The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Kentucky Annual Minutes

Description

How to fill out Kentucky Annual Minutes?

Searching for Annual Minutes - Kentucky sample and filling out them can be a challenge. In order to save time, costs and effort, use US Legal Forms and find the appropriate example specifically for your state within a couple of clicks. Our lawyers draw up all documents, so you just have to fill them out. It truly is that easy.

Log in to your account and come back to the form's page and save the document. All your saved templates are saved in My Forms and therefore are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Check out our thorough recommendations concerning how to get your Annual Minutes - Kentucky template in a few minutes:

- To get an qualified form, check its validity for your state.

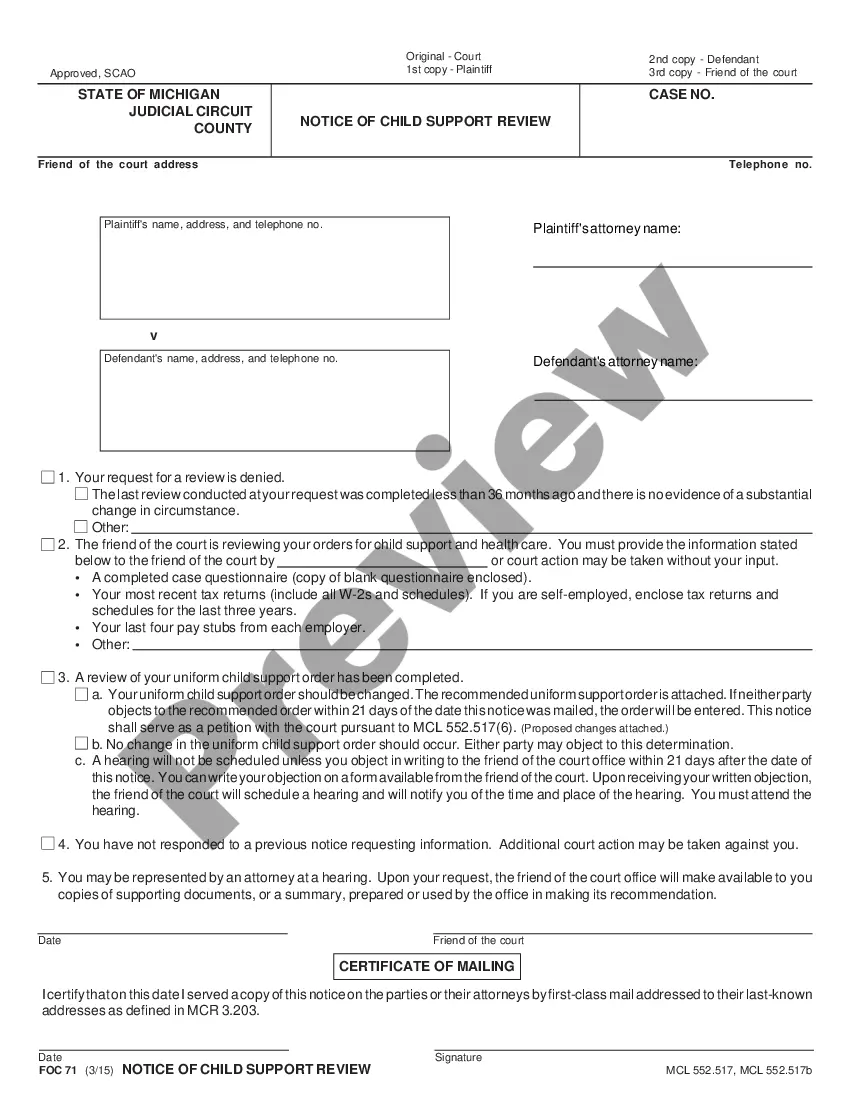

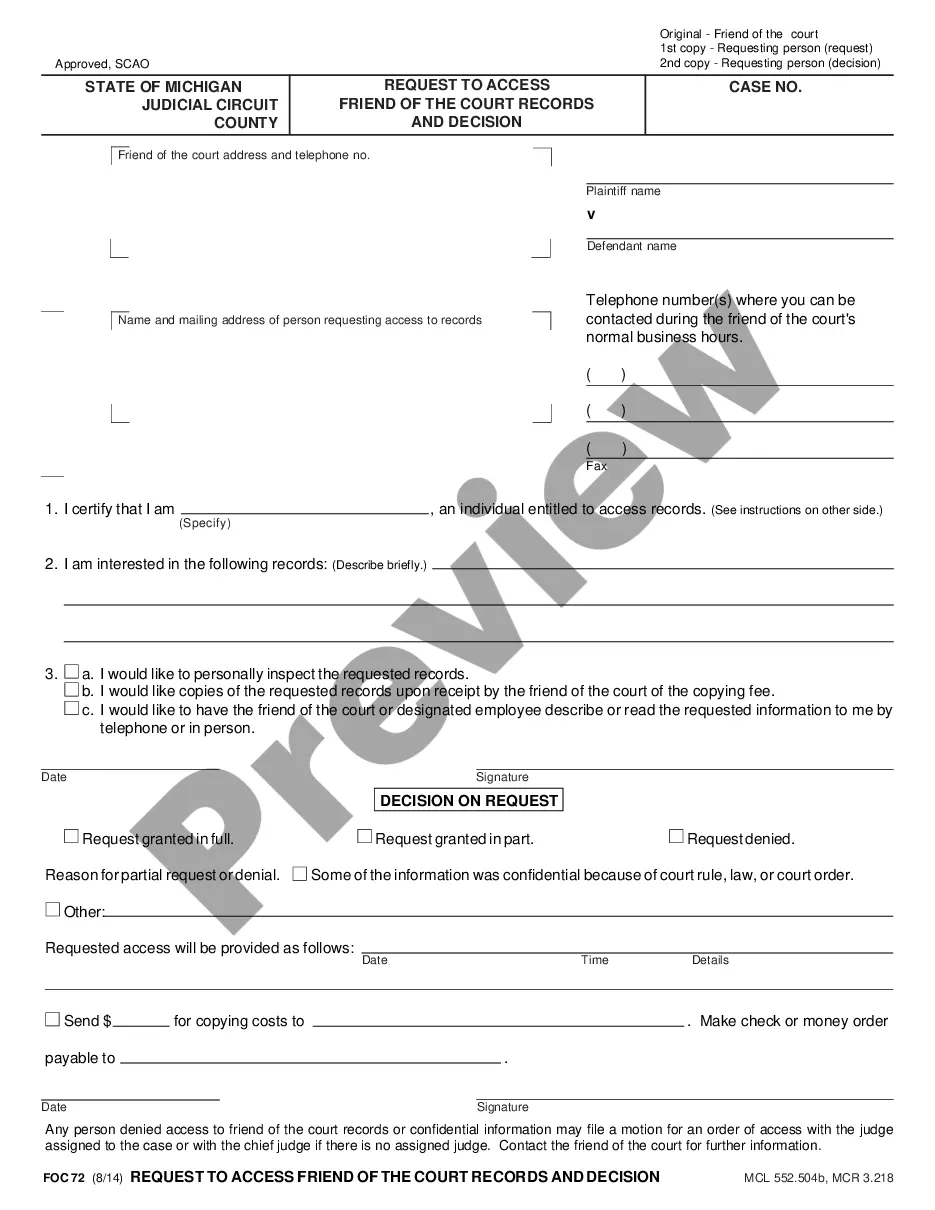

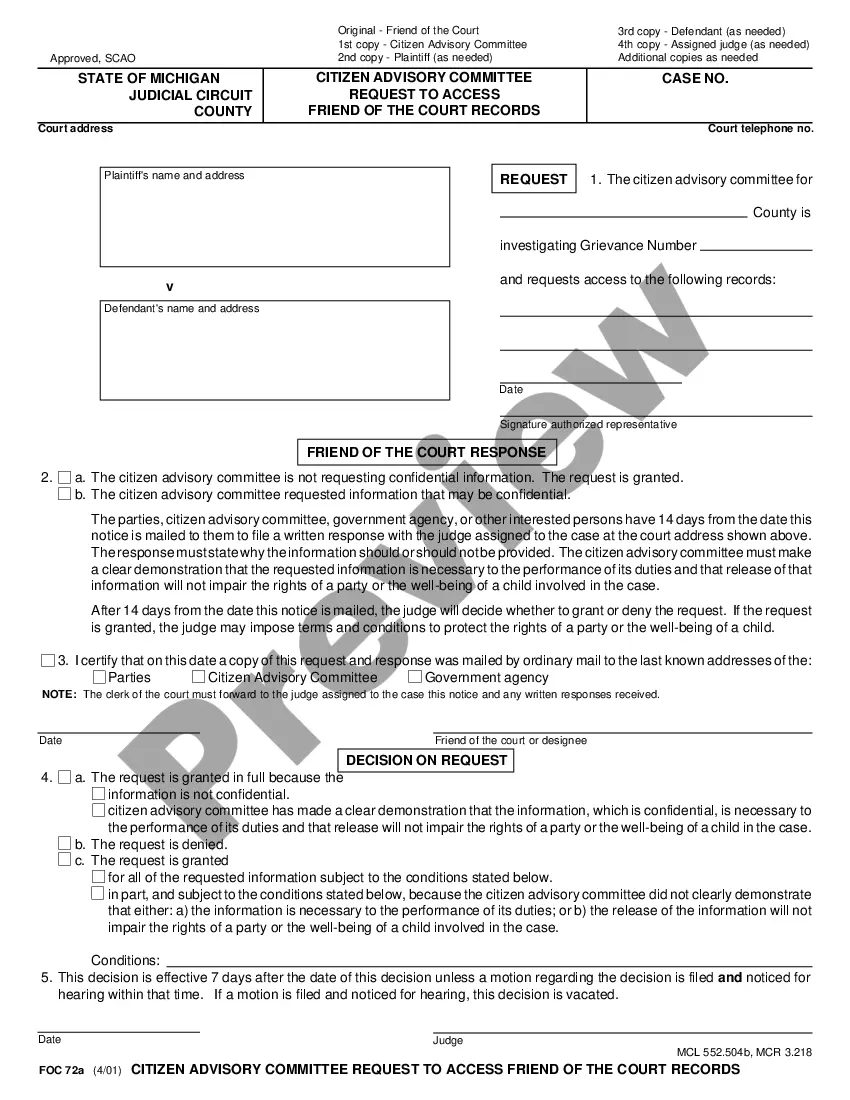

- Look at the form using the Preview option (if it’s accessible).

- If there's a description, read it to know the important points.

- Click on Buy Now button if you identified what you're seeking.

- Choose your plan on the pricing page and create an account.

- Select you wish to pay with a credit card or by PayPal.

- Download the form in the favored file format.

You can print the Annual Minutes - Kentucky template or fill it out utilizing any online editor. No need to worry about making typos because your template may be applied and sent, and printed out as many times as you wish. Check out US Legal Forms and access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

Annual reports are entity information updates due to the secretary of state each year. LLCs, corporations, and nonprofits are required to file annual reports to maintain good standing. Due dates, filing fees, and forms vary greatly by entity type and whether the entity is domestic or foreign to the state.

For many businesses, filing annual reports is among them. If you operate your business as an LLC or corporation (depending on the state in which your company is registered), you may need to publish an annual report to keep in good standing with the state.

If you are a corporation, LLC, or partnership conducting business in Kansas, you must pay $50 to file an annual report every year.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

An annual report is a business's yearly report required by the states for which entities are registered to do business.Filing an annual report in a timely manner ensures your good standing with state government.

Key Things to Know About Annual Reports Currently, all states, except Ohio, require some sort of annual report filing. Specific filing requirements and deadlines vary by state. Some states also require an initial report when first starting a business.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929, when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year.

Visit the FastTrack Business Entity Search Station. http://web.sos.ky.gov/ftsearch/ Search Your LLC Name. Browse the Results.