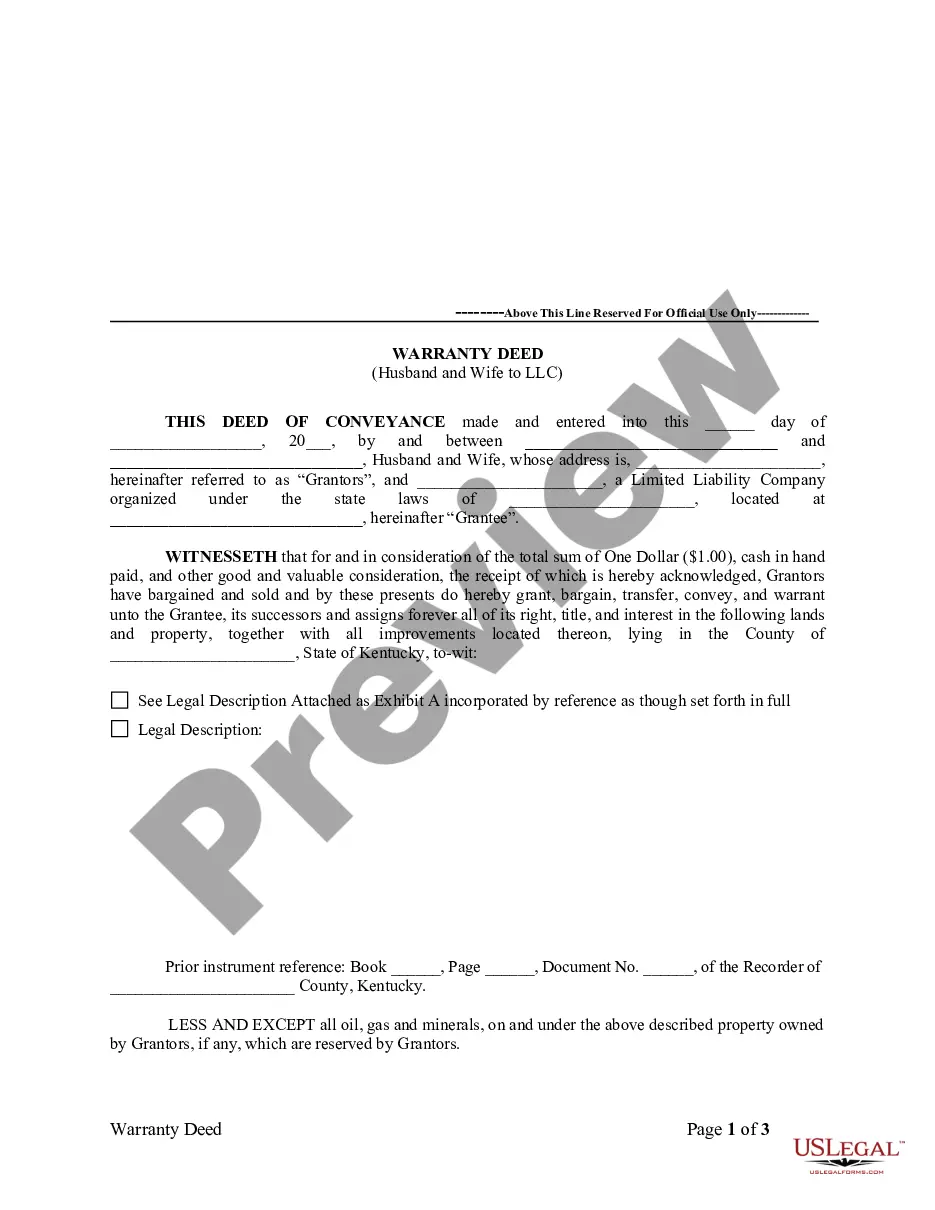

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Kentucky Warranty Deed from Husband and Wife to LLC

Description

How to fill out Kentucky Warranty Deed From Husband And Wife To LLC?

Looking for Kentucky Warranty Deed from Husband and Wife to LLC sample and completing them can be quite a problem. In order to save time, costs and effort, use US Legal Forms and find the correct example specifically for your state in a few clicks. Our legal professionals draft each and every document, so you just need to fill them out. It really is so easy.

Log in to your account and come back to the form's web page and download the document. All your saved examples are kept in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you have to register.

Check out our comprehensive recommendations concerning how to get your Kentucky Warranty Deed from Husband and Wife to LLC template in a couple of minutes:

- To get an eligible example, check out its validity for your state.

- Look at the sample using the Preview function (if it’s offered).

- If there's a description, read through it to know the important points.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and make your account.

- Choose you wish to pay by way of a card or by PayPal.

- Download the sample in the favored file format.

You can print out the Kentucky Warranty Deed from Husband and Wife to LLC template or fill it out using any online editor. Don’t concern yourself with making typos because your sample may be used and sent away, and published as many times as you want. Check out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

If both spouses take part in the business and are the only members of an LLC, and a joint tax return is personally filed, a qualified joint venture can be elected instead of a partnership. This election treats each spouse as a sole proprietor instead of a partnership.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. However, in community property states you can have your multi-member (husband and wife owners) and that LLC can get treated as a SMLLC for tax purposes.

When taking the first steps in how a husband and wife can form an LLC, you must file documents with your state and pay a fee. To make your LLC husband and wife company official, you will need to create articles of organization that acts like a charter for your business. You will file these with your state.

If you share a business with your husband or wife, you should have a written agreement to protect your interests.The benefits of a husband/wife LLC are that you can file as a disregarded entity. No need to file a separate partnership return.