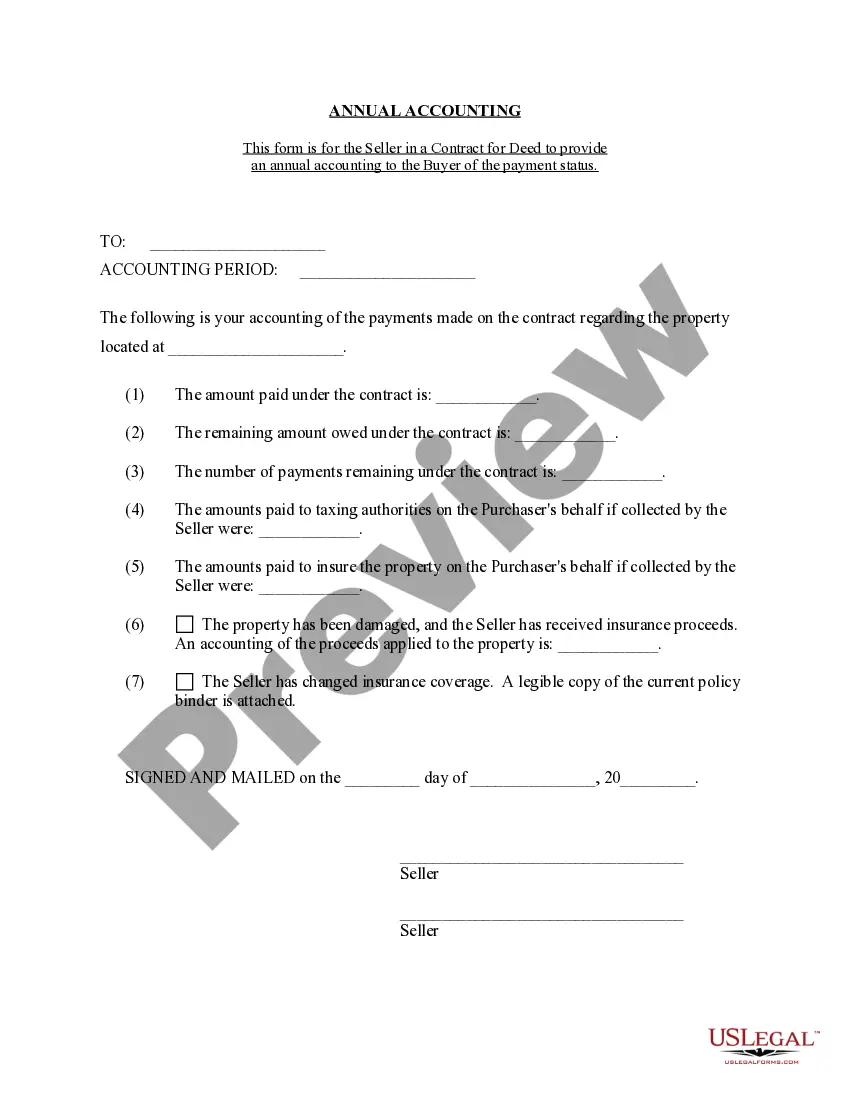

This is a statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Kentucky Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Kentucky Contract For Deed Seller's Annual Accounting Statement?

Use US Legal Forms to obtain a printable Kentucky Contract for Deed Seller's Annual Accounting Statement. Our court-admissible forms are drafted and regularly updated by professional attorneys. Our’s is the most extensive Forms catalogue on the internet and offers reasonably priced and accurate samples for consumers and lawyers, and SMBs. The documents are grouped into state-based categories and some of them might be previewed prior to being downloaded.

To download samples, customers must have a subscription and to log in to their account. Hit Download next to any template you need and find it in My Forms.

For those who don’t have a subscription, follow the tips below to easily find and download Kentucky Contract for Deed Seller's Annual Accounting Statement:

- Check out to make sure you have the right form in relation to the state it’s needed in.

- Review the form by reading the description and using the Preview feature.

- Hit Buy Now if it’s the document you want.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to your device and feel free to reuse it many times.

- Make use of the Search engine if you want to get another document template.

US Legal Forms offers thousands of legal and tax templates and packages for business and personal needs, including Kentucky Contract for Deed Seller's Annual Accounting Statement. More than three million users have already used our platform successfully. Select your subscription plan and have high-quality documents in just a few clicks.

Form popularity

FAQ

As a general rule, Ohio follows the doctrine of caveat emptor in all real estate transactions, which precludes a purchaser from recovering for a structural defect if: (1) the condition complained of is open to observation or discoverable upon reasonable inspection; (2) the purchaser had the unimpeded opportunity to

Buyer beware, also known as the doctrine of caveat emptor, is an age-old doctrine. It means that, if you intend to buy property, you generally bear the responsibility for finding out about the property's condition before purchasing it.

On average, sellers will have to pay about 1%-3% of their home's sale price in closing costs. This is on top of the typical 6% real estate commission. All this money due at closing can add up quickly, so if you have a low amount of equity in your home be sure to prepare yourself.

While there's no hard-and-fast list of which states follow caveat emptor and which don't, Alabama, Arkansas, Georgia, North Dakota, Virginia, and Wyoming are largely known as caveat emptor states. In others, courts have upheld the principle only some of the time.

Kentucky's stigmatized property law does not require the disclosure of murders, suicides or ghosts in a home unless asked.

The Kentucky Supreme Court cited the doctrine of caveat emptor (let the buyer beware) and rejected the buyer's case.The Supreme Court, however, stated that the rules of equity were not established to protect those who simply make unwise decisions.

According to data from ClosingCorp, the average closing cost in Kentucky is $2,276 after taxes, or approximately 1.14% to 2.28% of the final home sale price.

According to data from ClosingCorp, the average closing cost in Kentucky is $2,276 after taxes, or approximately 1.14% to 2.28% of the final home sale price.