A Kansas Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is a legal document used in Kansas to declare that the estate assets of a deceased person have been distributed to the designated beneficiaries (devises) and to provide a statement regarding any outstanding debts and taxes. This affidavit serves as proof that the executor or estate representative has fulfilled their duties by properly distributing the assets according to the decedent's wishes and settling any outstanding financial obligations. It offers reassurance to the court, beneficiaries, and creditors that the estate administration has been successfully completed. The Kansas Probate Code outlines specific requirements for this affidavit. It must contain a statement asserting that all the estate's assets have been distributed in accordance with the decedent's will or the state's intestacy laws if no will exists. Additionally, it should also include a statement indicating that all outstanding debts, including taxes, have been paid or resolved. There can be different variations of this affidavit, depending on the circumstances and specific requirements. Some possible types include: 1. Kansas Affidavit That All the Estate Assets Have Been Distributed to Devises with Statement Concerning Debts: This type is used when the executor or estate representative has distributed all the assets of the estate to the designated beneficiaries but still holds outstanding debts to be resolved. 2. Kansas Affidavit That All the Estate Assets Have Been Distributed to Devises with Statement Concerning Taxes: This variation is utilized when all the assets have been successfully distributed to the beneficiaries, but there are still pending tax matters related to the estate that need to be addressed. 3. Kansas Affidavit That All the Estate Assets Have Been Distributed to Devises with Statement Concerning Debts and Taxes: This comprehensive type of affidavit covers both the resolution of debts and taxes, confirming that all financial obligations have been settled before the distribution of assets occurred. It is crucial to consult with an experienced attorney or legal professional while drafting or using any specific type of Kansas Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes. This ensures compliance with the Kansas Probate Code and accurate representation of the estate's financial status.

Kansas Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Kansas Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

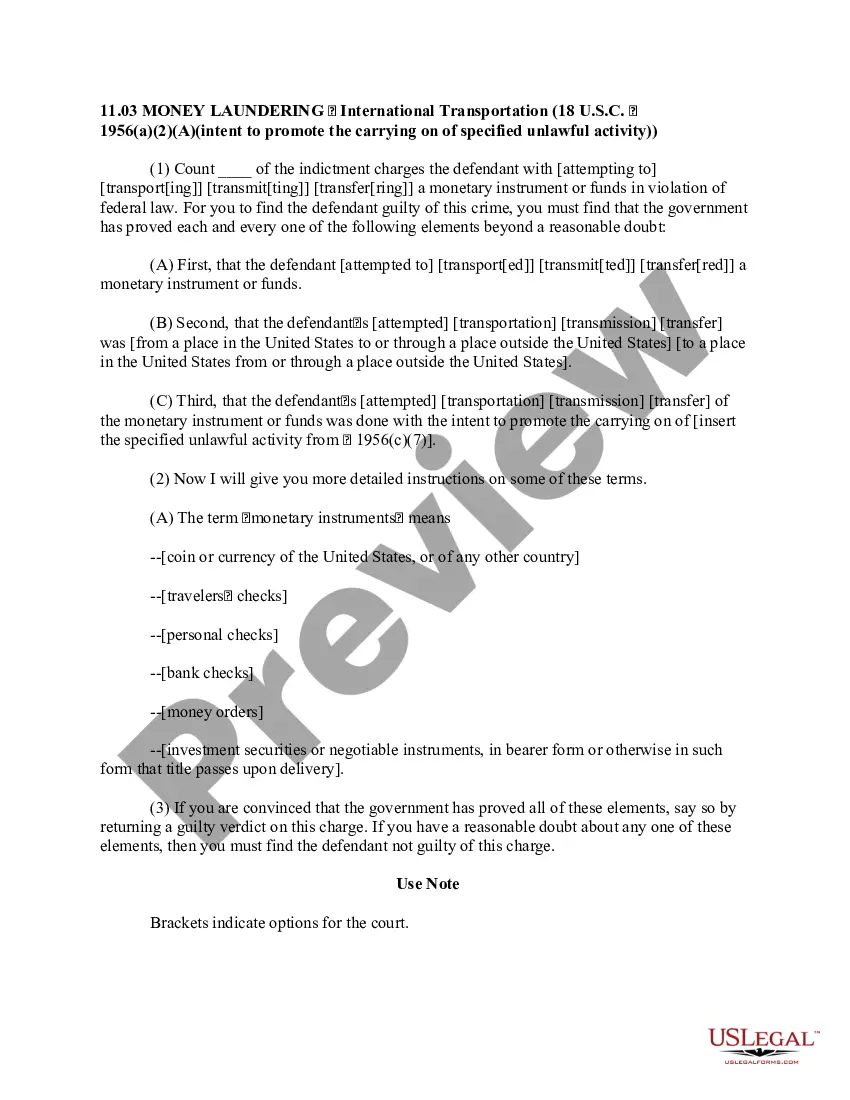

You are able to spend time online attempting to find the legal file template that fits the state and federal requirements you want. US Legal Forms gives 1000s of legal varieties which can be examined by pros. You can actually download or print the Kansas Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes from my services.

If you already have a US Legal Forms profile, it is possible to log in and click on the Down load option. Next, it is possible to full, revise, print, or signal the Kansas Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes. Each and every legal file template you acquire is the one you have for a long time. To get one more version for any obtained type, visit the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms website for the first time, follow the basic guidelines under:

- Initial, make sure that you have chosen the correct file template for your state/town of your liking. Look at the type outline to ensure you have selected the right type. If accessible, use the Preview option to look with the file template at the same time.

- If you wish to discover one more version in the type, use the Search field to discover the template that meets your needs and requirements.

- Upon having discovered the template you want, click Buy now to continue.

- Choose the prices strategy you want, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the purchase. You should use your charge card or PayPal profile to fund the legal type.

- Choose the structure in the file and download it for your gadget.

- Make changes for your file if possible. You are able to full, revise and signal and print Kansas Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

Down load and print 1000s of file templates utilizing the US Legal Forms website, that provides the largest selection of legal varieties. Use specialist and status-distinct templates to take on your small business or person demands.