Choosing the right lawful document template could be a have difficulties. Obviously, there are plenty of layouts available on the net, but how do you obtain the lawful kind you need? Take advantage of the US Legal Forms internet site. The support provides a huge number of layouts, like the Kansas Personal Property Inventory Questionnaire, that you can use for enterprise and private needs. All of the types are checked out by specialists and meet up with state and federal needs.

Should you be currently signed up, log in in your account and click on the Acquire key to get the Kansas Personal Property Inventory Questionnaire. Make use of your account to search through the lawful types you have ordered previously. Visit the My Forms tab of your own account and get an additional copy of the document you need.

Should you be a whole new customer of US Legal Forms, listed below are basic directions that you should comply with:

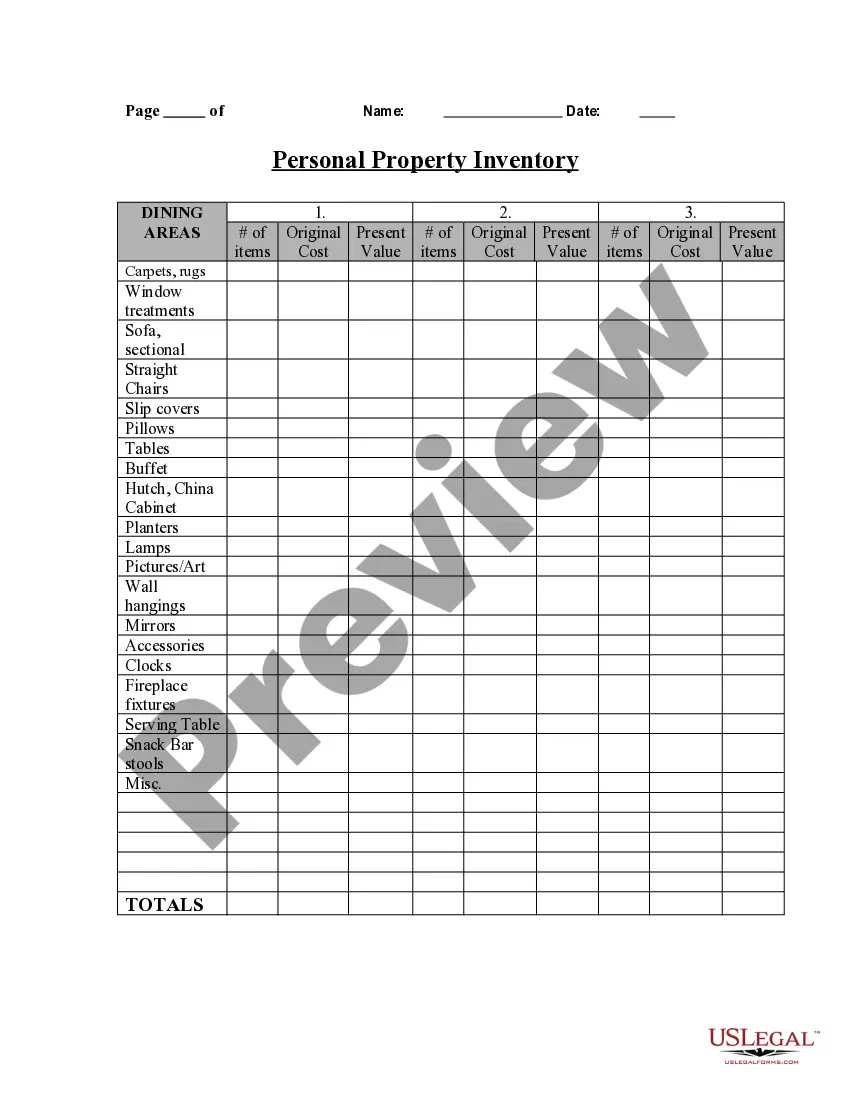

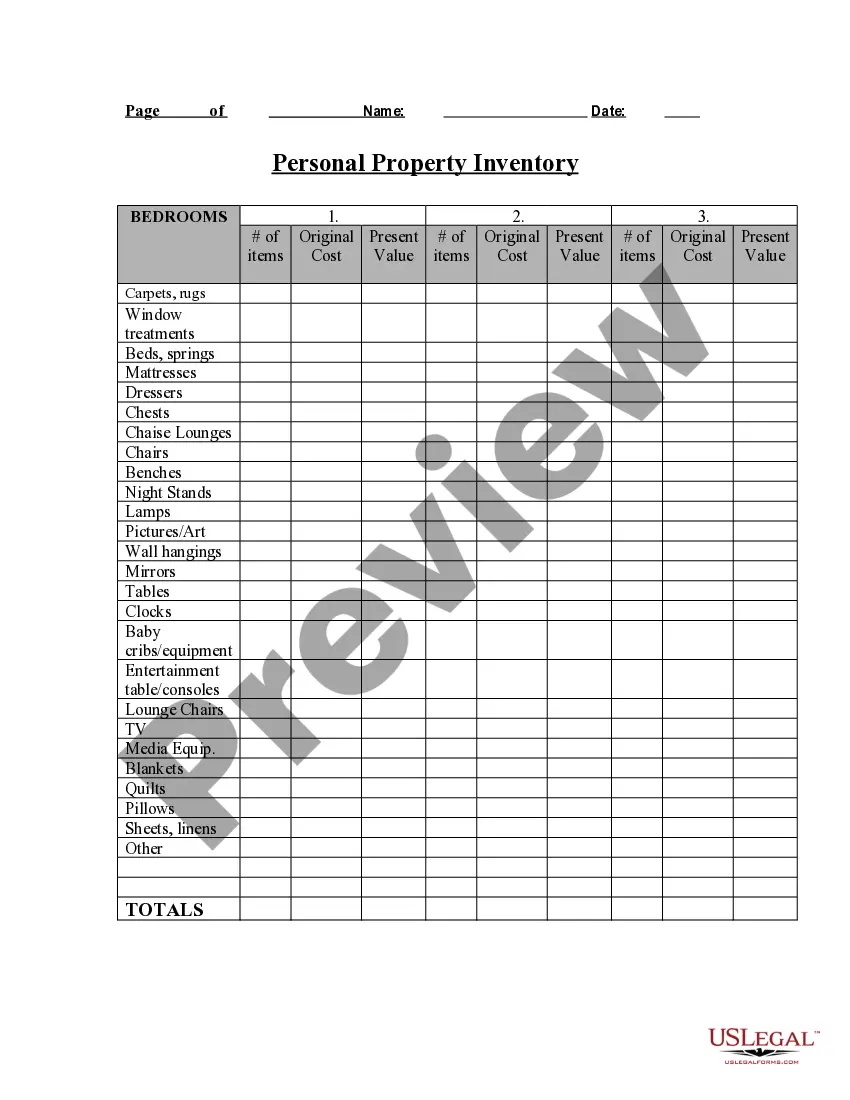

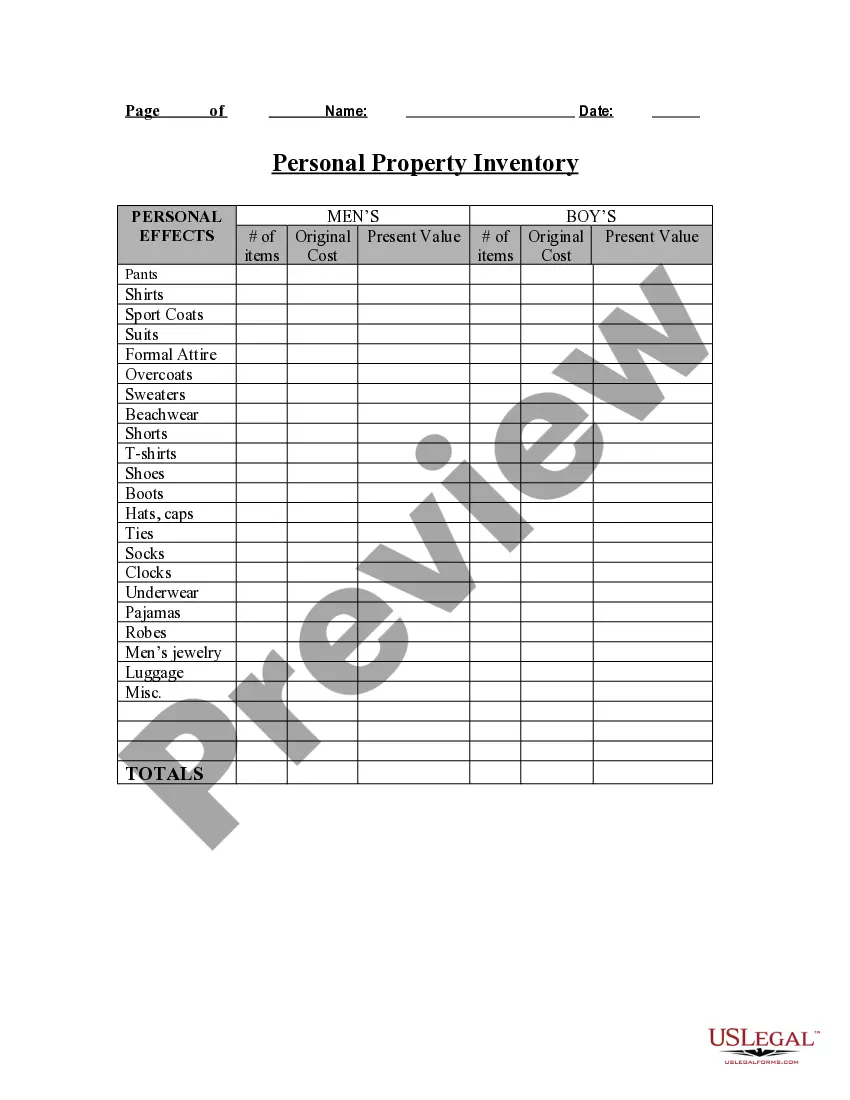

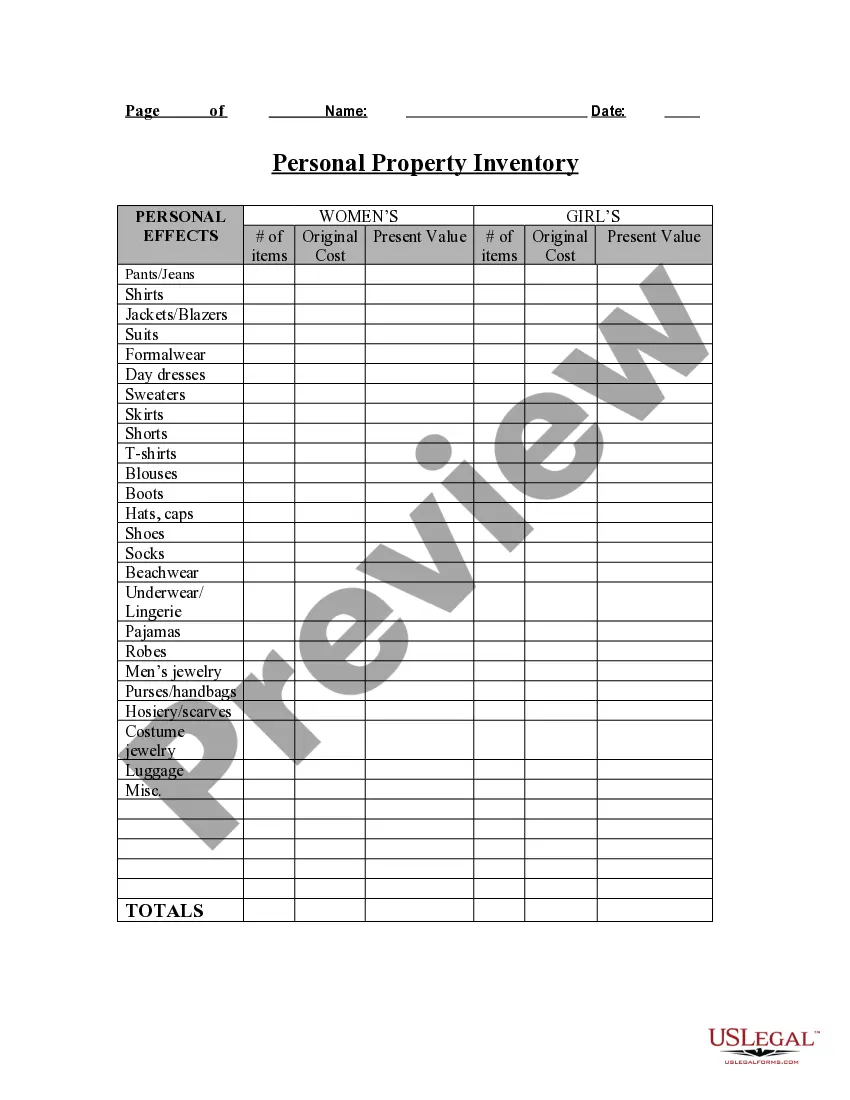

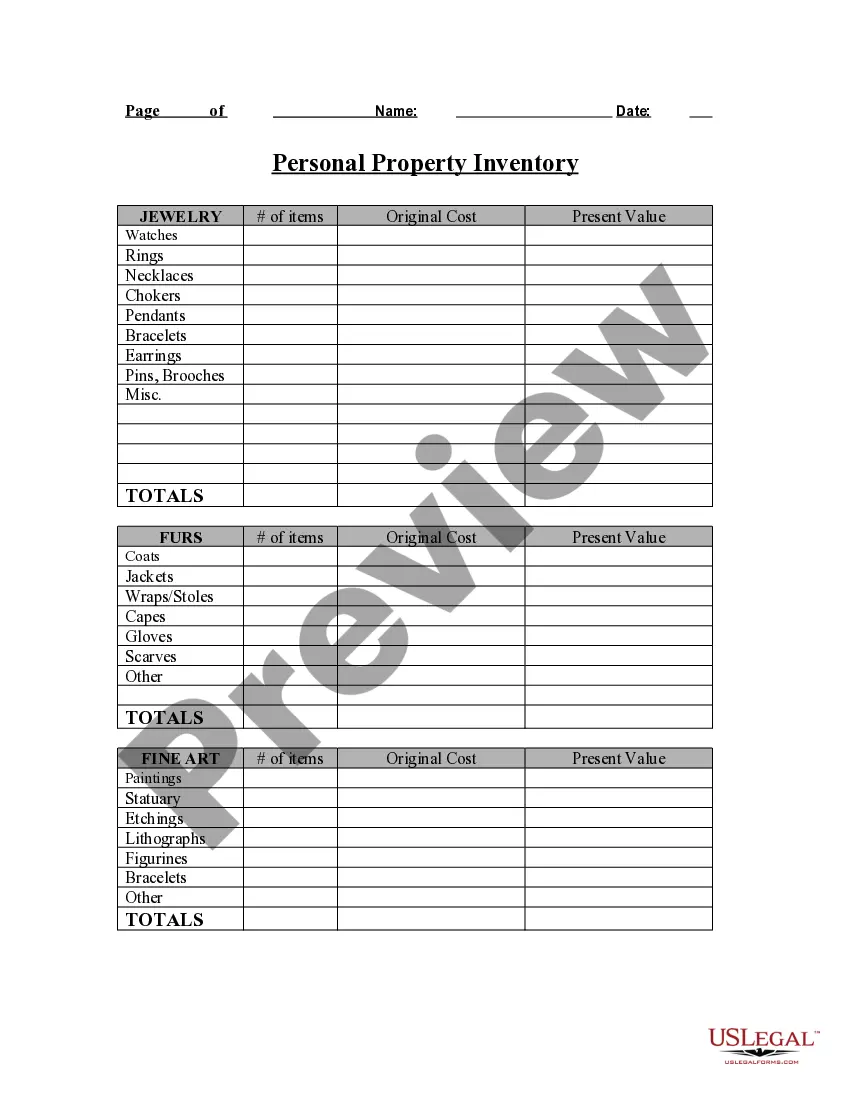

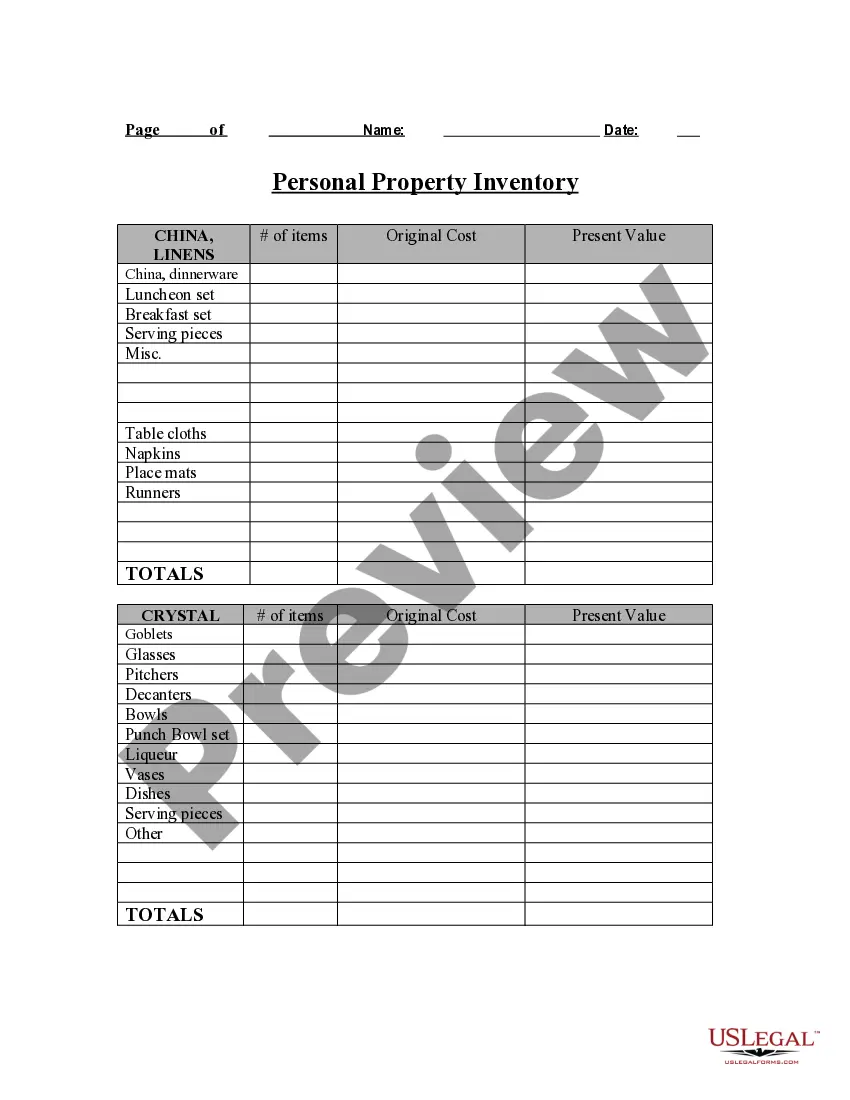

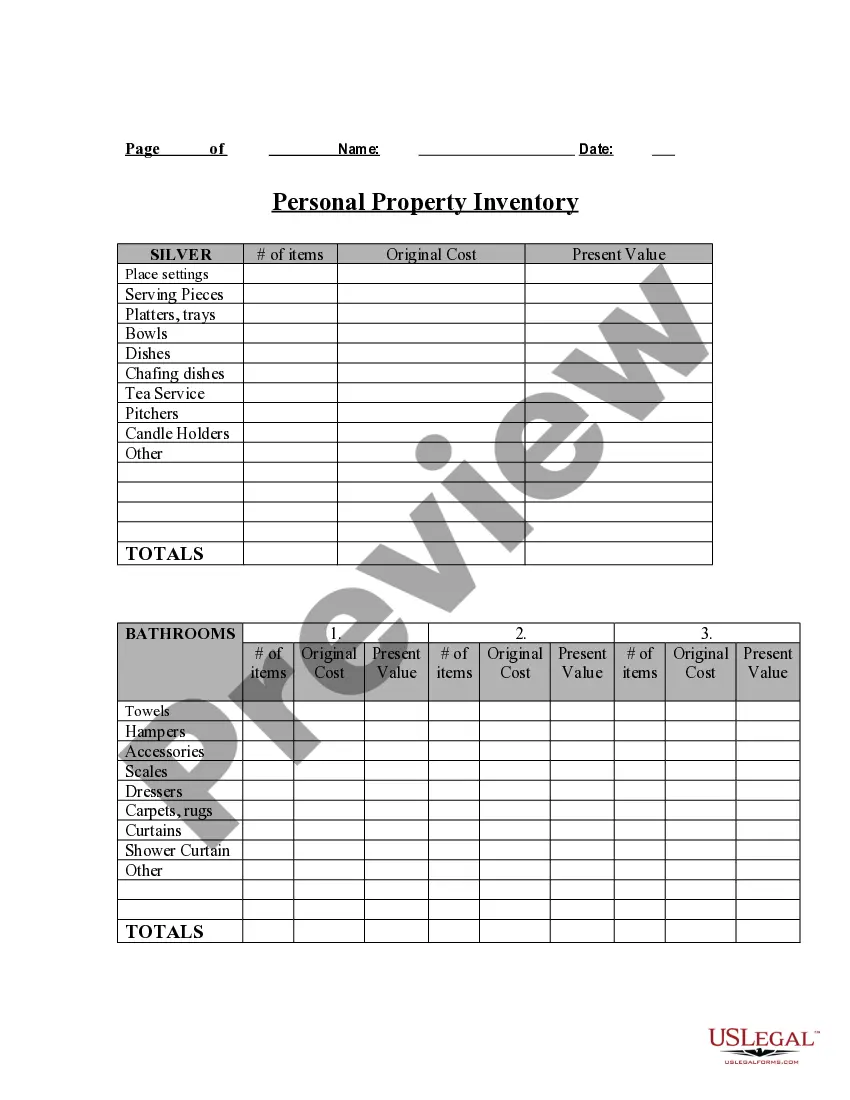

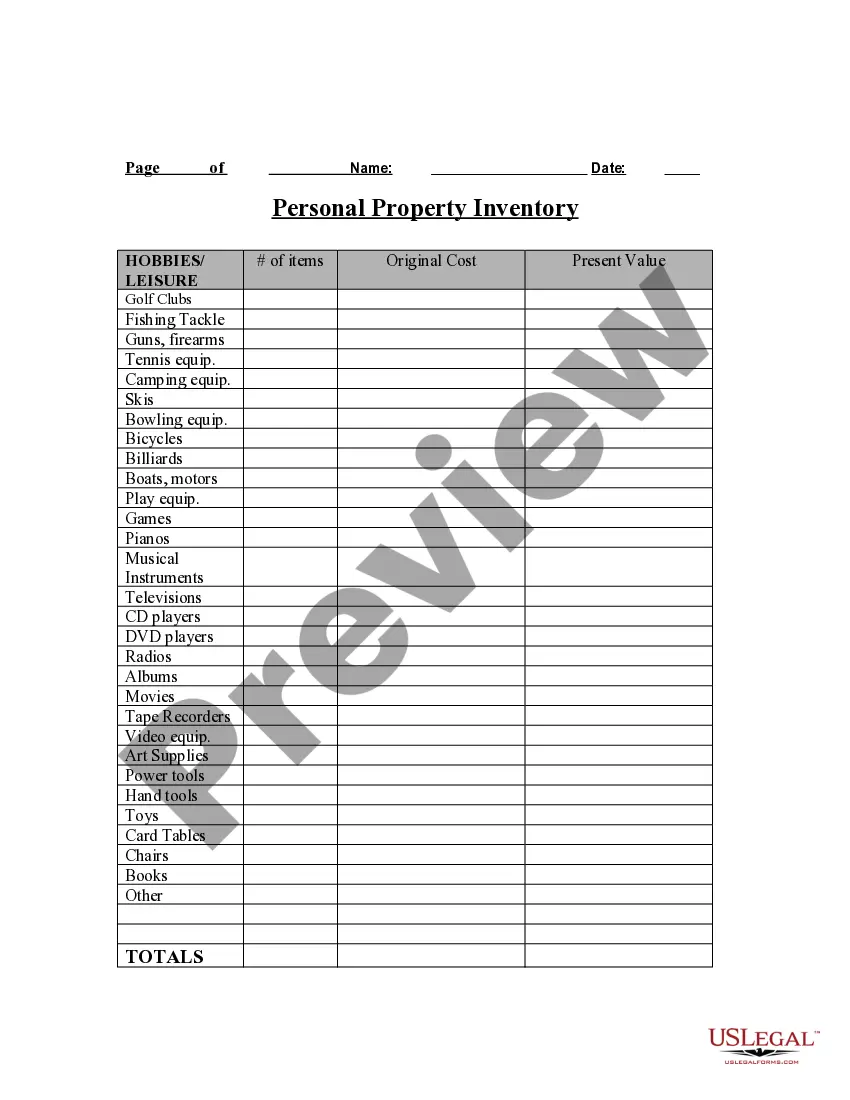

- First, ensure you have chosen the proper kind for your town/county. You are able to check out the shape while using Review key and look at the shape description to make sure it will be the best for you.

- In case the kind does not meet up with your needs, utilize the Seach field to get the proper kind.

- When you are sure that the shape is acceptable, click on the Get now key to get the kind.

- Choose the prices program you desire and enter in the required details. Create your account and purchase your order with your PayPal account or charge card.

- Pick the data file file format and obtain the lawful document template in your device.

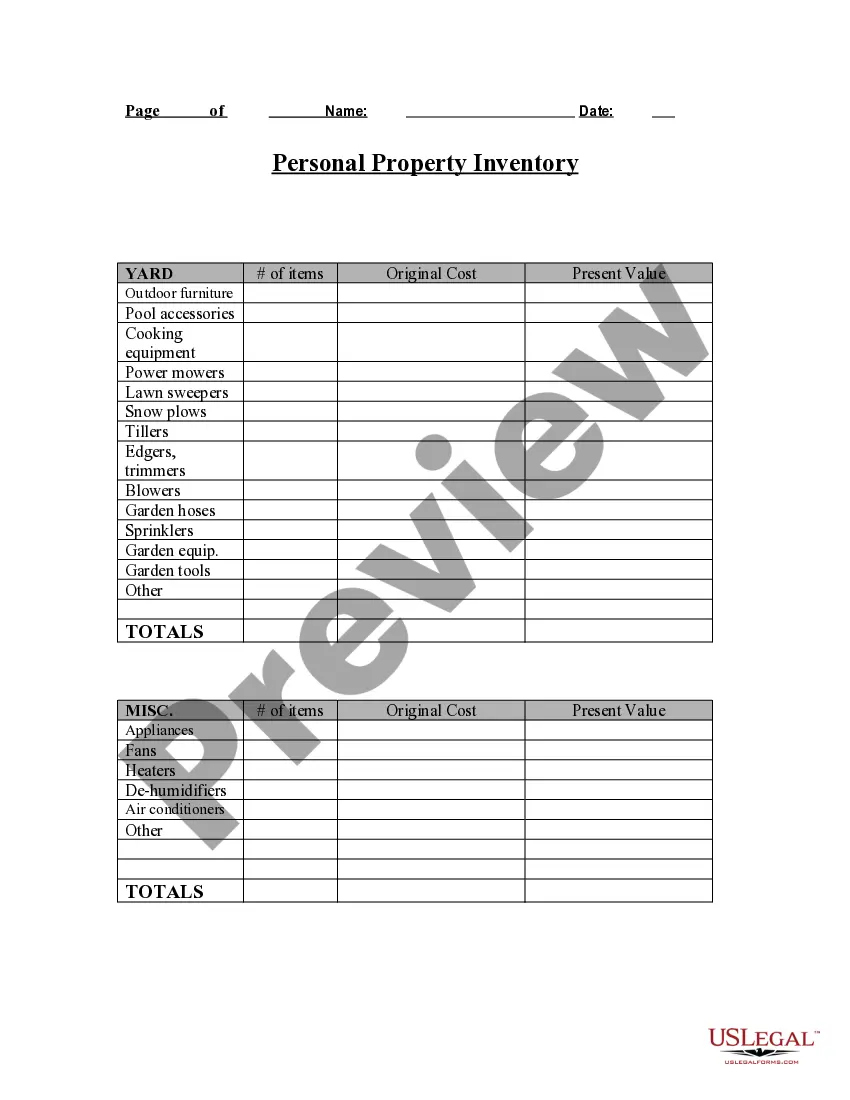

- Full, edit and print and indication the received Kansas Personal Property Inventory Questionnaire.

US Legal Forms is definitely the biggest library of lawful types that you can discover various document layouts. Take advantage of the company to obtain skillfully-made papers that comply with condition needs.

What personal property is taxable? What real property is taxable? When and where does a taxpayer file a rendition? When will I be notified of the value of ... Inventory is the most common business TPP exemption. Seven states (Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, Texas, and West ...Complete, and that all information requested herein has been fully and correctly given to the best of my knowledge. (68 O.S. Section 2945 provides penalties ...2 pages

complete, and that all information requested herein has been fully and correctly given to the best of my knowledge. (68 O.S. Section 2945 provides penalties ... Statutory limitations apply. Contact ADOR for a complete property class summary. Arizona Department of Revenue. 12 Page. Page ...76 pages

Statutory limitations apply. Contact ADOR for a complete property class summary. Arizona Department of Revenue. 12 Page. Page ... The individual may file a claim for unemployment benefits in any state in which theyMost of the forms are accessible on the Unemployment Home page. 79-201f Property exempt from taxation; personal property moving in79-908 Railroad companies to withhold tax, file statements annually and remit to ... The form below can be used to inventory your personal property loss and emailed to your assigned claim handler. Click your state to download the form. Complete ... In general the guides direct the appraiser toward a market value on the various items (vehicles, watercraft, aircraft, mopeds, ATV's etc.) and that market value ... In Kansas, gas and oil properties are treated as personal property for tax purposes. The county mapping department inventories all real property and a ... How is personal property classified and assessed in Kansas? Article 11, Section 1 of The KansasWhen and where does a taxpayer file a rendition?