This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

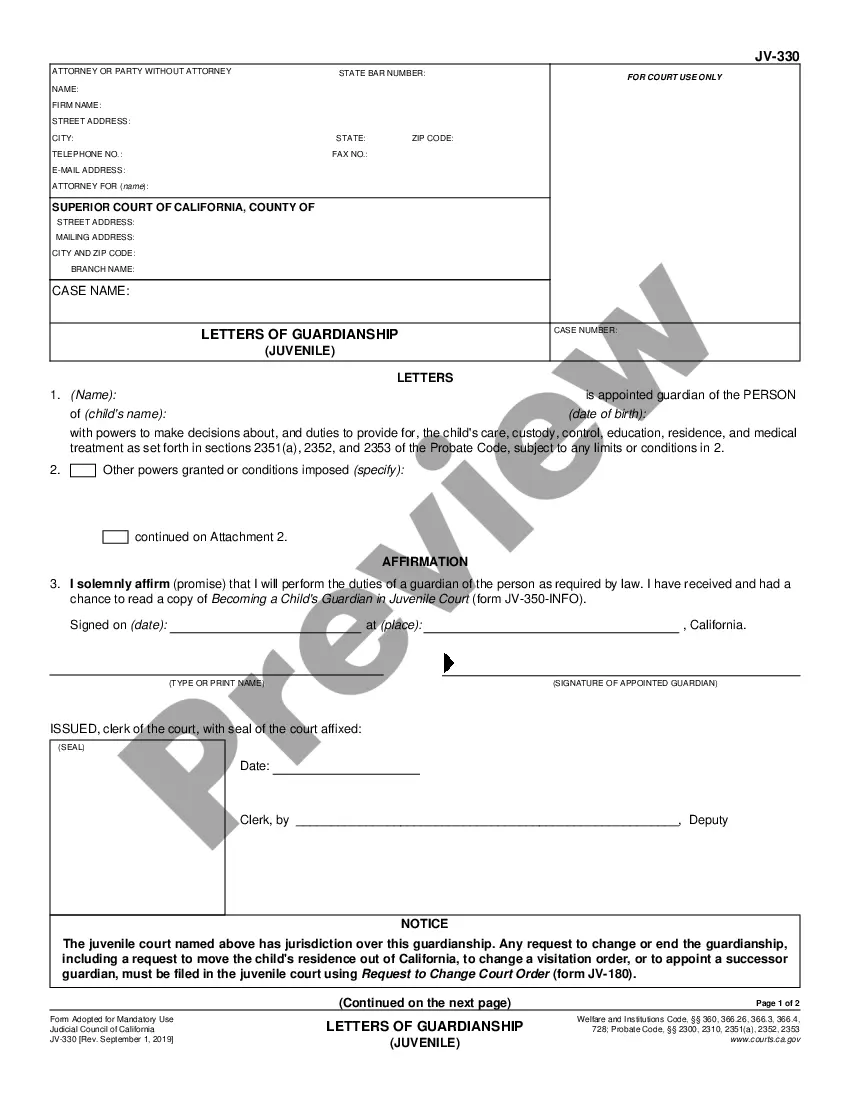

Note: The preview only shows the 1st page of the document.

Kansas Guide to Complying with the Red Flags Rule under FCRA and FACT is a comprehensive resource designed to assist businesses and organizations in understanding and complying with the requirements of the Red Flags Rule, as outlined by the Federal Trade Commission (FTC) under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). This guide serves as a valuable tool for entities operating in Kansas, providing them with a detailed explanation of the rules and regulations in place to combat identity theft and protect the personal information of consumers. The guide covers various key aspects of compliance, including risk assessment, detection and prevention of identity theft, and responding effectively to red flags. It provides specific guidance on implementing an identity theft prevention program, tailoring it to the unique needs and characteristics of each business or organization. By following the guidelines provided in this Kansas Guide, entities can ensure their compliance with federal regulations and protect themselves and their consumers from identity theft-related risks. Different types of guides available under the Kansas Guide to Complying with the Red Flags Rule under FCRA and FACT might include: 1. Kansas Guide for Financial Institutions: This particular guide focuses on the specific compliance requirements for financial institutions operating within the state of Kansas. It addresses the particular challenges and considerations faced by banks, credit unions, and other financial organizations in implementing a comprehensive identity theft prevention program. 2. Kansas Guide for Healthcare Providers: This guide is aimed at healthcare providers, including hospitals, clinics, and medical practices. It outlines the unique red flags and risk factors in the healthcare industry, providing specific guidance on protecting patients' health information and complying with relevant federal regulations. 3. Kansas Guide for Educational Institutions: Educational institutions, such as schools and universities, often handle sensitive personal information of students and faculty members. This guide provides tailored information for educational institutions in Kansas, helping them develop appropriate policies and procedures to safeguard personal information and prevent identity theft. 4. Kansas Guide for Small Businesses: Small businesses are not exempt from the requirements of the Red Flags Rule. This guide caters specifically to the needs and limitations of small businesses in Kansas, offering practical guidance on developing cost-effective identity theft prevention programs while staying compliant with federal regulations. By offering these specialized guides, the Kansas Guide to Complying with the Red Flags Rule under FCRA and FACT ensures that businesses and organizations across various industries can access relevant and applicable information to safeguard consumer information from identity theft risks.Kansas Guide to Complying with the Red Flags Rule under FCRA and FACT is a comprehensive resource designed to assist businesses and organizations in understanding and complying with the requirements of the Red Flags Rule, as outlined by the Federal Trade Commission (FTC) under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT). This guide serves as a valuable tool for entities operating in Kansas, providing them with a detailed explanation of the rules and regulations in place to combat identity theft and protect the personal information of consumers. The guide covers various key aspects of compliance, including risk assessment, detection and prevention of identity theft, and responding effectively to red flags. It provides specific guidance on implementing an identity theft prevention program, tailoring it to the unique needs and characteristics of each business or organization. By following the guidelines provided in this Kansas Guide, entities can ensure their compliance with federal regulations and protect themselves and their consumers from identity theft-related risks. Different types of guides available under the Kansas Guide to Complying with the Red Flags Rule under FCRA and FACT might include: 1. Kansas Guide for Financial Institutions: This particular guide focuses on the specific compliance requirements for financial institutions operating within the state of Kansas. It addresses the particular challenges and considerations faced by banks, credit unions, and other financial organizations in implementing a comprehensive identity theft prevention program. 2. Kansas Guide for Healthcare Providers: This guide is aimed at healthcare providers, including hospitals, clinics, and medical practices. It outlines the unique red flags and risk factors in the healthcare industry, providing specific guidance on protecting patients' health information and complying with relevant federal regulations. 3. Kansas Guide for Educational Institutions: Educational institutions, such as schools and universities, often handle sensitive personal information of students and faculty members. This guide provides tailored information for educational institutions in Kansas, helping them develop appropriate policies and procedures to safeguard personal information and prevent identity theft. 4. Kansas Guide for Small Businesses: Small businesses are not exempt from the requirements of the Red Flags Rule. This guide caters specifically to the needs and limitations of small businesses in Kansas, offering practical guidance on developing cost-effective identity theft prevention programs while staying compliant with federal regulations. By offering these specialized guides, the Kansas Guide to Complying with the Red Flags Rule under FCRA and FACT ensures that businesses and organizations across various industries can access relevant and applicable information to safeguard consumer information from identity theft risks.