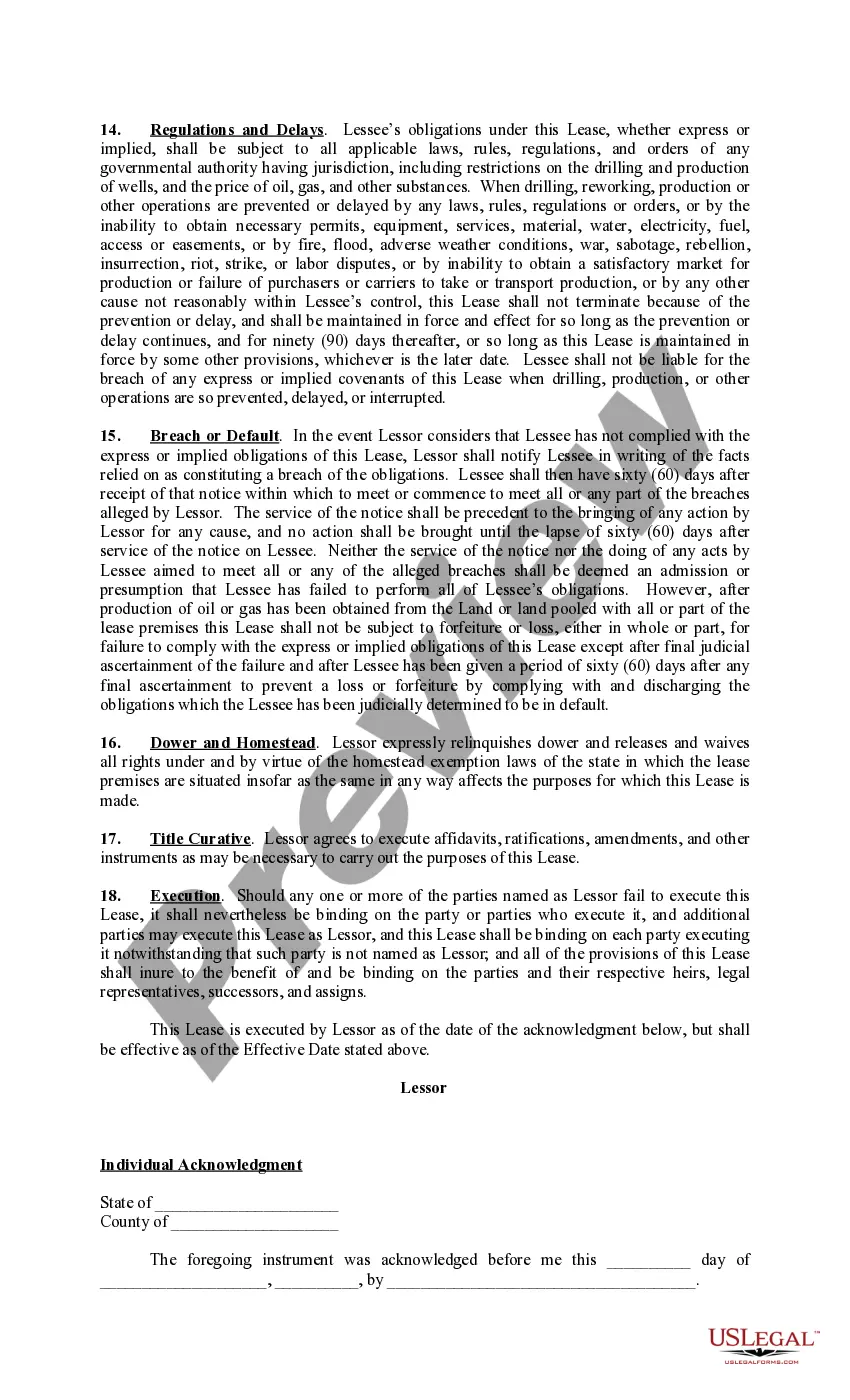

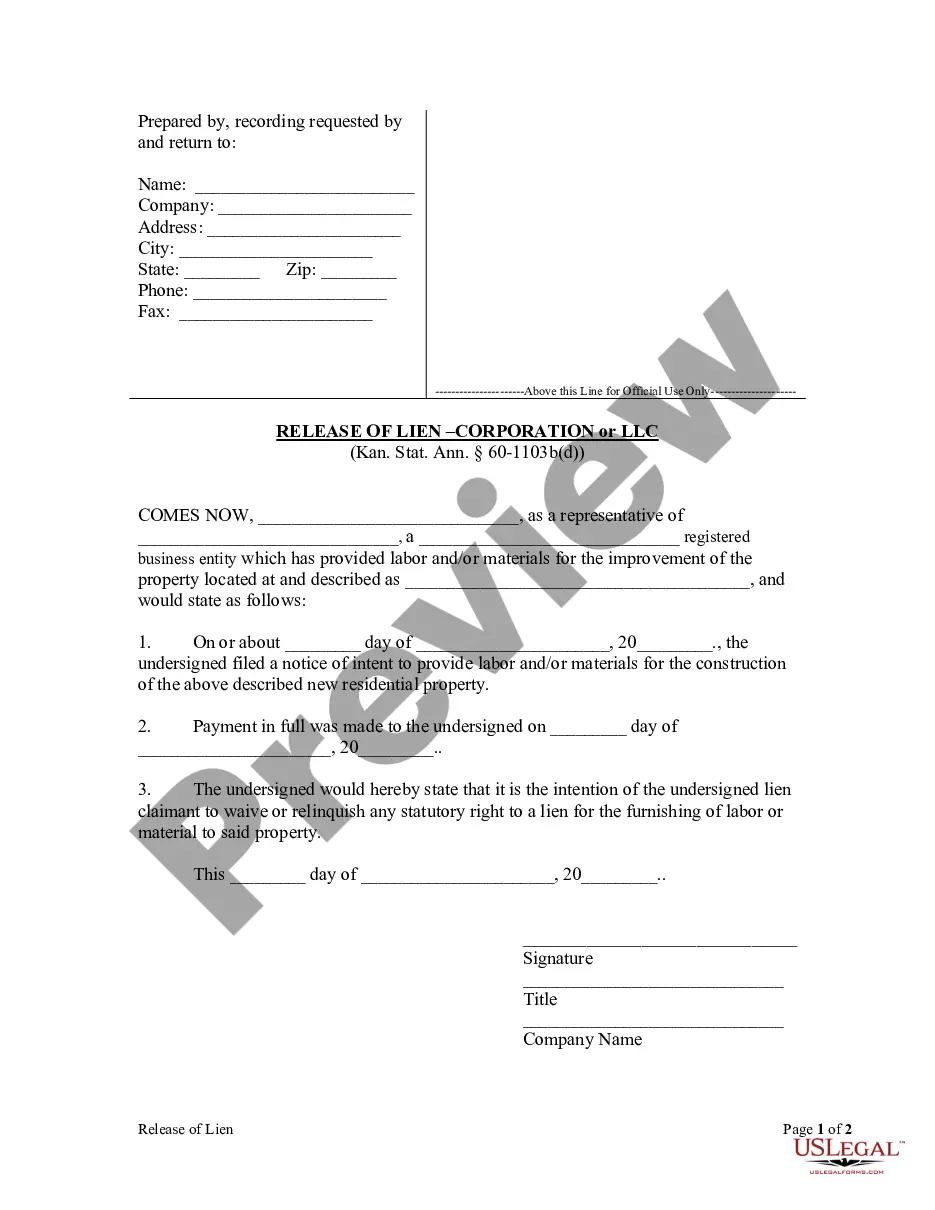

This form is a Kentucky Lease agreement wherein Lessor grants, leases, and lets exclusively to Lessee the lands described within for the purposes of conducting seismic and geophysical operations, exploring, drilling, mining, and operating for, producing and owning oil, gas, sulfur, and all other minerals whether or not similar to those mentioned (collectively the "oil or gas"), and the right to make surveys, lay pipelines, establish and utilize facilities for surface or subsurface disposal of salt water, construct roads and bridges, dig canals, build tanks, power stations, power lines, telephone lines, and other structures on the Lands, necessary or useful in Lessee's operations on the Lands or any other land adjacent to the Lands. This lease is a paid up lease and provides for pooling.

Kentucky Paid Up Lease Pooling Provision

Description

How to fill out Kentucky Paid Up Lease Pooling Provision?

In search of Kentucky Paid Up Lease Pooling Provision templates and filling out them might be a problem. In order to save time, costs and energy, use US Legal Forms and find the right template specifically for your state in just a couple of clicks. Our attorneys draft each and every document, so you just have to fill them out. It truly is so easy.

Log in to your account and return to the form's page and save the sample. All of your downloaded samples are saved in My Forms and are available all the time for further use later. If you haven’t subscribed yet, you need to register.

Have a look at our detailed recommendations concerning how to get your Kentucky Paid Up Lease Pooling Provision form in a few minutes:

- To get an eligible form, check its applicability for your state.

- Have a look at the example utilizing the Preview option (if it’s available).

- If there's a description, go through it to understand the important points.

- Click on Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and make an account.

- Pick how you wish to pay with a credit card or by PayPal.

- Save the file in the favored file format.

Now you can print the Kentucky Paid Up Lease Pooling Provision template or fill it out using any web-based editor. Don’t concern yourself with making typos because your sample may be applied and sent, and published as often as you would like. Check out US Legal Forms and access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Pay OnlinePay your taxes online using the Kentucky Department of Revenue's Electronic Payment Application. At this time, DOR accepts payments by credit card or electronic check. If you have questions, call the Department of Revenue at (502) 564-4581. You can also pay online at Official Payments Corporation.

Pay OnlinePay your taxes online using the Kentucky Department of Revenue's Electronic Payment Application. At this time, DOR accepts payments by credit card or electronic check. If you have questions, call the Department of Revenue at (502) 564-4581.

Under California law, non-exempt employees are entitled to one unpaid 30-minute meal break, and two paid 10-minute rest breaks, during a typical 8-hour shift.

Click Unemployment Benefits - Internet Claim Filing. Click I agree. Log into your account using your Social Security number and the personal identification number you created when you started your original unemployment claim. View your claim details and status on the next page.

When breaks aren't stipulated by law, employers may have company policies in place that provide for a certain amount of break time per work shift.For example, an employee could be given a 30-minute lunch break (unpaid) and two 15-minute breaks (paid) during each eight-hour shift.

In Kentucky, workers are luckyKY labor laws about breaks specify that employees must be given at least a 10 minute break for every 4 hours of work. Both federal and Kentucky labor laws about breaks require that these short rest breaks be paid, as long as they are less than 20 minutes long.

Kentucky does not define full- or part-time employment. Employers may define the terms themselves. In addition, there is no limitation on the number of hours employers can require employees to work in a day. Drivers.

15 minute break for 4-6 consecutive hours or a 30 minute break for more than 6 consecutive hours. If an employee works 8 or more consecutive hours, the employer must provide a 30-minute break and an additional 15 minute break for every additional 4 consecutive hours worked.

For each four hour work period, a worker must be given a ten minute paid rest period. Kentucky also has a special meal break requirement for workers under the age of 18. Employees ages 14 to 17 must be given a 30 minute lunch break for each five hours they work continuously.