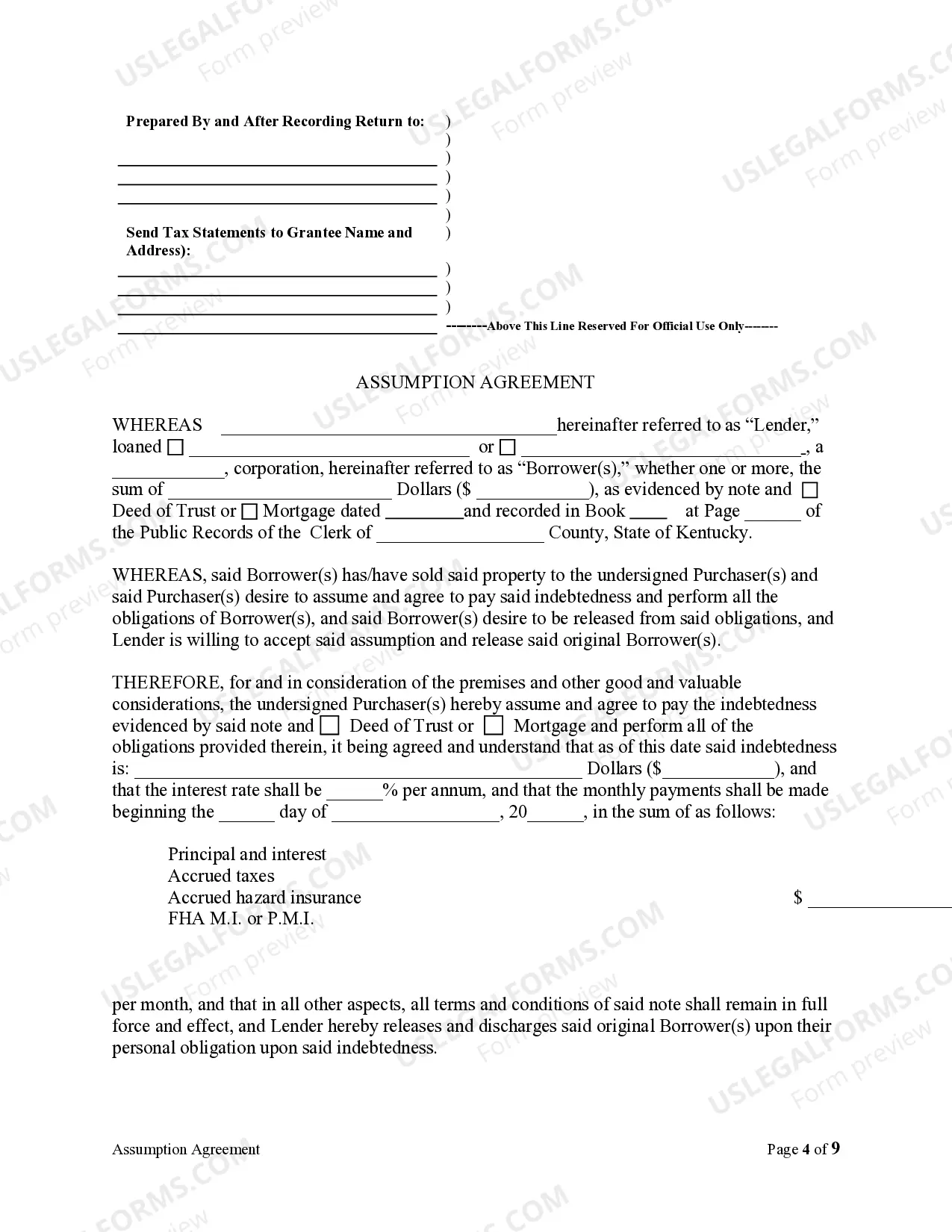

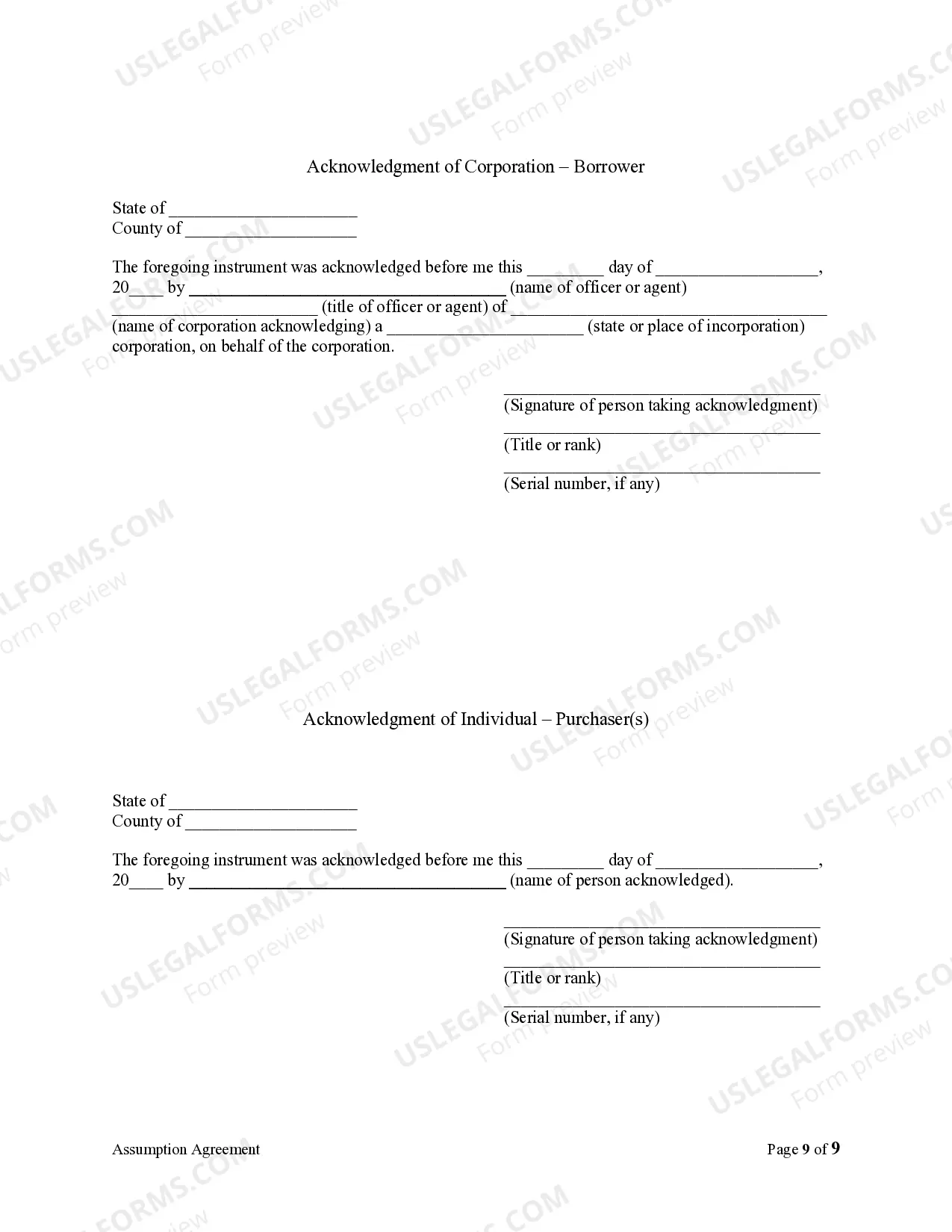

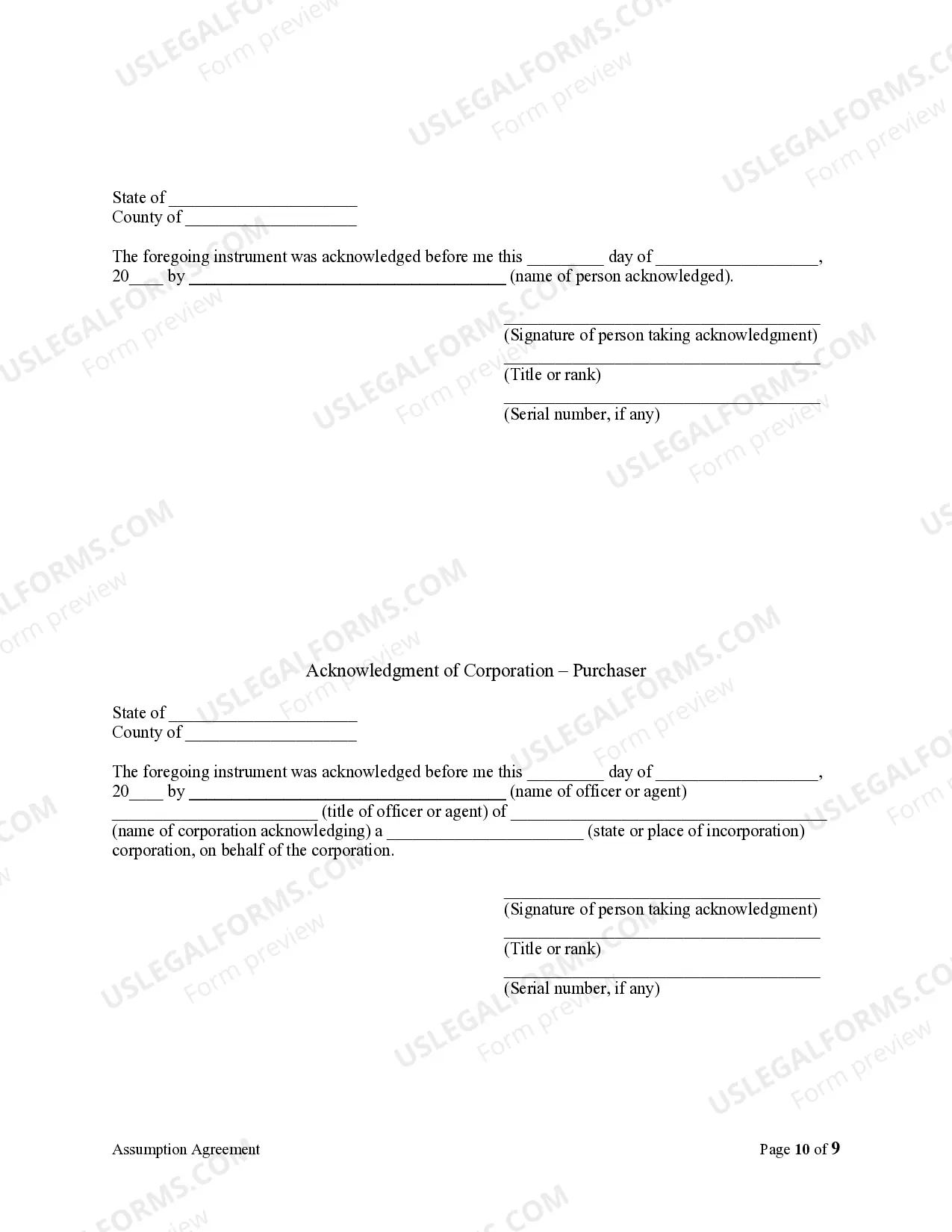

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Kentucky Assumption Agreement of Mortgage and Release of Original Mortgagors

Description Ky Mortgage Release

How to fill out Ky Mortgage Original?

In search of Kentucky Assumption Agreement of Mortgage and Release of Original Mortgagors templates and filling out them might be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the right sample specifically for your state in just a couple of clicks. Our attorneys draw up each and every document, so you just have to fill them out. It is really so simple.

Log in to your account and come back to the form's page and save the sample. All your downloaded templates are kept in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you need to sign up.

Take a look at our detailed instructions concerning how to get the Kentucky Assumption Agreement of Mortgage and Release of Original Mortgagors sample in a few minutes:

- To get an qualified form, check its validity for your state.

- Check out the example using the Preview option (if it’s accessible).

- If there's a description, go through it to know the specifics.

- Click Buy Now if you identified what you're looking for.

- Pick your plan on the pricing page and create an account.

- Select you want to pay with a credit card or by PayPal.

- Download the file in the preferred format.

Now you can print the Kentucky Assumption Agreement of Mortgage and Release of Original Mortgagors template or fill it out using any web-based editor. Don’t worry about making typos because your sample can be used and sent, and printed out as often as you would like. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Assumption Release Original Form popularity

Agreement Mortgage Original Other Form Names

Agreement Mortgage Mortgagors FAQ

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

What is a mortgage assumption agreement? It's actually pretty self-explanatory. A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

In most circumstances, a mortgage can't be transferred from one borrower to another. That's because most lenders and loan types don't allow another borrower to take over payment of an existing mortgage.

You will get the options like transferring an assumable mortgage by requesting your lender to make the change, refinancing the loan in the new owner's name, transferring when the situation demands a loan's due on sale clause, etc. If a loan is assumable that means you can transfer the mortgage to anyone else.

Conventional loans cannot be assumed because the loan must be backed (FHA loan) or insured (VA loan) by a government entity. If your parents' mortgage falls under either of these categories, you're in the clear. However, you'll need to see if the bank believes you're eligible to receive the loan.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

You can transfer a mortgage to another person if the terms of your mortgage say that it is assumable. If you have an assumable mortgage, the new borrower can pay a flat fee to take over the existing mortgage and become responsible for payment. But they'll still typically need to qualify for the loan with your lender.

If you simply want to transfer your own mortgage to another person, it is possible, but there are a few strings attached. This is known as gifting a property.Typically, you're removing yourself from the mortgage by repaying the loan in full. The new homeowner will then take out a new mortgage on the property.