The Kentucky Mileage Reimbursement Chart is a document used by employers in Kentucky to determine the rate of mileage reimbursement for employees who travel on business. The chart is updated annually by the Kentucky Department of Revenue and is based on the Internal Revenue Service's Standard Mileage Rate. The rate of reimbursement is the same for both business and medical miles driven. The Kentucky Mileage Reimbursement Chart is divided into two types: The Standard Mileage Reimbursement Chart and the Commuting Mileage Reimbursement Chart. The Standard Mileage Reimbursement Chart is used to calculate the amount of reimbursement payable for business miles driven, while the Commuting Mileage Reimbursement Chart is used to calculate the amount of reimbursement payable for commuting miles driven. The amount of reimbursement payable for each mile is determined by the number of miles driven, the type of miles driven (business or medical), and the location of the travel (within or outside of Kentucky).

Kentucky Mileage Reimbursement Chart

Description

How to fill out Kentucky Mileage Reimbursement Chart?

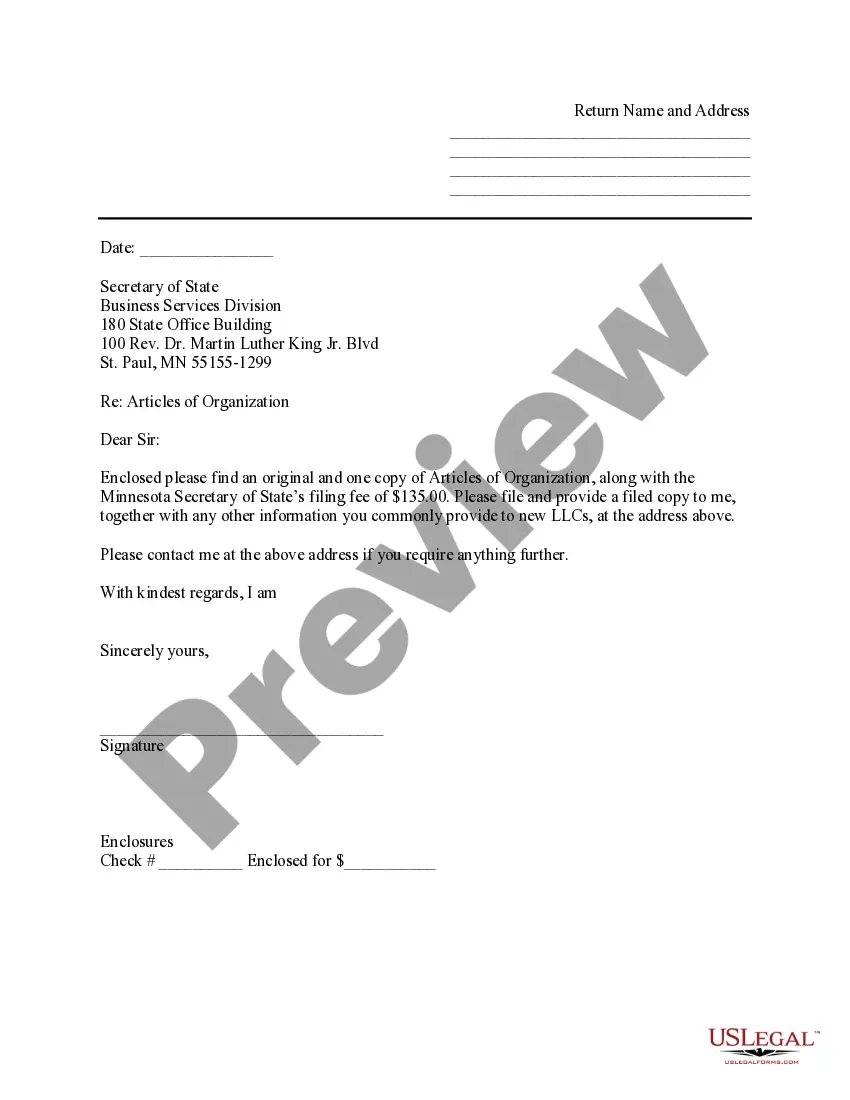

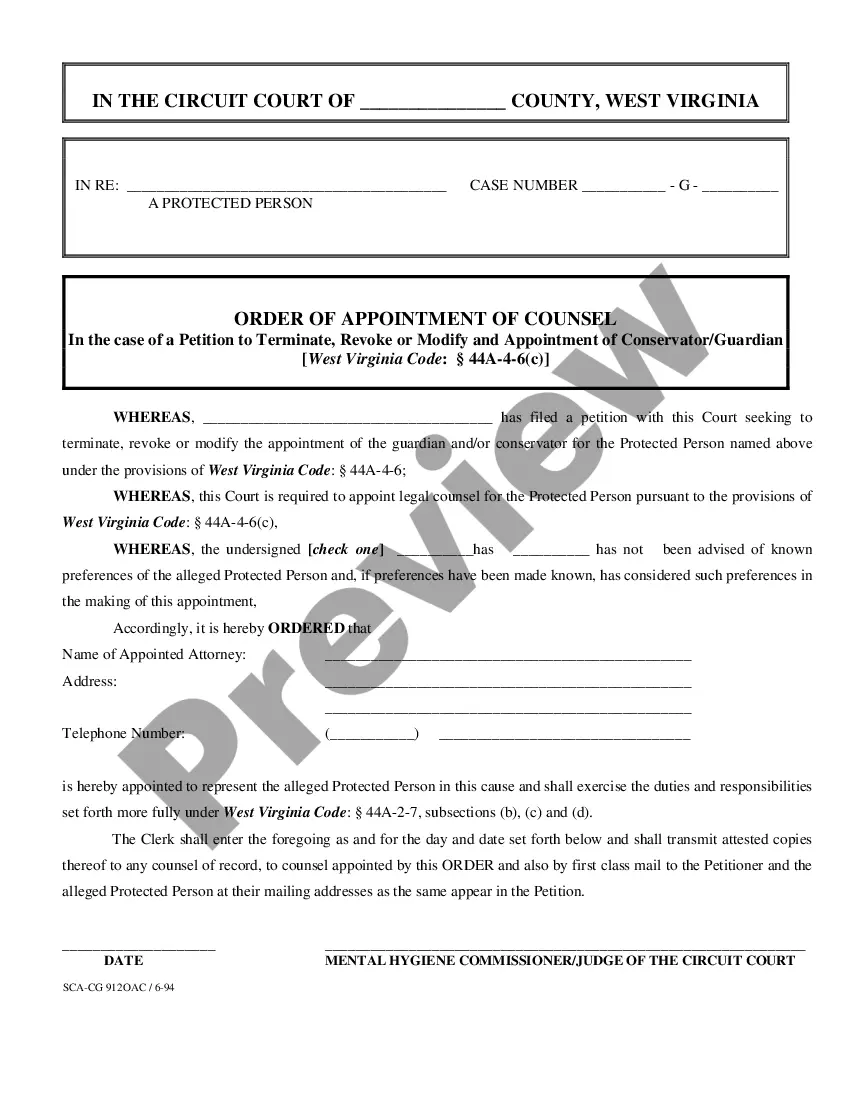

Preparing official paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you find, as all of them comply with federal and state regulations and are checked by our experts. So if you need to prepare Kentucky Mileage Reimbursement Chart, our service is the perfect place to download it.

Obtaining your Kentucky Mileage Reimbursement Chart from our service is as simple as ABC. Previously registered users with a valid subscription need only log in and click the Download button once they find the correct template. Afterwards, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and check whether it suits your needs and fulfills your state law regulations. Previewing your document and reviewing its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now once you see the one you want.

- Account registration and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Kentucky Mileage Reimbursement Chart and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. These expenses can include fuel costs, maintenance and vehicle depreciation. Mileage reimbursement is typically set at a per-mile rate ? usually below $1 per mile.

The standard mileage rate for transportation or travel expenses is 65.5 cents per mile for all miles of business use (business standard mileage rate).

Weight Distance (KYU) ?For each qualified vehicle operating upon the public highways within Kentucky, the weight distance tax is computed by the rate of $0.0285 (2.85 cents) per mile. Tax returns and remittance covering the taxes owed are due on the last day of the next calendar month following each quar?ter.

The Commonwealth of Kentucky mileage rate for Jan. 1, 2023, through March 31, 2023, will be 44 cents per mile. This is a decrease from the 2022 fourth-quarter rate of 46 cents per mile.