- US Legal Forms

-

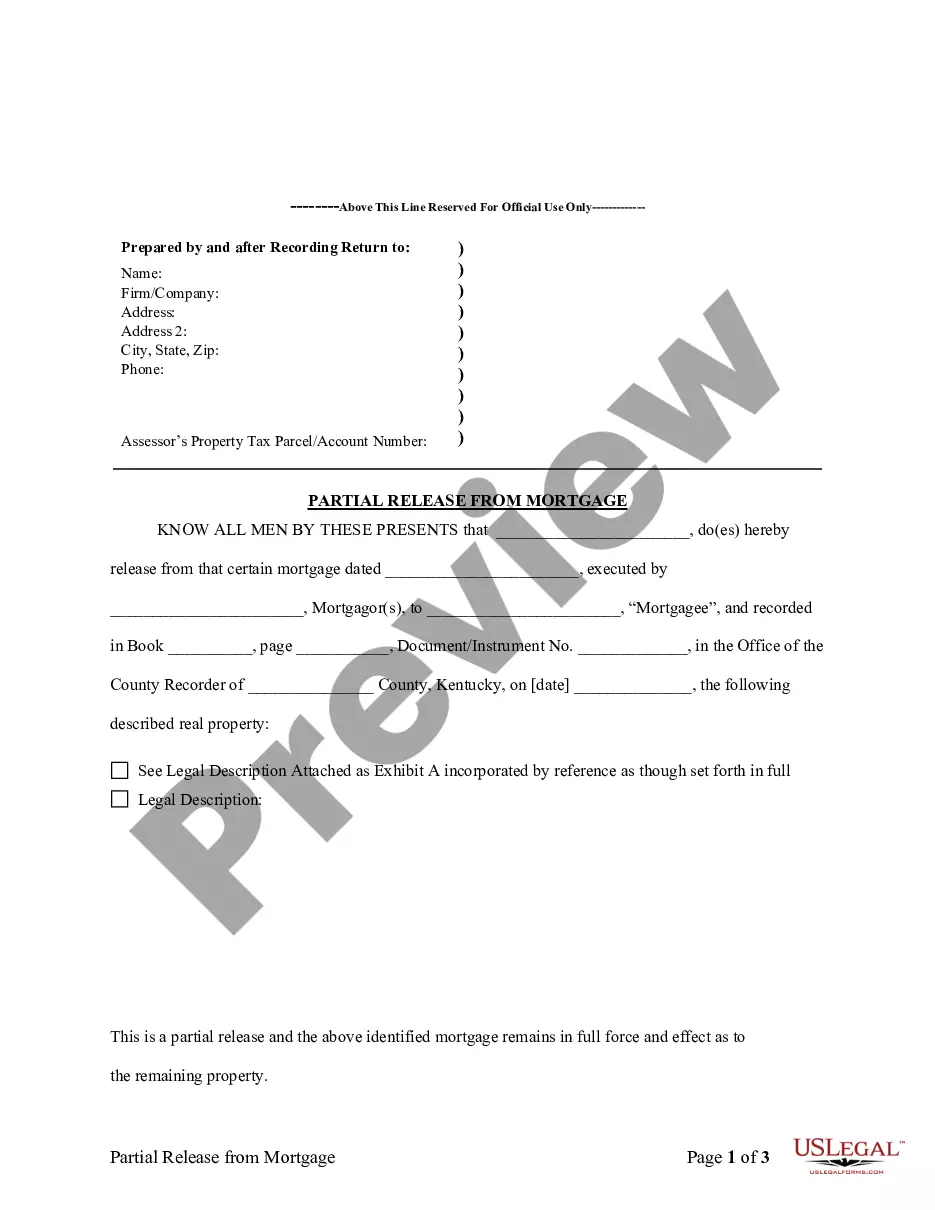

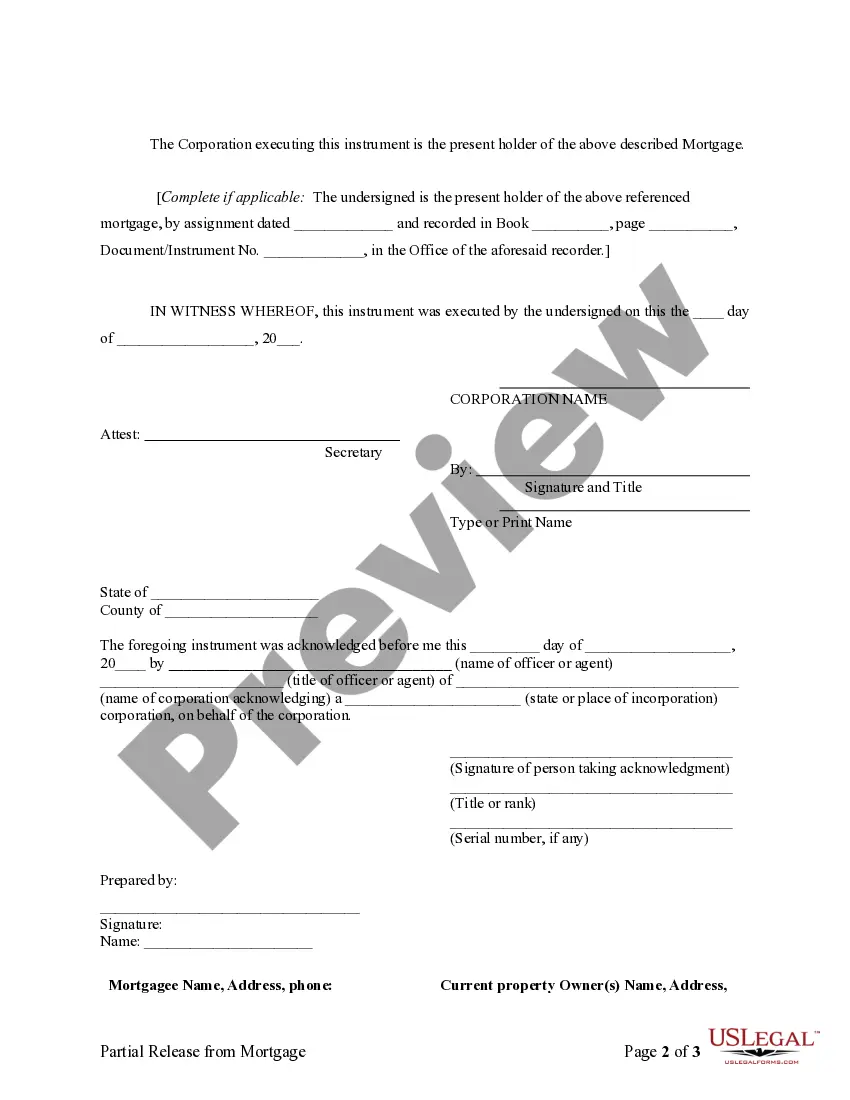

Kentucky Partial Release of Property From Mortgage for Corporation

Partial Deed

Description

Related forms

View Minutes for Organizational Meeting

View Michigan Real Estate Home Sales Package with Offer to Purchase, Contract of Sale, Disclosure Statements and more for Residential House

View Sample Transmittal Letter to Secretary of State's Office to File Articles of Incorporation

View Acknowledgment for Individuals

View Complaint (Request For Action, Delinquency Proceedings) Page 1

How to fill out Kentucky Partial Release Of Property From Mortgage For Corporation?

Trying to find Kentucky Partial Release of Property From Mortgage for Corporation sample and completing them can be a challenge. To save time, costs and energy, use US Legal Forms and find the right template specially for your state within a few clicks. Our legal professionals draw up every document, so you simply need to fill them out. It really is so simple.

Log in to your account and come back to the form's web page and save the sample. Your saved examples are kept in My Forms and are accessible at all times for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our comprehensive instructions regarding how to get your Kentucky Partial Release of Property From Mortgage for Corporation form in a few minutes:

- To get an qualified form, check its validity for your state.

- Check out the form using the Preview option (if it’s available).

- If there's a description, read through it to know the important points.

- Click on Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and create your account.

- Select you would like to pay by a card or by PayPal.

- Download the file in the preferred file format.

Now you can print the Kentucky Partial Release of Property From Mortgage for Corporation form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your template may be employed and sent, and printed as many times as you want. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Form Rating

Form popularity

FAQ

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Kentucky

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Kentucky Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Written demand required. See below, Penalty.

Recording Satisfaction: A holder of a lien on real property shall release the lien in the county clerk's office where the lien is recorded within thirty (30) days from the date of satisfaction.

Marginal Satisfaction: Not allowed.

Penalty: If the court finds that the lienholder received written notice of its failure to release and lacked good cause for not releasing the lien, the lienholder shall be liable to the owner of the real property in the amount of one hundred dollars ($100) per day for each day, beginning on the fifteenth day after receipt of the written notice, of the violation for which good cause did not exist. A lienholder that continues to fail to release a satisfied real estate lien, without good cause, within forty-five (45) days from the date of written notice shall be liable to the owner of the real property for an additional four hundred dollars ($400) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice, for a total of five hundred dollars ($500) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice. The lienholder shall also be liable for any actual expense including a reasonable attorney's fee incurred by the owner in securing the release of real property by such violation.

Acknowledgment: An assignment or satisfaction must contain a proper Kentucky acknowledgment, or other acknowledgment approved by statute.

Kentucky Statutes

382.290 Recording of mortgages and deeds retaining liens -- Assignment

--

Discharge -- Form of record -- Clerk's fee.

(1) In recording mortgages and deeds in which liens are retained (except railroad mortgages securing bonds payable to bearer), there shall be left a blank space immediately after the record of the deed or mortgage of at least two (2) full lines for each note or obligation named in the deed or mortgage, or in the alternative, at the option of the county clerk, a marginal entry record may be kept for the same purposes as the blank space. Each entry in the marginal entry record shall be linked to its respective referenced instrument in the indexing system for the referenced instruments.

(2) When any note named in any deed or mortgage is assigned to any other person, the assignor may, over his own hand, attested by the clerk, note such assignment in the blank space, or in a marginal entry record, beside a listing of the book and page of the document being assigned, and when any one (1) or more of the notes named in any deed or mortgage is paid, or otherwise released or satisfied, the holder of the note, and who appears from the record to be such holder, may release the lien, so far as such note is concerned, by release, over his own hand, attested by the clerk. Each entry in the marginal entry record shall be linked to its respective referenced instrument in the indexing system for the referenced instrument.

(3) No person who does not, from such record or assignment of record, appear at the time to be the legal holder of any note secured by lien in any deed or mortgage, shall be permitted to release the lien securing any such note, and any release made in contravention of this section shall be void; but this section does not change the existing law if no such entry is made.

(4) For each assignment and release so made and attested by the clerk, he may charge a fee pursuant to KRS 64.012 to be paid by the person executing the release or noting the assignment.

(5) If such assignment of a note is made by separate instrument or by deed assigning the note, or in a marginal entry record, the instrument of writing or deed or marginal entry record shall set forth the date of notes assigned, a brief description of notes, the name and post office address of assignee, and the deed book and page of the instrument wherein the lien or mortgage is recorded and the clerk or deputy clerk receiving such instrument of writing or deed of assignment for record shall at the option of the county clerk immediately either link the assignment and its filing location to its respective referenced instrument in the indexing system for the referenced instrument, or endorse at the foot of the record in the space provided in subsection (1), "The notes mentioned herein (giving a brief description of notes assigned) have been transferred and assigned to (insert name and address of assignee) by deed of assignment (or describe instrument) dated and recorded in deed book .... page ....," and attest such certificate. For making such notation on the record the clerk shall be allowed a fee pursuant to KRS 64.012 for each notation so made, to be paid by the party filing the instrument of writing or deed of assignment.

(6) No holder of a note secured by lien retained in either deed or mortgage shall lodge for record, and no clerk or deputy clerk shall receive and permit to be lodged for record, any deed or instrument of writing that does not comply with the provisions of this section.

382.335 Certain information to be included in instruments in order for them to be recorded.

(1) No county clerk shall receive or permit the recording of any instrument by which the title to real estate or personal property, or any interest therein or lien thereon, is conveyed, granted, encumbered, assigned, or otherwise disposed of; nor receive any instrument or permit any instrument, provided by law, to be recorded as evidence of title to real estate; and shall not receive or permit any instrument, relating to the organization or dissolution of a private corporation, unless the instrument has endorsed on it, a printed, typewritten, or stamped statement showing the name and address of the individual who prepared the instrument, and the statement is signed by the individual. The person who prepared the instrument may execute his signature by affixing a facsimile of his signature on the instrument. This subsection shall not apply to any instrument executed or acknowledged prior to July 1, 1962.

(2) No county clerk shall receive or permit the recording of any

instrument by which the title to real estate or any interest therein is

conveyed, granted, assigned, or

otherwise disposed of unless the instrument contains the mailing

address of the grantee or assignee. This subsection shall not apply to

any instrument executed or acknowledged prior to July 1, 1970.

(3) This section shall not apply to wills or to statutory liens in favor of the Commonwealth.

(4) No county clerk shall receive, or permit the recording of, any instrument by which real estate, or any interest therein, is conveyed, granted, assigned, transferred, or otherwise disposed of unless the instrument complies with the official indexing system of the county. The indexing system shall have been in place for at least twenty-four (24) months prior to July 15, 1994 or shall be implemented for the purpose of allowing computerized searching for the instruments of record of the county clerk. If a county clerk requires a parcel identification number on an instrument before recording, the clerk shall provide a computer terminal, at no charge to the public, for use in finding the parcel identification number. The county clerk may make reasonable rules about the use of the computer terminal, requests for a parcel identification number, or both.

(5) The receipt for record and recording of any instrument by the county clerk without compliance with the provisions of this section shall not prevent the record of filing of the instrument from becoming notice as otherwise provided by law, nor impair the admissibility of the record as evidence.

382.365 Release of lien, with notice to property owner, within thirty days of satisfaction -- Proceeding against lienholder in District Court or Circuit Court -- Liability of lienholder when lien not released or notice not sent -- Notice to state or lienholder.

(1) A holder of a lien on real property, including a lien provided for in KRS 376.010, shall release the lien in the county clerk's office where the lien is recorded within thirty (30) days from the date of satisfaction.

(2) A proceeding may be filed by any owner of real property or any party acquiring an interest in the real property in District Court or Circuit Court against a lienholder that violates subsection (1) of this section. A proceeding filed under this section shall be given precedence over other matters pending before the court.

(3) Upon proof to the court of the lien being satisfied, the court shall enter a judgment releasing the lien. The judgment shall be with costs including a reasonable attorney's fee. If the court finds that the lienholder received written notice of its failure to release and lacked good cause for not releasing the lien, the lienholder shall be liable to the owner of the real property in the amount of one hundred dollars ($100) per day for each day, beginning on the fifteenth day after receipt of the written notice, of the violation for which good cause did not exist.

(4) A lienholder that continues to fail to release a satisfied real estate lien, without good cause, within forty-five (45) days from the date of written notice shall be liable to the owner of the real property for an additional four hundred dollars ($400) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice, for a total of five hundred dollars ($500) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice. The lienholder shall also be liable for any actual expense including a reasonable attorney's fee incurred by the owner in securing the release of real property by such violation.

(5) The former holder of a lien on real property shall send by regular mail a copy of the lien release to the property owner at his last known address within seven (7) days of the release. A former lienholder that violates this subsection shall be liable to the owner of the real property for fifty dollars ($50) and any actual expense incurred by the owner in obtaining documentation of the lien release.

(6) For the purposes of this section, "date of satisfaction" means that date of receipt by a holder of a lien on real property of a sum of money in the form of a certified check, cashier's check, wired transferred funds, or other form of payment satisfactory to the lienholder that is sufficient to pay the principal, interest, and other costs owing on the obligation that is secured by the lien on the property.

(7) The provisions of this section shall not apply when a lienholder is deceased and the estate of the lienholder has not been settled.

(8) The state licensing agency, if applicable, or any holder of a lien on real property shall be notified of the disposition of any actions brought under this section against the lienholder.

(9) The provisions of this section shall be held and construed as ancillary and supplemental to any other remedy provided by law.

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Kentucky Law

Execution of Assignment or Satisfaction: Must be signed by the mortgagee.

Assignment: An assignment must be in writing and recorded.

Demand to Satisfy: Written demand required. See below, Penalty.

Recording Satisfaction: A holder of a lien on real property shall release the lien in the county clerk's office where the lien is recorded within thirty (30) days from the date of satisfaction.

Marginal Satisfaction: Not allowed.

Penalty: If the court finds that the lienholder received written notice of its failure to release and lacked good cause for not releasing the lien, the lienholder shall be liable to the owner of the real property in the amount of one hundred dollars ($100) per day for each day, beginning on the fifteenth day after receipt of the written notice, of the violation for which good cause did not exist. A lienholder that continues to fail to release a satisfied real estate lien, without good cause, within forty-five (45) days from the date of written notice shall be liable to the owner of the real property for an additional four hundred dollars ($400) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice, for a total of five hundred dollars ($500) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice. The lienholder shall also be liable for any actual expense including a reasonable attorney's fee incurred by the owner in securing the release of real property by such violation.

Acknowledgment: An assignment or satisfaction must contain a proper Kentucky acknowledgment, or other acknowledgment approved by statute.

Kentucky Statutes

382.290 Recording of mortgages and deeds retaining liens -- Assignment

--

Discharge -- Form of record -- Clerk's fee.

(1) In recording mortgages and deeds in which liens are retained (except railroad mortgages securing bonds payable to bearer), there shall be left a blank space immediately after the record of the deed or mortgage of at least two (2) full lines for each note or obligation named in the deed or mortgage, or in the alternative, at the option of the county clerk, a marginal entry record may be kept for the same purposes as the blank space. Each entry in the marginal entry record shall be linked to its respective referenced instrument in the indexing system for the referenced instruments.

(2) When any note named in any deed or mortgage is assigned to any other person, the assignor may, over his own hand, attested by the clerk, note such assignment in the blank space, or in a marginal entry record, beside a listing of the book and page of the document being assigned, and when any one (1) or more of the notes named in any deed or mortgage is paid, or otherwise released or satisfied, the holder of the note, and who appears from the record to be such holder, may release the lien, so far as such note is concerned, by release, over his own hand, attested by the clerk. Each entry in the marginal entry record shall be linked to its respective referenced instrument in the indexing system for the referenced instrument.

(3) No person who does not, from such record or assignment of record, appear at the time to be the legal holder of any note secured by lien in any deed or mortgage, shall be permitted to release the lien securing any such note, and any release made in contravention of this section shall be void; but this section does not change the existing law if no such entry is made.

(4) For each assignment and release so made and attested by the clerk, he may charge a fee pursuant to KRS 64.012 to be paid by the person executing the release or noting the assignment.

(5) If such assignment of a note is made by separate instrument or by deed assigning the note, or in a marginal entry record, the instrument of writing or deed or marginal entry record shall set forth the date of notes assigned, a brief description of notes, the name and post office address of assignee, and the deed book and page of the instrument wherein the lien or mortgage is recorded and the clerk or deputy clerk receiving such instrument of writing or deed of assignment for record shall at the option of the county clerk immediately either link the assignment and its filing location to its respective referenced instrument in the indexing system for the referenced instrument, or endorse at the foot of the record in the space provided in subsection (1), "The notes mentioned herein (giving a brief description of notes assigned) have been transferred and assigned to (insert name and address of assignee) by deed of assignment (or describe instrument) dated and recorded in deed book .... page ....," and attest such certificate. For making such notation on the record the clerk shall be allowed a fee pursuant to KRS 64.012 for each notation so made, to be paid by the party filing the instrument of writing or deed of assignment.

(6) No holder of a note secured by lien retained in either deed or mortgage shall lodge for record, and no clerk or deputy clerk shall receive and permit to be lodged for record, any deed or instrument of writing that does not comply with the provisions of this section.

382.335 Certain information to be included in instruments in order for them to be recorded.

(1) No county clerk shall receive or permit the recording of any instrument by which the title to real estate or personal property, or any interest therein or lien thereon, is conveyed, granted, encumbered, assigned, or otherwise disposed of; nor receive any instrument or permit any instrument, provided by law, to be recorded as evidence of title to real estate; and shall not receive or permit any instrument, relating to the organization or dissolution of a private corporation, unless the instrument has endorsed on it, a printed, typewritten, or stamped statement showing the name and address of the individual who prepared the instrument, and the statement is signed by the individual. The person who prepared the instrument may execute his signature by affixing a facsimile of his signature on the instrument. This subsection shall not apply to any instrument executed or acknowledged prior to July 1, 1962.

(2) No county clerk shall receive or permit the recording of any

instrument by which the title to real estate or any interest therein is

conveyed, granted, assigned, or

otherwise disposed of unless the instrument contains the mailing

address of the grantee or assignee. This subsection shall not apply to

any instrument executed or acknowledged prior to July 1, 1970.

(3) This section shall not apply to wills or to statutory liens in favor of the Commonwealth.

(4) No county clerk shall receive, or permit the recording of, any instrument by which real estate, or any interest therein, is conveyed, granted, assigned, transferred, or otherwise disposed of unless the instrument complies with the official indexing system of the county. The indexing system shall have been in place for at least twenty-four (24) months prior to July 15, 1994 or shall be implemented for the purpose of allowing computerized searching for the instruments of record of the county clerk. If a county clerk requires a parcel identification number on an instrument before recording, the clerk shall provide a computer terminal, at no charge to the public, for use in finding the parcel identification number. The county clerk may make reasonable rules about the use of the computer terminal, requests for a parcel identification number, or both.

(5) The receipt for record and recording of any instrument by the county clerk without compliance with the provisions of this section shall not prevent the record of filing of the instrument from becoming notice as otherwise provided by law, nor impair the admissibility of the record as evidence.

382.365 Release of lien, with notice to property owner, within thirty days of satisfaction -- Proceeding against lienholder in District Court or Circuit Court -- Liability of lienholder when lien not released or notice not sent -- Notice to state or lienholder.

(1) A holder of a lien on real property, including a lien provided for in KRS 376.010, shall release the lien in the county clerk's office where the lien is recorded within thirty (30) days from the date of satisfaction.

(2) A proceeding may be filed by any owner of real property or any party acquiring an interest in the real property in District Court or Circuit Court against a lienholder that violates subsection (1) of this section. A proceeding filed under this section shall be given precedence over other matters pending before the court.

(3) Upon proof to the court of the lien being satisfied, the court shall enter a judgment releasing the lien. The judgment shall be with costs including a reasonable attorney's fee. If the court finds that the lienholder received written notice of its failure to release and lacked good cause for not releasing the lien, the lienholder shall be liable to the owner of the real property in the amount of one hundred dollars ($100) per day for each day, beginning on the fifteenth day after receipt of the written notice, of the violation for which good cause did not exist.

(4) A lienholder that continues to fail to release a satisfied real estate lien, without good cause, within forty-five (45) days from the date of written notice shall be liable to the owner of the real property for an additional four hundred dollars ($400) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice, for a total of five hundred dollars ($500) per day for each day for which good cause did not exist after the forty-fifth day from the date of written notice. The lienholder shall also be liable for any actual expense including a reasonable attorney's fee incurred by the owner in securing the release of real property by such violation.

(5) The former holder of a lien on real property shall send by regular mail a copy of the lien release to the property owner at his last known address within seven (7) days of the release. A former lienholder that violates this subsection shall be liable to the owner of the real property for fifty dollars ($50) and any actual expense incurred by the owner in obtaining documentation of the lien release.

(6) For the purposes of this section, "date of satisfaction" means that date of receipt by a holder of a lien on real property of a sum of money in the form of a certified check, cashier's check, wired transferred funds, or other form of payment satisfactory to the lienholder that is sufficient to pay the principal, interest, and other costs owing on the obligation that is secured by the lien on the property.

(7) The provisions of this section shall not apply when a lienholder is deceased and the estate of the lienholder has not been settled.

(8) The state licensing agency, if applicable, or any holder of a lien on real property shall be notified of the disposition of any actions brought under this section against the lienholder.

(9) The provisions of this section shall be held and construed as ancillary and supplemental to any other remedy provided by law.