Kansas Farm Hand Services Contract - Self-Employed

Description

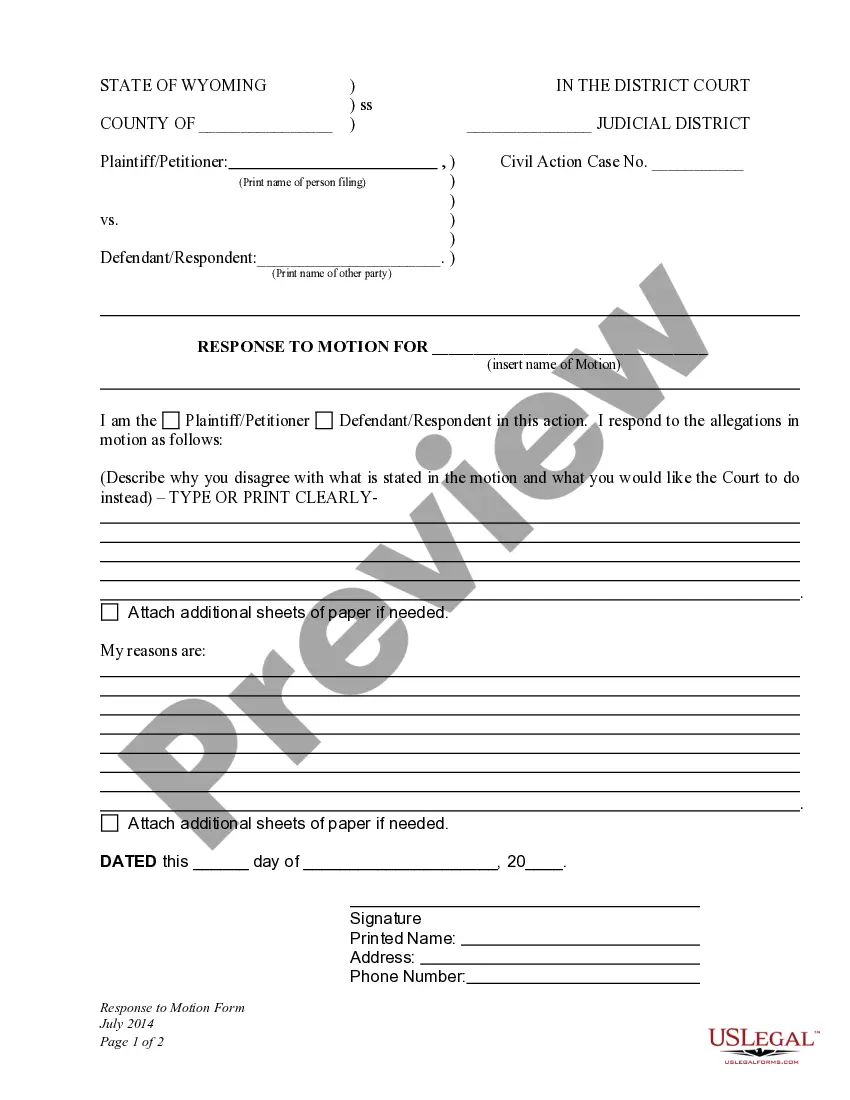

How to fill out Kansas Farm Hand Services Contract - Self-Employed?

If you need to complete, down load, or printing lawful document web templates, use US Legal Forms, the biggest selection of lawful types, which can be found on the web. Take advantage of the site`s easy and handy lookup to get the documents you need. Numerous web templates for company and specific functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to get the Kansas Farm Hand Services Contract - Self-Employed in just a number of click throughs.

In case you are already a US Legal Forms client, log in for your bank account and click on the Download switch to get the Kansas Farm Hand Services Contract - Self-Employed. You can also access types you formerly downloaded in the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for the right area/country.

- Step 2. Take advantage of the Preview option to check out the form`s articles. Don`t overlook to see the explanation.

- Step 3. In case you are not satisfied with all the develop, take advantage of the Look for area towards the top of the screen to get other versions of the lawful develop web template.

- Step 4. Once you have discovered the shape you need, click on the Acquire now switch. Opt for the costs strategy you like and include your accreditations to register for the bank account.

- Step 5. Approach the transaction. You can use your credit card or PayPal bank account to perform the transaction.

- Step 6. Find the structure of the lawful develop and down load it on your own gadget.

- Step 7. Complete, modify and printing or indicator the Kansas Farm Hand Services Contract - Self-Employed.

Each and every lawful document web template you buy is your own permanently. You possess acces to each develop you downloaded within your acccount. Click the My Forms section and select a develop to printing or down load once again.

Be competitive and down load, and printing the Kansas Farm Hand Services Contract - Self-Employed with US Legal Forms. There are thousands of specialist and status-specific types you can utilize for your personal company or specific requirements.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Write the contract in six stepsStart with a contract template.Open with the basic information.Describe in detail what you have agreed to.Include a description of how the contract will be ended.Write into the contract which laws apply and how disputes will be resolved.Include space for signatures.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

How to write an employment contractTitle the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors and subcontractors are both considered self-employed by the IRS. Both are responsible for making quarterly tax payments including self-employment tax.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

You have to file an income tax return if your net earnings from self-employment were $400 or more. If your net earnings from self-employment were less than $400, you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructionsPDF.

How to become an independent contractorIdentify your business structure.Choose and register your business name.Get business licenses and permit.Get a business number and find your taxation requirements.Get insurance for your business.Establish the requirements for your workplace safety.Manage your business well.More items...?

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?