The Kentucky Direct Deposit Form for IRS is a vital document that allows individuals or businesses in the state of Kentucky to switch from receiving paper checks to having their tax refunds or payments deposited directly into their designated bank account. This form ensures a more convenient, secure, and faster method of receiving reimbursements or paying taxes, eliminating the hassle of dealing with physical checks. By making use of the Kentucky Direct Deposit Form for IRS, taxpayers can avoid the inconvenience of manually depositing checks and waiting for them to clear. Direct deposit ensures the funds are transferred electronically from the Internal Revenue Service (IRS) directly to the specified bank account, offering a seamless and efficient process. This form is especially valuable for those looking to expedite their tax refund, as direct deposit typically results in faster access to funds compared to traditional paper checks. Key Information Required on the Kentucky Direct Deposit Form for IRS: 1. Personal Information: The form will require the individual's or business's name, social security number (SSN) or employer identification number (EIN), and contact details (address, phone number). 2. Financial Institution Details: The form will ask for the bank's name, routing number, and account number where the direct deposit should be made. It is crucial to double-check these numbers for accuracy to avoid any potential issues or delays in processing the deposit. While there may not be different versions of the Kentucky Direct Deposit Form for IRS, it is essential to obtain the correct form for the tax year in question. Each tax year brings updated versions of tax forms, including the direct deposit form. Therefore, taxpayers must download the most recent form from the official IRS website or visit the local IRS office to ensure they are using the correct and updated version. To summarize, the Kentucky Direct Deposit Form for IRS is a valuable tool for individuals or businesses in Kentucky, streamlining the process of receiving tax refunds or making tax payments. By providing accurate personal and financial institution details, individuals can enjoy the convenience and efficiency of having funds transferred directly into their designated bank account. Remember to double-check the correct form version for the tax year to ensure a successful direct deposit process.

Kentucky Direct Deposit Form for IRS

Description

How to fill out Kentucky Direct Deposit Form For IRS?

Are you within a placement in which you require paperwork for possibly organization or individual uses almost every day time? There are plenty of legitimate document themes available on the net, but locating ones you can rely isn`t easy. US Legal Forms offers thousands of form themes, such as the Kentucky Direct Deposit Form for IRS, which are composed to fulfill federal and state requirements.

When you are previously knowledgeable about US Legal Forms website and have an account, just log in. Following that, it is possible to download the Kentucky Direct Deposit Form for IRS design.

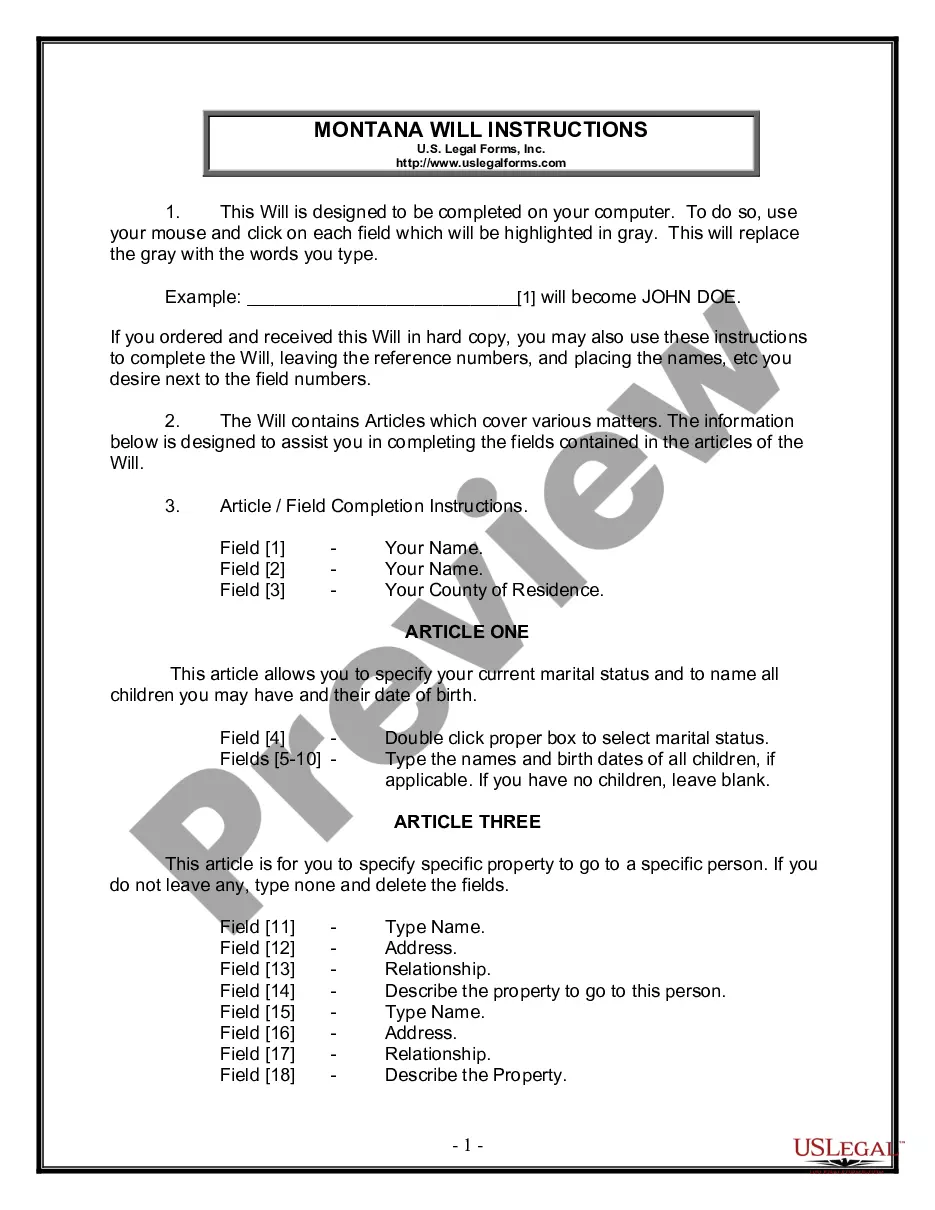

Unless you provide an profile and want to begin using US Legal Forms, follow these steps:

- Find the form you require and make sure it is for that right city/area.

- Utilize the Review option to review the shape.

- Read the explanation to actually have chosen the proper form.

- In the event the form isn`t what you are searching for, make use of the Research industry to discover the form that suits you and requirements.

- When you discover the right form, click on Buy now.

- Choose the rates program you desire, submit the necessary details to produce your account, and buy the order with your PayPal or charge card.

- Select a handy document file format and download your version.

Discover all the document themes you may have bought in the My Forms menus. You can aquire a extra version of Kentucky Direct Deposit Form for IRS any time, if possible. Just click the required form to download or print out the document design.

Use US Legal Forms, by far the most extensive selection of legitimate forms, to save lots of time as well as prevent errors. The support offers appropriately produced legitimate document themes which you can use for a selection of uses. Create an account on US Legal Forms and begin creating your daily life easier.

Form popularity

FAQ

Use Form 8888 to directly deposit your refund (or part of it) to one or more accounts at a bank or other financial institution (such as a mutual fund, brokerage firm, or credit union) in the United States. This form can also be used to buy up to $5,000 in paper series I savings bonds with your refund.

IRS has an on-line tool, "Where's My Tax Refund", at .irs.gov that will provide the status of a tax refund using the taxpayer's SSN, filing status, and refund amount.

To get your refund deposited directly into your bank account, select the direct deposit option when prompted by the tax software you are using. Then, enter your account and routing numbers of the bank account you want your refund deposited into.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040.

People who need to update their bank account information should go directly to the IRS.gov site and not click on links received by email, text or phone.

Using a check, paper or electronic documentation from the financial institution as proof of account, verify: ? Routing Transit Number (RTN). The RTN must contain 9 digits and begin with 01 through 12 or 21 through 32. Depositor Account Number (DAN). The DAN can be up to 17 characters.

And, you can choose to have your refund deposited into one, two or even three of your own bank accounts For more information go to IRS.gov/directdeposit. Whether you file electronically or on paper, direct deposit gives you access to your refund faster than a paper check.

??Whenever Possible, File Electronically Electronically filed returns generally process within two to three weeks. Only refunds from electronically-filed returns can be direct deposited into your bank account.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.