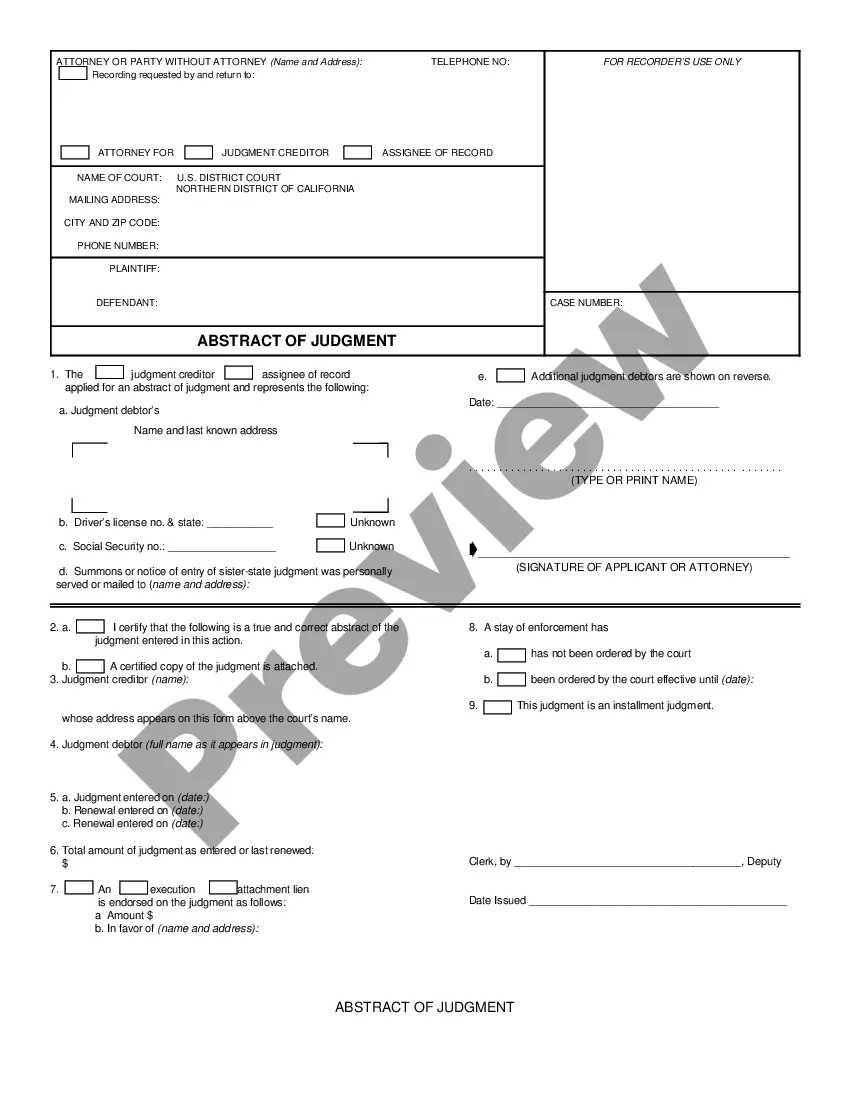

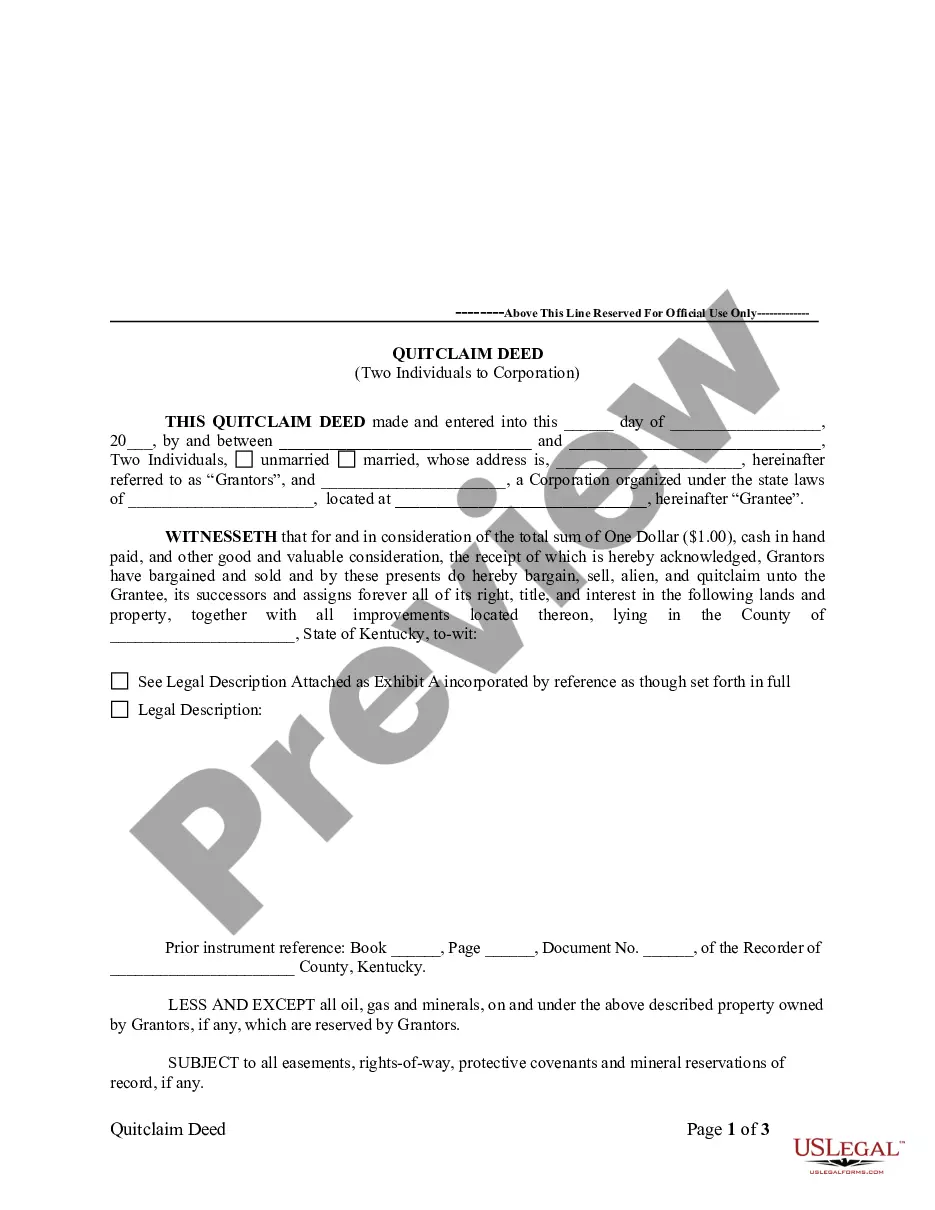

The Kansas Clawback Guaranty is a legal provision that aims to protect creditors from the risks associated with loans, financial obligations, or business transactions. It is designed to provide a sense of security and reassurance to lenders, allowing them to recover their investments in the event of borrower default or insolvency. This detailed description will provide insights into the Kansas Clawback Guaranty, illustrating its significance and various types. In Kansas, the Clawback Guaranty acts as a safeguard, granting lenders the ability to exercise their right to claw back or recover the funds lent to borrowers when certain predetermined conditions are met. These conditions generally pertain to the borrower's inability to fulfill their financial obligations, such as missed payments, bankruptcy, or default. The guarantor, usually an individual or an entity, assumes responsibility for the repayment of the loan or debt, should the borrower fail to do so. There are several types of Kansas Clawback Guaranties, each serving a specific purpose and catering to different scenarios. It is crucial for lenders and borrowers to understand these types to ensure proper safeguarding of investments and contractual agreements. Some notable forms include: 1. Traditional Clawback Guaranty: This type of guaranty provides a safety net to lenders by enabling them to reclaim the borrowed funds directly from the guarantor in the event of default. The guarantor becomes legally bound to repay the loan or debt on behalf of the borrower, ensuring the lender's recovery. 2. Fraudulent Conveyance Clawback Guaranty: This specific guaranty protects creditors from fraudulent transactions or conveyances made by the borrower. If the borrower unlawfully transfers assets or property to defraud creditors, the Clawback Guaranty empowers lenders to reclaim the transferred assets from the guarantor, ensuring their protection. 3. Collateral Clawback Guaranty: In cases where the borrower has provided collateral against the loan or debt, this type of guaranty enables the lender to recover the loan amount from the guarantor by seizing or liquidating the collateral. The guarantor becomes responsible for any shortfall if the proceeds from the collateral fall short of the outstanding balance. 4. Limited Clawback Guaranty: As the name suggests, this guaranty places constraints on the repayment responsibilities of the guarantor. The guarantor's liability is limited to a specific amount or duration, ensuring they are not burdened with indefinite repayment obligations. By implementing the Kansas Clawback Guaranty, lenders can mitigate the potential risks associated with loan agreements and provide a level of protection for their investments. It acts as a safety net, offering reassurance to lenders and facilitating a secure financial environment. Understanding the different types of Clawback Guaranties is essential for both lenders and borrowers to establish appropriate contractual arrangements and protect their interests.

Kansas Clawback Guaranty

Description

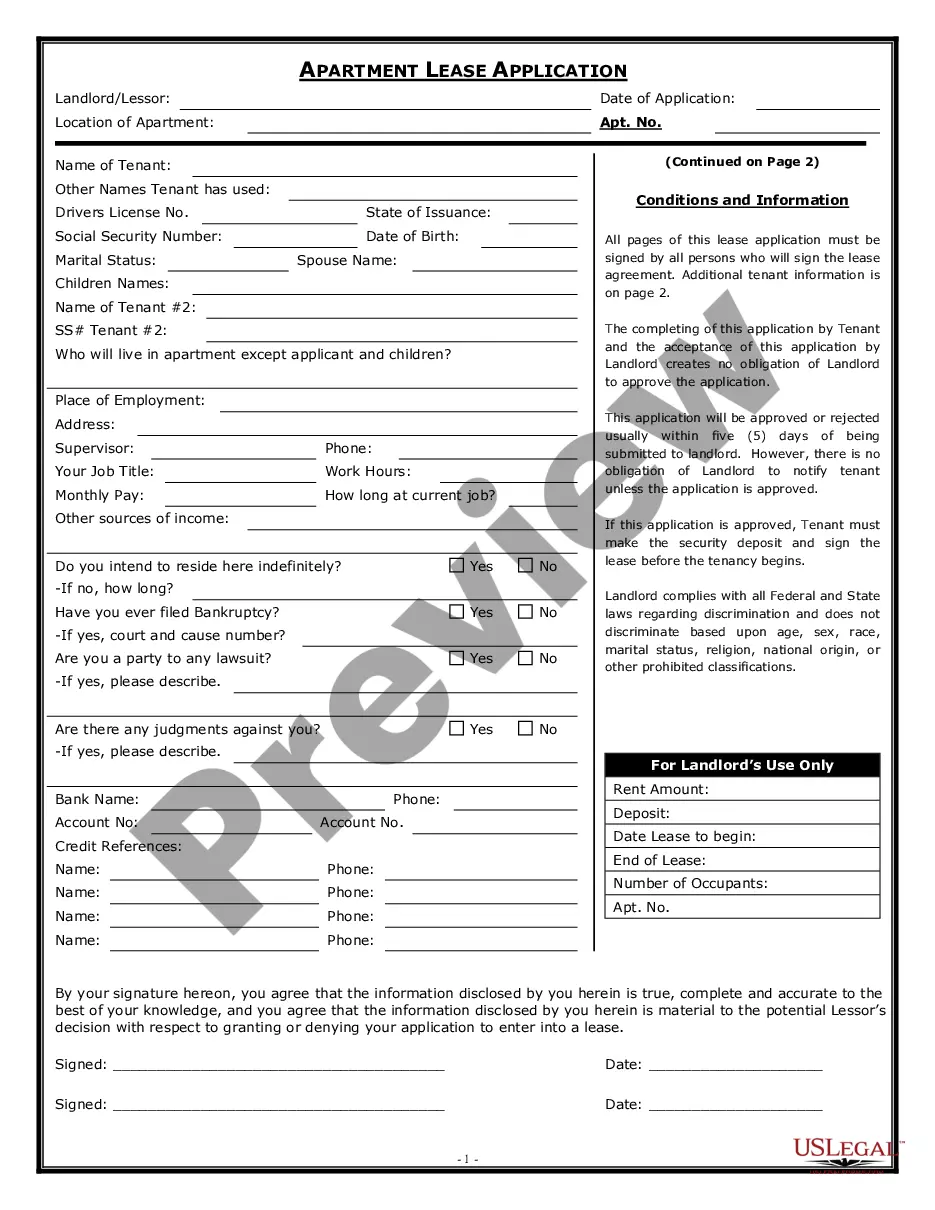

How to fill out Kansas Clawback Guaranty?

If you wish to comprehensive, acquire, or print out authorized papers layouts, use US Legal Forms, the biggest assortment of authorized types, that can be found on the web. Make use of the site`s basic and convenient research to find the papers you need. Different layouts for organization and specific functions are sorted by classes and claims, or keywords. Use US Legal Forms to find the Kansas Clawback Guaranty within a handful of mouse clicks.

Should you be currently a US Legal Forms client, log in to your account and then click the Obtain switch to have the Kansas Clawback Guaranty. You may also accessibility types you earlier downloaded in the My Forms tab of your account.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for that appropriate metropolis/land.

- Step 2. Make use of the Review option to look through the form`s articles. Never overlook to learn the description.

- Step 3. Should you be not satisfied with all the develop, make use of the Research area towards the top of the display to discover other variations in the authorized develop web template.

- Step 4. Upon having located the form you need, click on the Purchase now switch. Choose the pricing prepare you choose and add your references to register for an account.

- Step 5. Approach the financial transaction. You may use your charge card or PayPal account to complete the financial transaction.

- Step 6. Select the formatting in the authorized develop and acquire it on your own product.

- Step 7. Total, modify and print out or signal the Kansas Clawback Guaranty.

Each authorized papers web template you buy is yours for a long time. You have acces to each develop you downloaded within your acccount. Select the My Forms segment and pick a develop to print out or acquire once again.

Be competitive and acquire, and print out the Kansas Clawback Guaranty with US Legal Forms. There are many skilled and condition-particular types you can use to your organization or specific requires.

Form popularity

FAQ

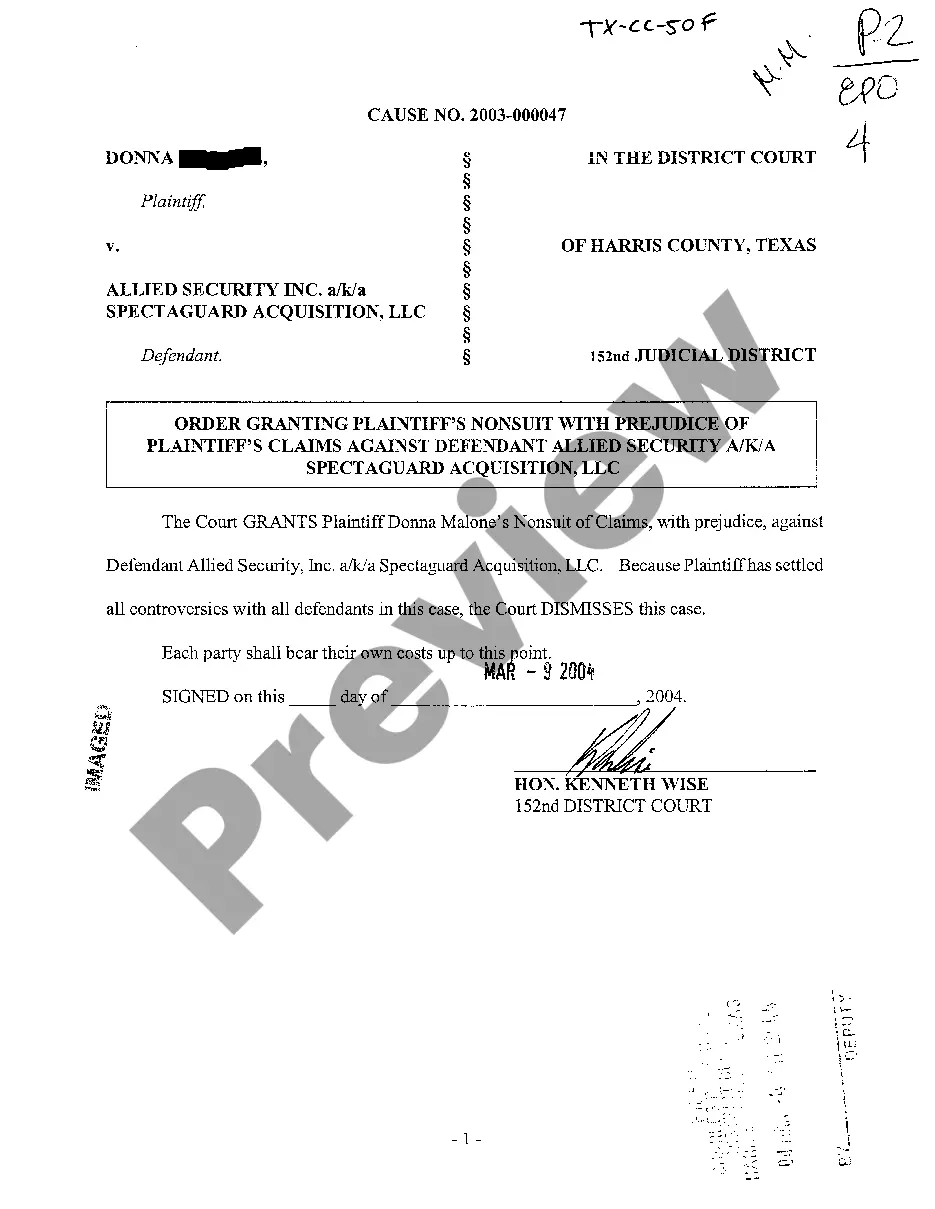

Rule 10D-1 states that a corporation's policy must be triggered any time a material accounting error is discovered in the preceding three years' financial statements.

In 2022, the SEC adopted much broader clawback rules under the federal Dodd-Frank Act of 2010. Stock exchanges must require listed companies to implement a clawback policy for erroneously awarded incentives received by current or former executives.

As discussed above, under the new disclosure requirement added to Item 402 of Regulation S-K, a company must disclose any erroneously awarded compensation that remains outstanding at the end of the last completed fiscal year and any amounts that are outstanding for 180 days or more.

A clawback is a contractual provision whereby money already paid to an employee must be returned to an employer or benefactor, sometimes with a penalty. Many companies use clawback policies in employee contracts for incentive-based pay like bonuses.

On February 22, 2023, the NYSE and Nasdaq released their respective versions of proposed listing standards, the final versions of which require listed companies to adopt, no later than December 1, 2023, clawback policies providing for the recovery of erroneously awarded incentive-based compensation ?received? by ...

Review the new clawback-related disclosure rules?Item 402(w) of Regulation S-K requires companies to disclose in their proxy statements any actions taken to recover erroneously awarded executive compensation during or following the end of the most recently completed fiscal year.

What is the clawback period? This 90-day period begins on the date that you file for bankruptcy. During this time, the trustee has the right to demand payment from creditors. If a creditor does not comply with the trustee's request, the trustee can take legal action to recover the money.

A clawback is a contractual provision that requires an employee to return money already paid by an employer, sometimes with a penalty. Clawbacks act as insurance policies in the event of fraud or misconduct, a drop in company profits, or for poor employee performance.