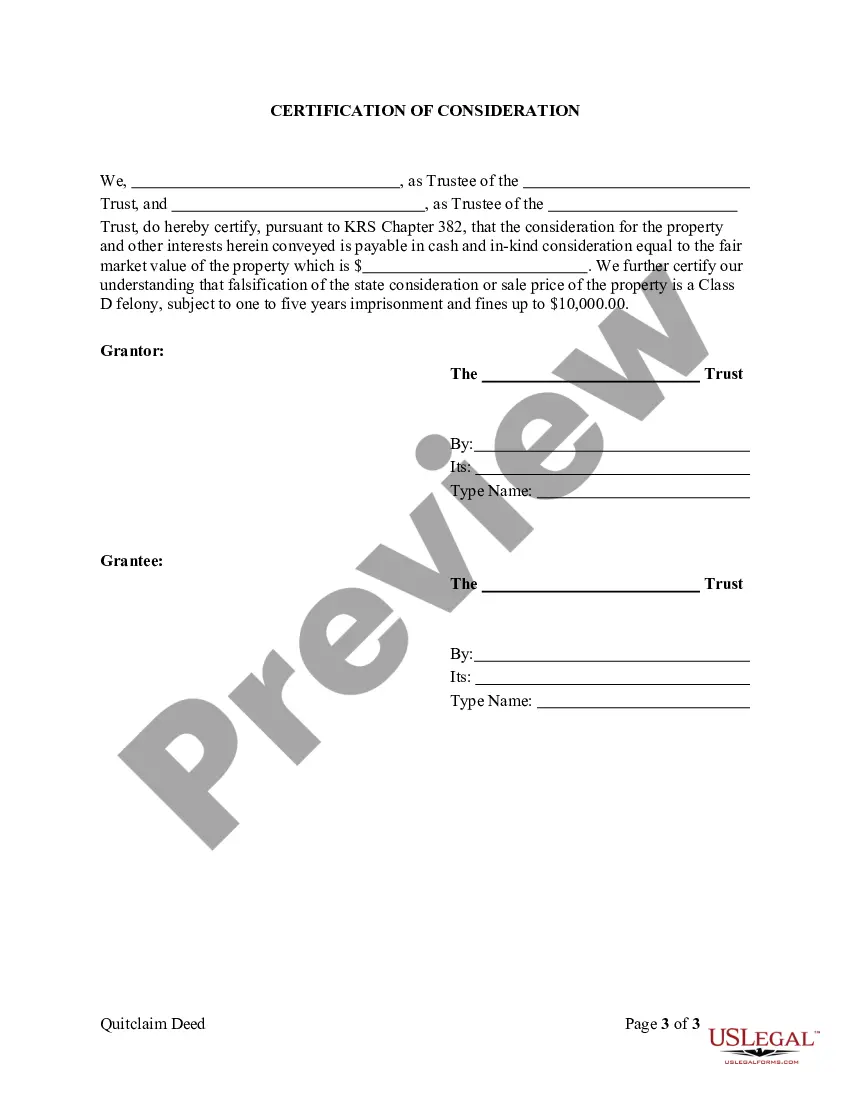

This form is a Quitclaim Deed where the grantor is the trustee of a trust, acting on behalf of the trust, and the grantee is also the trustee of a trust acting on behalf of the trustl. This deed complies with all state statutory laws.

Kentucky Quitclaim Deed - Trust to Trust

Description

How to fill out Kentucky Quitclaim Deed - Trust To Trust?

Searching for Kentucky Quitclaim Deed - Trust to Trust forms and completing them can be a challenge. In order to save time, costs and effort, use US Legal Forms and find the right template specially for your state in a few clicks. Our attorneys draft every document, so you just need to fill them out. It truly is that simple.

Log in to your account and return to the form's web page and save the document. All your downloaded templates are saved in My Forms and they are accessible at all times for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our thorough instructions on how to get the Kentucky Quitclaim Deed - Trust to Trust sample in a few minutes:

- To get an entitled sample, check out its applicability for your state.

- Check out the form using the Preview option (if it’s offered).

- If there's a description, go through it to learn the details.

- Click Buy Now if you identified what you're trying to find.

- Pick your plan on the pricing page and make an account.

- Choose you would like to pay out with a card or by PayPal.

- Save the file in the favored file format.

You can print out the Kentucky Quitclaim Deed - Trust to Trust template or fill it out utilizing any online editor. No need to concern yourself with making typos because your template can be applied and sent away, and printed as many times as you wish. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

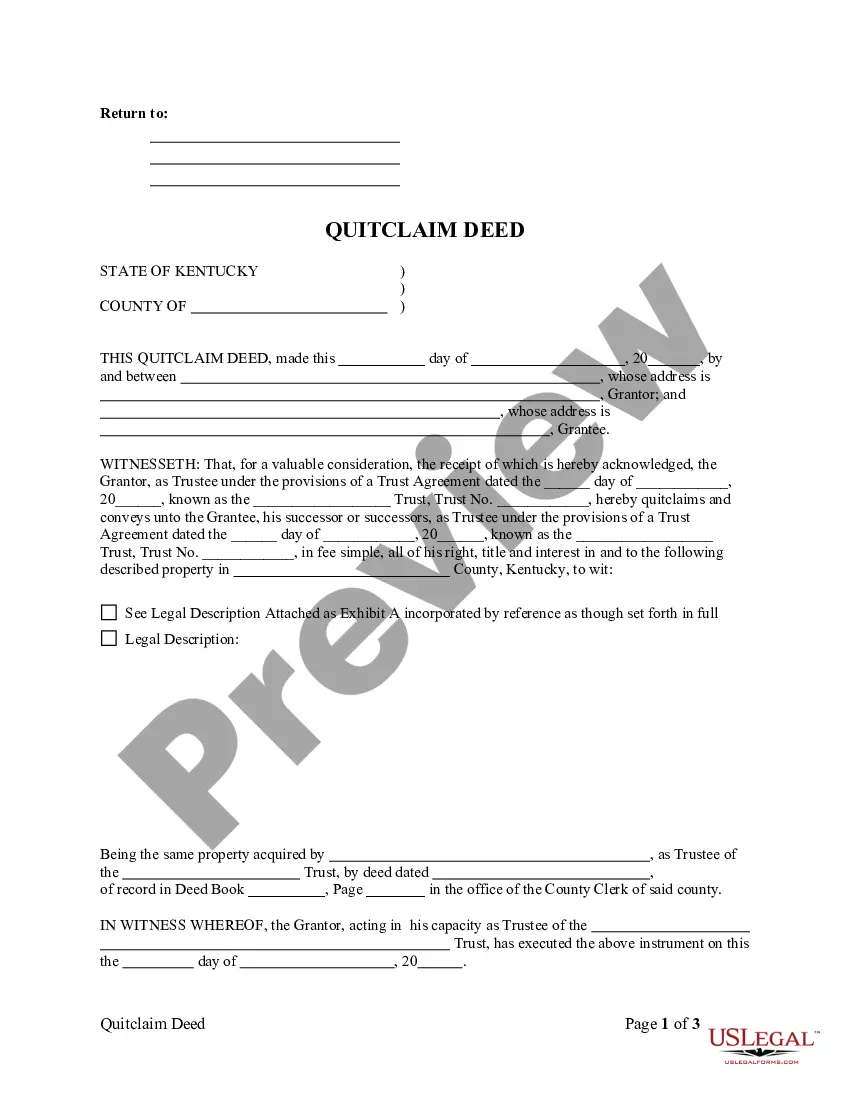

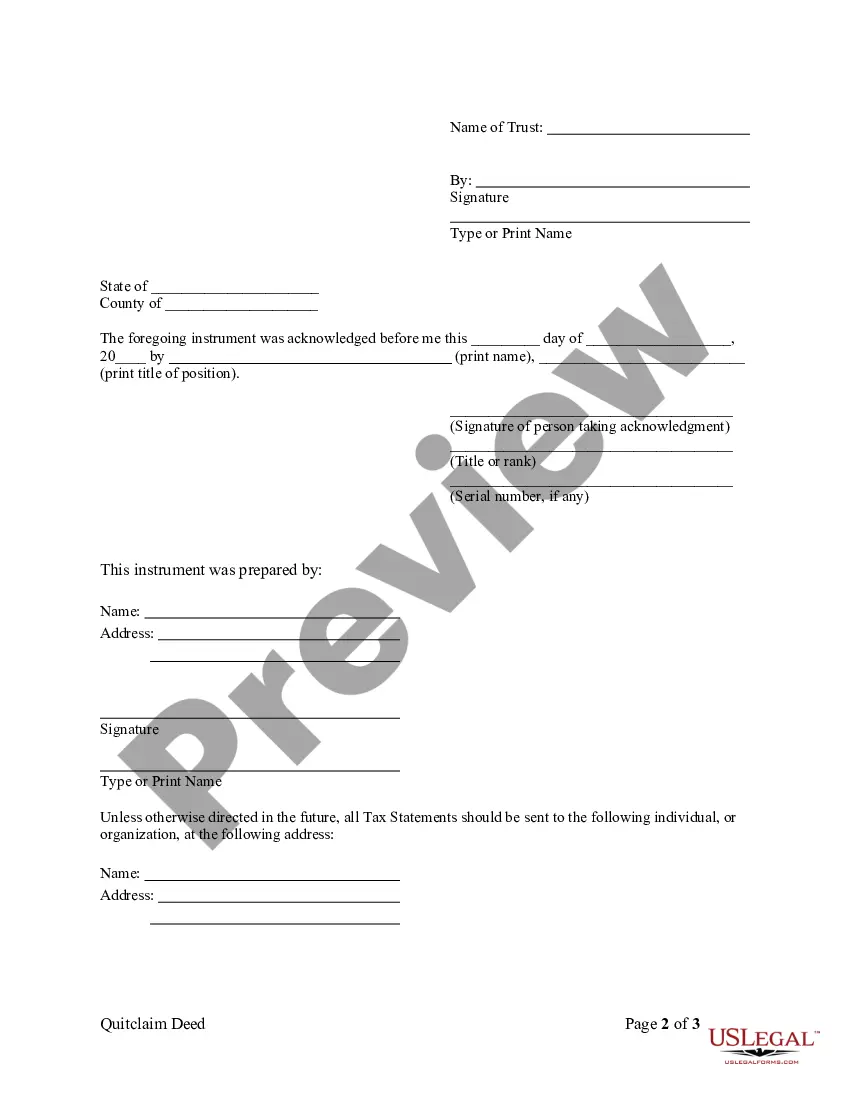

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Step 1: Find your KY quitclaim form. Step 2: Gather the information you need. Step 3: Enter the information about the parties. Step 4: File the deed in the County Clerk's office of the county where the property is located, along with the consideration certificate.

The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset. Additionally, the individual who is transferring ownership to the trust, will be liable to pay capital gains tax on the disposal of the asset.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.