Kentucky Individual Chapter 11 Discharge is a process available to individuals in Kentucky who have filed for Chapter 11 Bankruptcy. This type of discharge eliminates all legally dischargeable debt, including unsecured debt, secured debt, and certain priority debts such as taxes and alimony. The debtor must complete a repayment plan approved by the court before they can receive a discharge. There are two types of Kentucky Individual Chapter 11 Discharge: full discharge and partial discharge. A full discharge eliminates all debt except certain debts that may not be discharged, such as student loans, child support, and certain types of taxes. A partial discharge eliminates some or all of the debt, depending on the court's decision.

Kentucky Individual Chapter 11 Discharge

Description

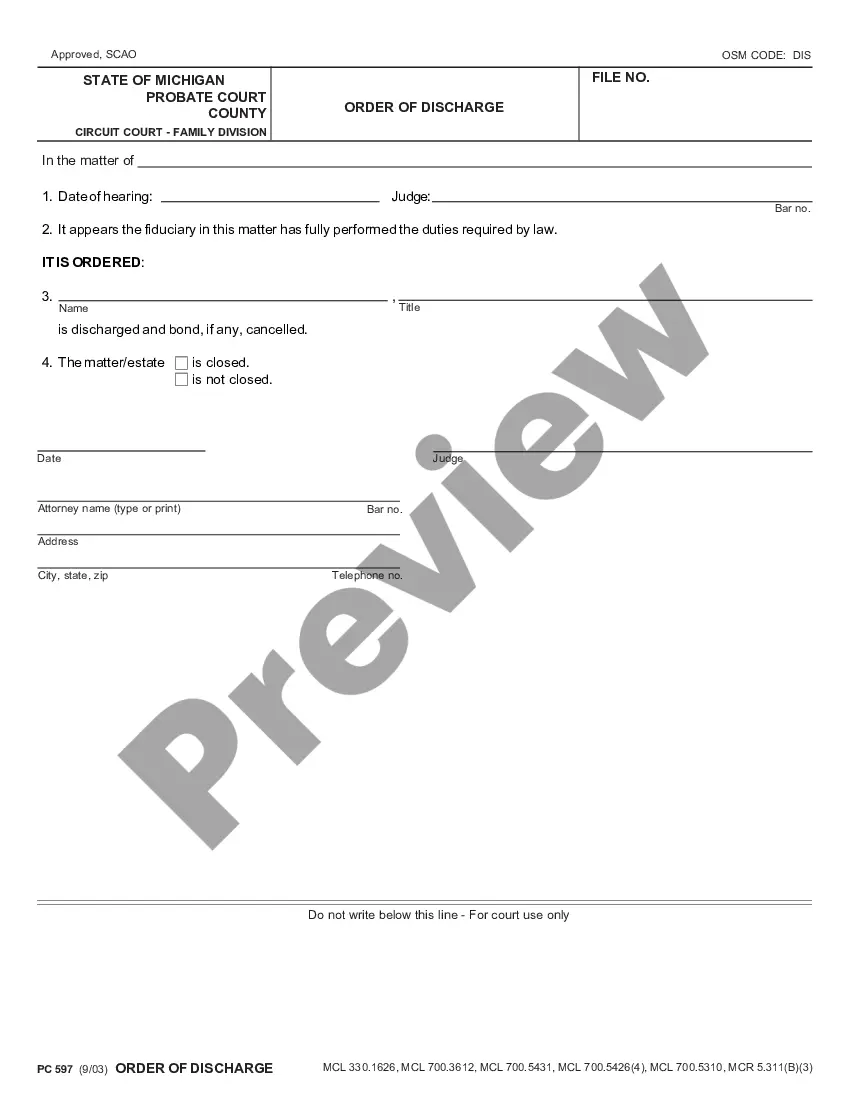

How to fill out Kentucky Individual Chapter 11 Discharge?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to complete Kentucky Individual Chapter 11 Discharge, our service is the perfect place to download it.

Getting your Kentucky Individual Chapter 11 Discharge from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief guide for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it suits your needs and fulfills your state law requirements. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate blank, and click Buy Now once you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Kentucky Individual Chapter 11 Discharge and click Download to save it on your device. Print it to complete your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to get any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

Chapter 11 bankruptcy is usually for corporations because of its complexity, but individuals can file too. The debtor usually keeps their assets and continues to operate the business while working on a plan to pay off the creditors.

Chapter 7 cases are typically only filed voluntarily by the debtor. The primary purpose of a Chapter 11 bankruptcy is to give business entities and individuals with large amounts of debt an opportunity to reorganize their financial affairs.

The main difference between Chapter 11 and Chapter 13 is that a Chapter 13 bankruptcy requires that the debtor pay his or her debts within five years. On the other hand, Chapter 11 allows the filer to extend the five-year period unlike Chapter 13. Another difference is how much the Debtor has to pay creditors.

While the average length of a Chapter 11 Bankruptcy case can last 17 months, larger and more complex cases can take up to five years. And following the conclusion of the bankruptcy case, it can still take months for Debtors to begin distributing payouts to the highest priority class of Creditors.

In a Chapter 11 bankruptcy proceeding, if a company or individual filer (the ?debtor?) is unable to pay its creditors in full, the absolute priority rule bars owners from retaining their interests unless the owners contribute ?new value? to the business.

In a Chapter 11 case filed by an individual (i.e., a natural person), a discharge is granted by the court separately, after the completion of payments under the plan. A discharge is a court order relieving the debtor from liability for certain debts.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

In individual chapter 11 cases, and in cases under chapter 12 (adjustment of debts of a family farmer or fisherman) and 13 (adjustment of debts of an individual with regular income), the court generally grants the discharge as soon as practicable after the debtor completes all payments under the plan.