Kansas Subordination of Lien (Deed of Trust/Mortgage to Right of Way)

Description

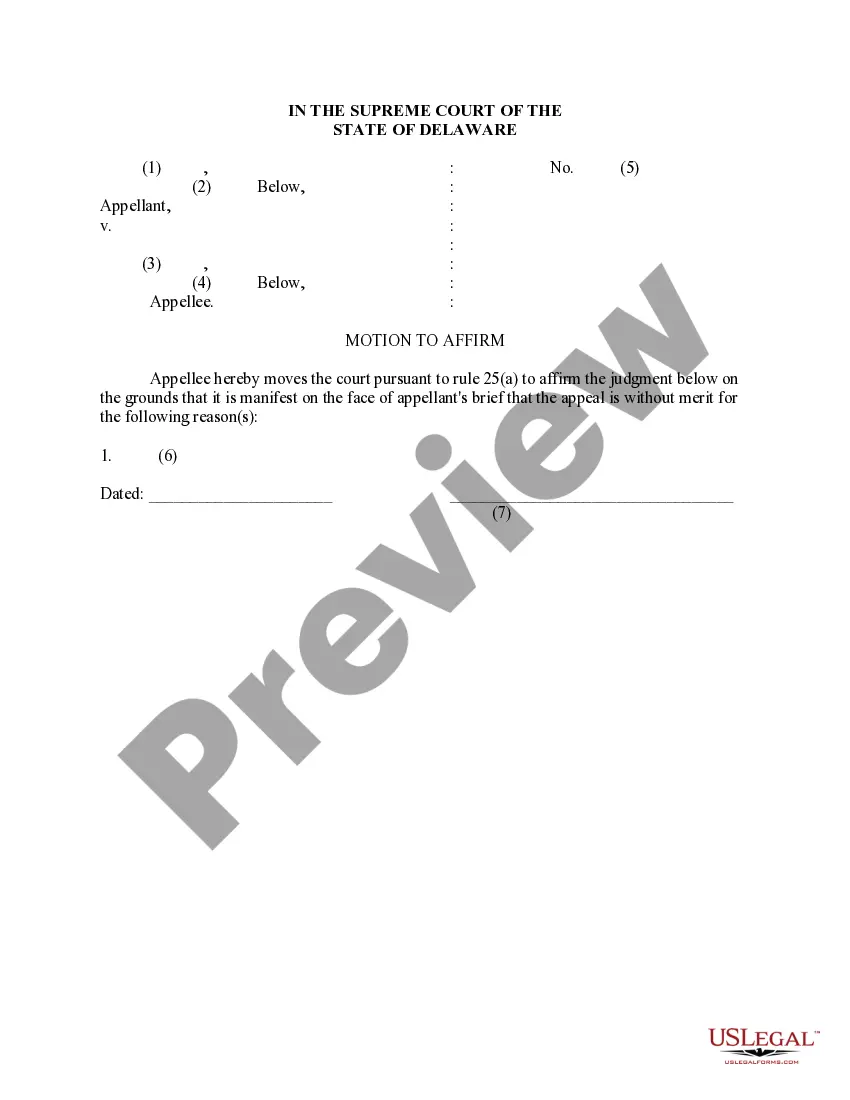

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage To Right Of Way)?

You may commit hours on the web trying to find the legitimate papers web template that suits the federal and state requirements you want. US Legal Forms provides 1000s of legitimate varieties that are reviewed by pros. It is possible to down load or produce the Kansas Subordination of Lien (Deed of Trust/Mortgage to Right of Way) from your service.

If you already possess a US Legal Forms accounts, it is possible to log in and then click the Obtain button. Afterward, it is possible to complete, edit, produce, or signal the Kansas Subordination of Lien (Deed of Trust/Mortgage to Right of Way). Every legitimate papers web template you get is the one you have forever. To acquire an additional backup associated with a obtained develop, visit the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms site the first time, follow the basic guidelines listed below:

- Very first, be sure that you have chosen the proper papers web template for your county/town of your liking. Browse the develop explanation to ensure you have selected the right develop. If readily available, make use of the Preview button to check through the papers web template too.

- If you would like discover an additional edition from the develop, make use of the Lookup discipline to discover the web template that fits your needs and requirements.

- Once you have discovered the web template you would like, just click Acquire now to carry on.

- Pick the costs prepare you would like, type in your accreditations, and register for your account on US Legal Forms.

- Full the purchase. You may use your bank card or PayPal accounts to cover the legitimate develop.

- Pick the formatting from the papers and down load it for your device.

- Make alterations for your papers if possible. You may complete, edit and signal and produce Kansas Subordination of Lien (Deed of Trust/Mortgage to Right of Way).

Obtain and produce 1000s of papers layouts utilizing the US Legal Forms web site, that offers the greatest assortment of legitimate varieties. Use skilled and status-distinct layouts to tackle your business or specific demands.

Form popularity

FAQ

Subordination. This Security Instrument is and shall be automatically subordinate to a loan made to Borrower evidenced by a purchase money promissory note and secured by a first deed of trust (the ?First Deed of Trust?) recorded concurrently herewith on the Property.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

Payment subordination establishes the hierarchy of interest and principal payments in case of default or liquidation. Senior debt is paid first, followed by junior debt. Lien subordination does not imply payment subordination. In the case of default, payments must continue to be made to all senior lenders equally.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

When you get a mortgage loan, the lender will likely include a subordination clause essentially stating that their lien will take precedence over any other liens placed on the house. A subordination clause serves to protect the lender if a homeowner defaults.

Since it's recorded after any HELOCs or second mortgages you already have in place, the first mortgage would naturally take a lower lien position. Most lenders won't allow this, so this could cause you to lose your loan approval if the second mortgage holder won't agree to subordinate.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Lien subordination refers to the order in which claims on collateral are prioritized. This takes place most often among senior secured lenders and does not imply that one tranche of senior debt has payment preference over another.