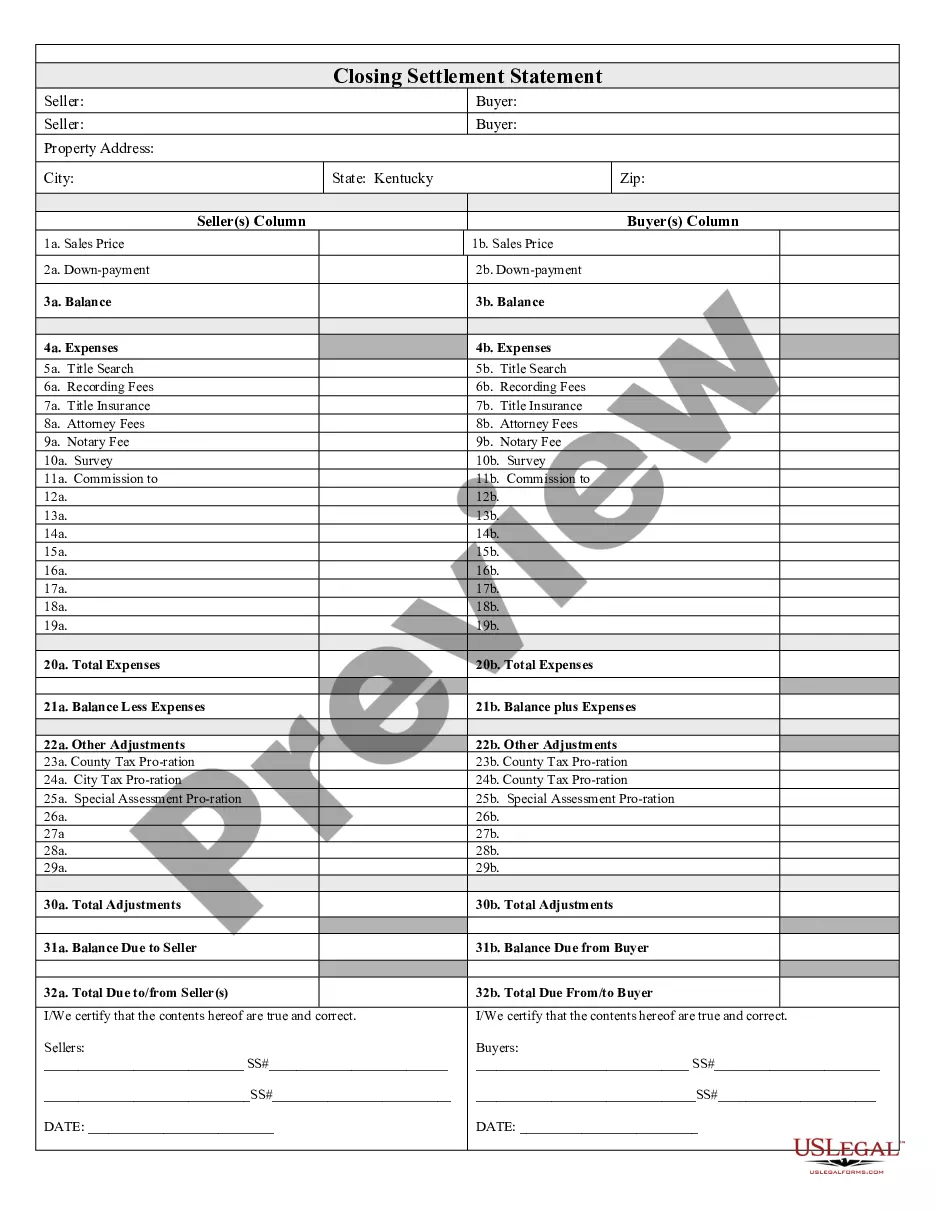

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Kentucky Closing Statement

Description

Key Concepts & Definitions

Closing statement, often used in various forms of formal negotiations, legal proceedings, and public or private presentations, refers to the final remarks where a speaker summarizes the main points, restates their position succinctly, and aims to convincingly conclude the discourse. This is commonly associated with trials, business deals, and public speeches in the United States.

Step-by-Step Guide

- Prepare: Gather all necessary information about your topic or case to ensure comprehensive coverage in your closing.

- Outline: Draft an outline organizing your key points logically, emphasizing the strongest arguments last for maximum impact.

- Engage: Start with a hook to recapture the audience's attention, possibly referencing something memorable from earlier in the discourse.

- Summarize: Clearly and concisely recap the main points, making sure to align them with the objectives of your closing.

- Conclude: End with a strong, memorable statement that reiterates your position or desired outcome, urging the audience toward your viewpoint.

Risk Analysis

- Overloading Information: Including too many details can overwhelm the audience, potentially diluting the impact of the key messages.

- Lacking Preparation: Insufficient research or organization can lead to a weak closing that fails to persuade.

- Ignoring Audience Perspective: Not tailoring the closing to the audience's interests or biases might result in disengagement or objection.

Best Practices

- Clarity and Brevity: Keep the closing statement clear and concise to maintain audience engagement and message retention.

- Passion and Poise: Present with confidence and enthusiasm to persuade effectively while maintaining professional decorum.

- Audience-Centric Approach: Tailor the content to resonate with the specific audience's needs and expectations.

Common Mistakes & How to Avoid Them

- Monotonous Delivery: Vary your tone and use pauses strategically to emphasize key points. Practice your delivery to ensure dynamism and engagement.

- Skipping Rehearsals: Always rehearse your closing statement multiple times. This will help in refining content and delivery, ensuring a polished performance.

- Ignoring Feedback: Seek feedback on your draft from peers or mentors and make adjustments as necessary before the final presentation.

FAQ

- How long should a closing statement be? Typically, 5-10 minutes is sufficient for most presentations or legal proceedings, depending on the complexity of the topic.

- What is the importance of a closing statement in legal trials? It's crucial as it's the last chance to persuade the jury or judge of a client's stance, summarizing the entire case.

How to fill out Kentucky Closing Statement?

Searching for Kentucky Closing Statement templates and completing them could be a difficulty.

To conserve time, expenses, and effort, utilize US Legal Forms and discover the suitable template specifically for your region with just a few clicks.

Our legal experts prepare all documents, so you only need to fill them out. It's genuinely that simple.

Choose your payment method, either by credit card or PayPal. Save the document in your preferred format. You can either print the Kentucky Closing Statement form or complete it with any online editor. Don’t worry about errors since your template can be used, submitted, and printed as many times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's page to download the document.

- All your saved templates are stored in My documents and are accessible at all times for future use.

- If you haven’t registered yet, it's recommended to sign up.

- Check our detailed instructions on how to obtain the Kentucky Closing Statement template within a few minutes.

- To obtain an eligible form, ensure its suitability for your state.

- Review the sample using the Preview feature (if it’s available).

- If there’s a description, read it to grasp the details.

- Click Buy Now if you found what you're searching for.

Form popularity

FAQ

According to data from ClosingCorp, the average closing cost in Kentucky is $2,276 after taxes, or approximately 1.14% to 2.28% of the final home sale price.

Alabama. Connecticut. Delaware. District of Columbia. Florida. Georgia. Kansas. Kentucky.

A settlement agent is also referred to as a closing agent. The closing agent's role is to make sure all parties involved receive required documents during a mortgage loan closing. They provide escrow instructions to third parties like real estate agents, to receive funds such as fees and commissions.

On average, sellers will have to pay about 1%-3% of their home's sale price in closing costs. This is on top of the typical 6% real estate commission. All this money due at closing can add up quickly, so if you have a low amount of equity in your home be sure to prepare yourself.

The so-called escrow states are California, Washington, Oregon, Texas, Nevada, New Mexico and Arizona.

The reality is having an attorney in your corner, especially at closing, protects you from documentation issues, titling errors and costly lawsuits. Most states don't require that sellers obtain legal representationbut even so, in certain cases, it would be reckless not to lawyer up.

The problem is that closing will be delayed because of a mortgage issue. What can we do? Figures from the National Association of Realtors (NAR) say that about three-quarters (76 percent) of all existing home sales close on time.

Several states have laws on the books mandating the physical presence of an attorney or other types of involvement at real estate closings, including: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New

Problems with a bank appraisal are a very common reason why a real estate closing can be delayed. The reasons issues that arise from a bank appraisal can delay a closing can vary from a home that under appraises and the buyer and seller cannot come to new terms or because of repairs that are required by the appraiser.