Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions

Description

How to fill out Reimbursement For Expenditures - Resolution Form - Corporate Resolutions?

You might invest hours on the Web trying to locate the valid document format that satisfies the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that have been evaluated by professionals.

You can obtain or print the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions from our platform.

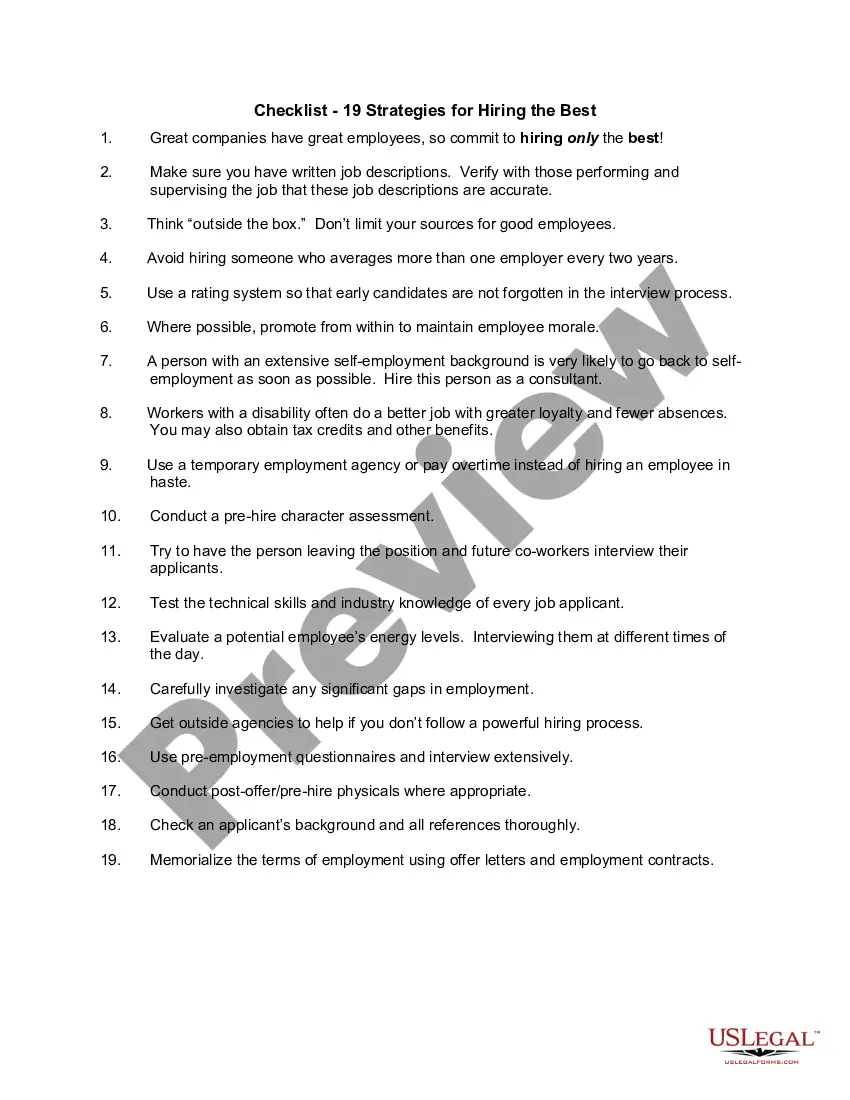

If available, utilize the Preview option to view the document format as well.

- If you have a US Legal Forms account, you can Log In and then click the Acquire option.

- After that, you can complete, modify, print, or sign the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

- Each legal document template you buy is yours to keep indefinitely.

- To access another copy of a purchased form, go to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the right document format for the area/city that you choose.

- Consult the form description to confirm you have picked the correct form.

Form popularity

FAQ

To calculate your KY LLET tax, you must multiply your gross receipts by the applicable tax rate set forth by the state of Kentucky. Accurate calculations can be crucial for your business’s financial health. Utilizing resources like the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions can provide clarity and help ensure you are correctly accounting for your tax obligations.

Calculating your Kentucky Limited Liability Entity Tax (LLET) involves determining your Gross Income and applying the appropriate tax rate, which varies based on the type of entity. It's essential to correctly fill out the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions, as this may help reveal eligible deductions that reduce your overall tax burden.

Estimating your total tax liability in Kentucky involves compiling all sources of income and applying the relevant tax rates, including any applicable deductions. You can utilize the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions to help clarify potential expenditures that can offset your liabilities. This process ensures you stay compliant while maximizing your potential refunds.

The hospital tax in Kentucky is assessed on certain healthcare providers and is used to fund state-sponsored Medicaid programs. This tax impacts hospitals and healthcare facilities based on their gross revenues. Understanding this tax is crucial if you're looking to manage costs effectively through the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions.

To find your Kentucky Limited Liability Entity Tax (LLET) number, you can start by visiting the Kentucky Secretary of State's website. You can search for your business entity by name or identification number. This is important for completing the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions accurately.

KY Form 720 ES is Kentucky's form designed for making estimated tax payments throughout the year. It is used by both individuals and entities to report and submit their estimated taxes. Accurate completion of this form is crucial for avoiding any potential issues during tax filing. For further assistance and resources, leverage the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions through the US Legal Forms platform.

Claiming exemption from Kentucky withholding means you believe you will owe no state income tax for the year. This status can apply if your income is below a certain threshold, or if you qualify under certain conditions. By claiming this exemption, you will not have taxes withheld from your paychecks, allowing you to manage your finances more freely. However, to ensure proper handling, use the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions for assistance.

Kentucky Form 720 ES is a declaration of estimated tax for individuals and corporations. Taxpayers use this form to report estimated tax payments for the current tax year. Filing this form accurately helps avoid underpayment penalties and ensures you meet your tax obligations. To simplify your tax management, explore the use of the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions on the US Legal Forms website.

Yes, Kentucky does conform to IRC Section 174, which deals with research and experimental expenditures. This means businesses can expense qualified research costs rather than capitalizing them. Keep in mind that this can significantly affect your tax strategy. For detailed guidance, consider using the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions to streamline your process.

If you earned income from Kentucky sources as a nonresident, you may need to file a Kentucky nonresident tax return. This requirement typically applies if you received wages, rental income, or business income tied to the state. Understanding your obligations can help ensure compliance and prevent any penalties. For assistance, you can utilize the Kentucky Reimbursement for Expenditures - Resolution Form - Corporate Resolutions on the US Legal Forms platform.