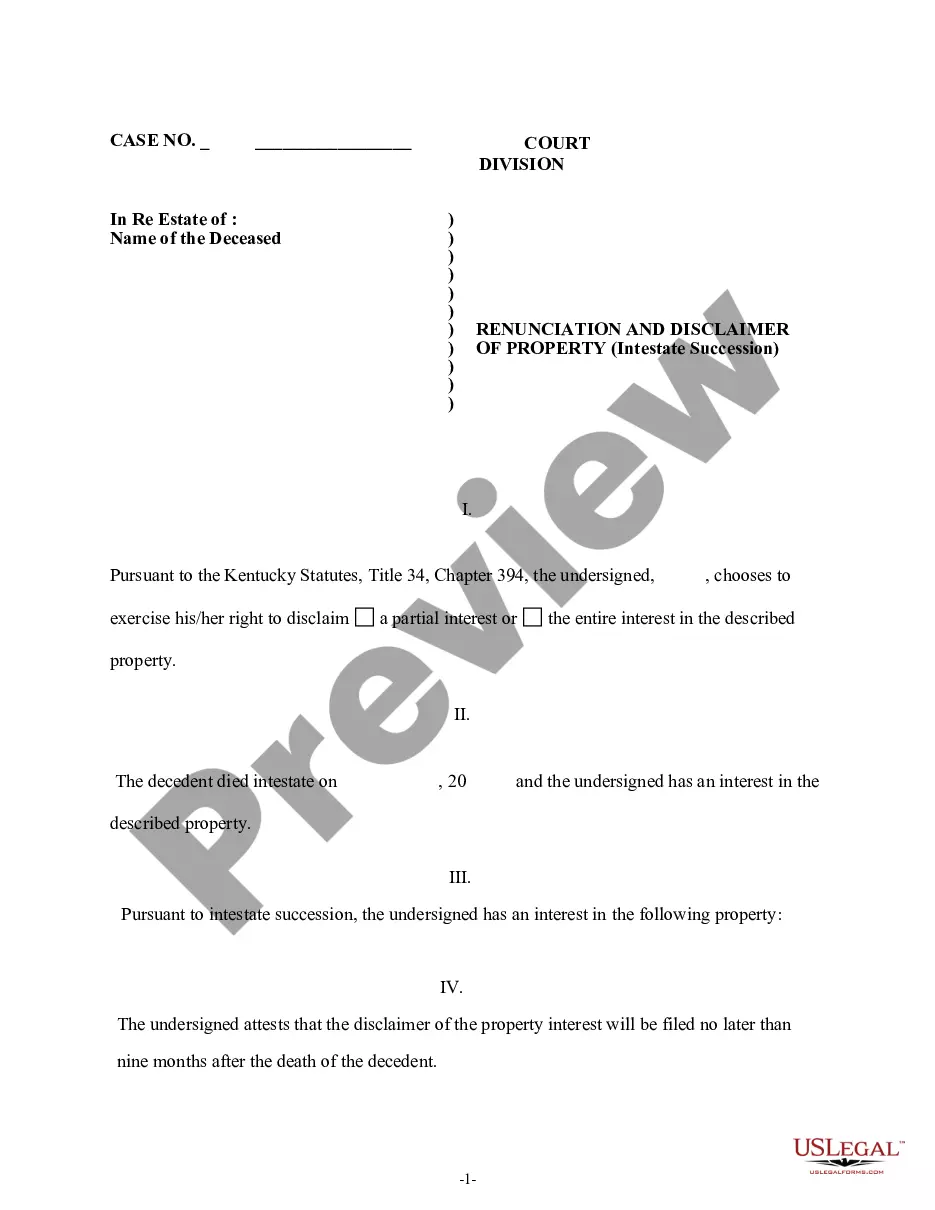

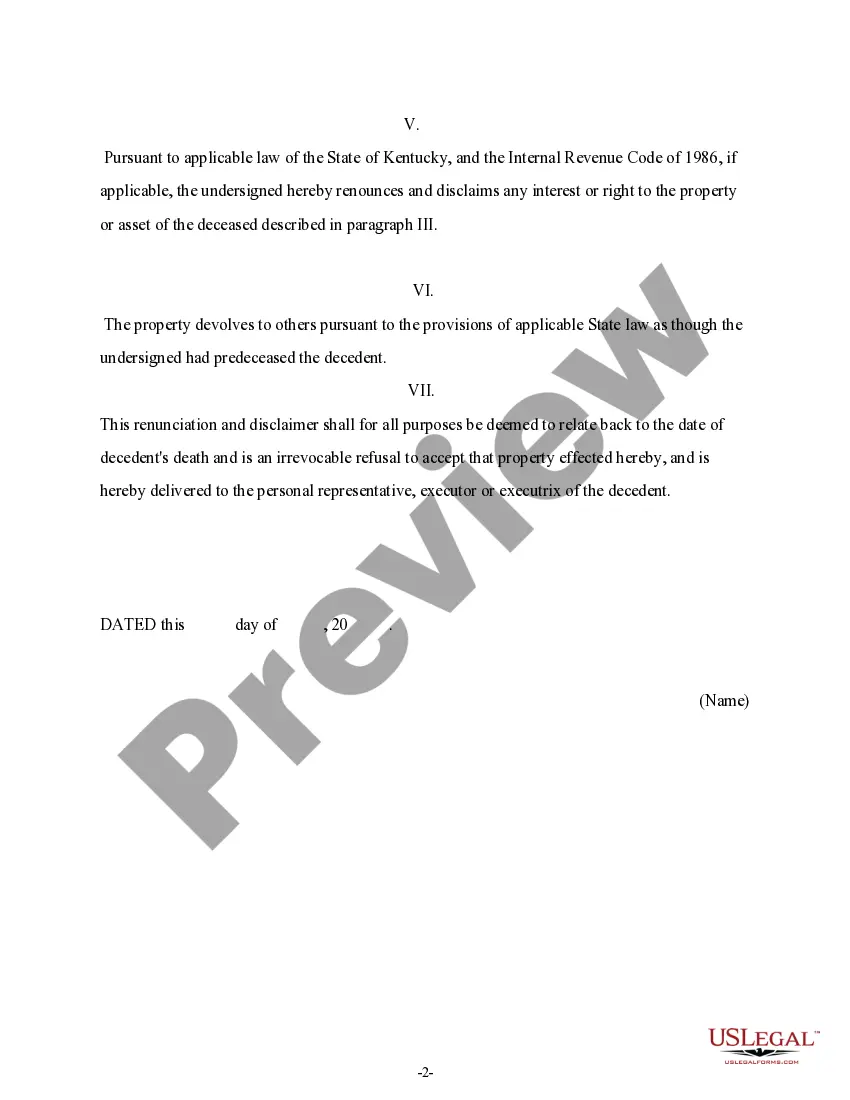

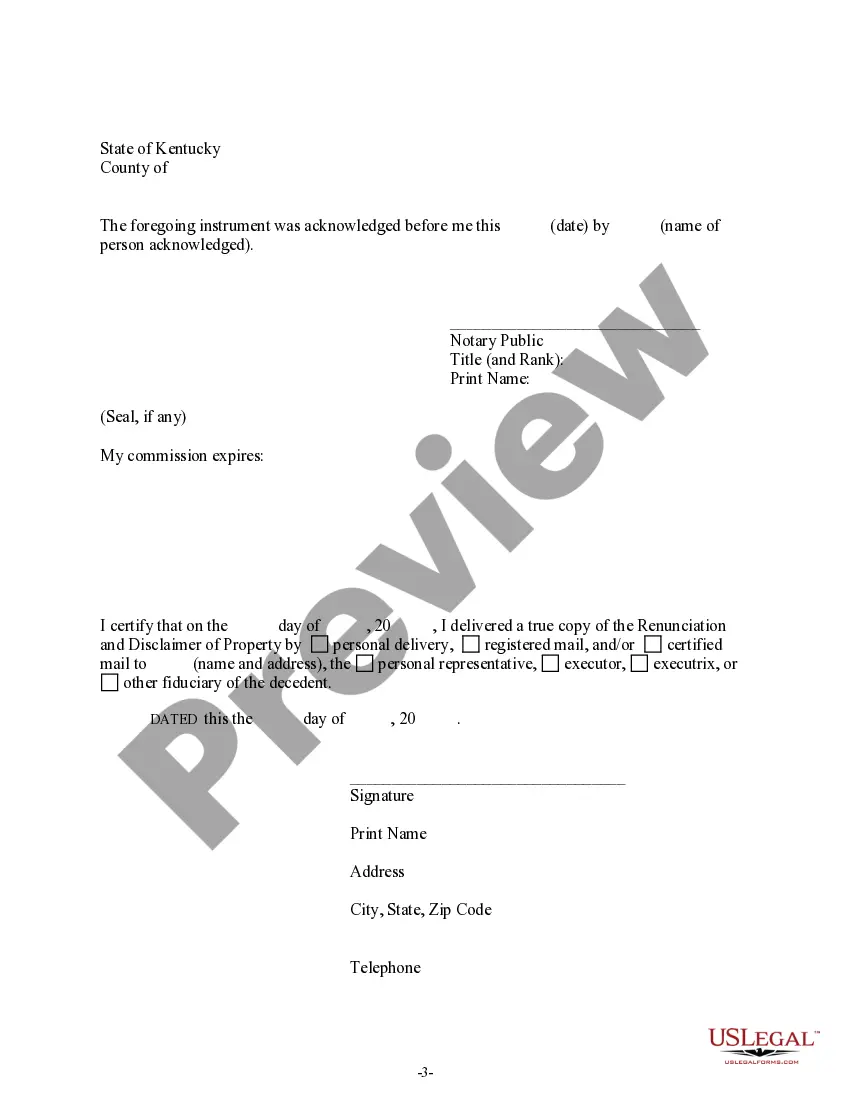

This form is a Renunciation and Disclaimer of Property acquired by Intestate Succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the described property. However, pursuant to the Kentucky Statutes, Title 34, Chapter 394, the beneficiary has chosen to disclaim a portion of or the entire interest in the described property. The beneficiary attests to the fact that the disclaimer will be filed no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Kentucky Renunciation and Disclaimer of Property received by Intestate Succession

Description Intestate Succession Ky

How to fill out Inherit Without A Will In Kentucky?

Searching for Kentucky Renunciation and Disclaimer of Property received by Intestate Succession sample and completing them can be a problem. To save time, costs and energy, use US Legal Forms and find the correct example specially for your state in a few clicks. Our lawyers draft every document, so you simply need to fill them out. It is really that easy.

Log in to your account and come back to the form's web page and save the sample. All of your saved samples are saved in My Forms and are available at all times for further use later. If you haven’t subscribed yet, you should register.

Look at our detailed recommendations concerning how to get the Kentucky Renunciation and Disclaimer of Property received by Intestate Succession template in a couple of minutes:

- To get an qualified sample, check its applicability for your state.

- Have a look at the sample using the Preview option (if it’s offered).

- If there's a description, go through it to know the important points.

- Click on Buy Now button if you found what you're searching for.

- Select your plan on the pricing page and create your account.

- Select you would like to pay by a credit card or by PayPal.

- Save the sample in the favored file format.

You can print the Kentucky Renunciation and Disclaimer of Property received by Intestate Succession form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your form can be applied and sent, and printed as many times as you wish. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Kentucky Renunciation Statement Form popularity

Kentucky Intestate Printable Other Form Names

Kentucky Intestate Ky FAQ

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.

In Kentucky, if you die without a will, your spouse will inherit property from you under a law called dower and curtesy. Usually, this means that your spouse inherits 1/2 of your intestate property. The rest of your property passes to your descendants, parents, or siblings.

Intestate succession specifically refers to the order in which spouses, children, siblings, parents, cousins, great-aunts/uncles, second cousins twice removed, etc. are entitled to inherit from a family member when no will or trust exists.

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.