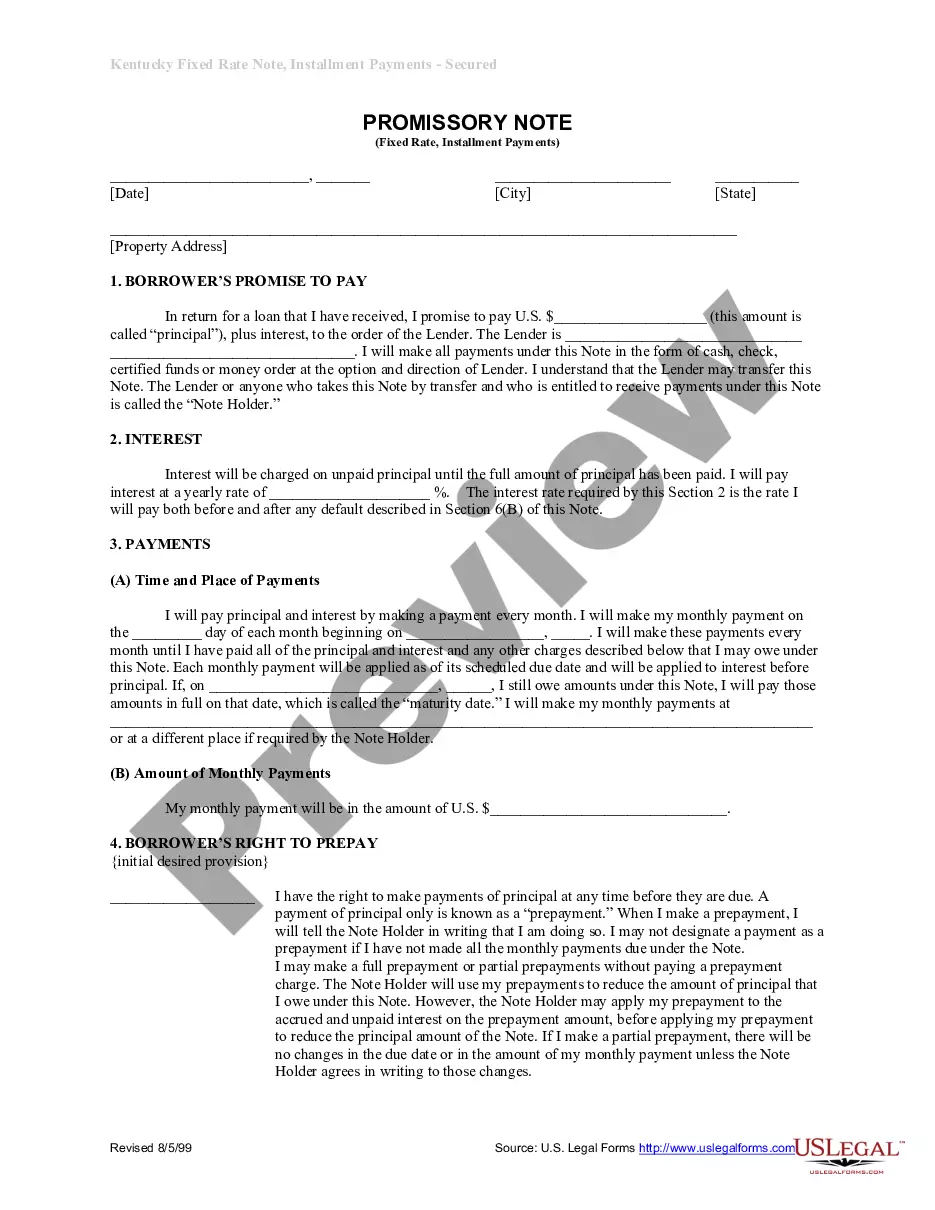

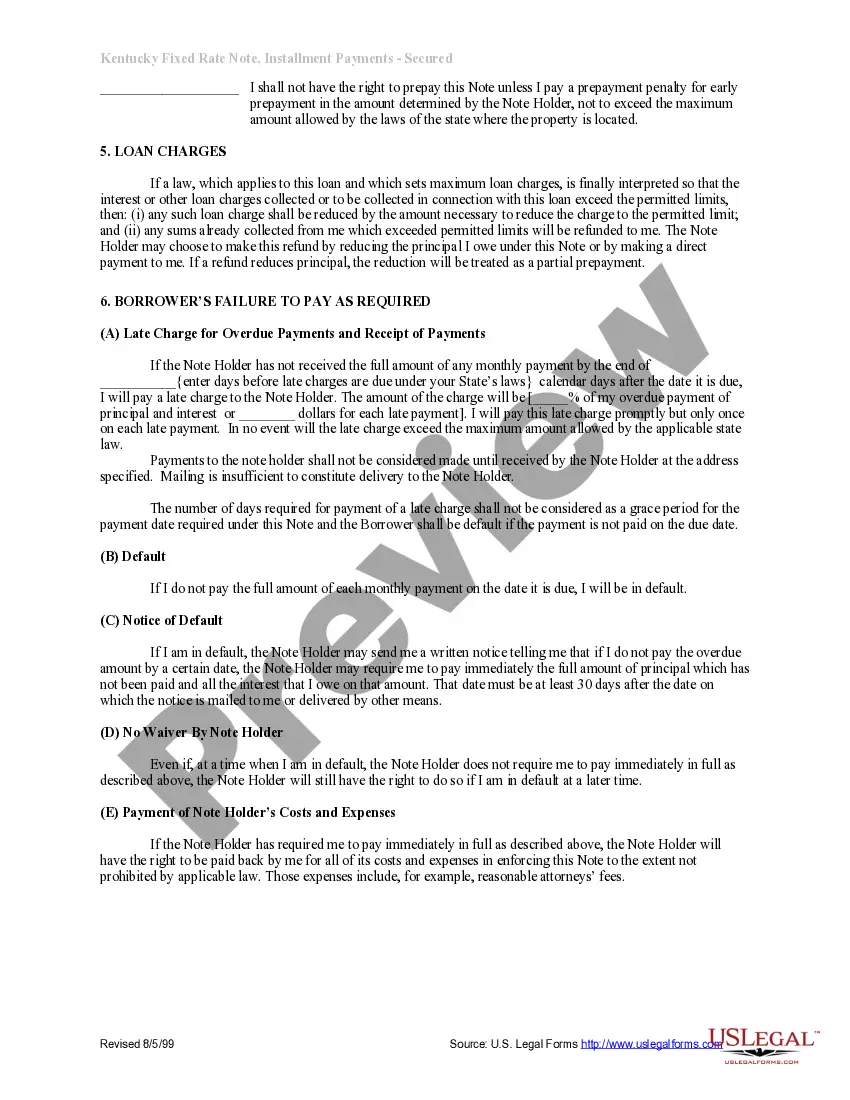

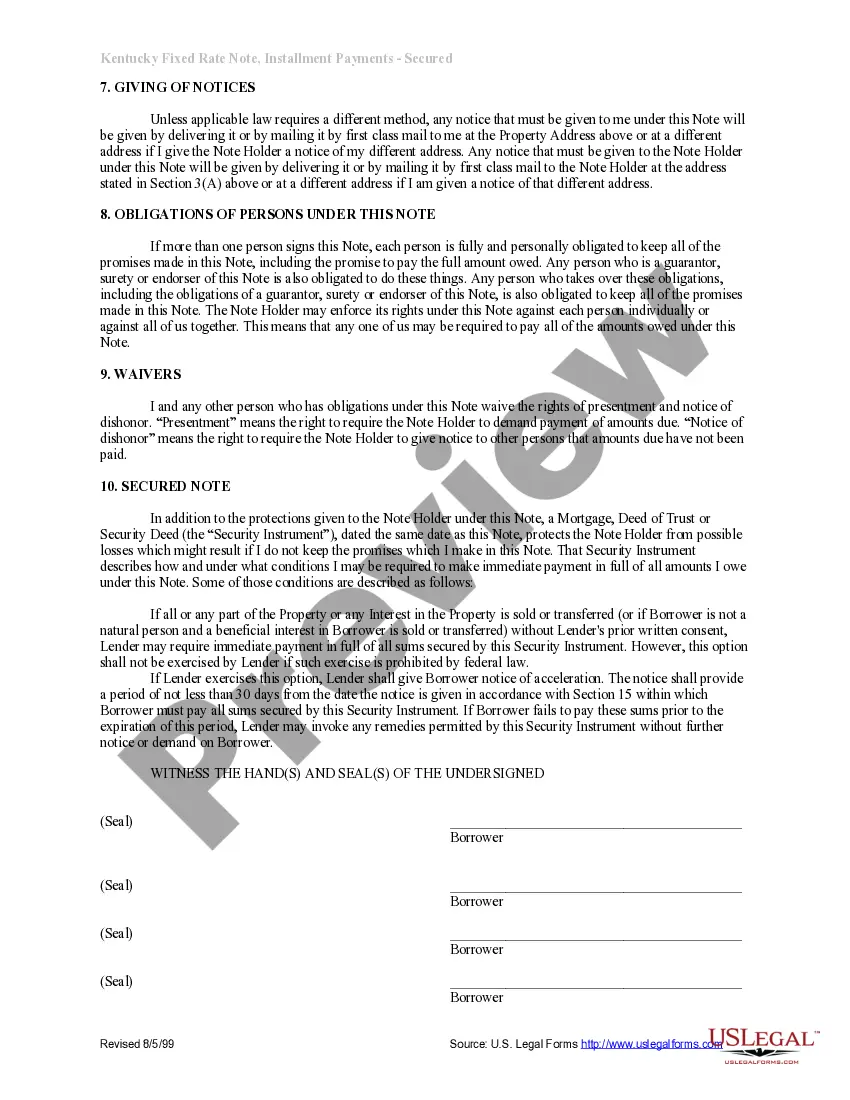

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Kentucky Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Kentucky Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Searching for Kentucky Installments Fixed Rate Promissory Note Secured by Residential Real Estate forms and completing them can be a problem. To save lots of time, costs and energy, use US Legal Forms and choose the right sample specially for your state in just a couple of clicks. Our legal professionals draft every document, so you simply need to fill them out. It really is so simple.

Log in to your account and come back to the form's web page and download the document. Your downloaded examples are kept in My Forms and therefore are available at all times for further use later. If you haven’t subscribed yet, you should sign up.

Look at our detailed instructions concerning how to get your Kentucky Installments Fixed Rate Promissory Note Secured by Residential Real Estate sample in a few minutes:

- To get an entitled sample, check its validity for your state.

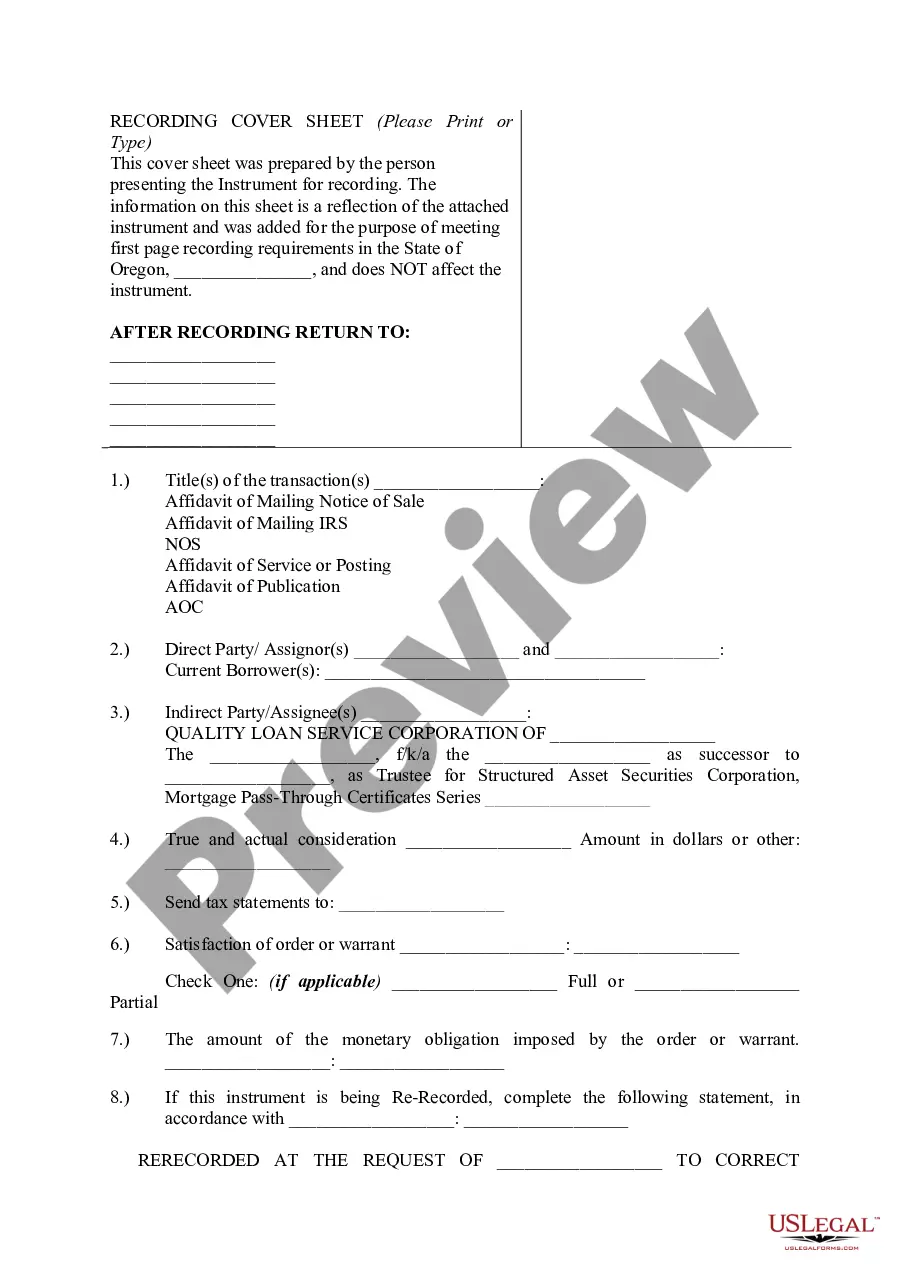

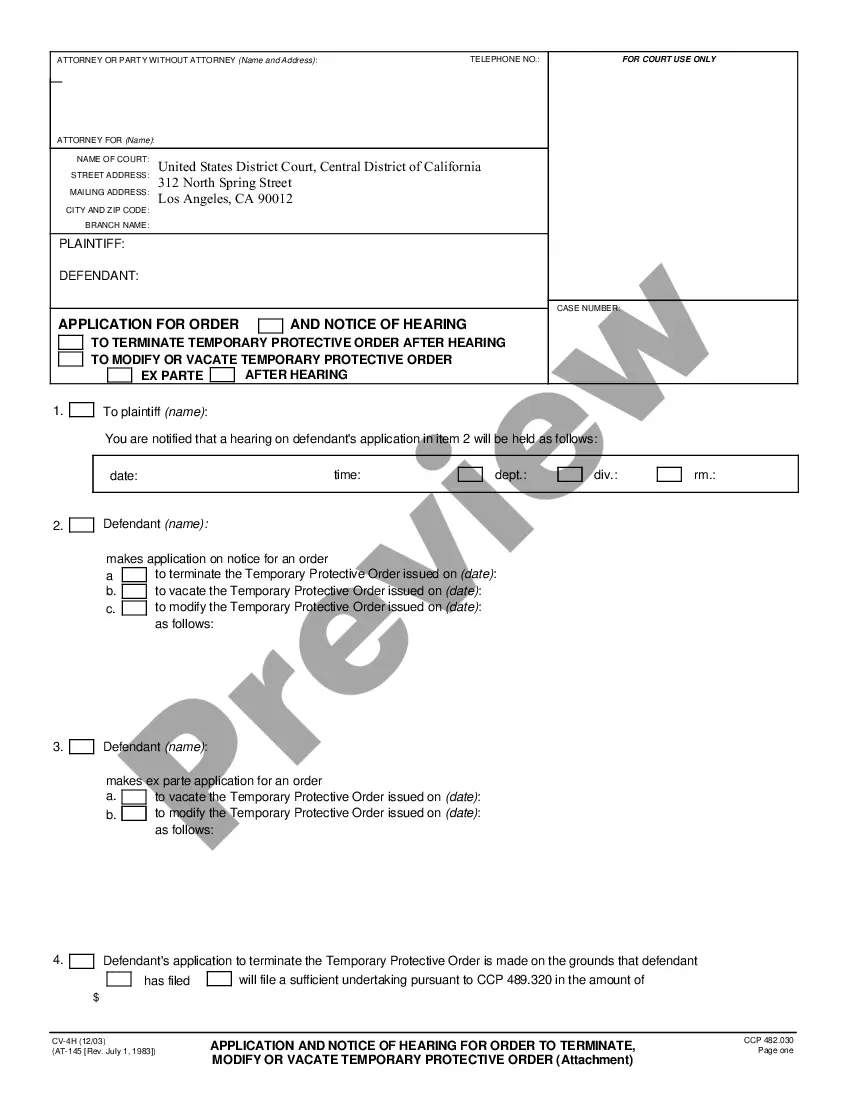

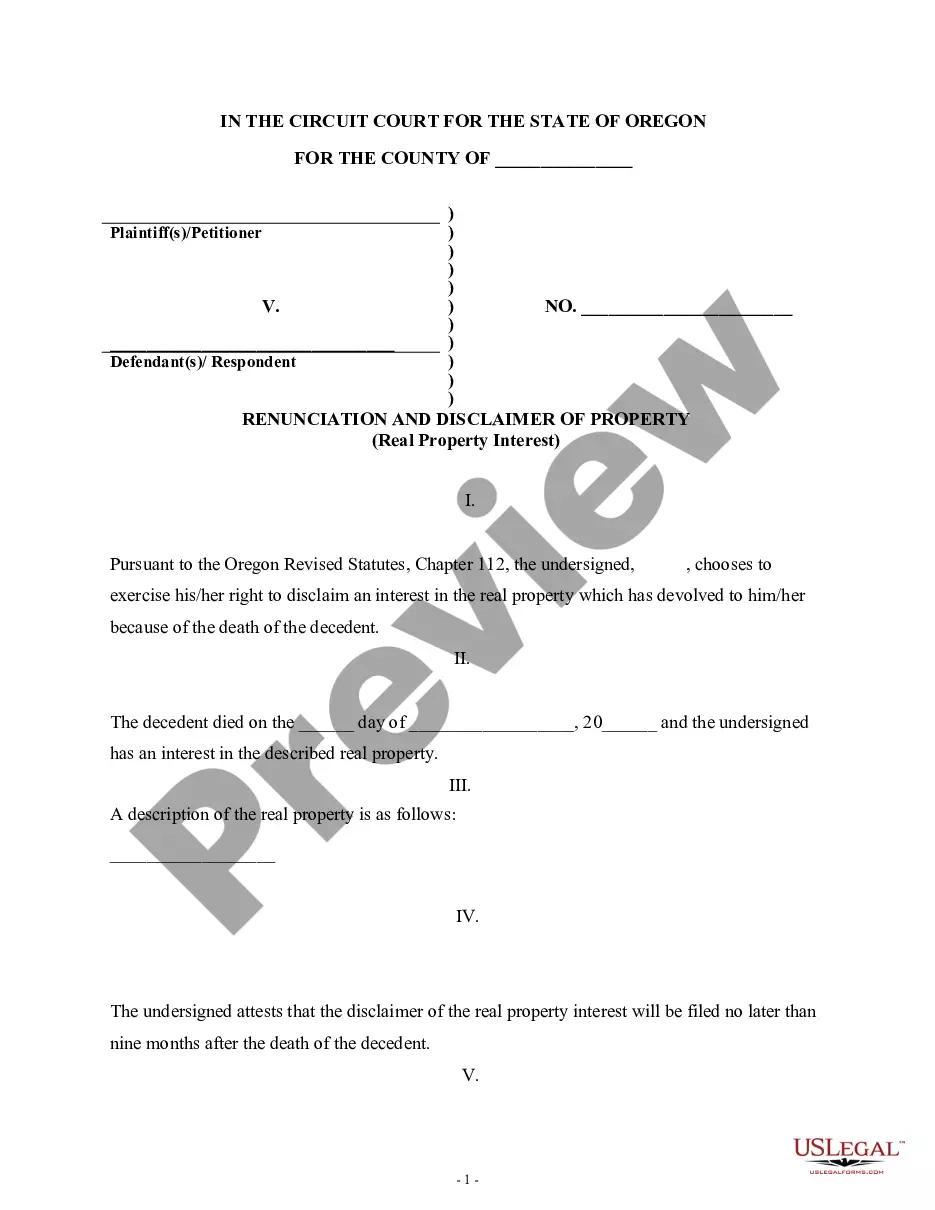

- Look at the sample using the Preview function (if it’s available).

- If there's a description, read through it to know the specifics.

- Click on Buy Now button if you identified what you're seeking.

- Select your plan on the pricing page and make an account.

- Choose you want to pay out with a credit card or by PayPal.

- Save the sample in the favored format.

You can print the Kentucky Installments Fixed Rate Promissory Note Secured by Residential Real Estate form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your form can be utilized and sent away, and published as often as you wish. Check out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

Navigate to the website: www.studentloans.gov. Click "Log In." Enter your FSA ID and Password. Click "Complete Master Promissory Note." Select the appropriate loan type. Enter Your Personal Information.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.