This Petition is an official form used by the Commonwealth of Kentucky, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Kentucky Petition Order to Dispense with Administration Surviving Spouse, Children, or Preferred Creditor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Petition Order To Dispense With Administration Surviving Spouse, Children, Or Preferred Creditor?

Looking for Kentucky Petition Order to Waive Administration Surviving Spouse, Children, or Preferred Creditor forms and completing them can be a challenge.

To conserve time, money, and effort, utilize US Legal Forms and select the appropriate template specifically for your state in just a few clicks.

Our lawyers prepare each document, so all you have to do is fill it out. It’s really that easy.

Choose your plan on the pricing page and set up your account. Decide if you want to pay with a credit card or through PayPal. Download the form in your desired file format. You can print the Kentucky Petition Order to Waive Administration Surviving Spouse, Children, or Preferred Creditor template or complete it using any online editor. Don’t worry about making mistakes because your template can be used and submitted as many times as you like. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's webpage to save the template.

- Your saved templates are stored in My documents and are available at all times for future reference.

- If you haven’t registered yet, you should enroll.

- Review our thorough instructions on how to obtain the Kentucky Petition Order to Waive Administration Surviving Spouse, Children, or Preferred Creditor template in minutes.

- To obtain a valid form, verify its applicability for your state.

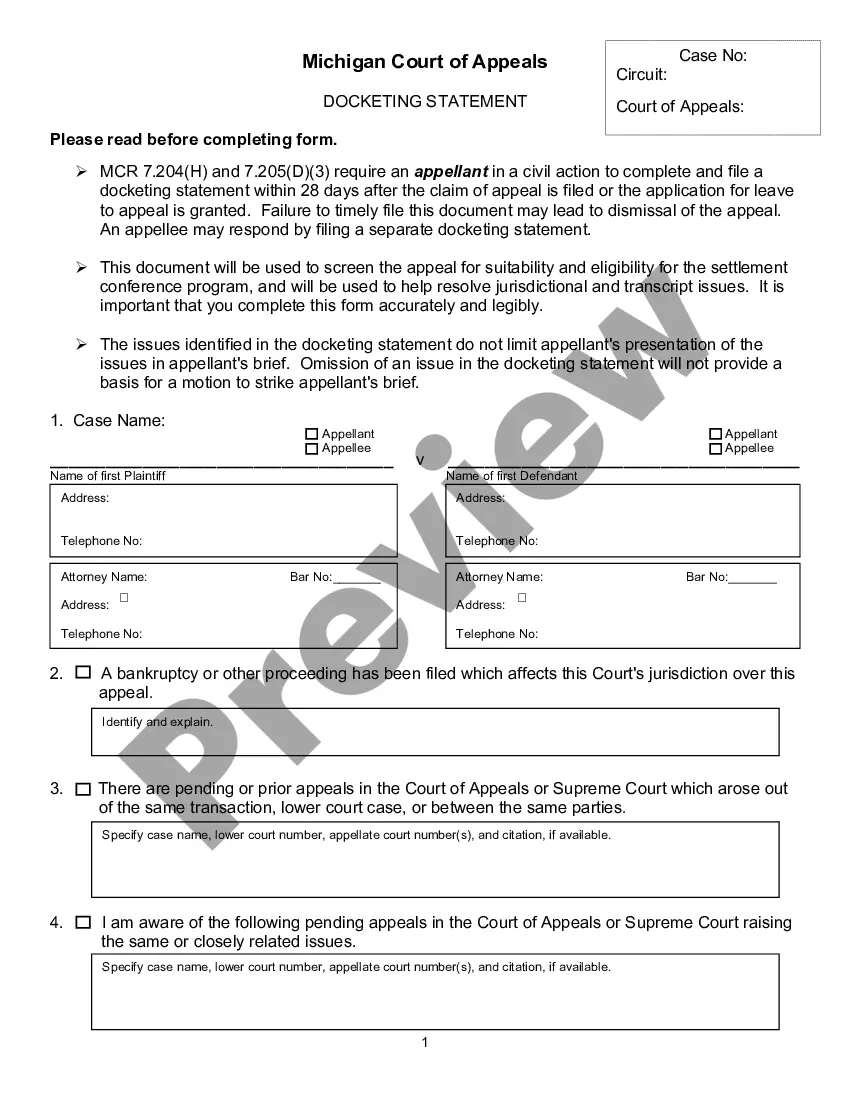

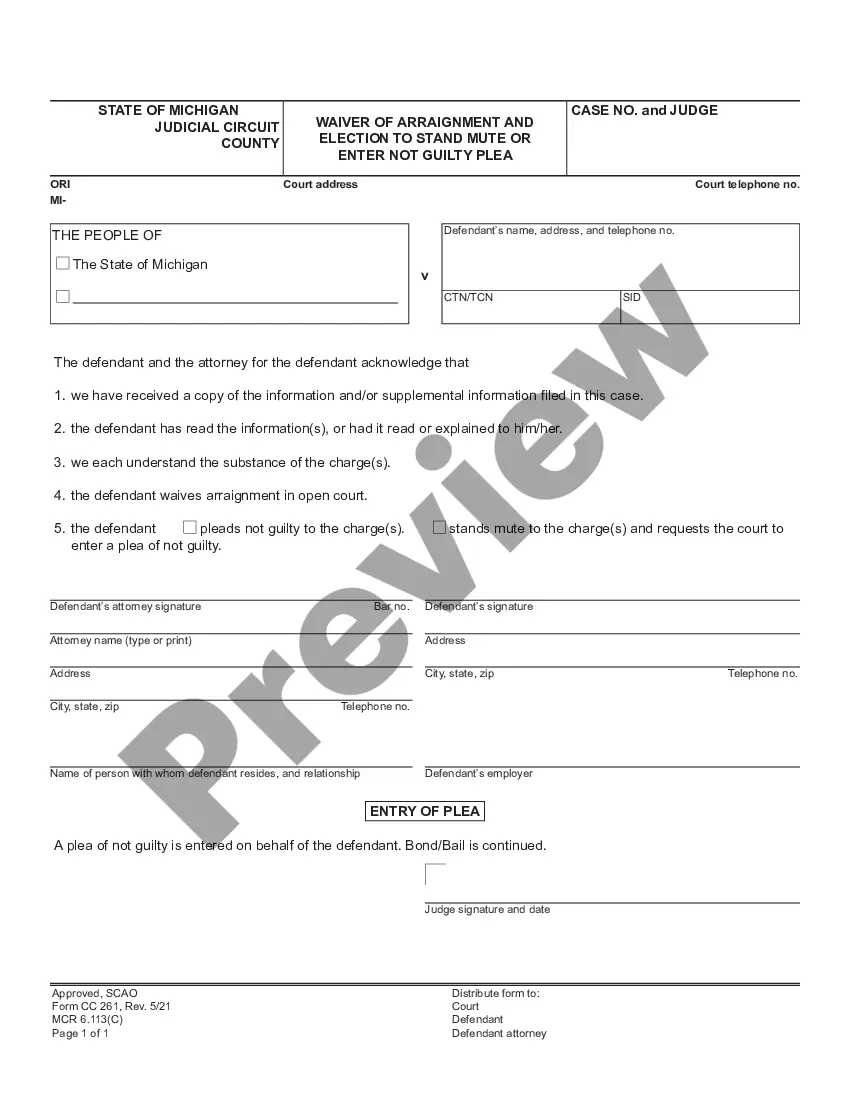

- Examine the form using the Preview feature (if available).

- If there's a description, read it to understand the vital details.

- Click Buy Now if you found what you are looking for.

Form popularity

FAQ

The Kentucky small estate affidavit, legally titled the 'Petition to Dispense with Administration' or Form AOC-830, is for use by the survivors of a person who has passed away with a small estate who want to avoid the hassles of probate.In addition, preferred creditor's can file the petition.

In Kentucky, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The petition must also be submitted with a filing fee which is typically around $60.00. If the decedent died with a will, the original will must be submitted with the petition. A will is valid in Kentucky only if it is in writing, in English and signed at the end by the decedent.

As a rule, you can expect probate to take anywhere from six months to a year in most average cases. Simple probate matters can sometimes be handled more rapidly, while complex estates can take years.

Of the Estate's Affairs The final settlement with the probate clerk may be filed any time after six months following the date of appointment as executor and must be filed at least two years following appointment.

(NHJB-2145-P) Form use. This form is used to ask the court to appoint an executor or administrator for a deceased's estate.

Kentucky defines a small estate as real estate or personal property such as bank accounts valued less than $15,000.This includes bank accounts, vehicles, retirement accounts, heirlooms, and other personal property.

In Kentucky, if you die without a will, your spouse will inherit property from you under a law called dower and curtesy. Usually, this means that your spouse inherits 1/2 of your intestate property.If you don't have descendants, parents, or siblings, then your spouse inherits everything.

Settling the Estate The settlement may not be filed until at least six months from the date the personal representative was appointed. KRS §395.190. If settling the estate takes more than two years, a periodic settlement may be required.