The Kansas Clauses Relating to Accounting Matters refer to specific provisions in the Kansas state laws that pertain to accounting principles, practices, and matters within the state. These clauses ensure compliance with generally accepted accounting principles (GAAP) and facilitate proper financial reporting and transparency in various entities operating within Kansas. Here, we will explore some types of Kansas Clauses Relating to Accounting Matters: 1. Kansas Accounting Standards Clause: This provision establishes that all financial statements and accounting records in Kansas must adhere to the universally accepted accounting principles set forth by GAAP. It ensures consistency, comparability, and accuracy in financial reporting by businesses, government agencies, nonprofits, and other entities operating in the state. 2. Kansas Disclosure Requirements Clause: This clause specifies the information that entities must disclose in their financial statements for the benefit of investors, creditors, stakeholders, and the public. It may include the disclosure of major accounting policies, significant accounting estimates, related party transactions, contingent liabilities, and other financial information deemed necessary for transparency. 3. Kansas Auditing and Compliance Clause: This provision requires entities to conduct regular audits of their financial statements by independent certified public accountants (CPA's) or external auditing firms. It mandates compliance with auditing standards and the submission of audited financial statements to the relevant Kansas state authorities, ensuring financial accountability and accuracy. 4. Kansas Tax Reporting Clause: This clause pertains to the accounting and reporting requirements for tax purposes. It necessitates the accurate calculation, reporting, and payment of various taxes, such as income tax, sales tax, property tax, and payroll tax, following the guidelines provided by the Kansas Department of Revenue. It serves to ensure proper tax compliance and prevent potential tax evasion. 5. Kansas Nonprofit and Government Accounting Clause: This clause specifically addresses accounting matters related to nonprofit organizations and government entities operating in Kansas. It may include guidelines for fund accounting, cost allocation methods, reporting of restricted funds, compliance with specific regulations applicable to nonprofit or government sectors, and other relevant accounting practices. 6. Kansas Securities and Exchange Commission (SEC) Reporting Clause: For publicly-traded companies based in Kansas, this clause applies to accounting matters related to financial reporting under SEC regulations. It includes adherence to Generally Accepted Accounting Principles (GAAP) and compliance with the relevant sections of the Securities Act of 1933 and the Securities Exchange Act of 1934. It is important to note that the specific clauses and their details may vary over time. Organizations and entities operating in Kansas should consult the Kansas state statutes, accounting boards, relevant regulatory bodies, and professional accountants for accurate and up-to-date information regarding the Kansas Clauses Relating to Accounting Matters.

Kansas Clauses Relating to Accounting Matters

Description

How to fill out Kansas Clauses Relating To Accounting Matters?

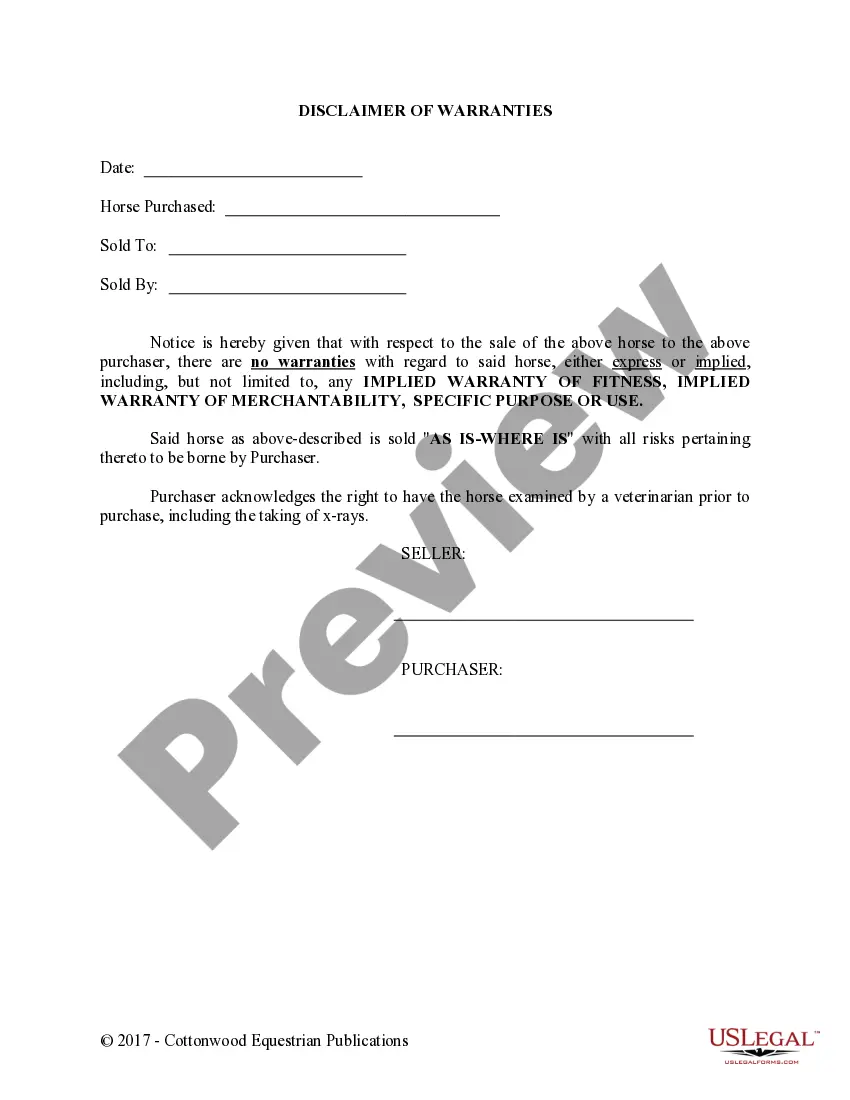

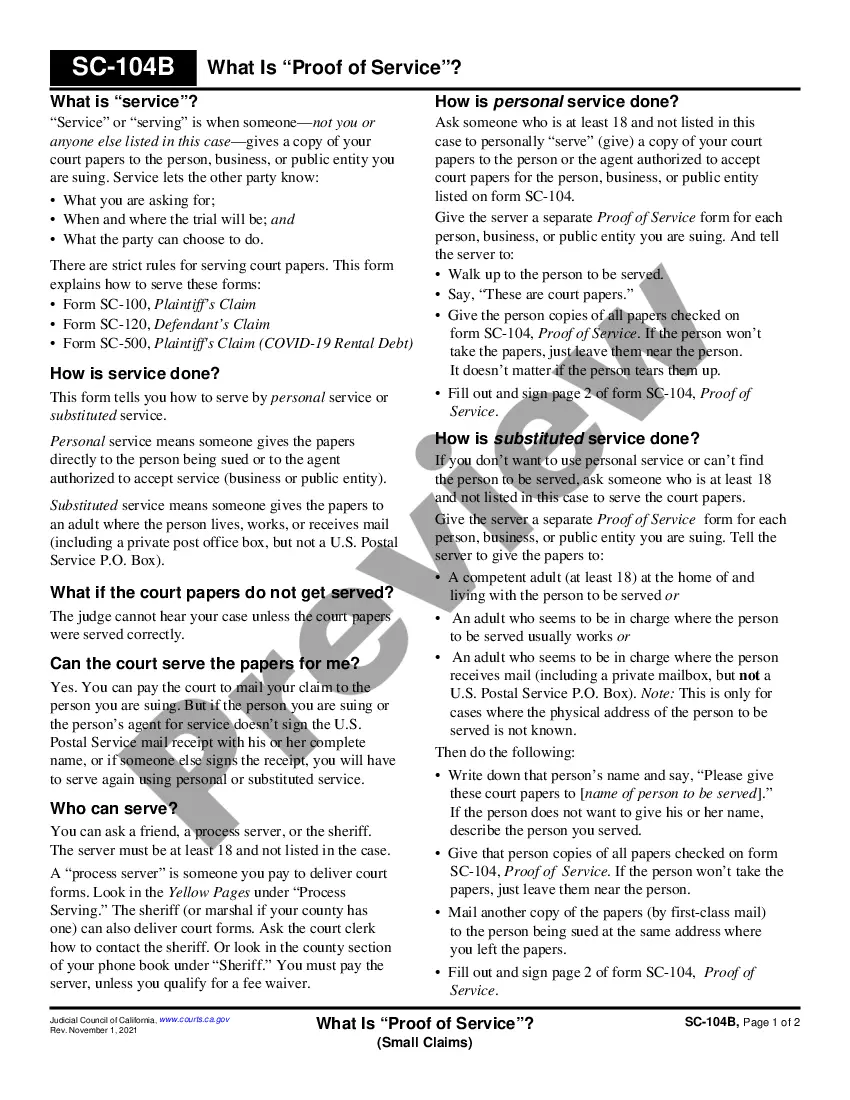

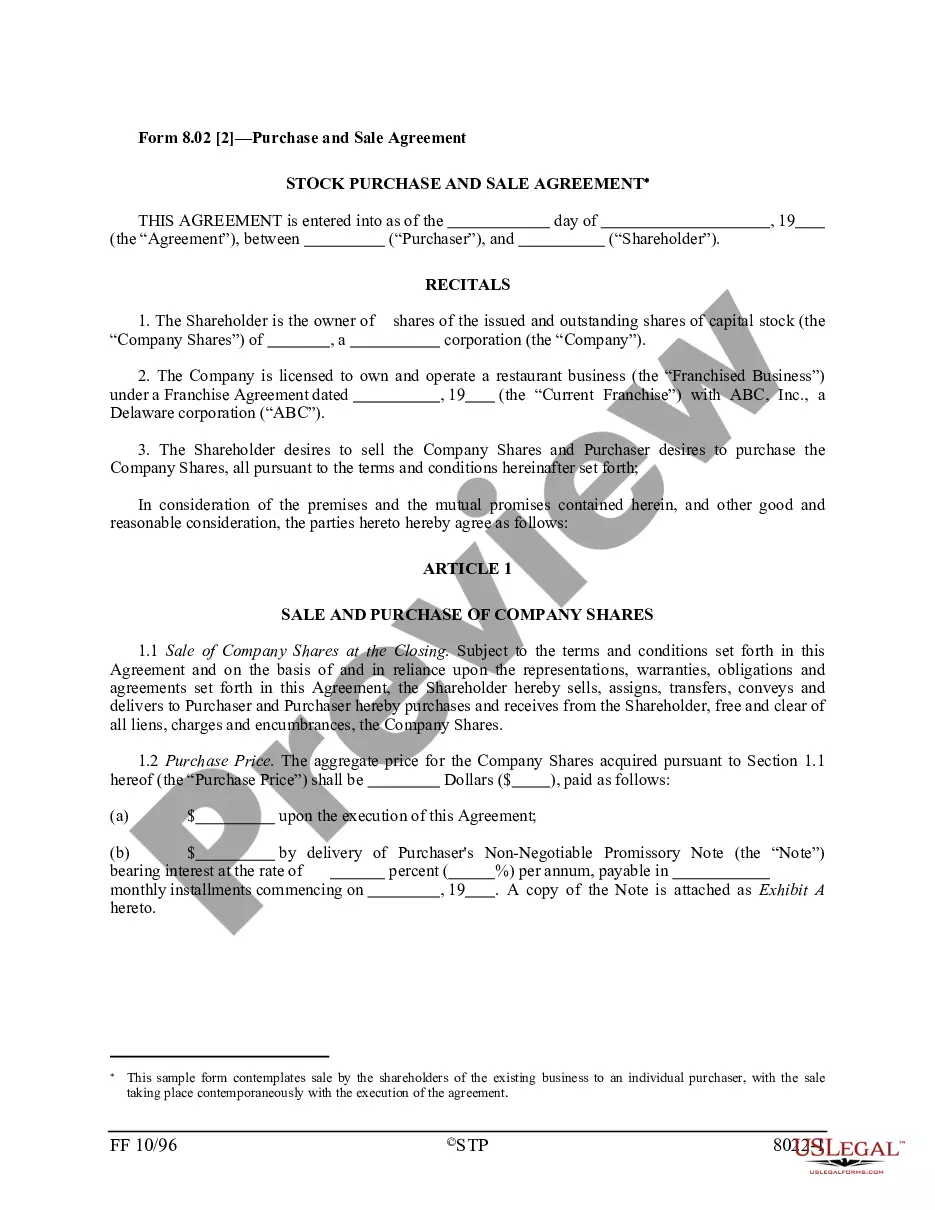

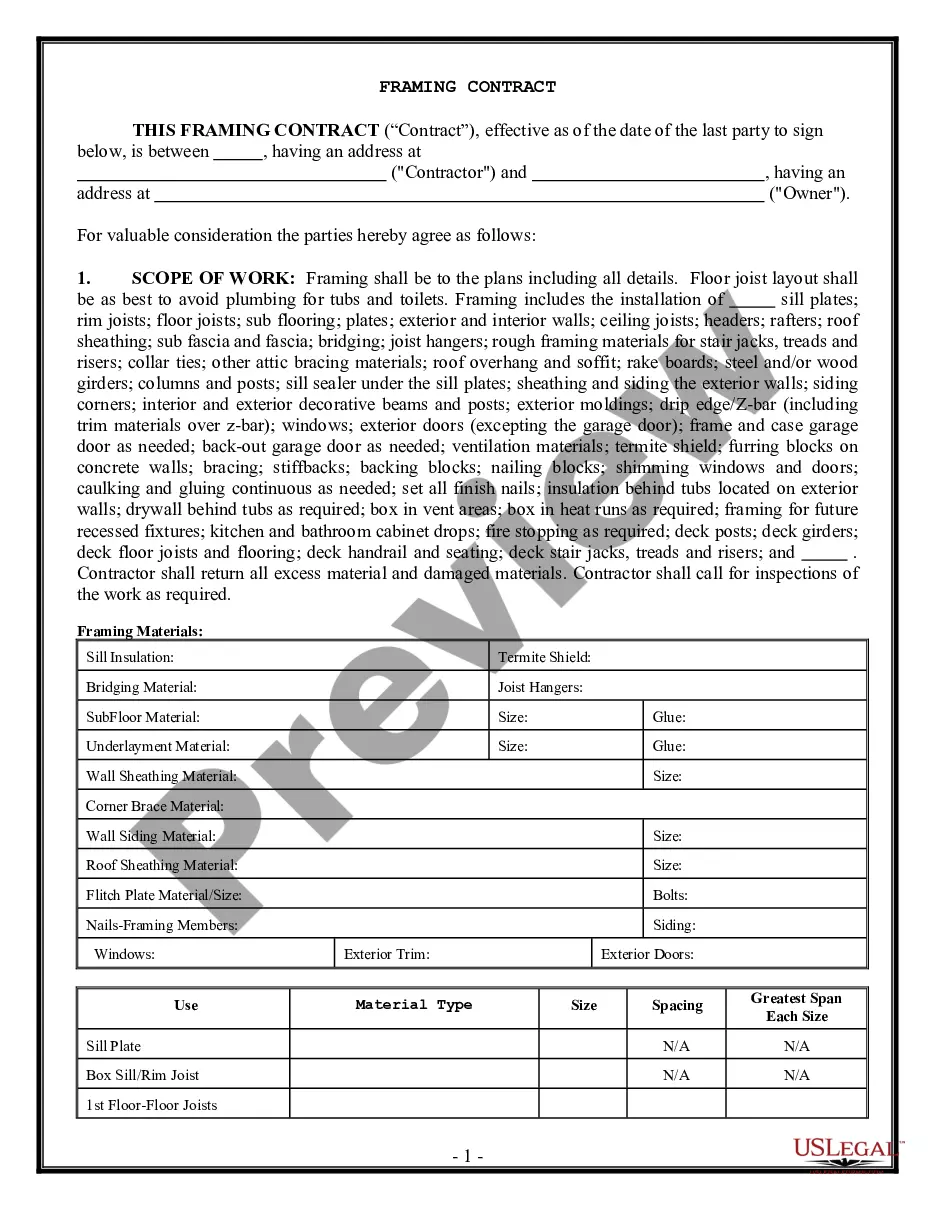

You can invest hours on the web looking for the authorized papers design that fits the state and federal specifications you need. US Legal Forms gives a large number of authorized forms that happen to be examined by pros. It is possible to down load or produce the Kansas Clauses Relating to Accounting Matters from your support.

If you have a US Legal Forms profile, you may log in and click the Down load button. Following that, you may complete, change, produce, or indication the Kansas Clauses Relating to Accounting Matters. Each authorized papers design you purchase is yours for a long time. To obtain an additional copy of the obtained kind, go to the My Forms tab and click the corresponding button.

If you use the US Legal Forms web site for the first time, adhere to the basic instructions under:

- Initial, be sure that you have chosen the best papers design for that area/town of your choice. Look at the kind explanation to make sure you have picked the appropriate kind. If offered, take advantage of the Preview button to appear through the papers design also.

- If you wish to find an additional edition of the kind, take advantage of the Look for field to get the design that fits your needs and specifications.

- Once you have found the design you want, click Get now to proceed.

- Select the costs prepare you want, type your accreditations, and sign up for an account on US Legal Forms.

- Total the transaction. You may use your charge card or PayPal profile to cover the authorized kind.

- Select the formatting of the papers and down load it to your device.

- Make adjustments to your papers if necessary. You can complete, change and indication and produce Kansas Clauses Relating to Accounting Matters.

Down load and produce a large number of papers layouts making use of the US Legal Forms website, that provides the biggest variety of authorized forms. Use skilled and status-specific layouts to tackle your business or individual requires.