The chapter 13 plan contains, but is not limited to, information concerning payment plans, treatment of administrative expenses, and treatment of secured claims.

Kentucky Chapter 13 Plan

Description

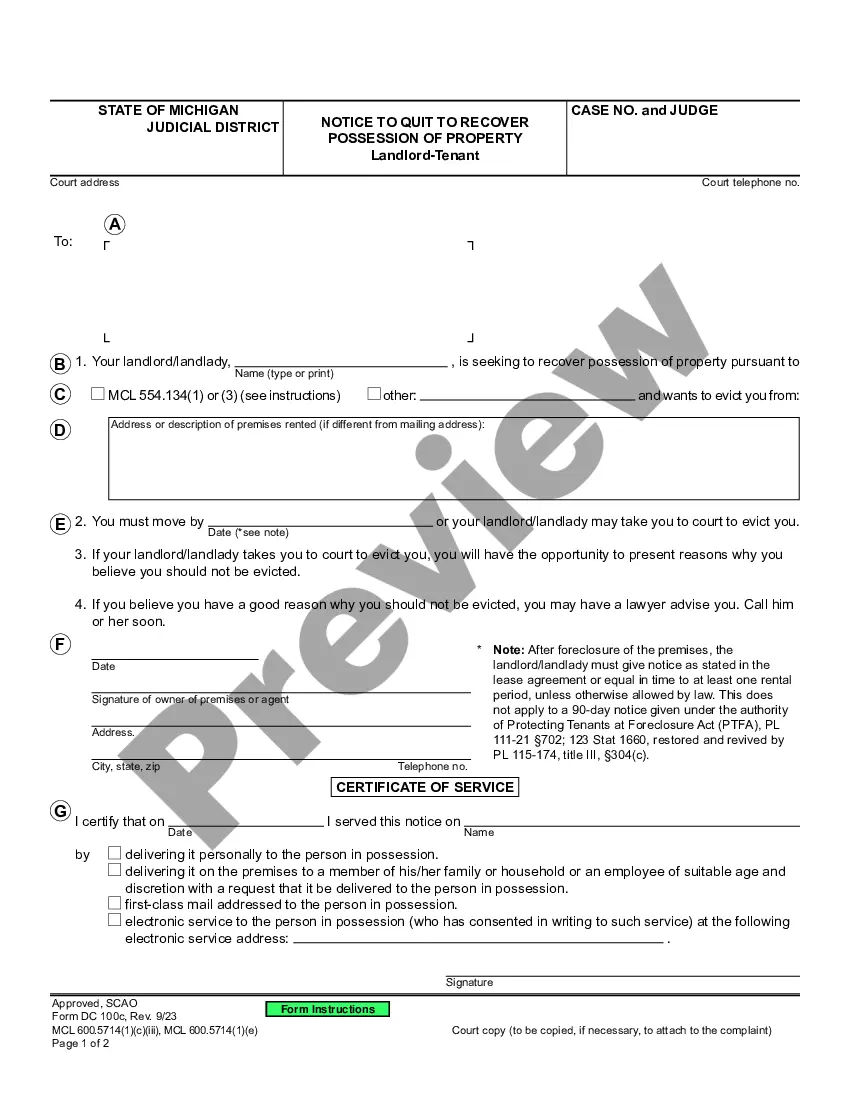

How to fill out Kentucky Chapter 13 Plan?

Searching for Kentucky Chapter 13 Plan forms and completing them could be a challenge. To save lots of time, costs and effort, use US Legal Forms and find the correct example specially for your state in a few clicks. Our attorneys draft each and every document, so you just have to fill them out. It truly is that simple.

Log in to your account and return to the form's page and save the sample. All of your downloaded templates are kept in My Forms and they are available always for further use later. If you haven’t subscribed yet, you should register.

Check out our comprehensive recommendations regarding how to get the Kentucky Chapter 13 Plan form in a couple of minutes:

- To get an eligible form, check out its applicability for your state.

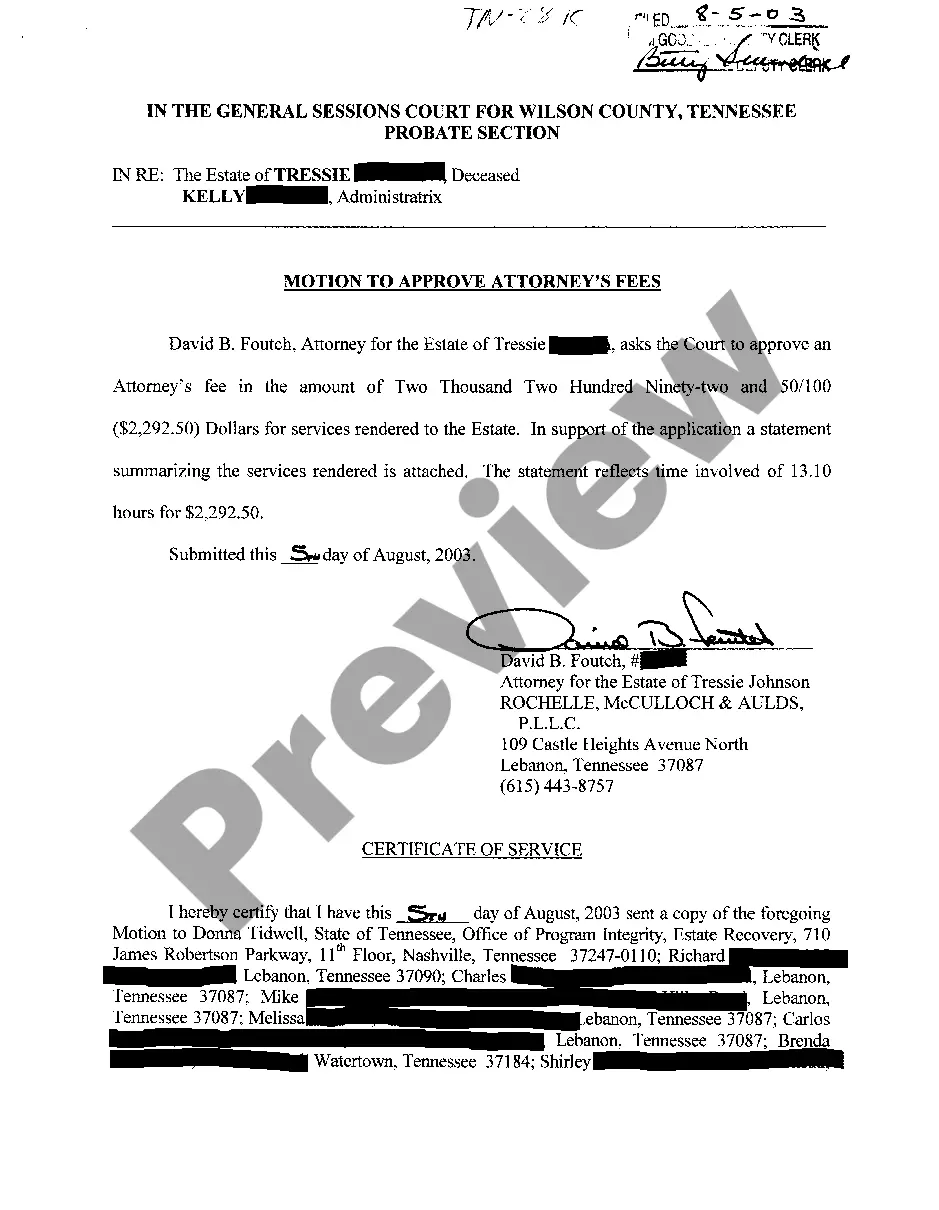

- Look at the form using the Preview option (if it’s accessible).

- If there's a description, read it to learn the details.

- Click Buy Now if you found what you're searching for.

- Pick your plan on the pricing page and create an account.

- Choose you want to pay by a credit card or by PayPal.

- Save the form in the favored file format.

Now you can print out the Kentucky Chapter 13 Plan form or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your template may be used and sent, and published as often as you wish. Check out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

Credit card debt. medical bills. personal loans. older nonpriority income tax obligations. utility bills, and. most lawsuit judgments.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.