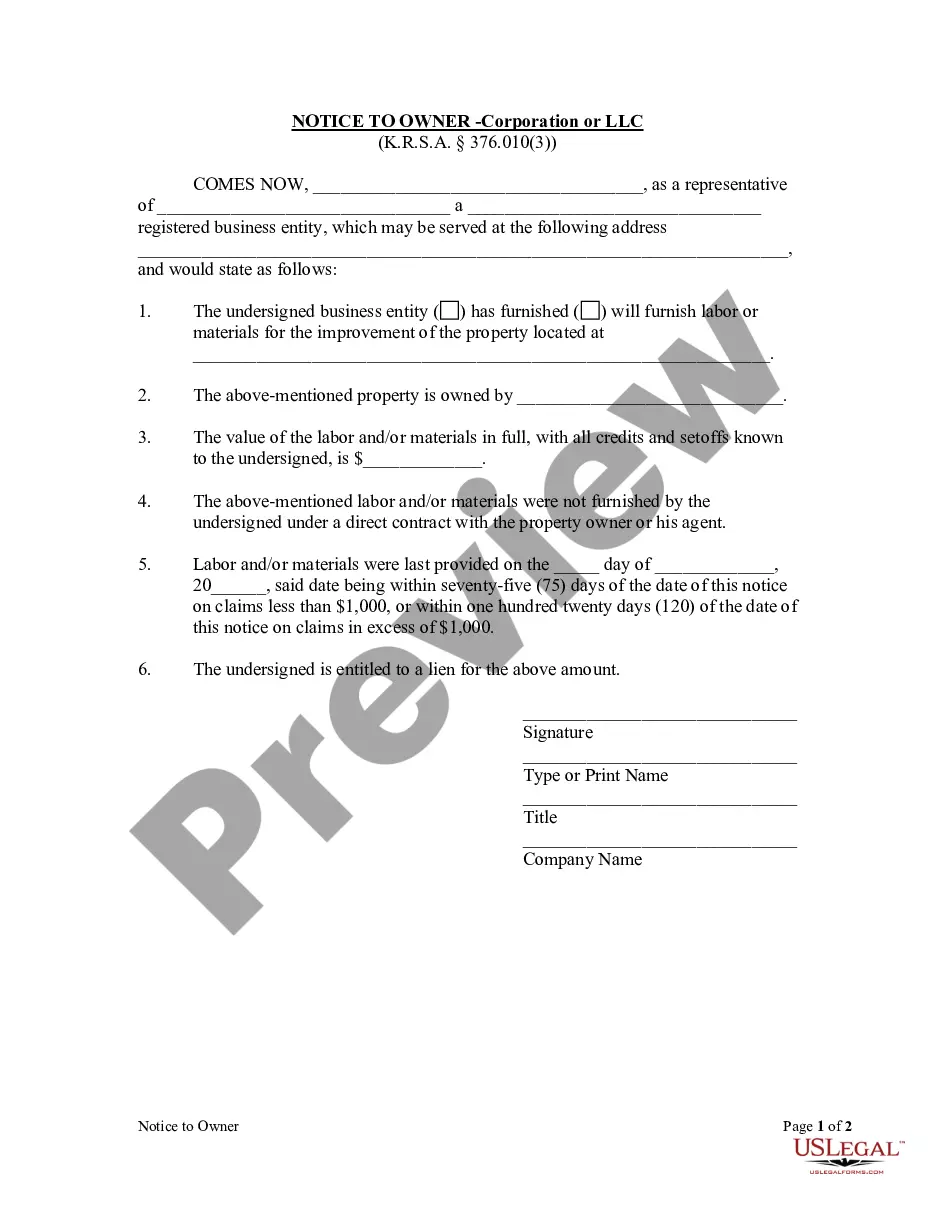

This notice is provided to a property owner by a corporate or LLC lien claimant who has not contracted directly with the property owner. No party who has not contracted directly with the property owner may acquire a lien unless this notice is provided timely. If the claim is less than $1000, the lien claimant has seventy-five (75) days to provide notice to the property owner. If the claim is more than $1000, the lien claimant has one hundred twenty (120) days to provide notice to the property owner. Kentucky statutes permit this notice to be mailed to the last known address of the owner, or his duly authorized agent.

Kentucky Notice to Owner - Corporatation or LLC

Description Corporation Limited Liability Company

How to fill out Owner Corporation Contract?

Looking for Kentucky Notice to Owner - Corporation or LLC templates and filling out them can be quite a challenge. To save time, costs and effort, use US Legal Forms and choose the right template specially for your state within a few clicks. Our attorneys draw up every document, so you just need to fill them out. It really is that simple.

Log in to your account and return to the form's web page and download the sample. All of your saved templates are kept in My Forms and are accessible all the time for further use later. If you haven’t subscribed yet, you have to sign up.

Have a look at our detailed guidelines on how to get your Kentucky Notice to Owner - Corporation or LLC sample in a couple of minutes:

- To get an eligible sample, check out its applicability for your state.

- Look at the form utilizing the Preview option (if it’s available).

- If there's a description, read through it to understand the important points.

- Click Buy Now if you found what you're trying to find.

- Choose your plan on the pricing page and create your account.

- Choose you would like to pay out by a card or by PayPal.

- Save the form in the preferred file format.

You can print out the Kentucky Notice to Owner - Corporation or LLC template or fill it out making use of any web-based editor. No need to concern yourself with making typos because your sample may be utilized and sent away, and printed out as many times as you wish. Check out US Legal Forms and access to around 85,000 state-specific legal and tax files.

Form Corporation Llc Form popularity

Limited Liability Company Document Other Form Names

Limited Liability Company Fill FAQ

The LLET is a tax on the Kentucky gross receipts or gross profits (i.e., gross receipts less cost of goods sold, as that term is statutorily defined) from the sale of tangible property of each non-exempt corporation and limited liability tax pass-through entity (LLPTE), such as a limited liability company (LLC),

Name Your Kentucky LLC. Choose a Registered Agent. File the Articles of Organization. Create an Operating Agreement. Get an EIN.

Kentucky does not have a statewide business license that applies to all businesses, but certain types of businesses are required to have a special license or permit to legally operate their business. In some cases, more than one license may be required.

In general, a company can do business in a state if it engages in one or more of these types of business activities: Having a bank account in the state. Selling in the state through a distributor, an agent, or a manufacturer's representative.Transacting business or holding meetings in the state.

According to KRS 141.010(25), doing business in Kentucky includes but is not limited to: Being organized under the laws of Kentucky. Having a commercial domicile in Kentucky. Owning or leasing property in Kentucky.

Choose a corporate structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Kentucky Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

Can I get a Kentucky account number for a client? 200bThe best way to access company account numbers is via Kentucky One Stop Business Portal. Another way would be if the interested party is listed on form 20A100 (Power of Attorney/Declaration of Representative) on file with the Department of Revenue.

The tax is based on a business's annual gross receipts. For businesses with gross receipts less than $3 million, there is a minimum LLET of $175. For businesses with $3 million or more in gross receipts, the LLET is the lesser of 9.5 ¢ per $100 of gross receipts or 75 A¢ per $100 of gross receipts.