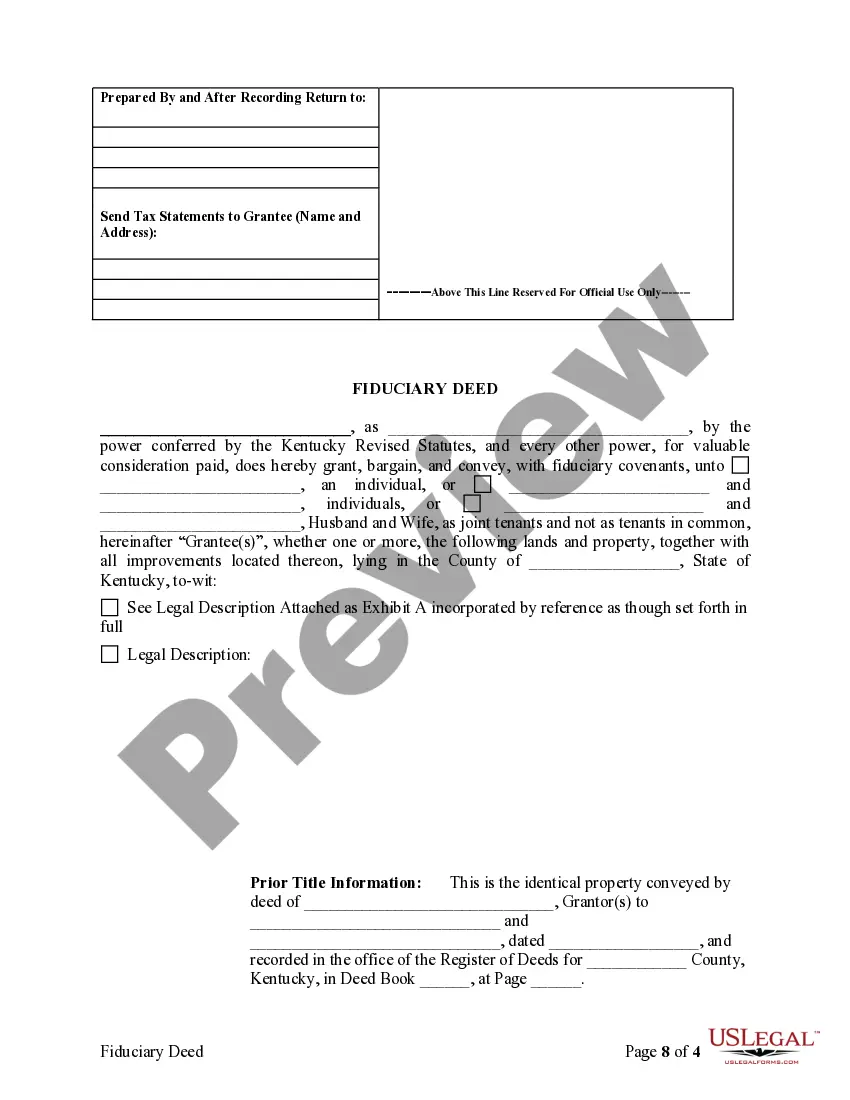

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Kentucky Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Kentucky Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Amid numerous paid and complimentary samples available online, you cannot guarantee their trustworthiness.

For instance, who created them or if they possess enough qualifications to manage the items you need these for.

Always stay calm and utilize US Legal Forms!

Review the document by examining the information available through the Preview function. Click Buy Now to initiate the purchasing process or search for another template using the Search field in the header. Select a pricing option and set up an account. Pay for the subscription with your credit/debit card or PayPal. Download the form in the desired format. Once you’ve registered and completed your purchase, you can use your Kentucky Fiduciary Deed for Executors, Trustees, Trustors, Administrators, and other Fiduciaries as frequently as you wish or as long as it is valid in your area. Modify it with your preferred online or offline editor, complete it, sign it, and print it. Accomplish more for less with US Legal Forms!

- Find Kentucky Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries templates crafted by experienced attorneys.

- Avoid the costly and time-consuming task of searching for an attorney and then compensating them to draft a document for you that you can readily obtain on your own.

- If you have a subscription, Log In to your account and find the Download button next to the file you want.

- You will also have access to all your previously downloaded templates in the My documents section.

- If you are using our platform for the first time, follow the instructions below to quickly obtain your Kentucky Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries.

- Ensure that the document you find is applicable in your jurisdiction.

Form popularity

FAQ

Executors can use the money in the estate in whatever way they determine best for the estate and for fulfilling the decedent's wishes. Typically, this will amount to paying off debts and transferring bequests to the beneficiaries according to the terms of the will.

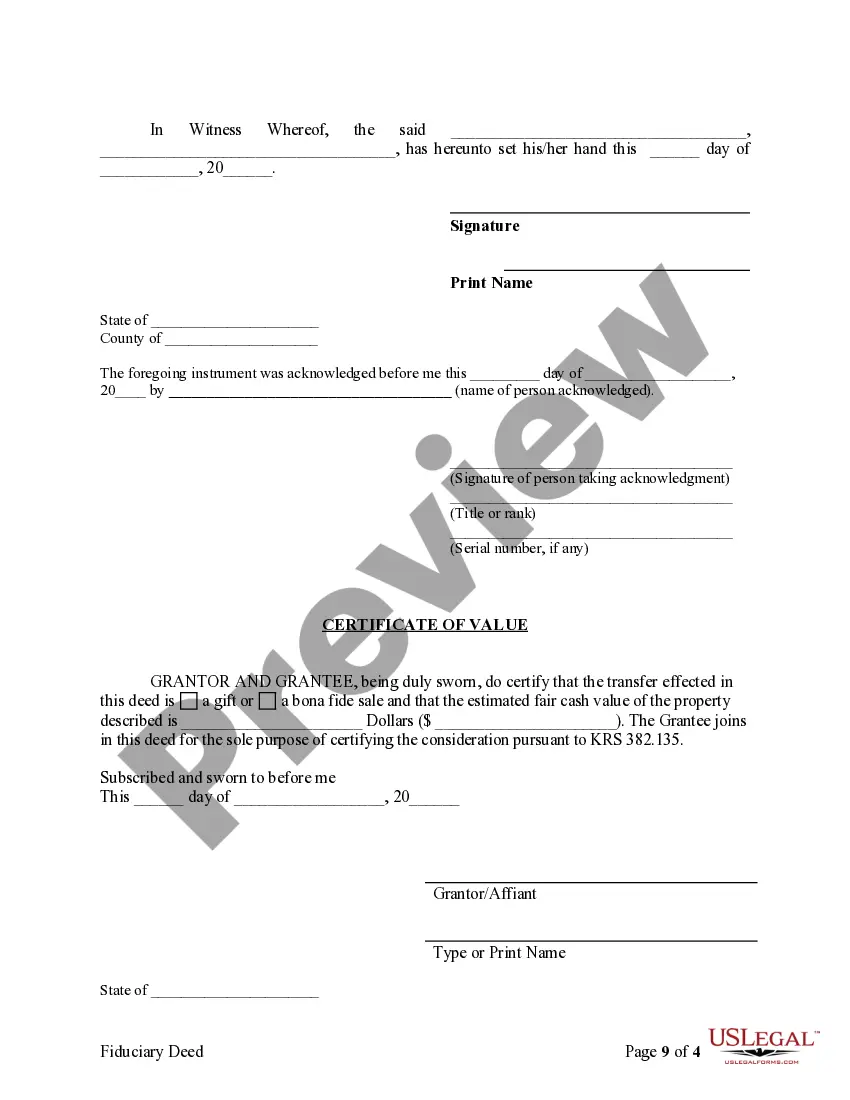

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

The executor can be removed by the judge on the case. The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot give away property because the property belongs to someone else. Unless he pays full price for it.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

Yes, It's Possible for an Executor to Sell Property To Themselves Here's How. If you've been named the executor of an estate, you have a crucial job.In most cases, the executor sets about putting the house on the market and selling it so the proceeds can be distributed to any heirs.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

The court will force the executor to return the property to the estate or pay restitution to the beneficiaries of the estate.The executor cannot transfer estate property to himself because the property belongs to someone else unless he pays the full price for it.

As an Executor, what you cannot do is go against the terms of the Will, Breach Fiduciary duty, fail to act, self-deal, embezzle, intentionally or unintentionally through neglect harm the estate, and cannot do threats to beneficiaries and heirs.