Kentucky Sample Letter for Agreement to Extend Debt Payment

Description

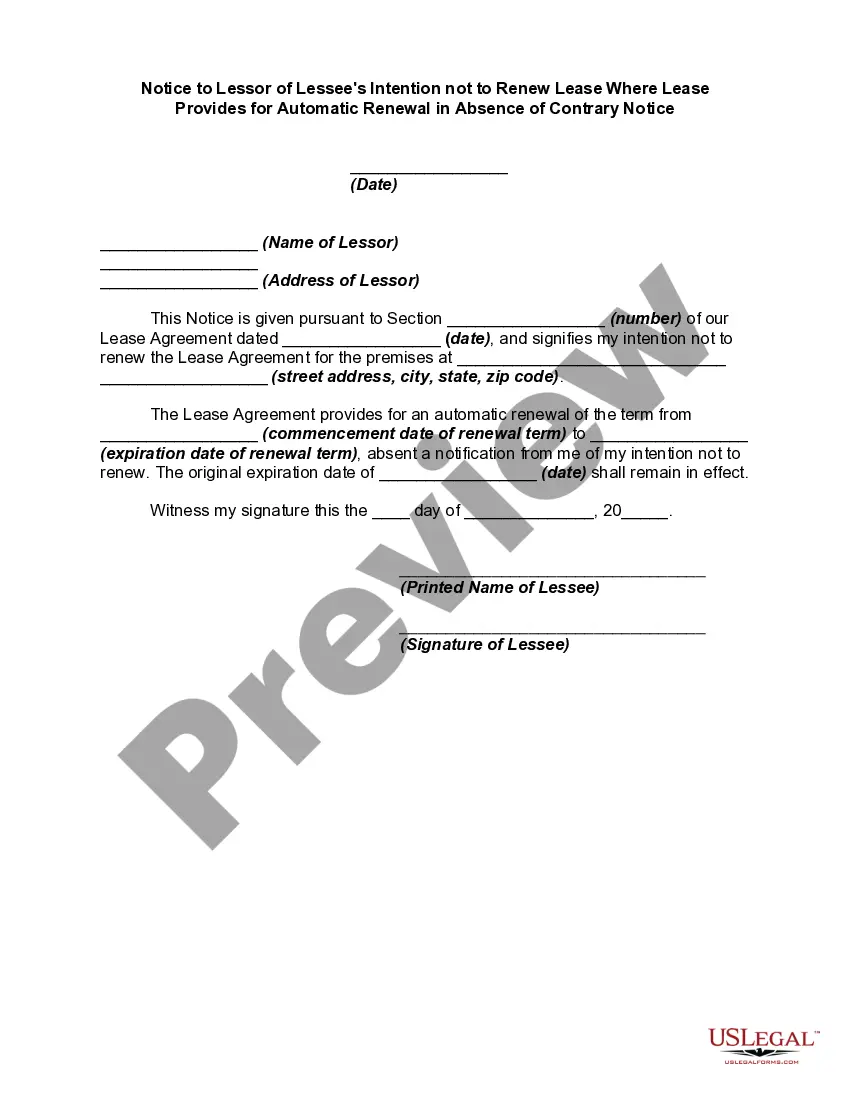

How to fill out Sample Letter For Agreement To Extend Debt Payment?

It is feasible to spend numerous hours online looking for the approved document format that meets the state and federal requirements you will require.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can obtain or print the Kentucky Sample Letter for Agreement to Extend Debt Payment from the service.

If you want to get an additional version of the form, use the Search field to find the format that suits your needs and requirements.

- If you possess a US Legal Forms account, you may Log In and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Kentucky Sample Letter for Agreement to Extend Debt Payment.

- Each legal document format you download is yours permanently.

- To acquire an additional copy of the downloaded form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct format for the county/city of your choice.

- Review the form description to confirm you have selected the appropriate type. If available, use the Review button to examine the document format as well.

Form popularity

FAQ

If you are mailing your Kentucky state tax return, it should be sent to the Kentucky Department of Revenue's address. The specific address may vary depending on whether you owe taxes or expect a refund, so checking the latest instructions is advisable. Additionally, you can mention your Kentucky Sample Letter for Agreement to Extend Debt Payment in your correspondence.

To file an extension in Kentucky, you typically need to submit Form 740EXT to the Department of Revenue. Make sure to provide necessary details about your reasons for the extension. Including a Kentucky Sample Letter for Agreement to Extend Debt Payment can clarify your circumstances during the extension process.

The Kentucky 740 form is used for filing individual income taxes in Kentucky. This form details your income, deductions, and tax credits. If you are considering an extension, you might reference your Kentucky Sample Letter for Agreement to Extend Debt Payment while filling out the 740 form to reflect your financial arrangements.

Yes, Kentucky offers eFile forms for various tax purposes. However, not all forms are available for electronic submission. You may want to confirm which forms can be eFiled, and consider using your Kentucky Sample Letter for Agreement to Extend Debt Payment as part of your filing package if you need a paper submission.

To set up a payment plan for Kentucky state taxes, you must contact the Kentucky Department of Revenue to discuss your options. They typically require you to provide information about your financial situation. Additionally, incorporating a Kentucky Sample Letter for Agreement to Extend Debt Payment can help outline your request for a manageable plan.

No, the Kentucky Form 725 cannot be filed electronically. It is necessary to submit it by mail. If you need assistance with drafting your Kentucky Sample Letter for Agreement to Extend Debt Payment, our USLegalForms platform can help streamline the process.

You should mail Form 725 to the Kentucky Department of Revenue at their designated address. Generally, it should be sent to the Frankfort, KY office, but it is beneficial to check the latest guidelines to ensure accuracy. Utilize your Kentucky Sample Letter for Agreement to Extend Debt Payment when mailing to ensure your intentions are clear.

Yes, you can eFile a Kentucky extension using the Kentucky Department of Revenue's online system. This makes the process quicker and easier for taxpayers. With the right documentation, you can submit your Kentucky Sample Letter for Agreement to Extend Debt Payment through their e-filing portal.

Debt collectors in Kentucky must adhere to both federal and state regulations to protect consumer rights. They cannot harass or threaten debtors, and they must provide written validation upon request. Additionally, collectors are required to cease contact if a debtor disputes the debt. If you encounter difficulties or disputes with a collector, consider leveraging a Kentucky Sample Letter for Agreement to Extend Debt Payment as part of your resolution strategy.

Debts in Kentucky are generally considered uncollectible after the five-year mark of the last payment or acknowledgment of the debt. It's important to keep track of these timelines as they affect your rights and responsibilities. Additionally, maintaining communication with creditors can sometimes lead to agreements that prevent collection actions during this period. To formalize any negotiations, using a Kentucky Sample Letter for Agreement to Extend Debt Payment may be beneficial.