A Kentucky Corporate Resolution for Nonprofit Organizations is a legally binding document that outlines the decisions made by the board of directors or other authorized individuals within a nonprofit organization in the state of Kentucky. This resolution is used to record and document actions taken by the organization in accordance with its bylaws, and is often required by third parties such as banks or government agencies. The purpose of a corporate resolution is to provide evidence of the organization's decision-making process and to establish the authority of the individuals who acted on behalf of the nonprofit. It helps ensure transparency, accountability, and legal compliance. There are several types of Kentucky Corporate Resolutions that may be specific to nonprofit organizations, including: 1. Resolution to Open Bank Accounts: This type of resolution authorizes the opening of a bank account on behalf of the nonprofit organization. It typically includes the names and positions of individuals authorized to sign checks and make financial transactions on behalf of the organization. 2. Resolution to Borrow Funds: When a nonprofit organization needs to borrow money, this resolution is used to approve the borrowing, specify the purpose of the loan, and outline the terms and conditions of repayment. 3. Resolution to Enter into Contracts or Agreements: This type of resolution grants authority to certain individuals within the nonprofit to enter into contracts or agreements on behalf of the organization. It may include specific guidelines or limitations for signing agreements. 4. Resolution to Establish Committees or Task Forces: Nonprofits often create committees or task forces addressing specific issues or initiatives. This resolution is used to formally establish these committees, designate their purpose, and appoint the individuals responsible for their operation. 5. Resolution to Approve annual budget: Nonprofit organizations must have their annual budget approved by the board of directors. This resolution outlines the budget's key components, revenue sources, and expense allocation. It is important for nonprofit organizations to keep a record of all corporate resolutions passed by the board of directors. These documents should be carefully prepared, signed, and maintained in the organization's records for future reference. They can also be used to demonstrate the organization's compliance in audits or legal proceedings.

Kentucky Corporate Resolution for Nonprofit Organizations

Description

How to fill out Kentucky Corporate Resolution For Nonprofit Organizations?

Are you currently in the location where you frequently require documents for either business or personal purposes daily.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a wide range of form templates, including the Kentucky Corporate Resolution for Nonprofit Organizations, which can be tailored to satisfy federal and state requirements.

Once you find the correct form, simply click Acquire now.

Select the pricing plan you wish, enter the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Corporate Resolution for Nonprofit Organizations template.

- If you don’t have an account and wish to use US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/region.

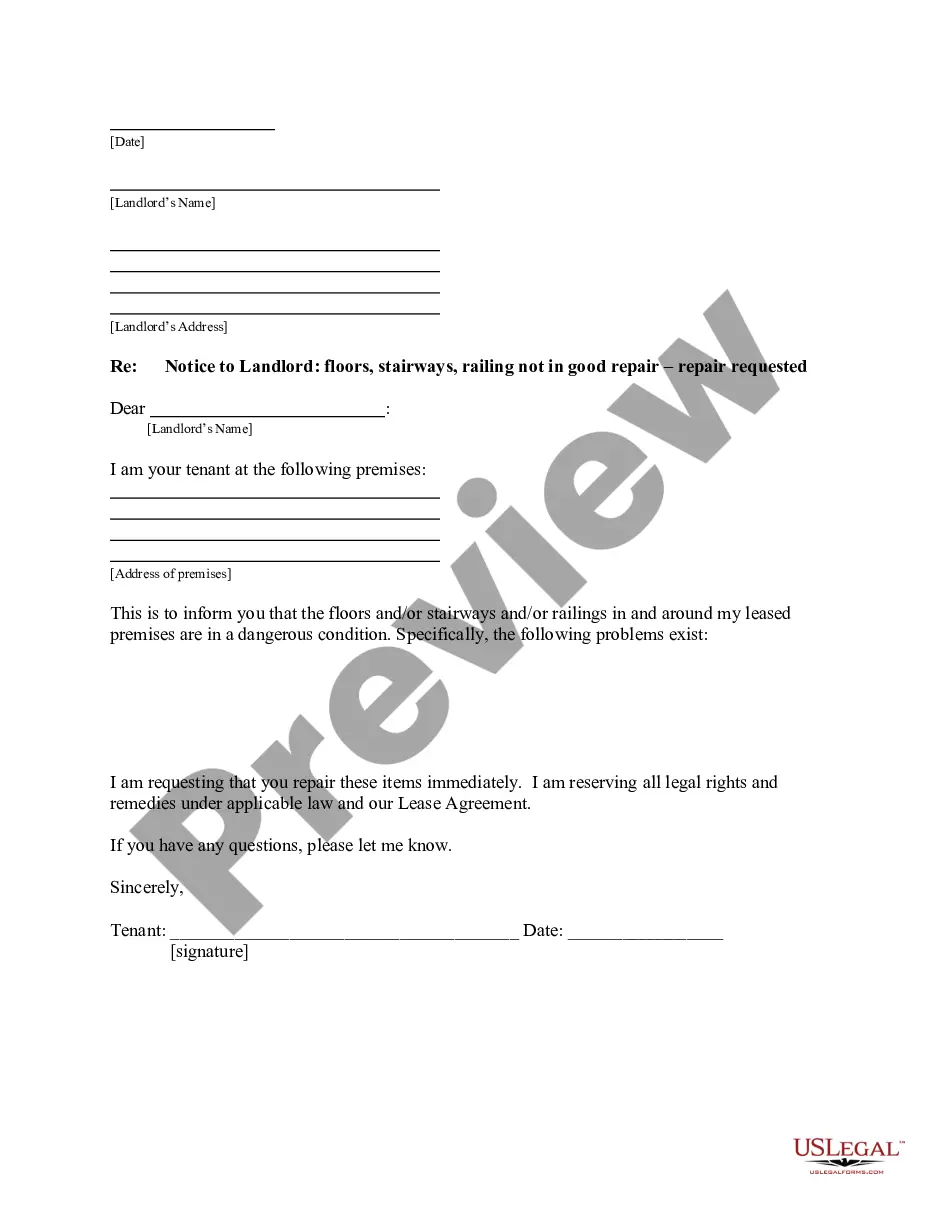

- Use the Preview button to view the form.

- Examine the description to confirm you have selected the appropriate form.

- If the form isn’t what you’re looking for, utilize the Search box to find the form that suits your needs.

Form popularity

FAQ

They are only required when the board of directors makes a significant business decision. A corporate resolution creates a paper trail of an important decision in case it ever needs to be reviewed by shareholders, officers, or the IRS.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

Labeling a vote a resolution means that the board believed the issue was important enough to separate it from standard voting issues. A resolution is considered an official board action and it requires a quorum. Board directors must document all official board actions, including resolutions, in their meeting minutes.

Elected by the board. Two or more offices may be held by the same individual, except the president may not also serve as secretary or treasurer.

A corporate resolution is the document commonly used for this purpose. The resolution is generally drafted after a meeting and vote by the directors on an important issue for the corporation.

In general, the SEC guidelines permit resolutions only from shareholders who have continuously held at least $2,000 of the company's stock for a year or longer. If a shareholder meets these requirements, then the board can choose to bring up the resolution for a vote at the next shareholder meeting.

With a resolution and plan in hand, Kentucky law provides for voluntary dissolution as follows:if your nonprofit has members, by action of the directors followed by a vote or other consent of the members; or.if your nonprofit doesn't have members, by a vote of the directors.

A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances. Corporate resolutions provide a paper trail of the decisions made by the board and the executive management team.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity. The length of the resolution isn't important. It only needs to be as long as what you need to say.

Nonprofit corporations often deal with government agencies on issues of public concern, which may involve applying for grants, loans or other governmental approvals. In many situations, the government agency requires a corporate resolution to verify the board's approval for making the government application.