A Kentucky Corporate Resolution for Single Member LLC is a legal document that outlines the decisions and actions taken by a single member Limited Liability Company (LLC) operating in the state of Kentucky. It is a formal record of the decisions made by the single member regarding the company's activities, financial matters, contracts, and other important business-related matters. Keywords: Kentucky, Corporate Resolution, Single Member LLC, legal document, decisions, actions, Limited Liability Company, state, activities, financial matters, contracts, business-related matters. There are several types of Kentucky Corporate Resolutions for Single Member LLC, including: 1. Operating Agreement Amendment Resolution: This type of resolution is used when the single member decides to amend the LLC's operating agreement. It outlines the changes to be made and requires the single member's signature and date. 2. Banking Resolution: This resolution is used when the single member wants to establish financial accounts for the LLC or make changes to existing accounts. It authorizes the single member to open and manage bank accounts, sign checks, and conduct financial transactions on behalf of the LLC. 3. Contract Signing Resolution: When the single member wants to enter into a contract or legal agreement on behalf of the LLC, this resolution is used. It authorizes the single member to sign contracts and agreements, specifying the terms and conditions. 4. Tax Filing Resolution: This resolution is used when the single member needs to authorize an individual or a tax professional to file tax returns and handle tax matters on behalf of the LLC. 5. Dissolution Resolution: In the event that the single member decides to dissolve the LLC, this resolution outlines the decision, specifies the winding-up process, and appoints a liquidator if needed. These are some commonly used types of Kentucky Corporate Resolutions for Single Member LLC. It is important for the single member to consult with an attorney or legal professional to ensure compliance with the state's laws and regulations when creating and executing these resolutions.

Kentucky Corporate Resolution for Single Member LLC

Description

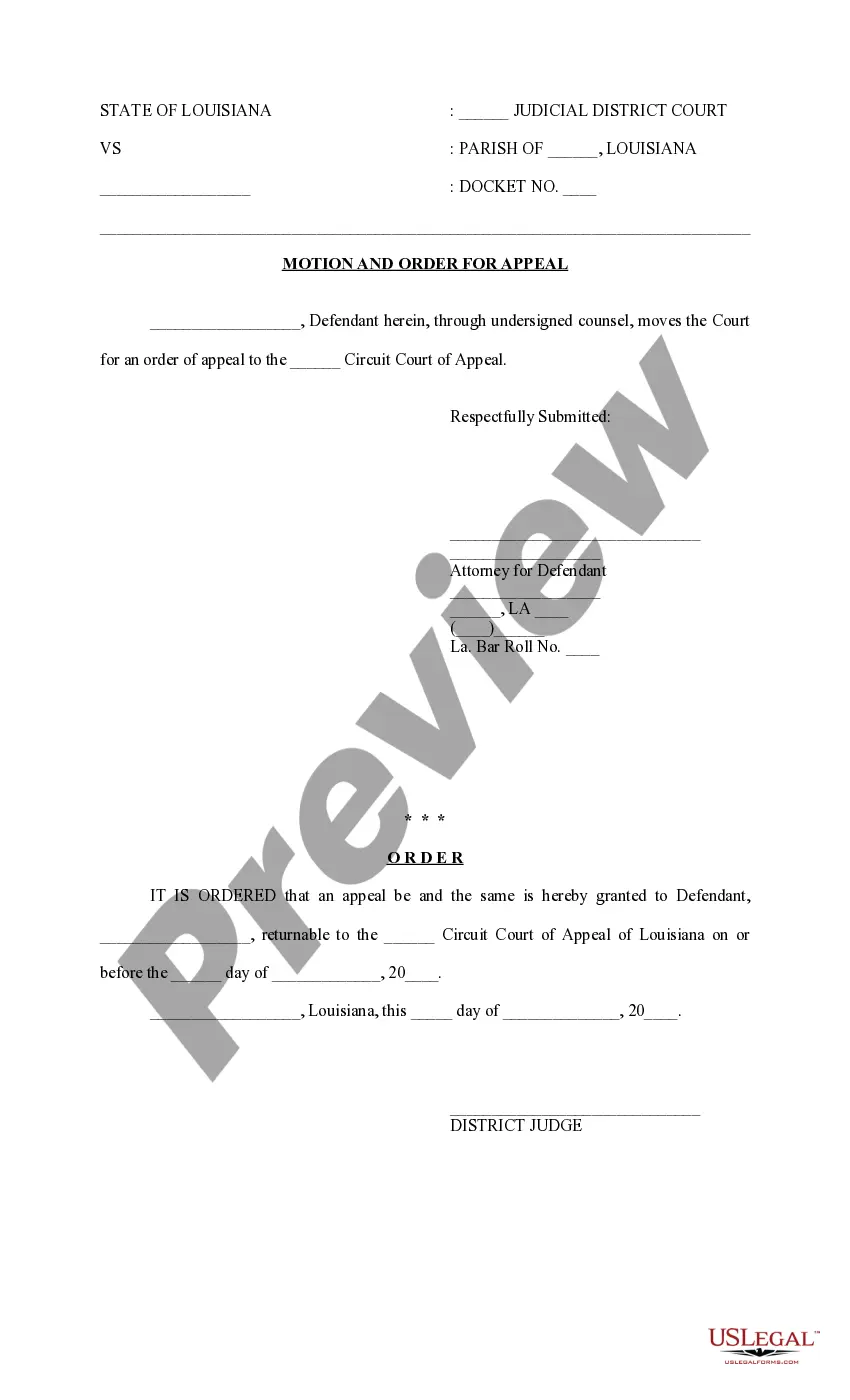

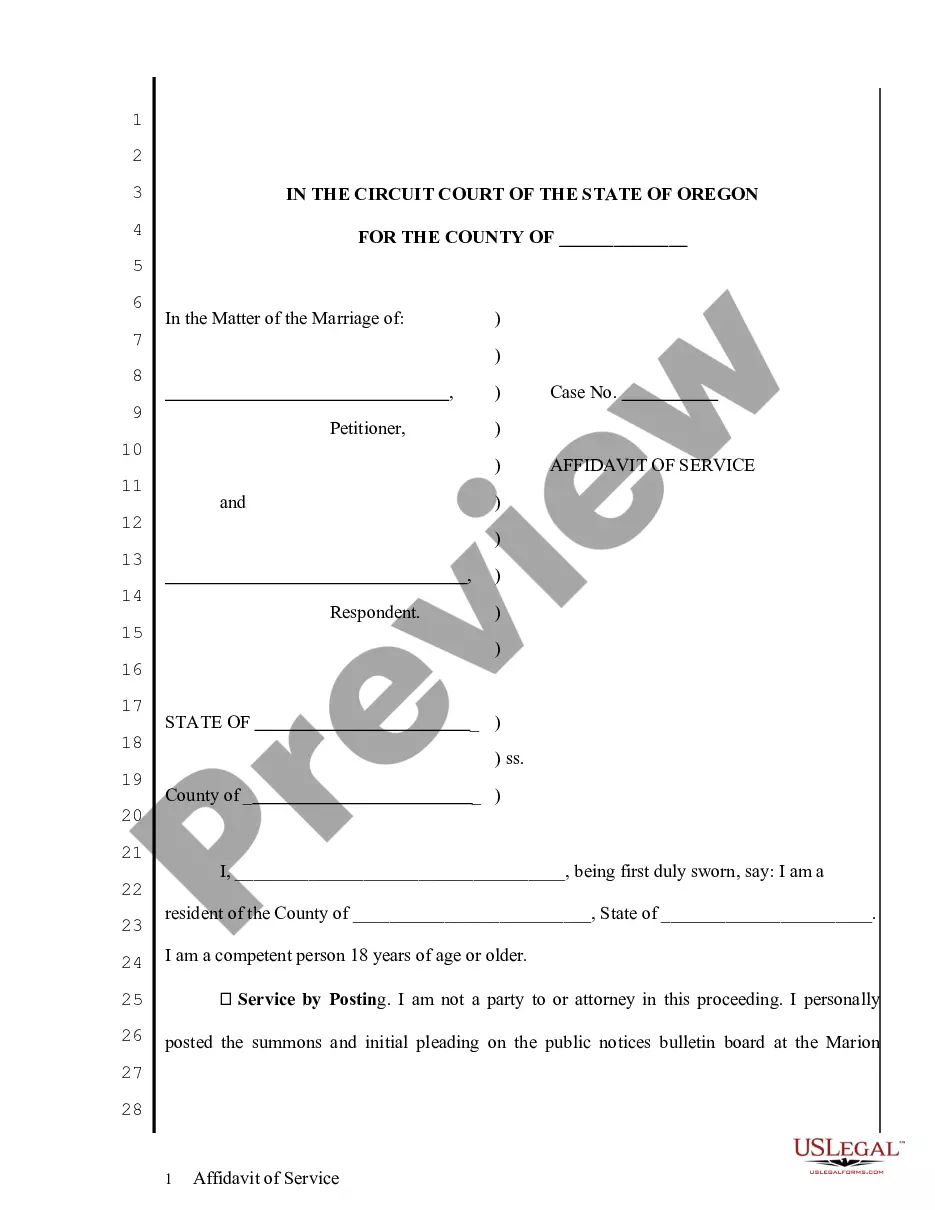

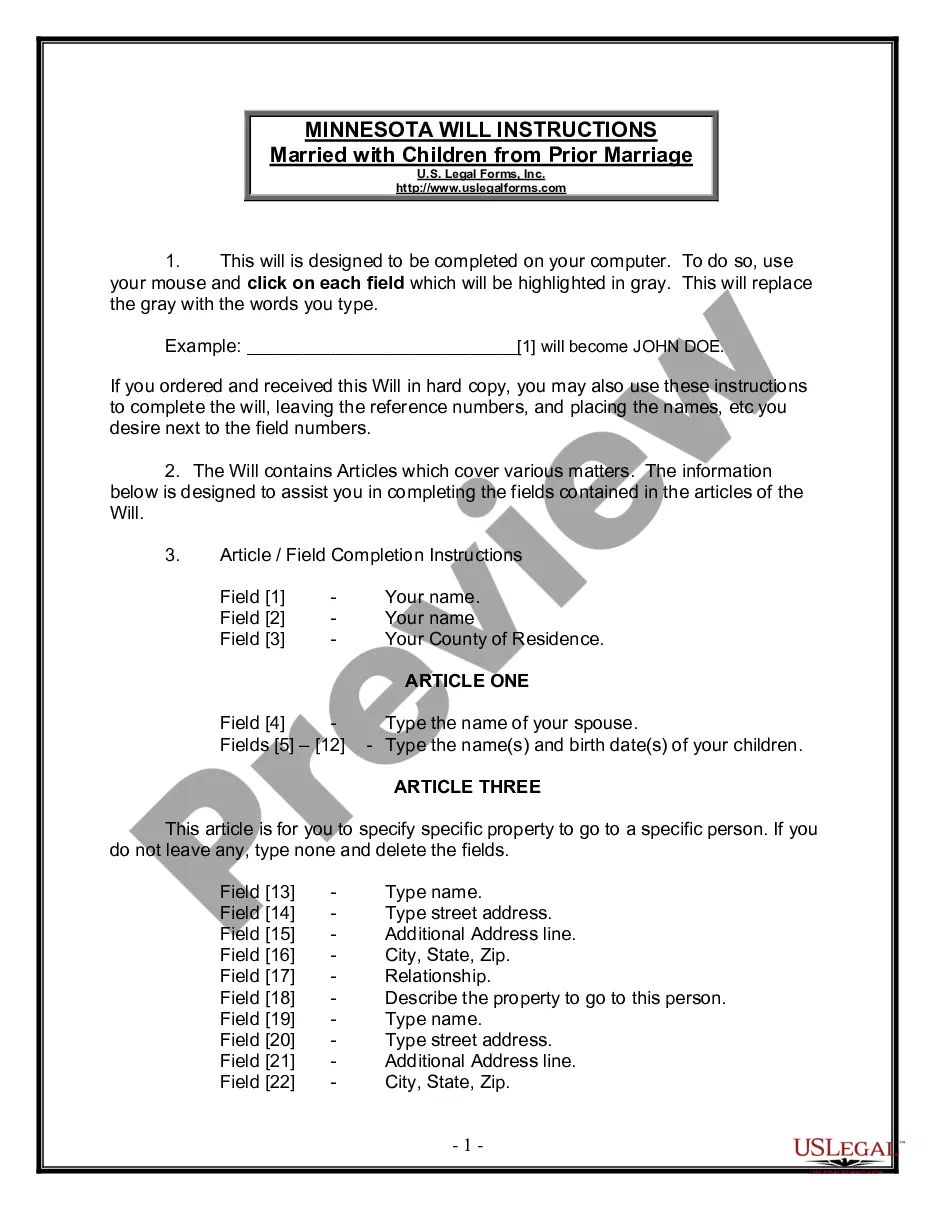

How to fill out Kentucky Corporate Resolution For Single Member LLC?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad selection of legal document templates that you can download or create.

By using the website, you can access thousands of templates for business and personal purposes, categorized by type, state, or keywords. You can find the most recent versions of forms like the Kentucky Corporate Resolution for Single Member LLC in a matter of seconds.

If you already have a monthly subscription, Log In and download the Kentucky Corporate Resolution for Single Member LLC from the US Legal Forms library. The Download button will be visible on every template you view. You can access all previously downloaded forms in the My documents section of your account.

Process the purchase. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit the form. Fill, modify, and print and sign the downloaded Kentucky Corporate Resolution for Single Member LLC. All templates you added to your account have no expiration date and are yours forever. To download or create another copy, just go to the My documents section and click on the form you need. Access the Kentucky Corporate Resolution for Single Member LLC with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to view the details of the form.

- Review the form summary to confirm you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the appropriate one.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your credentials to register for an account.

Form popularity

FAQ

Kentucky is now offering KY File, a new way to file your current year return free of charge. It allows you to: Select the Kentucky income tax forms and schedules that you need. Fill in your tax information online.

Note: Single-member LLCs may NOT file a partnership return. Most LLCs with more than one member file a partnership return, Form 1065. If you would rather file as a corporation, Form 8832 must be submitted. You don't need to file a Form 8832 if you want to file as a partnership.

If the owner is an individual, the activities of the LLC will generally be reflected on: Form 1040 or 1040-SR Schedule C, Profit or Loss from Business (Sole Proprietorship) Form 1040 or 1040-SR Schedule E, Supplemental Income or Loss. Form 1040 or 1040-SR Schedule F, Profit or Loss from Farming.

Note: The IRS requires Schedule K-1 for a single-member LLC to be issued in the name and SSN of the owner, not the LLC itself. You may need to request a revised K-1 if this is not true for the K-1 you received.

You can prepare a 2021 Kentucky Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

The KY-725 can be extended and e-filed independently of the other Kentucky main forms. The extension is generated from the STEX screen. Amending can be done independent of the KY main form and is done from the 725 screen (note that the amended 725 cannot be e-filed).

Effective , Kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after January 1, 2021. (103 KAR 0) To register and file online, please visit wraps.ky.gov.

A single member LLC whose single member is an individual, estate, trust, or general partnership must file a Kentucky Single Member LLC Individually Owned Income and LLET Return (Form 725) or a Kentucky Single Member LLC Individually Owned LLET Return (Form 725-EZ) to report and pay any LLET that is due.

Kentucky Department of Revenue P. O. Box 856905 Louisville, KY 40285-6905 Kentucky Department of Revenue Frankfort, KYReturn (Form 725).

Sole-Proprietors and Single-member LLCs do not file a Schedule K-1. Instead, they report business income on a Schedule C of a Form 1040.

More info

Business with the right legal help.