A Kansas Commingling and Entirety Agreement By Royalty Owners (also known as Kansas Commingling Agreement or Kansas Entirety Agreement) refers to a legal agreement made by royalty owners in the state of Kansas when there are multiple owners of mineral rights in lands subject to lease. This agreement allows the owners to efficiently manage their interests and actions related to the production and distribution of minerals, typically oil or gas, from the shared lease area. The purpose of the agreement is to avoid potential conflicts, streamline operations, and maintain transparency among the participating parties. Keywords: Kansas, Commingling Agreement, Entirety Agreement, Royalty Owners, Royalty Ownership, Lands Subject to Lease, Multiple Owners, Mineral Rights, Production, Distribution, Oil, Gas, Conflicts, Operations, Transparency. There are two different types of Kansas Commingling and Entirety Agreements that may be encountered: 1. Kansas Commingling Agreement: This agreement is utilized when multiple royalty owners have varying ownership shares in different parts of the lease area. It allows for the commingling of production from various wells or units within the lease, irrespective of the percentage of ownership each party holds. The commingling ensures smoother and more effective production and distribution operations. 2. Kansas Entirety Agreement: This agreement is used when multiple royalty owners jointly own the entire lease area. Instead of dividing the lease into separate tracts or units, all parties agree to treat the entire lease as a single entity. This arrangement allows for the efficient operation, production, and distribution of minerals, as decisions and actions are consolidated among all owners, ensuring a unified approach. By implementing a Kansas Commingling and Entirety Agreement, royalty owners can avoid disputes and delays that may arise due to differences in ownership percentages or confusion regarding the lease boundaries. The agreement promotes cooperation, collaboration, and coordination among the involved parties, making the management of the lease area more streamlined and advantageous for all stakeholders.

Kansas Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

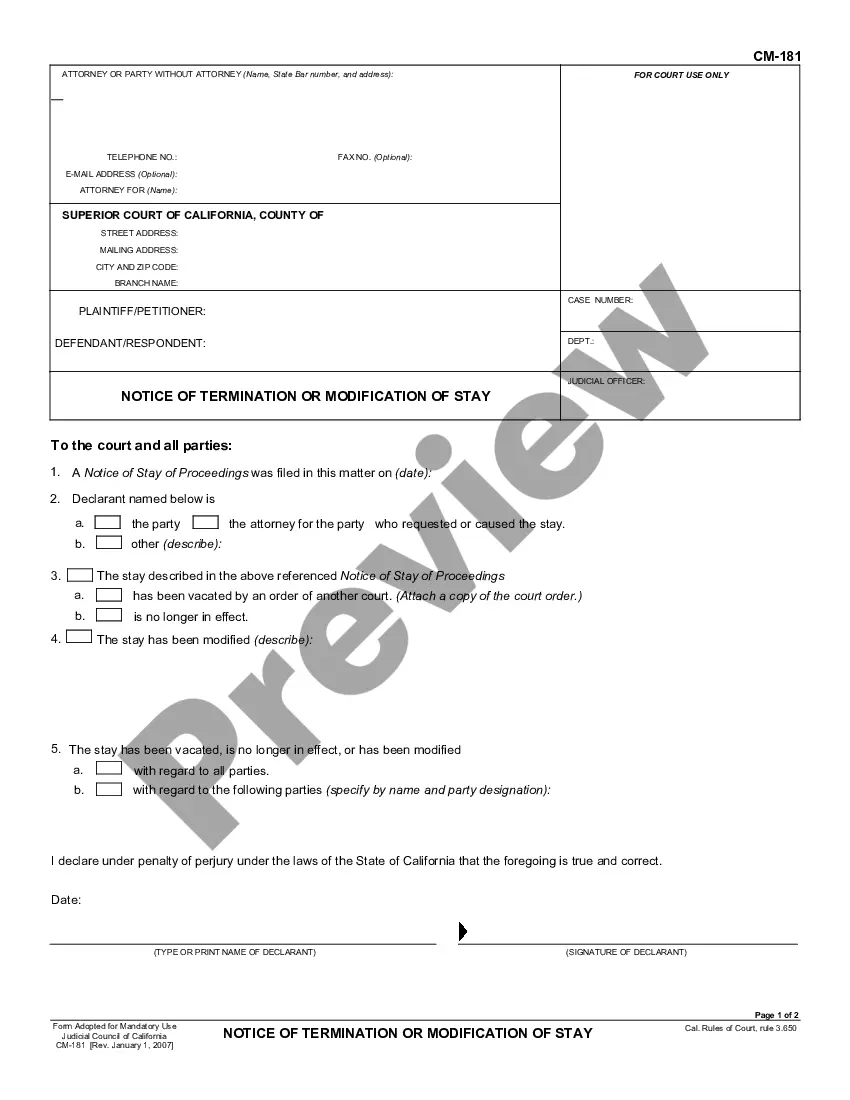

How to fill out Kansas Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

Are you inside a position the place you require files for both company or person functions nearly every day? There are a variety of legitimate file templates available online, but finding versions you can rely is not effortless. US Legal Forms offers 1000s of develop templates, just like the Kansas Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease, that happen to be composed to meet federal and state specifications.

In case you are already informed about US Legal Forms site and also have your account, merely log in. Next, you are able to obtain the Kansas Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease format.

Should you not provide an account and need to begin using US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for the correct area/county.

- Make use of the Review switch to examine the form.

- Read the information to actually have selected the correct develop.

- In case the develop is not what you`re looking for, utilize the Look for area to find the develop that meets your requirements and specifications.

- When you get the correct develop, just click Acquire now.

- Opt for the costs program you would like, complete the desired information to make your money, and pay for the transaction making use of your PayPal or charge card.

- Select a hassle-free file file format and obtain your duplicate.

Locate all the file templates you may have purchased in the My Forms food selection. You can obtain a further duplicate of Kansas Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease anytime, if needed. Just click on the essential develop to obtain or print the file format.

Use US Legal Forms, by far the most substantial assortment of legitimate forms, to save lots of time as well as prevent mistakes. The support offers expertly created legitimate file templates that you can use for a selection of functions. Generate your account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

Royalty refers to a contractual payment by a person for the use of assets belonging to another person. The payment includes royalty for the use of intangible assets, such as copyrights, trademarks, or franchise model agreements. Royalty is also paid for the use of natural resources, such as mining leases.

The amount someone pays you to use your property, after you subtract the expenses you have for the property.

Hear this out loud PauseThe owner is called the Lessor and the person who takes the right to the asset is called the lessee. In the royalty account notes, there is often a mention of the lease which is made between two people. The amount which is to be paid to the lessor on behalf of the lessee is known as Royalties.

Royalties are payable based on sales and production. The amount of the royalty is variable by sales and production. The parties of the rent are called a tenant or landlord. Rents are payable by time or week.

Hear this out loud PauseRoyalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

It is the amount that has to be paid by the lessee to the lessor whether or not he has derived benefit from the asset. Hence, it is also called Dead Rent or Rock Rent. Minimum rent can be a fixed sum for every year or may change every year as per the terms of the agreement.