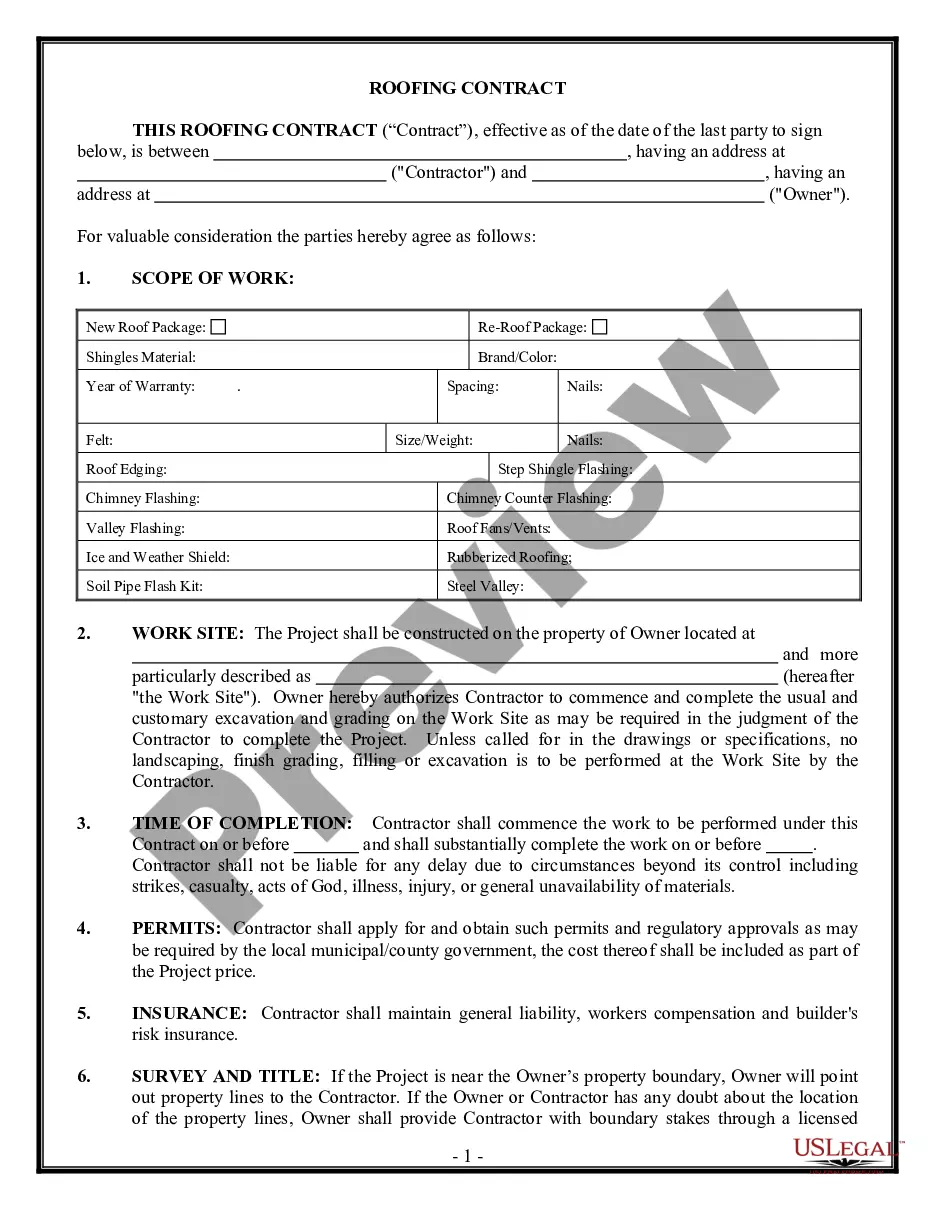

A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The "Kentucky Release of Claims Against an Estate By Creditor" is a legal document used in the state of Kentucky to formally release any claims or debts owed by a creditor against the estate of a deceased individual. This document is crucial in settling the affairs of the deceased and ensuring a smooth administration of the estate. Keywords: Kentucky, Release of Claims, Estate, Creditor, Legal Document, Debt, Deceased, Settlement, Administration. There are various types and forms of Kentucky Release of Claims Against an Estate By Creditor, determined by specific circumstances and the nature of the debt: 1. General Release of Claims: This type of release is used when a creditor wants to completely waive their right to pursue any outstanding debts owed by the deceased individual's estate. It releases the creditor from any further financial claims against the estate and is typically applicable for any type of debt. 2. Specific Release of Claims: In some cases, creditors may only want to release their claim against a specific asset or property that was owned by the deceased. This type of release is used when the creditor limits their claim to a particular item or asset within the estate. 3. Conditional Release of Claims: This type of release is utilized when a creditor agrees to release their claim against the estate, subject to certain conditions being met. For example, the creditor may agree to release the debt owed if the estate pays a certain amount within a specified timeframe. 4. Partial Release of Claims: When a creditor agrees to release only a portion of the debt owed by the estate, they can execute a partial release of claims. This document specifies the amount being released, and the creditor retains the right to pursue the remaining balance. 5. Release of Claims Under Probate Code: In certain situations, creditors may opt to use a specific release form provided by the Kentucky Probate Code. This form ensures compliance with the state's legal requirements for releasing claims against an estate. By utilizing the appropriate Kentucky Release of Claims Against an Estate By Creditor, creditors can assert their rights while participating in the estate administration process. It is crucial to consult with an attorney or legal professional experienced in estate matters to ensure the document is accurately prepared and adheres to Kentucky's laws and regulations. Always consider seeking professional advice when dealing with legal documents and matters.