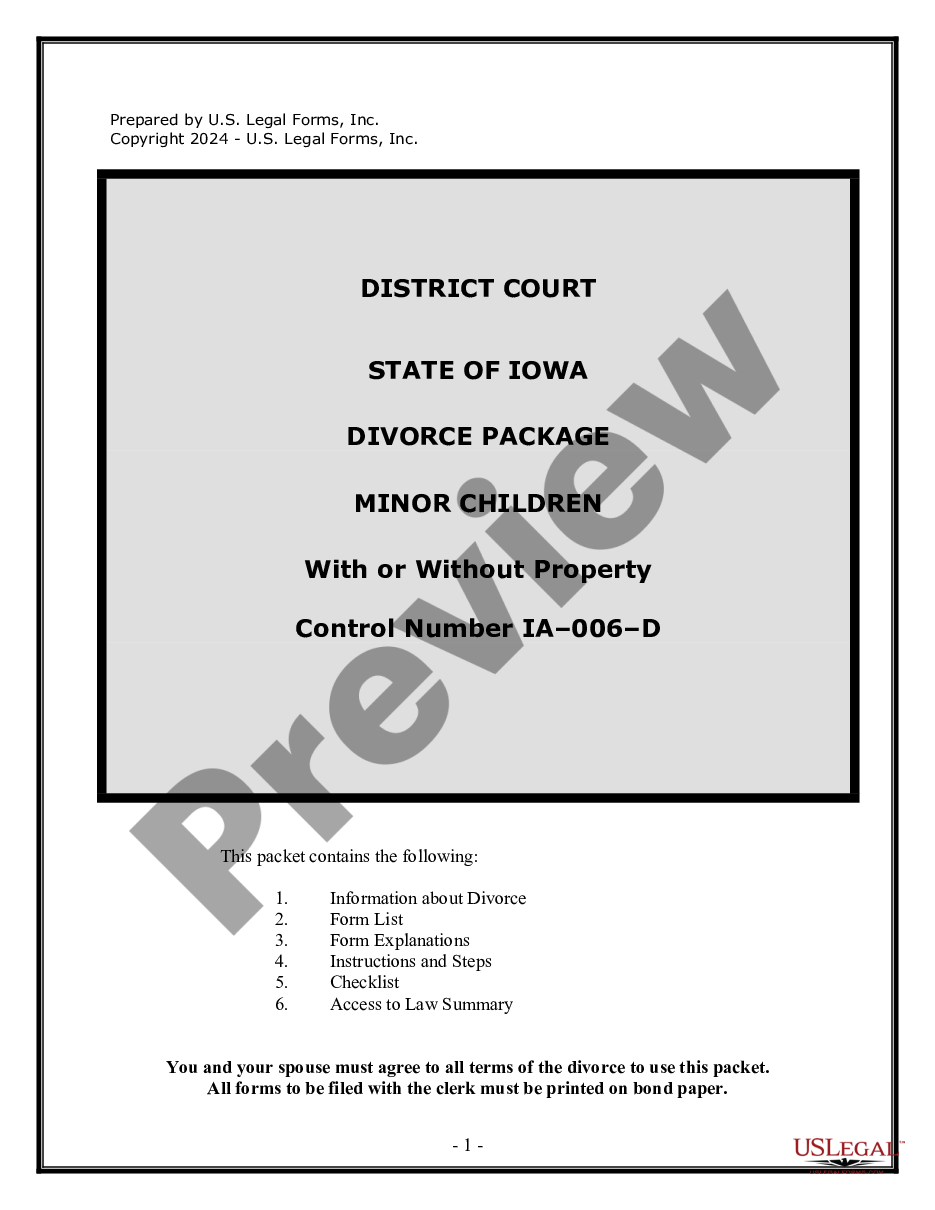

Kentucky Summary Administration Package for Small Estates

Description Petition For Summary Administration

How to fill out Kentucky Summary Administration Package For Small Estates?

In search of Kentucky Summary Administration Petition for Small Estates forms and completing them could be a problem. To save lots of time, costs and energy, use US Legal Forms and choose the right template specially for your state in just a couple of clicks. Our lawyers draft each and every document, so you just have to fill them out. It truly is that easy.

Log in to your account and return to the form's web page and save the sample. All your downloaded samples are saved in My Forms and they are available always for further use later. If you haven’t subscribed yet, you need to register.

Take a look at our detailed recommendations concerning how to get your Kentucky Summary Administration Petition for Small Estates form in a couple of minutes:

- To get an eligible sample, check its applicability for your state.

- Take a look at the sample making use of the Preview option (if it’s available).

- If there's a description, read it to understand the important points.

- Click on Buy Now button if you identified what you're looking for.

- Choose your plan on the pricing page and make your account.

- Choose you want to pay out by a card or by PayPal.

- Save the form in the preferred file format.

Now you can print out the Kentucky Summary Administration Petition for Small Estates form or fill it out using any online editor. No need to concern yourself with making typos because your template may be applied and sent away, and published as often as you wish. Check out US Legal Forms and get access to around 85,000 state-specific legal and tax files.

Form popularity

FAQ

Probate is a legal process that's sometimes needed to deal with a deceased person's property, money and assets (their Estate).A small Estate is difficult to define, but usually if an Estate contains property or has a value of more than £5000, it will not be deemed a small Estate and Probate will be needed.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

Settling the Estate The settlement may not be filed until at least six months from the date the personal representative was appointed. KRS §395.190. If settling the estate takes more than two years, a periodic settlement may be required.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Kentucky defines a small estate as real estate or personal property such as bank accounts valued less than $15,000.This includes bank accounts, vehicles, retirement accounts, heirlooms, and other personal property.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.