Kentucky Direct Deposit Form for Chase

Description

How to fill out Direct Deposit Form For Chase?

If you want to total, download, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it onto your device. Step 7. Complete, edit, and print or sign the Kentucky Direct Deposit Form for Chase. Every legal document format you acquire is yours eternally. You have access to every form you downloaded with your account. Check the My documents section and select a form to print or download again. Stay competitive and download, and print the Kentucky Direct Deposit Form for Chase with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Kentucky Direct Deposit Form for Chase in just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Kentucky Direct Deposit Form for Chase.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct area/state.

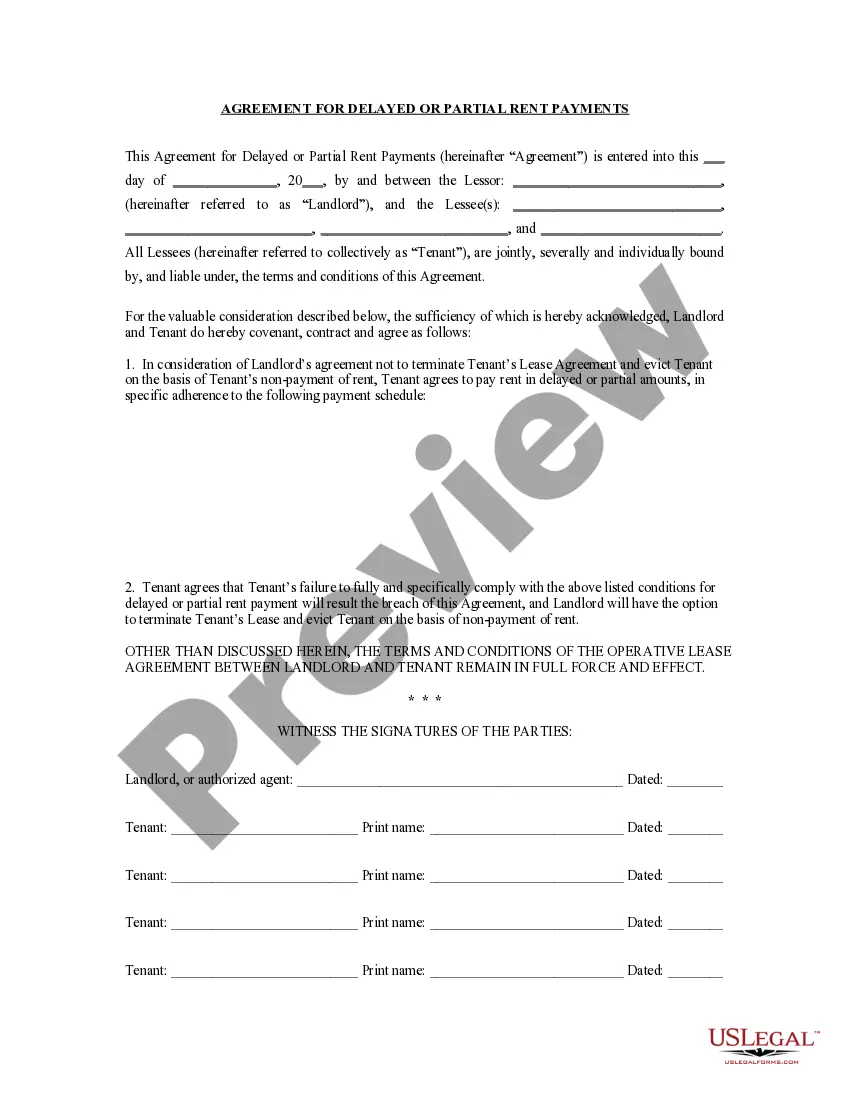

- Step 2. Use the Preview feature to review the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, take advantage of the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Sending your direct deposit form for Chase is easy. Once you've filled out your Kentucky Direct Deposit Form for Chase, you can either hand it directly to your employer or send it via email if they accept electronic submissions. Ensure that you keep a copy for your records, as this will help in future transactions.

To submit your Chase direct deposit form, first complete the form with the required bank information. You can provide it to your employer or the organization facilitating your direct deposit. Make sure your Kentucky Direct Deposit Form for Chase is accurate to avoid any delays in payment.

To create a voided check for direct deposit with Chase, you can use a blank check and write 'VOID' across the front. Alternatively, you can use the Chase app to generate a voided check directly from your account. This method simplifies the process while ensuring you have the correct details for your Kentucky Direct Deposit Form for Chase.

When setting up direct deposit with Chase, you will need your bank account number, routing number, and personal information, such as your name and address. These details ensure that your funds are deposited correctly. You can find the necessary information on your Kentucky Direct Deposit Form for Chase, making the process straightforward.

To get a void check on the Chase app, start by logging into your account. Navigate to the account from which you want to print the void check. Select 'Print Checks' or 'View Checks,' and then choose the option to print a voided check. This option is convenient for completing your Kentucky Direct Deposit Form for Chase.

Yes, you can get a direct deposit form from Chase online. After logging into your account, navigate to the appropriate section to access your direct deposit form. This method is efficient, especially when you need your Kentucky Direct Deposit Form for Chase quickly and easily.

You can print a direct deposit form online through your Chase account. Once logged in, locate the direct deposit section where you will find the option to print the form. This feature is designed to make it easier for you to manage your Kentucky Direct Deposit Form for Chase and other banking needs.

Yes, you can get a direct deposit form online with Chase. Simply log in to your Chase online banking account and navigate to the direct deposit forms section. This allows you to access the Kentucky Direct Deposit Form for Chase conveniently from anywhere, making your banking experience smoother.

To obtain a bank verification form from Chase, you can visit a local branch or log into your online account. In your account dashboard, look for the forms section where you can request a bank verification form. This process is straightforward and ensures you have the proper documentation, especially when handling your Kentucky Direct Deposit Form for Chase.

Yes, you can print out a Chase deposit slip. To do this, visit the Chase website and log into your account. Once logged in, navigate to the deposit slip section where you can easily print the necessary forms. This feature helps streamline your banking needs, including your Kentucky Direct Deposit Form for Chase.