Kansas Government Contractor Agreement - Self-Employed

Description

How to fill out Kansas Government Contractor Agreement - Self-Employed?

If you need to comprehensive, download, or printing legitimate document layouts, use US Legal Forms, the biggest selection of legitimate types, which can be found on the Internet. Use the site`s easy and convenient lookup to discover the documents you will need. A variety of layouts for business and person purposes are sorted by classes and says, or keywords. Use US Legal Forms to discover the Kansas Government Contractor Agreement - Self-Employed in a couple of clicks.

In case you are presently a US Legal Forms client, log in for your bank account and click the Obtain switch to obtain the Kansas Government Contractor Agreement - Self-Employed. You may also accessibility types you previously delivered electronically in the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions under:

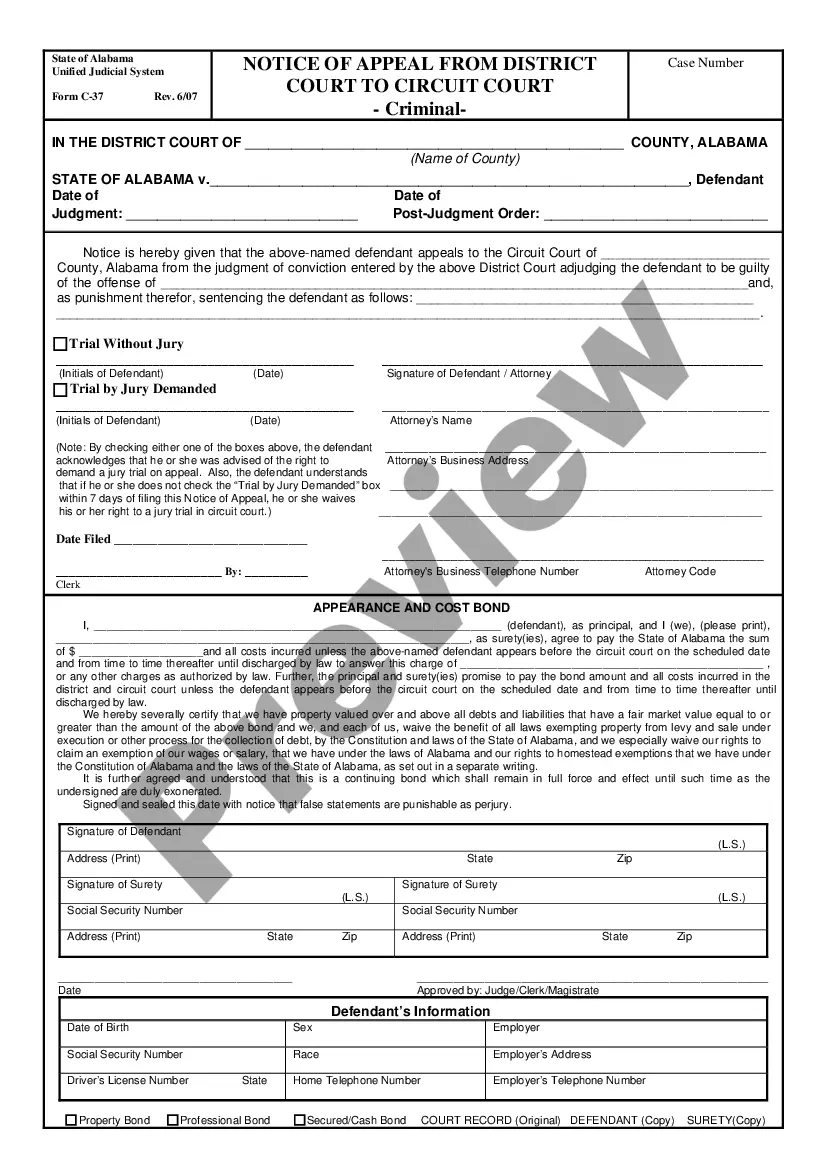

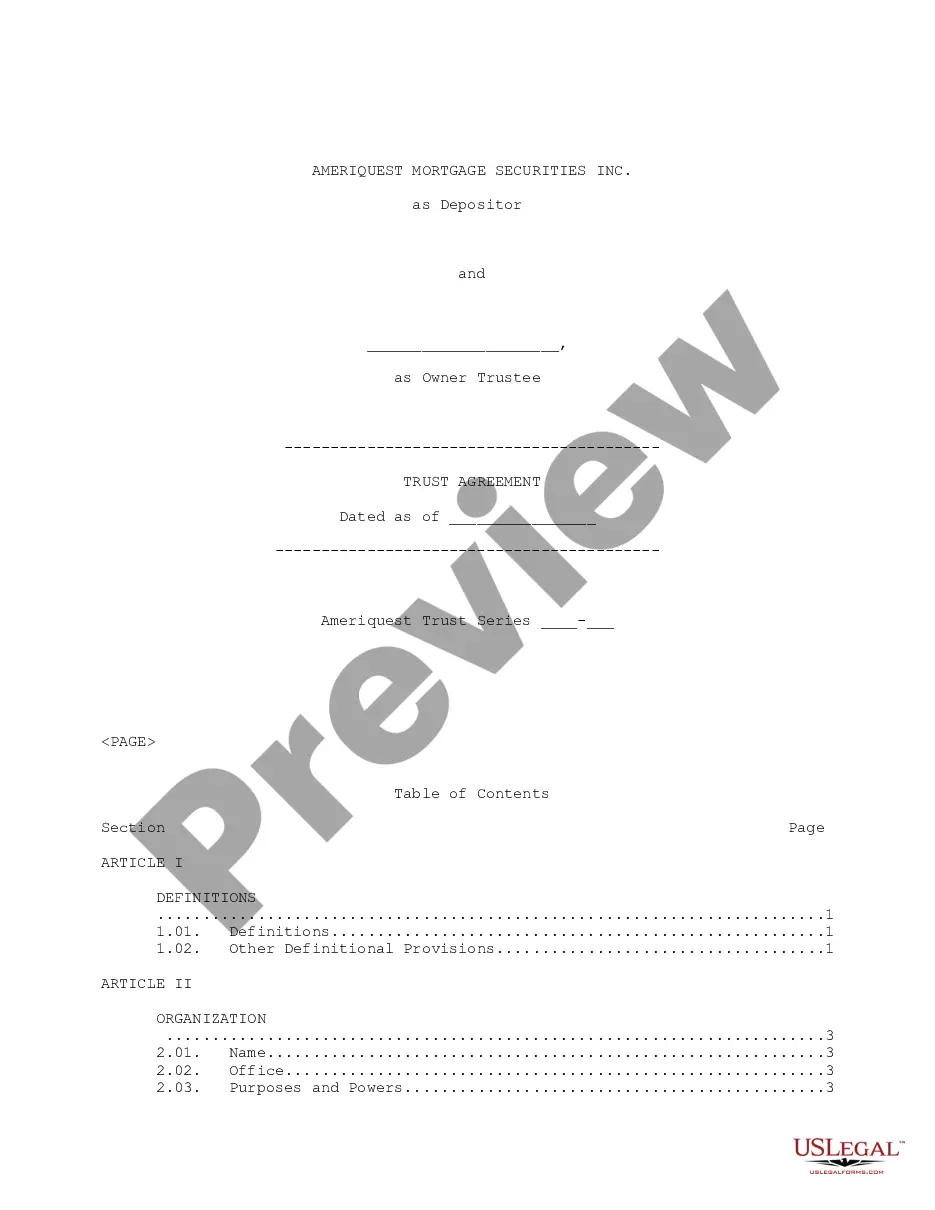

- Step 1. Be sure you have selected the shape for that correct area/land.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Do not forget to learn the description.

- Step 3. In case you are not satisfied together with the develop, utilize the Lookup field at the top of the screen to get other models from the legitimate develop design.

- Step 4. Once you have discovered the shape you will need, click on the Get now switch. Opt for the costs prepare you prefer and put your credentials to register on an bank account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal bank account to finish the transaction.

- Step 6. Choose the file format from the legitimate develop and download it on your own device.

- Step 7. Full, modify and printing or sign the Kansas Government Contractor Agreement - Self-Employed.

Each and every legitimate document design you get is yours permanently. You possess acces to each develop you delivered electronically inside your acccount. Select the My Forms section and select a develop to printing or download once more.

Be competitive and download, and printing the Kansas Government Contractor Agreement - Self-Employed with US Legal Forms. There are millions of professional and condition-certain types you may use for your business or person requirements.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The other contract (Independent contractor) is a Contract for Service, and is usually a contract where the contractor undertakes to perform a specific service or task, and upon completion of the agreed service or task, or upon production of the result agreed upon, the contractor will be paid.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

The Labour Relations Act applies to all employers, workers, trade unions and employers' organisations.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.