The Kentucky Self-Insurance Application Attachment is a form used by employers in Kentucky to apply for self-insurance coverage for the benefits of their employees. It is a required attachment that must be completed and submitted along with the Self-Insurance Application. The attachment is a comprehensive document that requires employers to provide detailed information about their businesses, including financial and actuarial data, as well as a description of the benefits to be provided to employees. The form also requires employers to list the types of coverage they intend to provide, such as health, disability, workers' compensation, and life insurance. In addition, employers must submit a description of their safety and claims management programs, as well as a plan of operations for self-insurance. There are two types of Kentucky Self-Insurance Application Attachment forms, one for a single-employer plan and another for a multi-employer plan.

Kentucky Self-Insurance Application Attachment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Kentucky Self-Insurance Application Attachment?

US Legal Forms is the easiest and most lucrative method to find suitable legal templates.

It’s the most comprehensive online collection of business and personal legal documents created and verified by lawyers.

Here, you can discover printable and fillable forms that adhere to federal and state regulations - just like your Kentucky ?Self-Insurance Application Attachment.

Review the form description or preview the document to ensure you’ve identified the one that meets your needs, or find another one using the search option above.

Click Buy now when you’re sure of its compliance with all the stipulations, and choose the subscription plan that suits you best.

- Acquiring your template involves just a few straightforward steps.

- Clients who already possess an account with an active subscription just need to Log In to the online service and download the document onto their device.

- Afterward, they can locate it in their profile in the My documents section.

- And here’s how you can obtain a correctly drafted Kentucky ?Self-Insurance Application Attachment if you are using US Legal Forms for the first time.

Form popularity

FAQ

In either paper or electronic format, the proof of insurance shall prominently display the following information, in the order listed: (a) Title: "COMMONWEALTH OF KENTUCKY PROOF OF INSURANCE"; (b) The name of the insurance company and its five (5) digit code number assigned by the National Association of Insurance

A model letter for use by executive branch federal agencies when responding to requests for proof of insurance or proposed contract clauses which require proof of insurance.

Type of plan usually present in larger companies where the employer itself collects premiums from enrollees and takes on the responsibility of paying employees' and dependents' medical claims.

insured health plan is the traditional model of structuring an employersponsored health plan and is the most familiar option to employees. On the other hand, selfinsured plans are funded and managed by an employer, often to reduce health insurance costs.

Saving money may be the primary driver when companies decide to self-insure, but there are other benefits as well. Employers can eliminate costs for state insurance premium taxes. And they don't have to adhere to state-mandated coverage requirements.

What Is Self-Insurance? Self-insurance involves setting aside your own money to pay for a possible loss instead of purchasing insurance and expecting an insurance company to reimburse you.

Self-insurance involves acquiring a certificate of coverage from the Florida DMV and taking fiscal responsibility for all accident-related expenses for which the motorist is legally liable. Self-insurance can either be a cost-cutting measure or a risky gamble that could financially wipe out the self-insured party.

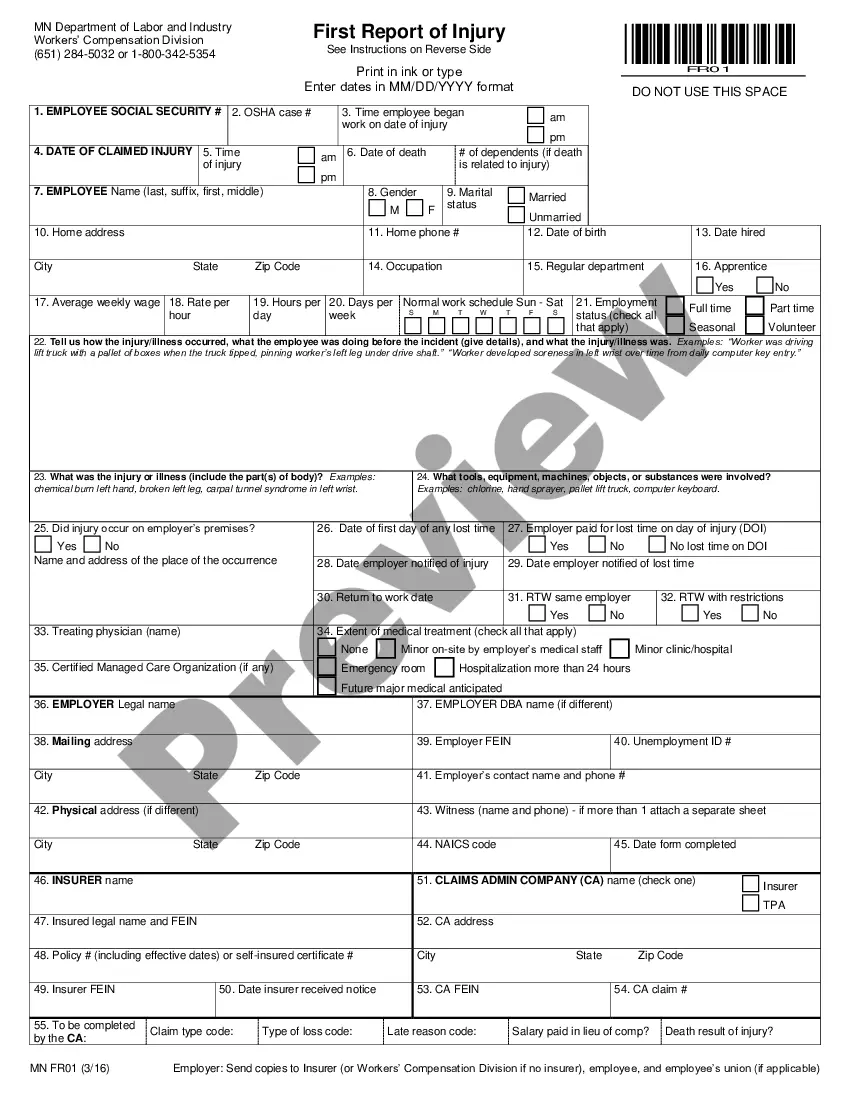

Each state regulates who may be self-insured for workers' compensation. Normally, a prospective self-insured submits a required application accompanied by audited financial data, prior workers' compensation loss history, and other information required by each state.