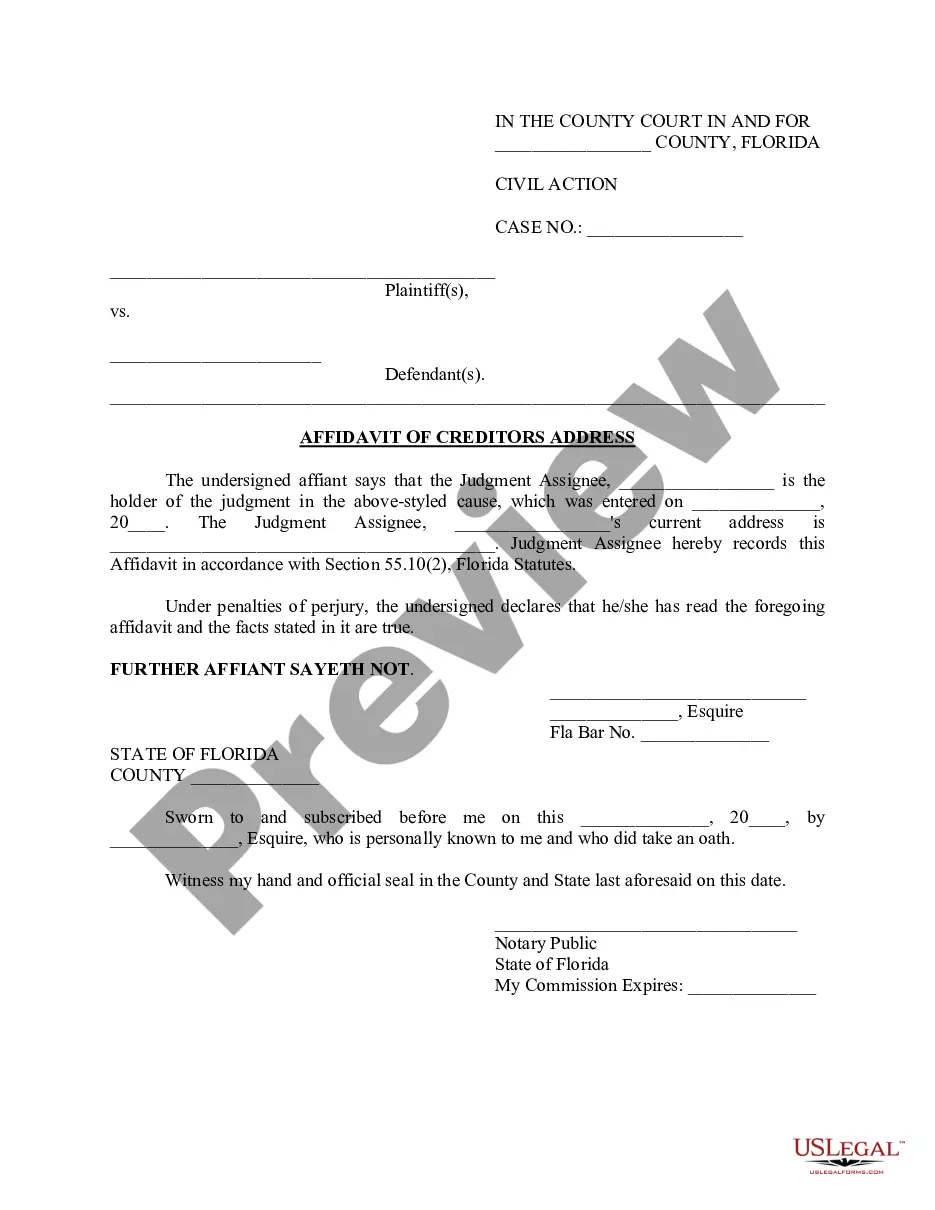

Kansas Accredited Investor Verification Letter — Individual Investor: Detailed Description and Types The Kansas Accredited Investor Verification Letter — Individual Investor is an official document that verifies an individual's status as an accredited investor in the state of Kansas. This letter serves as proof that an individual meets the criteria set forth by the Kansas Securities Commissioner to qualify as an accredited investor. To qualify as an accredited investor in Kansas, individuals must meet certain criteria such as having a net worth of at least $1 million, excluding the value of their primary residence, or having an annual income of at least $200,000 (or $300,000 jointly with a spouse) for the past two consecutive years with a reasonable expectation of reaching the same income level in the current year. The Kansas Accredited Investor Verification Letter is often requested by individuals who wish to participate in certain investment opportunities that are only available to accredited investors. This letter helps issuers and financial institutions ensure compliance with securities laws by verifying the accredited investor status of potential investors. Types of Kansas Accredited Investor Verification Letters — Individual Investor: 1. Net Worth Verification Letter: This type of verification letter confirms that an individual meets the net worth criteria to qualify as an accredited investor. It includes details about the individual's net worth, excluding the value of their primary residence, such as the value of assets, liabilities, and other relevant financial information. 2. Income Verification Letter: This type of verification letter confirms that an individual meets the income criteria to qualify as an accredited investor. It includes details about the individual's annual income for the past two consecutive years, along with any supporting documentation required to validate the income claimed. 3. Joint Income Verification Letter: In the case of a couple, where both spouses jointly meet the income criteria, a joint income verification letter may be requested. This letter provides details about the combined annual income of the spouses for the past two consecutive years, demonstrating that they qualify as accredited investors together. 4. Continuation or Renewal Verification Letter: This type of verification letter is requested when an individual's accredited investor status needs to be confirmed continuously for participation in ongoing investment opportunities. It is often required annually or at regular intervals to ensure the investor still meets the accreditation requirements. 5. Customized Verification Letter: Depending on the specific requirements of the investment opportunity or institution, a customized verification letter may be requested. This letter includes specific information or additional documentation requested by the issuer or institution to further validate an individual's accredited investor status. Obtaining a Kansas Accredited Investor Verification Letter — Individual Investor is crucial for individuals wishing to engage in investment opportunities reserved for accredited investors. It provides assurance to issuers, financial institutions, and other involved parties that the investor meets the necessary qualifications, ensuring compliance with securities laws.

Kansas Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Kansas Accredited Investor Veri?cation Letter - Individual Investor?

You are able to spend hours on the Internet searching for the authorized file format that meets the federal and state requirements you will need. US Legal Forms supplies a huge number of authorized kinds that are examined by pros. You can easily obtain or produce the Kansas Accredited Investor Veri?cation Letter – Individual Investor from the assistance.

If you already possess a US Legal Forms bank account, you can log in and click the Download button. After that, you can full, revise, produce, or indicator the Kansas Accredited Investor Veri?cation Letter – Individual Investor. Every authorized file format you purchase is your own forever. To get yet another version associated with a purchased type, visit the My Forms tab and click the related button.

Should you use the US Legal Forms internet site the first time, keep to the simple guidelines beneath:

- First, make sure that you have selected the correct file format for the region/metropolis of your choice. Look at the type information to make sure you have selected the right type. If readily available, make use of the Review button to search through the file format also.

- If you want to locate yet another variation of your type, make use of the Research discipline to find the format that meets your needs and requirements.

- When you have identified the format you need, just click Get now to proceed.

- Choose the rates prepare you need, key in your references, and register for a free account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal bank account to cover the authorized type.

- Choose the file format of your file and obtain it to the system.

- Make modifications to the file if required. You are able to full, revise and indicator and produce Kansas Accredited Investor Veri?cation Letter – Individual Investor.

Download and produce a huge number of file themes making use of the US Legal Forms web site, which offers the biggest collection of authorized kinds. Use expert and state-certain themes to handle your business or person needs.