Kansas Guaranty of Payment of Open Account

Description

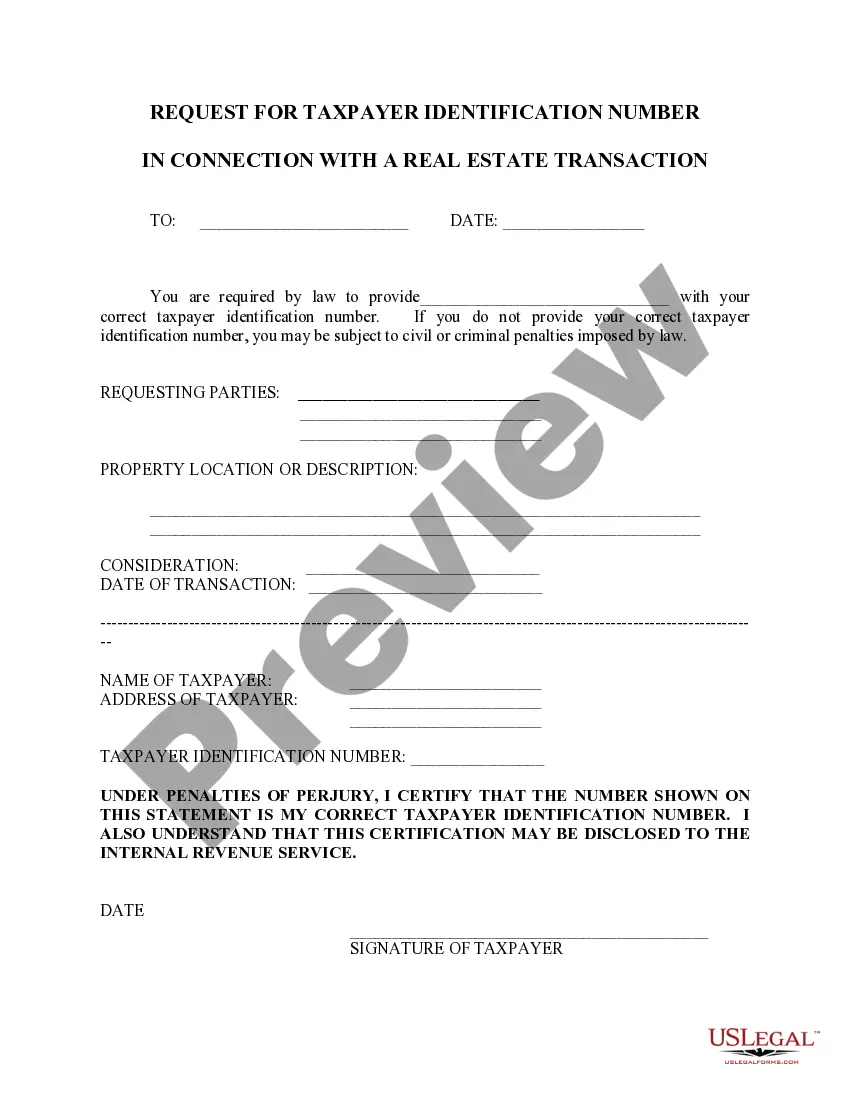

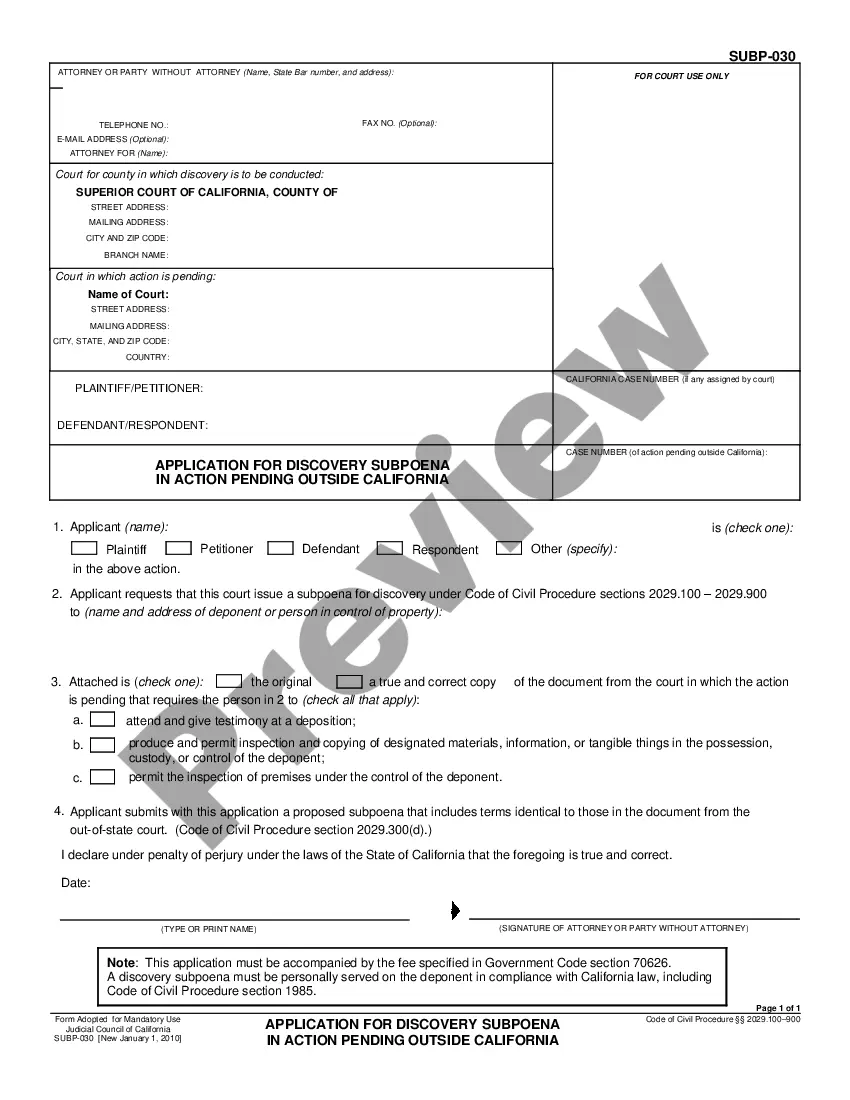

How to fill out Kansas Guaranty Of Payment Of Open Account?

If you need to complete, acquire, or printing legitimate papers templates, use US Legal Forms, the greatest assortment of legitimate varieties, that can be found on the web. Take advantage of the site`s basic and convenient research to find the documents you want. Numerous templates for company and person reasons are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to find the Kansas Guaranty of Payment of Open Account with a handful of click throughs.

In case you are already a US Legal Forms client, log in to the account and click on the Obtain key to find the Kansas Guaranty of Payment of Open Account. You can even entry varieties you earlier downloaded inside the My Forms tab of your respective account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the appropriate area/region.

- Step 2. Use the Review method to check out the form`s information. Never neglect to see the outline.

- Step 3. In case you are unhappy with all the type, take advantage of the Research discipline near the top of the display screen to discover other variations from the legitimate type web template.

- Step 4. Upon having located the shape you want, go through the Purchase now key. Select the rates prepare you prefer and put your accreditations to sign up for the account.

- Step 5. Approach the transaction. You can use your bank card or PayPal account to finish the transaction.

- Step 6. Select the format from the legitimate type and acquire it in your device.

- Step 7. Full, revise and printing or indication the Kansas Guaranty of Payment of Open Account.

Every single legitimate papers web template you purchase is the one you have for a long time. You may have acces to each type you downloaded in your acccount. Go through the My Forms segment and select a type to printing or acquire again.

Be competitive and acquire, and printing the Kansas Guaranty of Payment of Open Account with US Legal Forms. There are millions of specialist and condition-certain varieties you can utilize for your company or person needs.

Form popularity

FAQ

Insurance guaranty associations are given their powers by the state insurance commissioner. Most of these organizations are funded with the money they collect from conducting assessments of member insurers. The total payout in most states is capped at $300,000 per individual.

Guaranty funds pay both first-party and third-party claims. If a liability claim has been filed against your firm and defense is needed, the fund will pay your defense costs. Most guaranty funds specify a maximum amount they will pay for any claim. The most common limit is $300,000.

Insurance guaranty associations provide protection to insurance policyholders and beneficiaries of policies issued by an insurance company that has become insolvent and is no longer able to meet its obligations. All states, the District of Columbia, and Puerto Rico have insurance guaranty associations.

State life and health insurance guaranty associations provide a safety net for their state's policyholders, ensuring that they continue to receive coverage (up to the limits spelled out by state law) even if their insurer is declared insolvent.

State life and health insurance guaranty associations provide a safety net for their state's policyholders, ensuring that they continue to receive coverage (up to the limits spelled out by state law) even if their insurer is declared insolvent.

How Do Guaranty Associations Work? Guaranty associations are funded by assessments levied against member insurance companies that help pay claims when a member company fails. The funds are combined with the failed company's assets to pay claims up to statutory limits.

A guaranty fund (or guaranty association) is an organization established by state law. Its purpose is to protect policyholders from insurer insolvencies. It pays claims an insurer would have paid had it not become financially impaired.

Guaranty associations are funded by assessments levied against member insurance companies that help pay claims when a member company fails. The funds are combined with the failed company's assets to pay claims up to statutory limits.

State life and health insurance guaranty associations provide a safety net for their state's policyholders, ensuring that they continue to receive coverage (up to the limits spelled out by state law) even if their insurer is declared insolvent.