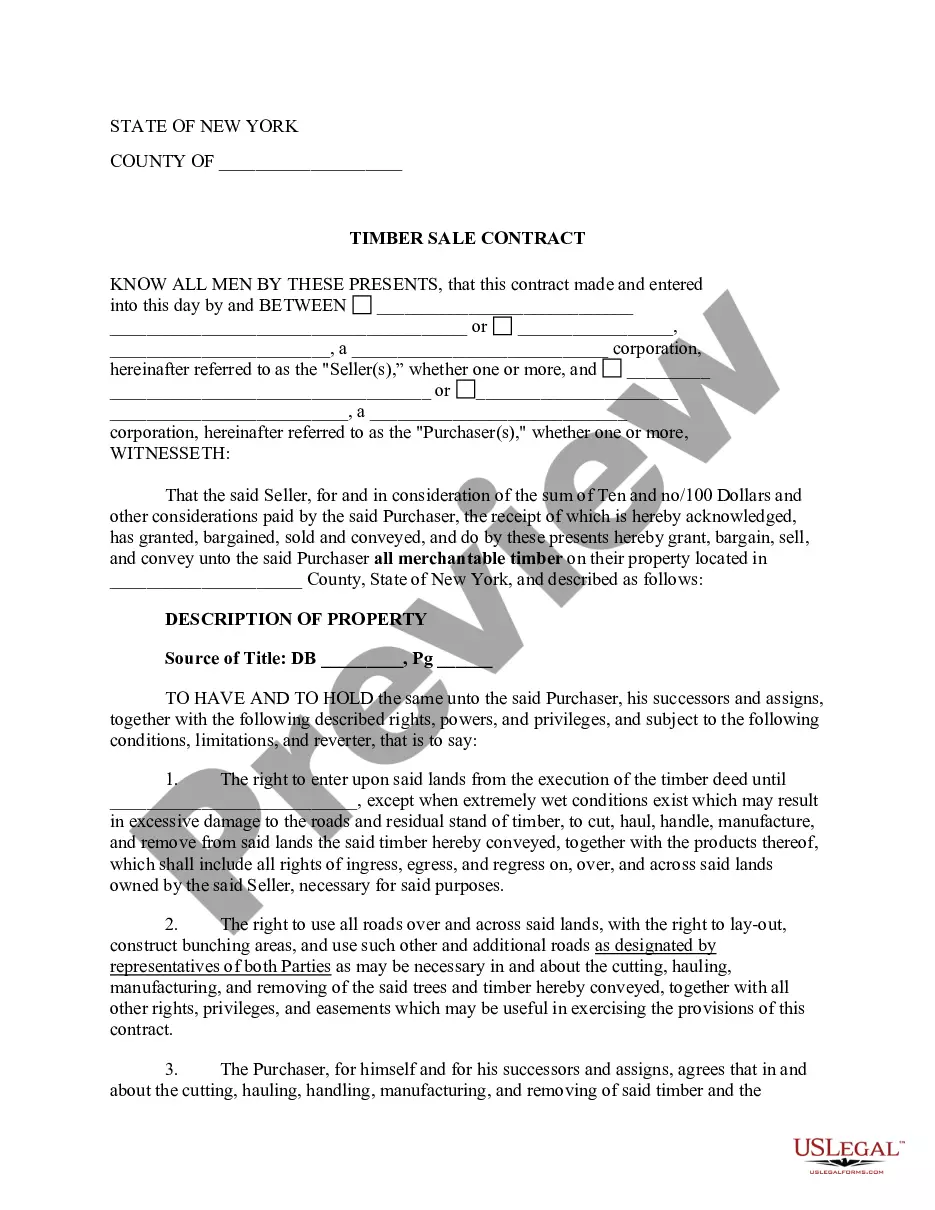

Description

How to fill out Kansas Post-Petition Loan And Security Agreement Between Various Financial Institutions Regarding Revolving Line Of Credit?

Have you been within a situation that you will need papers for possibly organization or individual uses nearly every working day? There are a lot of authorized record themes available on the net, but finding ones you can trust is not straightforward. US Legal Forms provides 1000s of develop themes, much like the Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit, that are written to fulfill state and federal needs.

When you are presently knowledgeable about US Legal Forms web site and get your account, simply log in. Afterward, it is possible to acquire the Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit template.

Unless you offer an accounts and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for the right area/state.

- Take advantage of the Review option to examine the shape.

- Read the explanation to actually have chosen the appropriate develop.

- In the event the develop is not what you are seeking, make use of the Research field to get the develop that fits your needs and needs.

- When you discover the right develop, simply click Get now.

- Choose the rates prepare you desire, fill in the desired information to generate your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a practical paper structure and acquire your copy.

Get all of the record themes you have bought in the My Forms menu. You can get a more copy of Kansas Post-Petition Loan and Security Agreement between Various Financial Institutions regarding revolving line of credit whenever, if needed. Just click the required develop to acquire or printing the record template.

Use US Legal Forms, probably the most comprehensive variety of authorized varieties, to save time and stay away from faults. The support provides professionally produced authorized record themes which you can use for a selection of uses. Produce your account on US Legal Forms and begin making your life a little easier.