Kentucky Acknowledgment by Charitable or Educational Institution of Receipt of Gift is a formal document that serves as proof of receiving a donation or gift by a non-profit organization or educational institution in the state of Kentucky. This acknowledgment is an essential requirement for both the donor and the organization to maintain transparency and comply with tax regulations. The Kentucky Acknowledgment contains various key elements to ensure its validity and authenticity. These elements include the name and address of the organization, the donor's name and contact details, a detailed description of the gift received, and the date of receipt. Additionally, the acknowledgment should mention whether any goods or services were exchanged for the gift, specifying their value if applicable. Keywords: Kentucky, acknowledgment, charitable, educational institution, receipt, gift, donor, non-profit organization, transparency, tax regulations, validity, authenticity, organization, contact details, description, date of receipt, goods, services, value. Different Types of Kentucky Acknowledgment by Charitable or Educational Institution of Receipt of Gift: 1. Monetary Gift Acknowledgment: This type of acknowledgment is used when a charitable or educational institution receives a cash donation from a donor. It includes all the essential elements mentioned above, along with the monetary value of the gift stated clearly. 2. In-Kind Gift Acknowledgment: If a donor contributes non-cash items such as goods, services, or property, this acknowledgment is used. It describes the in-kind donation in detail, including its estimated value, and includes the essential elements required for a valid acknowledgment. 3. Recurring Gift Acknowledgment: When a donor sets up a recurring donation or pledges to contribute regularly to a charitable or educational institution, this acknowledgment is used. It outlines the terms of the recurring gift, including the frequency, duration, and monetary value of each installment, along with the essential information required for a valid acknowledgment. 4. Stock or Securities Gift Acknowledgment: This type of acknowledgment pertains to donors who contribute stocks, bonds, or other securities to a non-profit organization or educational institution. It includes essential information about the donated securities, such as their type, quantity, and estimated market value at the time of the donation. 5. Estate or Planned Gift Acknowledgment: In situations where individuals include non-profit organizations or educational institutions in their estate plans or make planned gifts, this type of acknowledgment is utilized. It acknowledges the donor's intent to make a future gift and may include details about any specific terms or conditions associated with the gift. It is important for both donors and non-profit organizations/educational institutions to understand and comply with the guidelines set forth by Kentucky law to ensure accurate and complete acknowledgment of any gifts received. This helps maintain transparency, foster a positive relationship between the donor and the organization, and ensures compliance with applicable tax regulations.

Kentucky Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Kentucky Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Are you within a situation the place you need to have papers for possibly enterprise or personal reasons virtually every day? There are plenty of lawful document web templates available online, but discovering ones you can depend on is not effortless. US Legal Forms delivers a huge number of kind web templates, such as the Kentucky Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which can be written to meet state and federal requirements.

If you are currently acquainted with US Legal Forms website and get a free account, merely log in. Following that, you are able to acquire the Kentucky Acknowledgment by Charitable or Educational Institution of Receipt of Gift design.

Unless you come with an profile and want to begin to use US Legal Forms, follow these steps:

- Obtain the kind you need and make sure it is for that appropriate town/region.

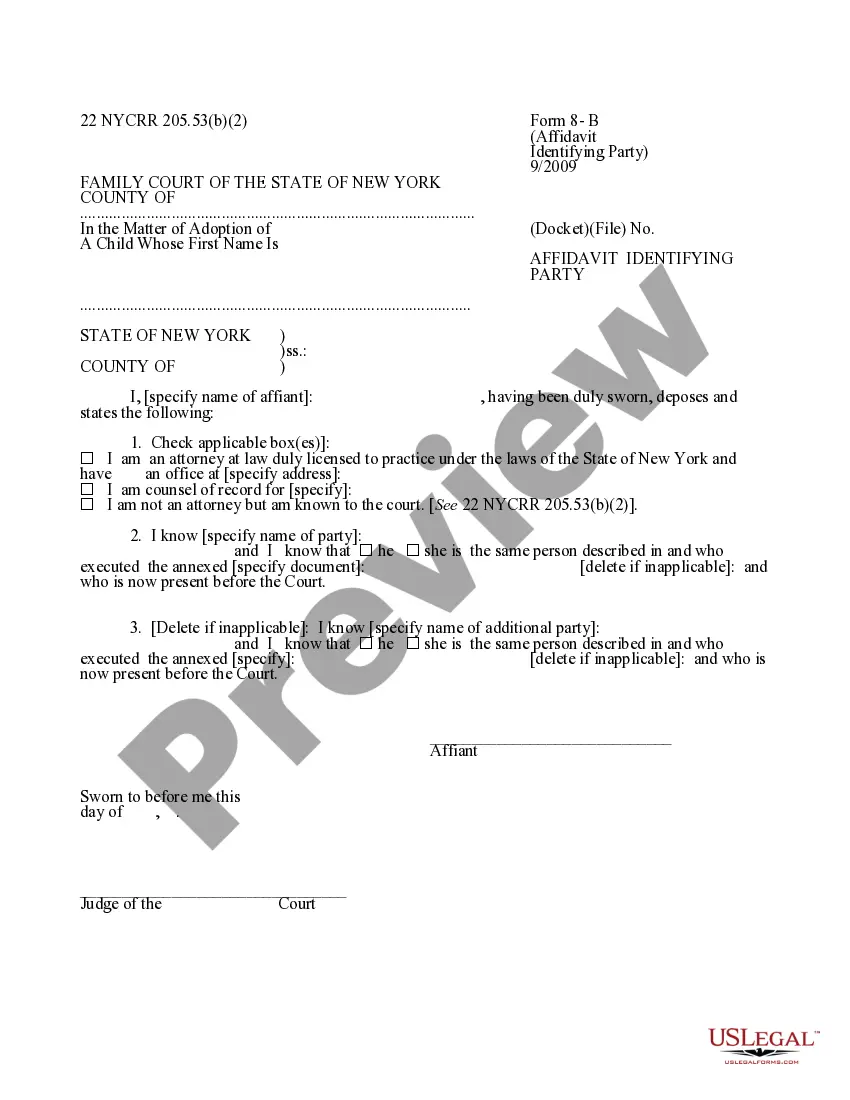

- Utilize the Review switch to analyze the shape.

- See the explanation to actually have selected the right kind.

- In case the kind is not what you are trying to find, take advantage of the Lookup industry to get the kind that meets your requirements and requirements.

- Whenever you get the appropriate kind, just click Acquire now.

- Select the costs plan you need, submit the necessary information to create your account, and buy the order using your PayPal or charge card.

- Select a handy file structure and acquire your duplicate.

Locate all of the document web templates you may have purchased in the My Forms food selection. You can aquire a further duplicate of Kentucky Acknowledgment by Charitable or Educational Institution of Receipt of Gift any time, if necessary. Just select the required kind to acquire or print the document design.

Use US Legal Forms, one of the most comprehensive assortment of lawful varieties, in order to save efforts and avoid blunders. The assistance delivers appropriately made lawful document web templates that can be used for an array of reasons. Produce a free account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

The written acknowledgment required to substantiate a charitable contribution of $250 or more must contain the following information: name of the organization; amount of cash contribution; description (but not value) of non-cash contribution;

16 Ideas for How to Thank Nonprofit Donors Show Appreciation on Your Website. ... Highlight Donors on Social Media. ... Craft a Personalized Thank You Email. ... Lean Into the Power of Video. ... Pick Up the Phone or Send a Text. ... Send Donation Thank You Letters. ... Prioritize Handwritten Thank You Notes. ... Send Anniversary Cards.

Gift acknowledgment letters are letters sent to donors that formally acknowledge their generous donation. These letters should express gratitude and appreciation while also providing the donor with a record of the donation.

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

How should I recognize in-kind donations? Send the donor an acknowledgment that includes your tax ID number, a description of the goods and/or services they donated and the date you received them. This letter should also confirm that donors received no substantial goods or services in exchange for their contribution.

While we recommend sending donation acknowledgment letters to all of your donors, you are legally obligated to send documentation to donors who have given a gift of $250 or more. The IRS requires nonprofit organizations to provide a formal acknowledgment letter to these donors for tax purposes.

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

THE IRS RULES ON ACKNOWLEDGING DONATIONS Although a 501(c)(3) organization is not required to provide a written acknowledgement for donations under $250, it is good practice to provide acknowledgements for all donations.