Kansas Letter Regarding Wage Statement is a legal document that employers in the state of Kansas must provide to their employees. This letter is intended to inform workers about their wages, deductions, and other related information. The Kansas Letter Regarding Wage Statement includes various essential details and is important for both the employer and the employee. It ensures transparency in the payment process, enables employees to keep track of their earnings, and helps resolve potential payment disputes. The content of this letter may vary slightly depending on the specific circumstances and types of employees. The Kansas Department of Labor mandates that the wage statement must include the following information: 1. Employee Information: This section includes the full name of the employee, their Social Security Number or Employee Identification Number, and their job title or position within the company. 2. Earnings: This section outlines the employee's gross wages for the pay period being reported, which includes regular hourly or salary rate, overtime pay, bonuses, commissions, and any other additional compensation earned during that period. 3. Deductions: The letter should clearly state the deductions made from the employee's wages, such as federal and state taxes, Social Security contributions, Medicare, health insurance premiums, retirement plan contributions, garnishments, and any other permissible deductions agreed upon by both parties. 4. Net Pay: This section calculates the total amount of wages the employee is entitled to after deducting all applicable taxes and deductions. It reflects the final amount that will be deposited into the employee's bank account or issued as a physical check. 5. Pay Period Date: The letter should state the specific dates covered by the wage statement, indicating the beginning and the end of the pay period. 6. Employer Information: This section provides important details about the employer, such as the company's name, address, contact information, and federal employer identification number (VEIN). 7. Employment Period: The letter should specify the period of employment to which the wage statement corresponds, including the starting and ending dates for that particular pay period. It must be noted that there are no specific types of Kansas Letters Regarding Wage Statement. However, the content may be modified based on certain circumstances. For example, if an employee has multiple positions within the same company, it may be necessary to provide separate wage statements for each role. Additionally, if an employee is paid by different methods (e.g., hourly wages for some hours and a salary for others), those details may be included as well. However, regardless of the complexity, the wage statement must conform to the Kansas Department of Labor guidelines to maintain compliance with the state's employment laws. In conclusion, the Kansas Letter Regarding Wage Statement is a crucial document that ensures transparency and compliance with labor laws. It provides essential information about an employee's earnings, deductions, and net pay, enabling both employers and employees to stay informed and resolve any payment-related issues effectively.

Kansas Letter regarding Wage Statement

Description

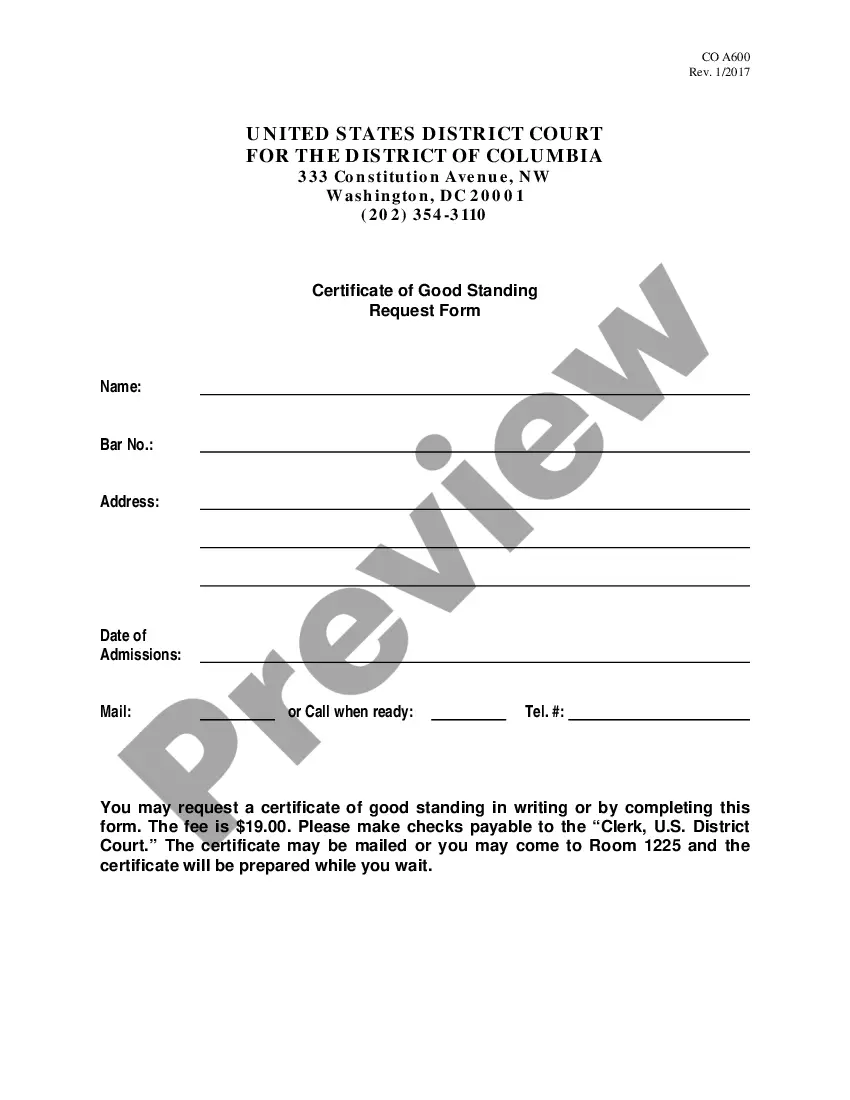

How to fill out Kansas Letter Regarding Wage Statement?

US Legal Forms - among the most significant libraries of lawful types in the United States - delivers a wide array of lawful document layouts you may obtain or printing. Making use of the internet site, you may get a huge number of types for company and specific uses, sorted by categories, suggests, or search phrases.You can get the most recent variations of types just like the Kansas Letter regarding Wage Statement within minutes.

If you have a monthly subscription, log in and obtain Kansas Letter regarding Wage Statement in the US Legal Forms local library. The Obtain key will show up on every single develop you view. You gain access to all in the past delivered electronically types inside the My Forms tab of your own profile.

If you wish to use US Legal Forms for the first time, listed here are easy recommendations to get you started off:

- Ensure you have picked the right develop for the town/area. Click on the Review key to examine the form`s content. See the develop description to ensure that you have chosen the appropriate develop.

- In the event the develop doesn`t satisfy your needs, use the Look for field near the top of the display to find the one that does.

- In case you are pleased with the shape, validate your option by clicking the Get now key. Then, choose the costs program you want and offer your accreditations to sign up to have an profile.

- Procedure the deal. Use your credit card or PayPal profile to complete the deal.

- Find the format and obtain the shape on your own product.

- Make adjustments. Complete, revise and printing and sign the delivered electronically Kansas Letter regarding Wage Statement.

Each template you put into your bank account lacks an expiration time and is also your own permanently. So, in order to obtain or printing one more version, just proceed to the My Forms segment and click in the develop you require.

Get access to the Kansas Letter regarding Wage Statement with US Legal Forms, probably the most substantial local library of lawful document layouts. Use a huge number of professional and express-certain layouts that fulfill your small business or specific requires and needs.

Form popularity

FAQ

Accurate pay stubs must be kept in California for three years, even if they are generated and kept out-of-state. California Labor Code section 1174 requires that all payroll records showing employees' daily hours worked and the wages paid to them be kept in the State of California.

Ing to the Fair Labor Standards Act (FLSA), employers are not required to provide employees with pay stubs.

The state of Kansas passed legislation in 2007 that allowed employers to select their employee pay method. The legislation was known as the "paperless payroll law," and many employers opted to give their employees pay cards instead of cash, check, or direct deposit.

My employer refuses to give pay stubs ? what can I do? If an employer refuses to give an employee a pay stub, then the employee may be able to sue in a court of law to obtain the requested records.

What to Include in Your Demand Letter Background facts describing the wages that are owed. ... Use concise and polite language when discussing facts or making your demand. ... State how your employer can pay the wages. ... Include a deadline and intent to sue language. ... Add your signature.

The Kansas Wage Payment Act (KWPA) is a state law that governs how employers must pay their employees. The KWPA sets forth rules for when and how employers must pay their employees, and the amount of money they must pay. It applies to all employers in Kansas, regardless of the number of employees.

If you have not been paid all of your earned wages, please complete the enclosed Claim for Wages form and mail it to the Kansas Department of Labor, Employment Standards, 401 SW Topeka Blvd., Topeka, KS 66603-3182. A labor conciliator will review your claim and contact you to ask more questions if necessary.

The Kansas Wage Payment Act (KWPA) is a state law that governs how employers must pay their employees. The KWPA sets forth rules for when and how employers must pay their employees, and the amount of money they must pay. It applies to all employers in Kansas, regardless of the number of employees.