Kentucky Promissory Note - Balloon Note

Description

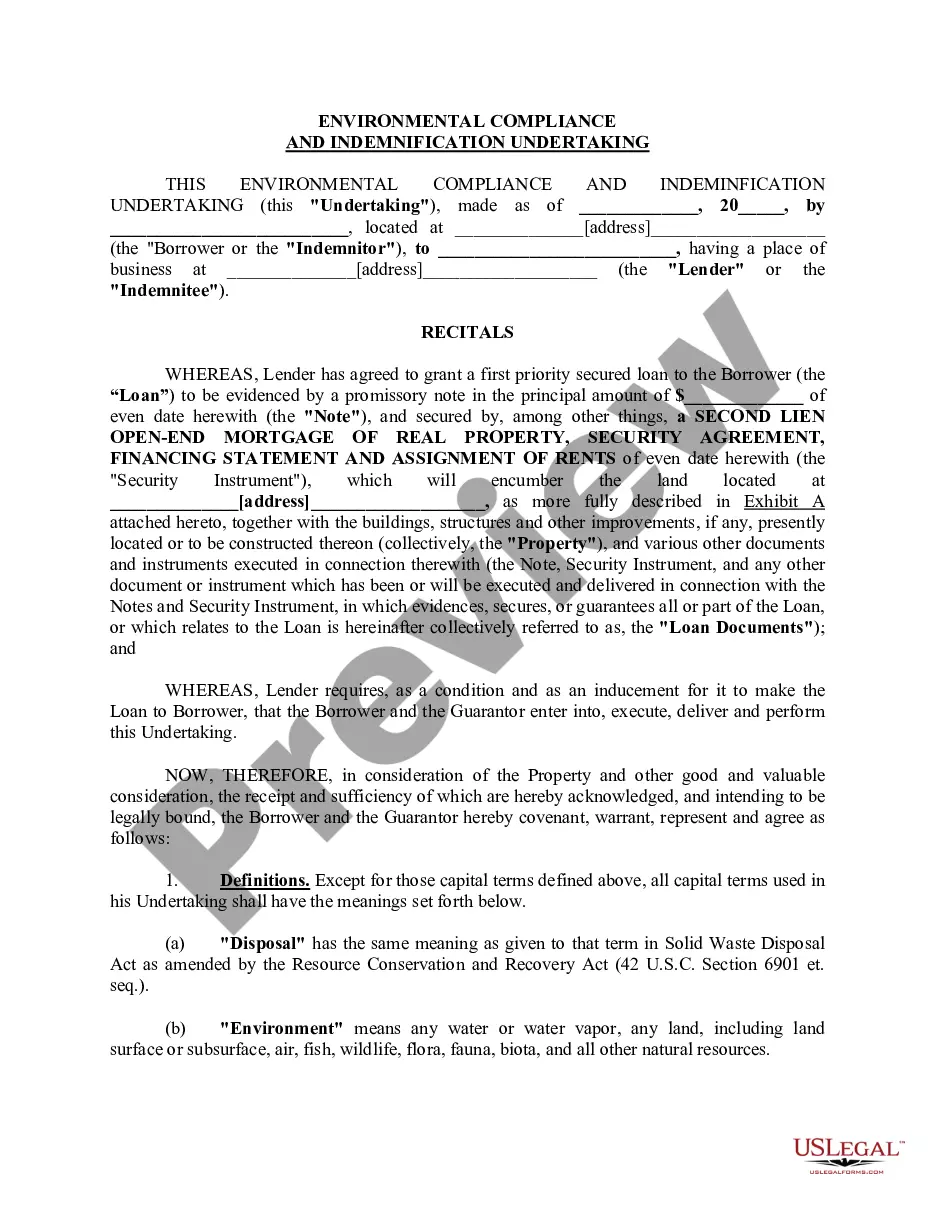

How to fill out Promissory Note - Balloon Note?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Kentucky Promissory Note - Balloon Note within moments.

If you already have an account, Log In to download the Kentucky Promissory Note - Balloon Note from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously acquired forms in the My documents section of your account.

Once you have processed the transaction, use your Visa or Mastercard or PayPal account to complete the transaction.

Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Kentucky Promissory Note - Balloon Note. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the form you wish to access. Gain access to the Kentucky Promissory Note - Balloon Note with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates to fulfill your business or personal needs.

- Ensure you have selected the correct form for your area/region.

- Click on the Review button to examine the form’s content.

- Check the form details to confirm that you have chosen the correct form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Claiming a Kentucky Promissory Note - Balloon Note involves a few straightforward steps. First, confirm that the note is duly signed and includes all necessary details like payment dates and amounts. If the borrower defaults, you may need to provide written notice of default. In some cases, using a legal platform like US Legal Forms can simplify the process by offering templates and guidance to help you effectively manage claims.

When filling out a promissory note sample, start by entering your name, address, and the borrower's information. Clearly list the amount borrowed and the interest rate to avoid misunderstandings. Be sure to specify the payment terms, especially for a Kentucky Promissory Note - Balloon Note, where the final payment is significantly larger. US Legal Forms can help you navigate this with user-friendly templates and tips to ensure accuracy.

Filling out a Kentucky Promissory Note - Balloon Note involves several important steps. First, clearly state the principal amount, interest rate, and payment schedule. Next, include the maturity date when the balloon payment is due. To simplify this process, consider using a platform like US Legal Forms, which provides templates and guidance tailored for your needs.

In most cases, you do not need a lawyer to write a Kentucky Promissory Note - Balloon Note. However, consulting with a legal professional can be beneficial if your situation is complex or if you require specific legal protections. Using platforms like US Legal Forms allows you to create a legally sound note without the need for a lawyer, while still providing you with the confidence that it meets legal requirements.

Getting a Kentucky Promissory Note - Balloon Note is quite easy. You can either write one yourself or download a template from trusted sources such as US Legal Forms. These templates provide guidance on what to include, ensuring your note is clear and legally binding. This approach saves you time and minimizes the risk of errors.

Examples of balloon payments often include real estate loans where the borrower pays small monthly installments for a set period, followed by a large final payment. For instance, a five-year term on a Kentucky Promissory Note - Balloon Note might require lower monthly payments, culminating in a hefty balance due. This structure is common in various lending scenarios and can be tailored to meet specific needs.

A promissory note is generally enforceable if it meets certain legal criteria, including being in writing and signed by the borrower. For a Kentucky Promissory Note - Balloon Note, proper documentation helps ensure it is legally binding. Consulting legal experts or platforms like uslegalforms can provide clarity on enforcement.

Yes, balloon notes are legal in Kentucky and many other states. They are widely used in various financial transactions, including loans and real estate agreements. When structured correctly, a Kentucky Promissory Note - Balloon Note can serve as a valid and enforceable financial document.