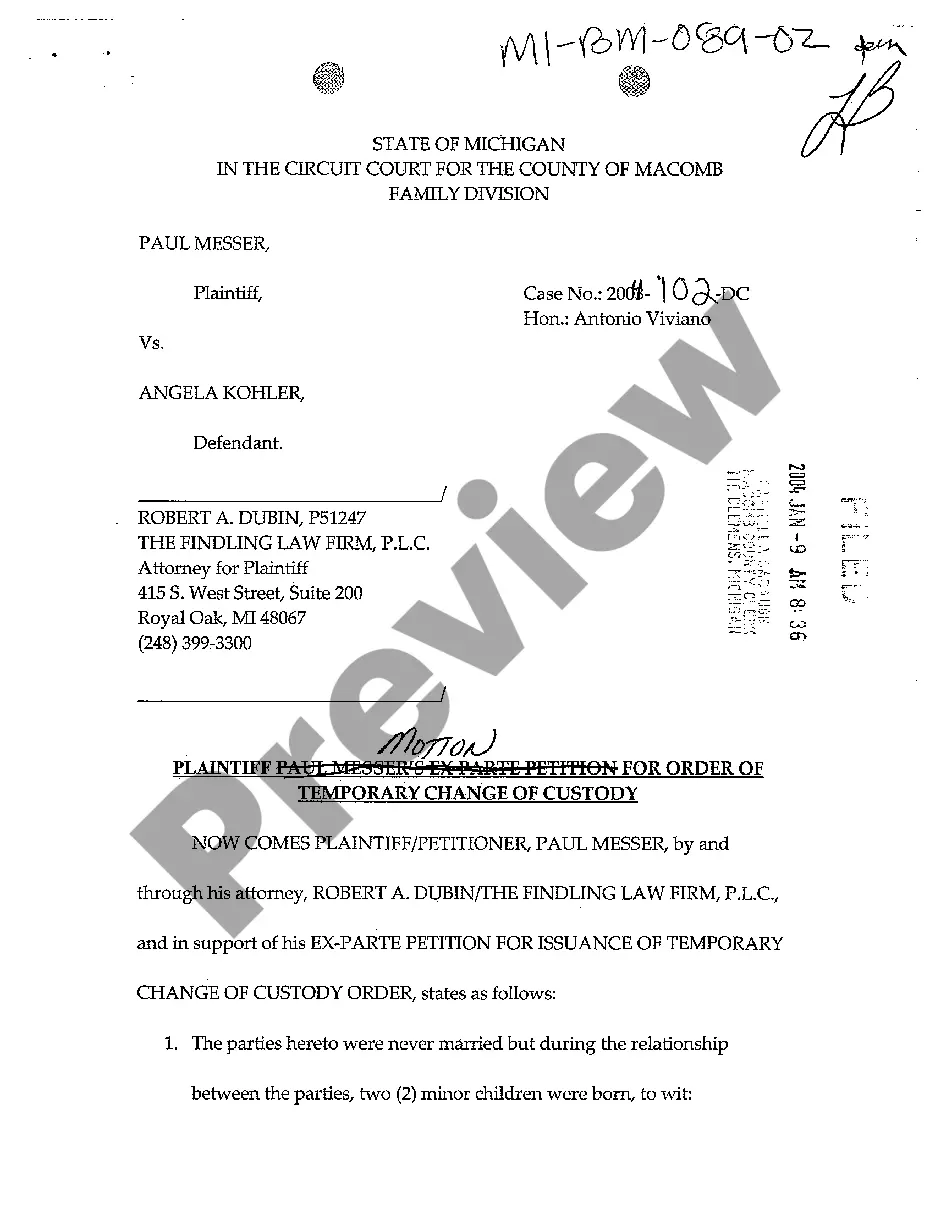

This is an Affidavit for Writ of Non-Wage Garnishment. It is an official form used by the Commonwealth of Kentucky in a civil action, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Kentucky Affidavit for Writ of Non-Wage Garnishment

Description Non Wage Garnishment

How to fill out Kentucky Affidavit For Writ Of Non-Wage Garnishment?

Searching for Kentucky Affidavit for Writ of Non-Wage Garnishment forms and filling out them could be a problem. To save lots of time, costs and energy, use US Legal Forms and choose the right sample specially for your state within a few clicks. Our legal professionals draw up every document, so you just have to fill them out. It really is that easy.

Log in to your account and come back to the form's web page and save the document. Your saved examples are stored in My Forms and are available all the time for further use later. If you haven’t subscribed yet, you have to register.

Check out our thorough recommendations concerning how to get your Kentucky Affidavit for Writ of Non-Wage Garnishment sample in a few minutes:

- To get an eligible form, check out its applicability for your state.

- Check out the example making use of the Preview option (if it’s available).

- If there's a description, go through it to understand the specifics.

- Click on Buy Now button if you identified what you're trying to find.

- Choose your plan on the pricing page and create your account.

- Select you wish to pay by way of a credit card or by PayPal.

- Download the form in the preferred format.

You can print the Kentucky Affidavit for Writ of Non-Wage Garnishment template or fill it out making use of any web-based editor. No need to concern yourself with making typos because your form may be utilized and sent away, and printed as often as you wish. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

According to the Kentucky law on oral contracts, or verbal agreements, debt collection agencies have five years since the last action on the debt to put forward a suit (KRS 413.120). However, the Kentucky law on written contracts allows creditors fifteen years to sue a Kentucky resident.

The creditor must then wait for a specific period, such as 15 days after the mailing, before filing the wage garnishment. Depending on your state, the court may allow the creditor to file the garnishment after it obtains the judgment, without notifying you first.

Kentucky law limits the amount that a creditor can garnish (take) from your wages for repayment of debts.Generally speaking, creditors with judgments can take only 25% of your wages.

Pay the Debt and Avoid the Suit. The best way to stop the garnishment you're experiencing in Kentucky is to pay the debt off. Appeal to the Court in Kentucky. Bankruptcy in Kentucky. Seek Legal Assistance.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

The statute of limitations for credit card debt in Kentucky is 5 years. Written contracts have a 4- or 15-year statute of limitations, depending on the circumstances. A judgment-creditor can ask the sheriff to seize your personal property.