Kansas Special Improvement Project and Assessment

Description

How to fill out Special Improvement Project And Assessment?

Choosing the best lawful file format could be a battle. Of course, there are tons of themes accessible on the Internet, but how do you get the lawful develop you need? Utilize the US Legal Forms website. The services offers a huge number of themes, such as the Kansas Special Improvement Project and Assessment, that can be used for enterprise and personal needs. All the types are examined by professionals and satisfy state and federal specifications.

Should you be previously registered, log in in your bank account and then click the Acquire option to get the Kansas Special Improvement Project and Assessment. Utilize your bank account to check with the lawful types you may have bought previously. Check out the My Forms tab of your respective bank account and get one more version in the file you need.

Should you be a fresh customer of US Legal Forms, listed below are basic directions that you can adhere to:

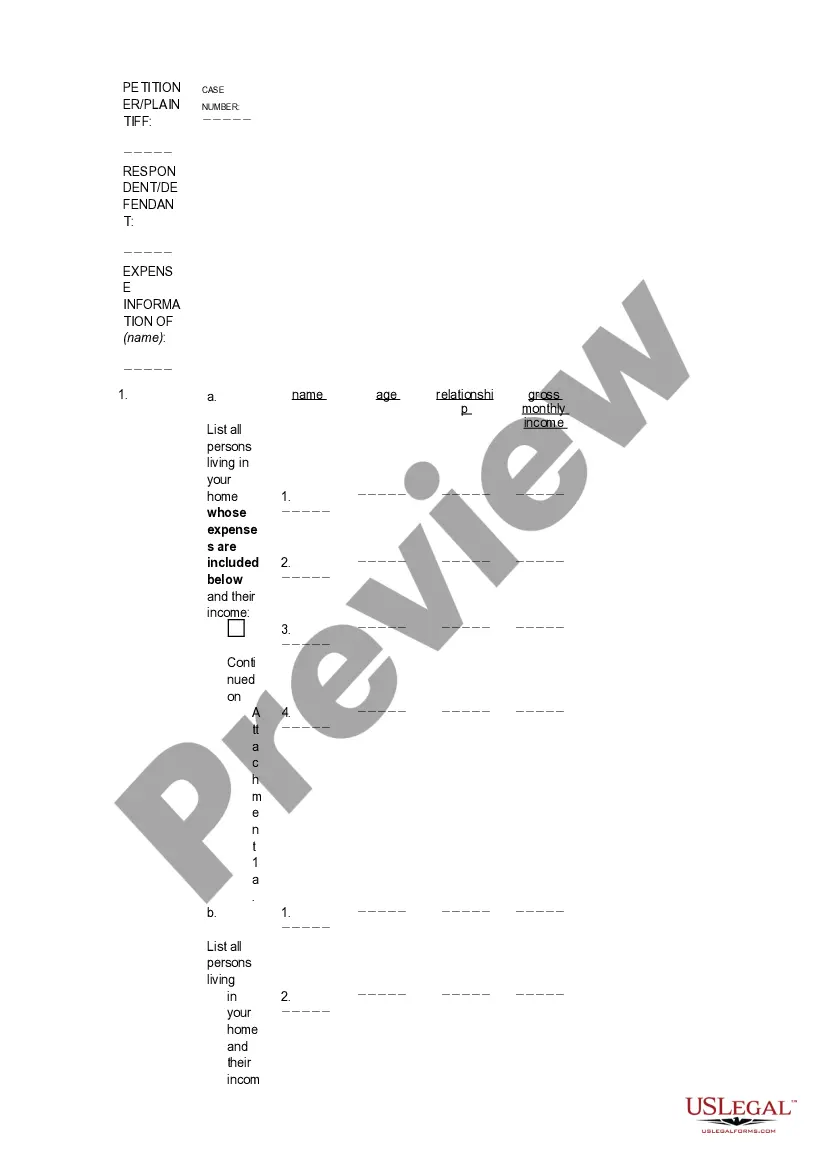

- Initially, be sure you have selected the correct develop for your city/region. You may check out the shape using the Preview option and read the shape outline to make sure it will be the best for you.

- In case the develop does not satisfy your preferences, take advantage of the Seach industry to get the right develop.

- Once you are certain the shape is proper, go through the Buy now option to get the develop.

- Opt for the prices strategy you need and enter in the necessary information. Make your bank account and pay for your order with your PayPal bank account or charge card.

- Pick the document structure and download the lawful file format in your system.

- Full, modify and printing and indication the obtained Kansas Special Improvement Project and Assessment.

US Legal Forms will be the biggest catalogue of lawful types for which you can see different file themes. Utilize the service to download professionally-made files that adhere to express specifications.

Form popularity

FAQ

Johnson Countians account for 34 percent of the revenue. The top ten property tax paying counties in Kansas account for 73 percent of the state's total property tax collections. However, they have 59 percent of the state's population. Johnson County has the highest property tax rate per capita at $1,786.

Delinquent real estate taxes not paid within 3 years are referred to the Legal Department for foreclosure action, thus putting the property in jeopardy of being sold at auction.

What are "specials"? Specials are additional assessments charged against real property for improvements to the immediate area; this could include streets, sewers, sidewalks and more. Specials are normally added to the real property tax bill for 10 to 15 years, unless they were prepaid.

Special assessment. noun. : a specific tax levied on private property to meet the cost of public improvements that provide a special benefit enhancing the value of the property.

Kansas has a statewide assessment percentage of 11.5%. This means that assessed value, which is the value on which you pay taxes, is equal to 11.5% of your home's appraised value.