Kansas Cook Services Contract - Self-Employed

Description

How to fill out Kansas Cook Services Contract - Self-Employed?

If you wish to comprehensive, down load, or produce lawful record themes, use US Legal Forms, the most important collection of lawful varieties, that can be found on the web. Take advantage of the site`s easy and practical lookup to find the files you need. Numerous themes for business and person reasons are sorted by types and says, or key phrases. Use US Legal Forms to find the Kansas Cook Services Contract - Self-Employed within a number of clicks.

In case you are already a US Legal Forms buyer, log in for your bank account and then click the Down load switch to find the Kansas Cook Services Contract - Self-Employed. You can even access varieties you previously saved within the My Forms tab of your bank account.

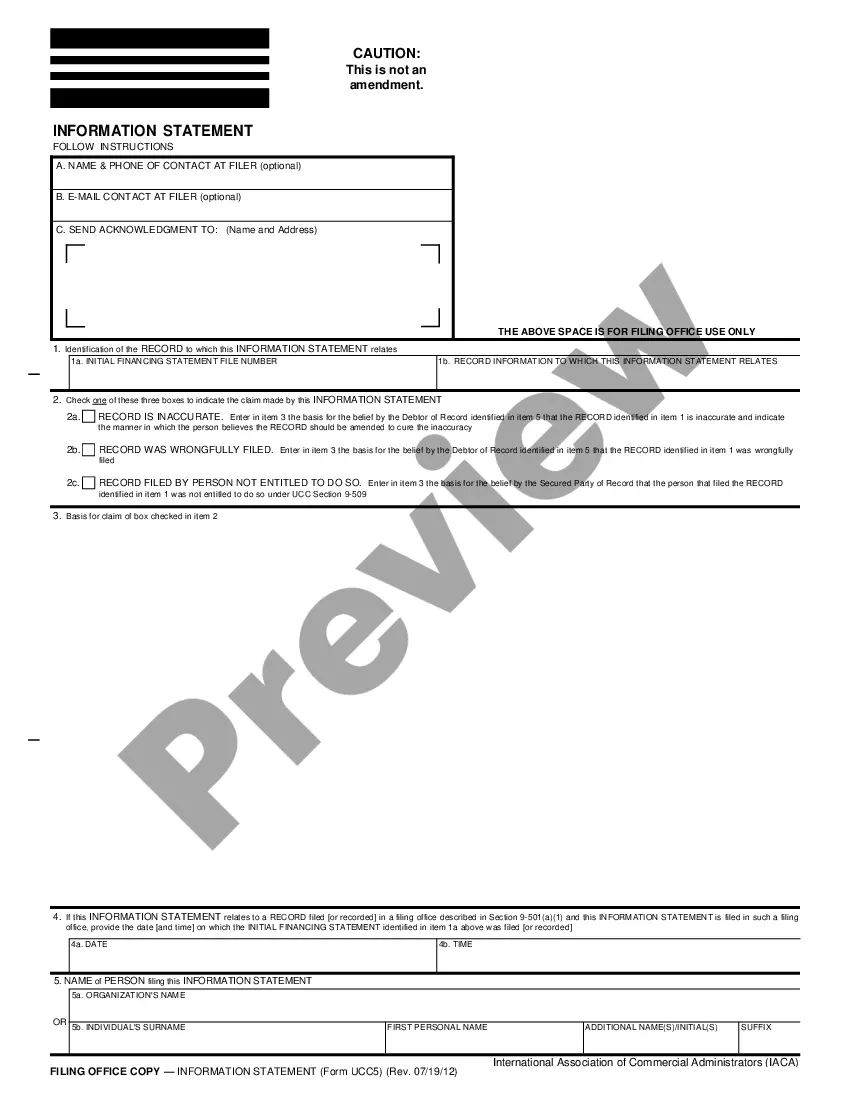

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for your correct city/region.

- Step 2. Take advantage of the Preview solution to check out the form`s articles. Don`t neglect to learn the description.

- Step 3. In case you are unhappy with the develop, make use of the Lookup discipline on top of the screen to discover other versions from the lawful develop web template.

- Step 4. After you have found the shape you need, select the Acquire now switch. Choose the rates strategy you like and put your accreditations to sign up on an bank account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Find the formatting from the lawful develop and down load it on your own system.

- Step 7. Comprehensive, revise and produce or sign the Kansas Cook Services Contract - Self-Employed.

Every lawful record web template you get is your own property forever. You may have acces to every single develop you saved within your acccount. Go through the My Forms area and decide on a develop to produce or down load once again.

Compete and down load, and produce the Kansas Cook Services Contract - Self-Employed with US Legal Forms. There are millions of professional and status-distinct varieties you can use to your business or person requires.

Form popularity

FAQ

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

A chef is integral to the business of preparing food and would not be considered an independent contractor. A specialist chef, who prepares food for a one-time event for the restaurant, could be considered an independent contractor.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.