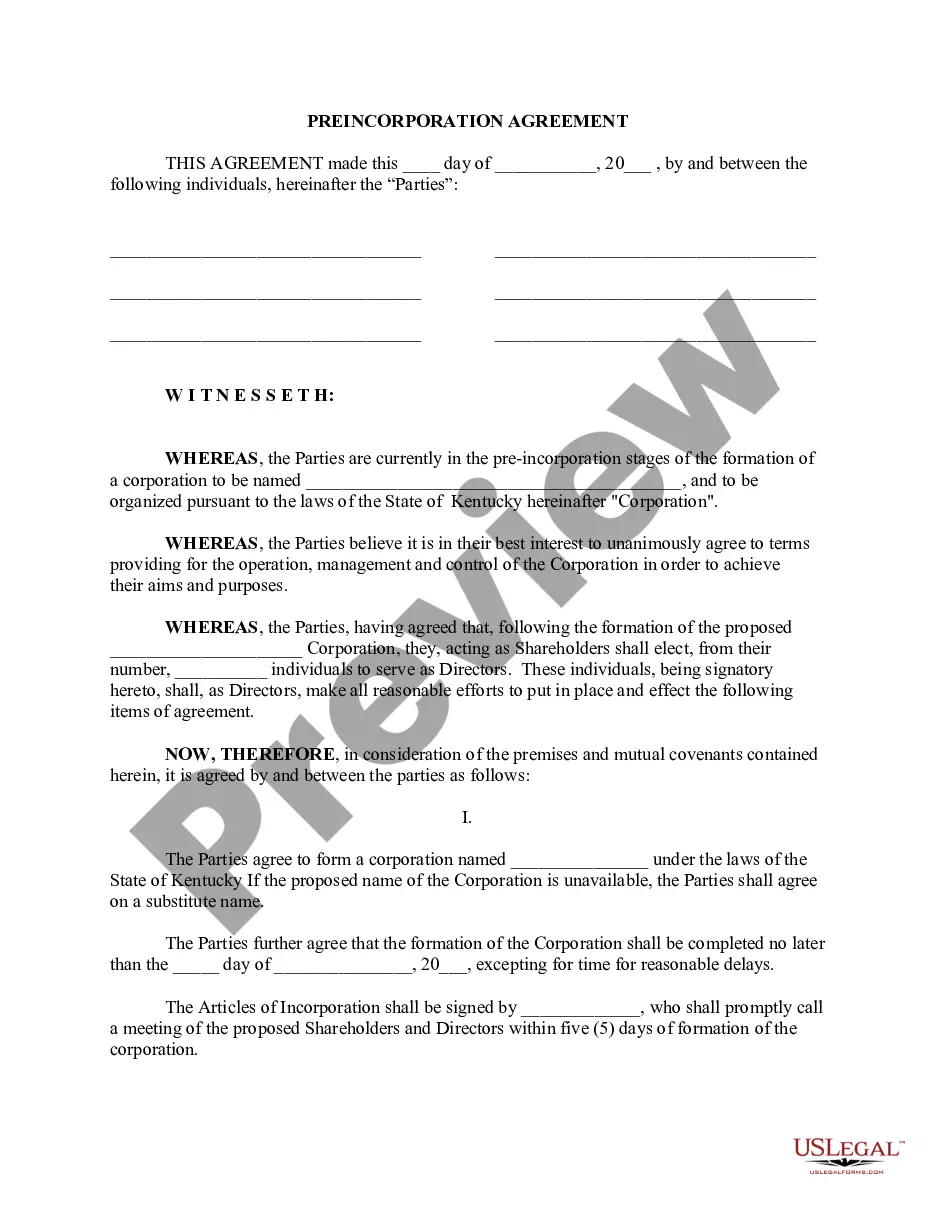

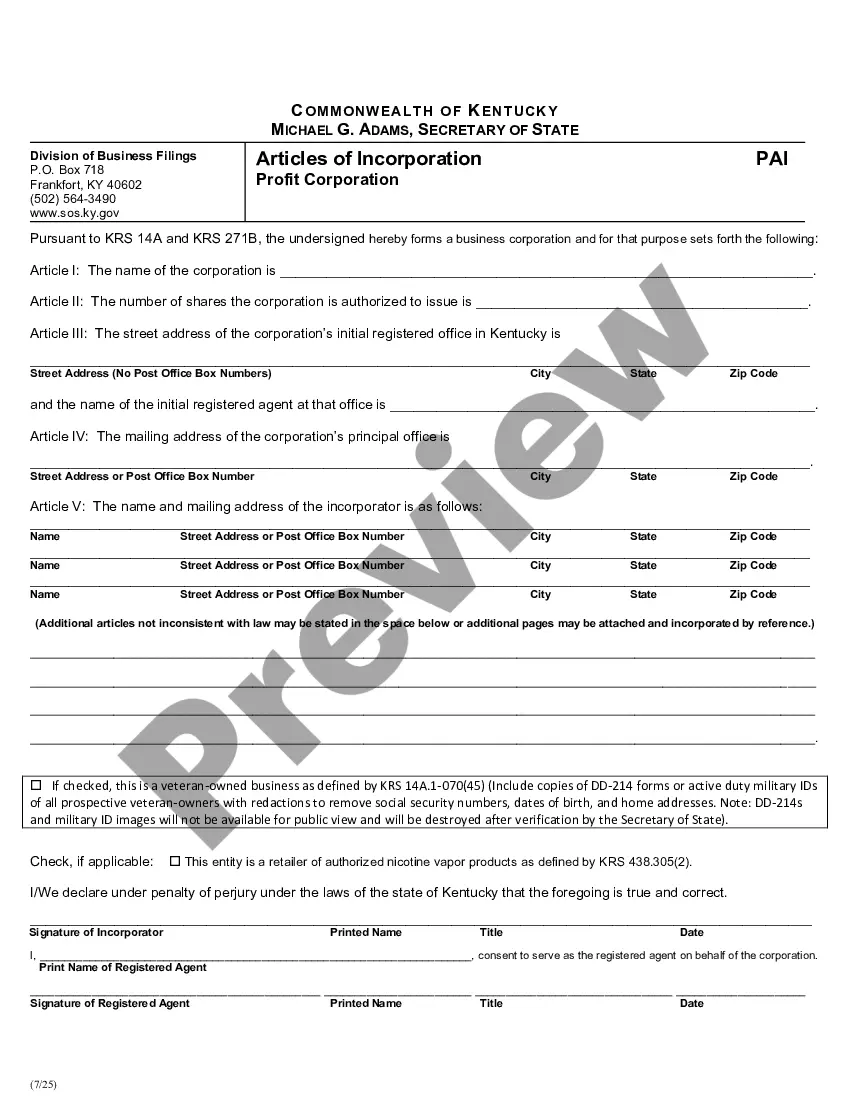

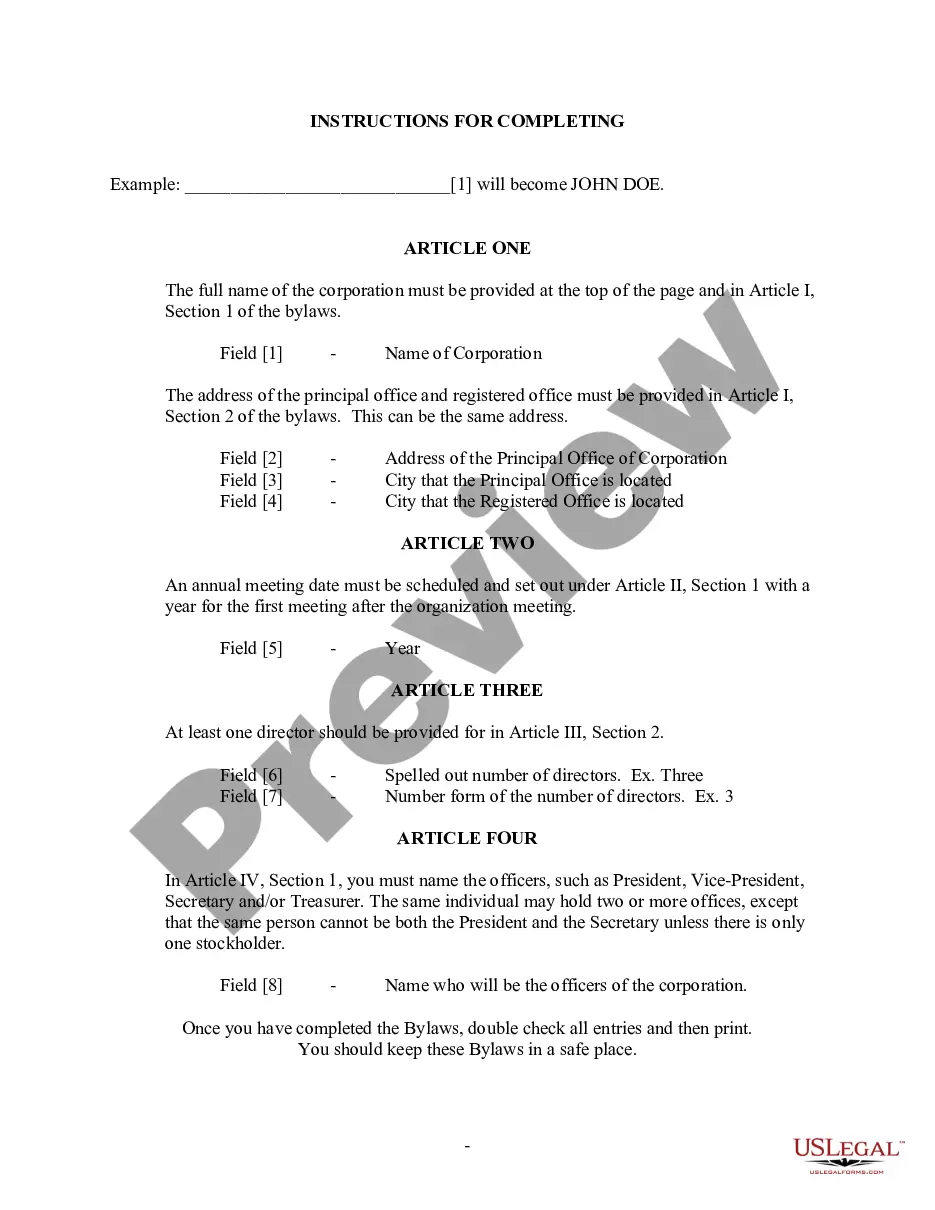

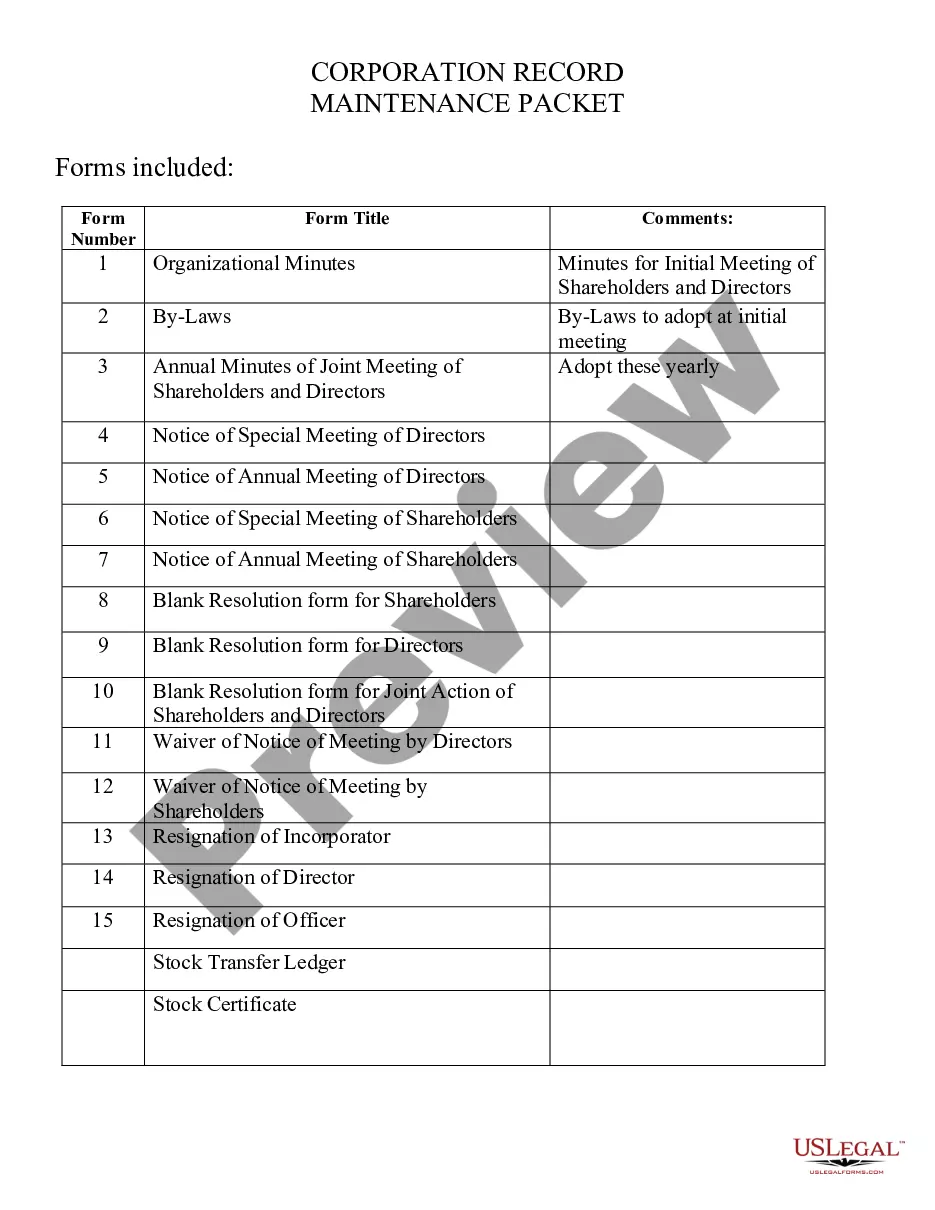

This Professional Corporations Package contains all forms and directions for filing needed in order to incorporate a Professional Corporation in your particular state. The forms included are as follows: articles on incorporation, by-laws, any other forms needed for creation and maintenance of the corporation.

Professional Corporation Package for Kentucky

Description

How to fill out Professional Corporation Package For Kentucky?

Among lots of paid and free templates which you find on the internet, you can't be sure about their reliability. For example, who made them or if they are skilled enough to take care of what you need them to. Keep relaxed and utilize US Legal Forms! Get Professional Corporation Package for Kentucky templates created by professional lawyers and avoid the expensive and time-consuming process of looking for an lawyer and then paying them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all your earlier acquired templates in the My Forms menu.

If you are making use of our website the very first time, follow the guidelines listed below to get your Professional Corporation Package for Kentucky quickly:

- Ensure that the file you see applies where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or look for another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you have signed up and bought your subscription, you may use your Professional Corporation Package for Kentucky as often as you need or for as long as it continues to be valid in your state. Edit it with your favorite editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

A disregarded entity refers to a business entity with one owner that is not recognized for tax purposes as an entity separate from its owner. A single-member LLC ( SMLLC), for example, is considered to be a disregarded entity.As the result of being disregarded, the SMLLC does not file a separate tax return.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

What are pass-through businesses? Most US businesses are not subject to the corporate income tax; rather, their profits flow through to owners or members and are taxed under the individual income tax. Pass-through businesses include sole proprietorships, partnerships, limited liability companies, and S-corporations.

How much does it cost to form an LLC in Kentucky? The Kentucky Secretary of State charges $40 to file the Articles of Organization. You can reserve your LLC name with the Kentucky Secretary of State for $15.

Can I get a Kentucky account number for a client? 200bThe best way to access company account numbers is via Kentucky One Stop Business Portal. Another way would be if the interested party is listed on form 20A100 (Power of Attorney/Declaration of Representative) on file with the Department of Revenue.

The LLET is a tax on the Kentucky gross receipts or gross profits (i.e., gross receipts less cost of goods sold, as that term is statutorily defined) from the sale of tangible property of each non-exempt corporation and limited liability tax pass-through entity (LLPTE), such as a limited liability company (LLC),

Kentucky's limited liability entity tax applies to traditional corporations, S corporations, LLCs, limited partnerships (LPs), and limited liability partnerships (LLPs). The tax is based on a business's annual gross receipts. For businesses with gross receipts less than $3 million, there is a minimum LLET of $175.

STEP 1: Name your Kentucky LLC. STEP 2: Choose a Registered Agent in Kentucky. STEP 3: File Your Kentucky LLC Articles of Organization. STEP 4: Create Your Kentucky LLC Operating Agreement. STEP 5: Get an EIN.

Kentucky does not impose a corporate franchise tax, but it does impose a limited liability entity tax pursuant to KRS 141.0401 on every non-exempt corporation and limited liability pass-through entity doing business in Kentucky on all Kentucky gross receipts or Kentucky gross profits.