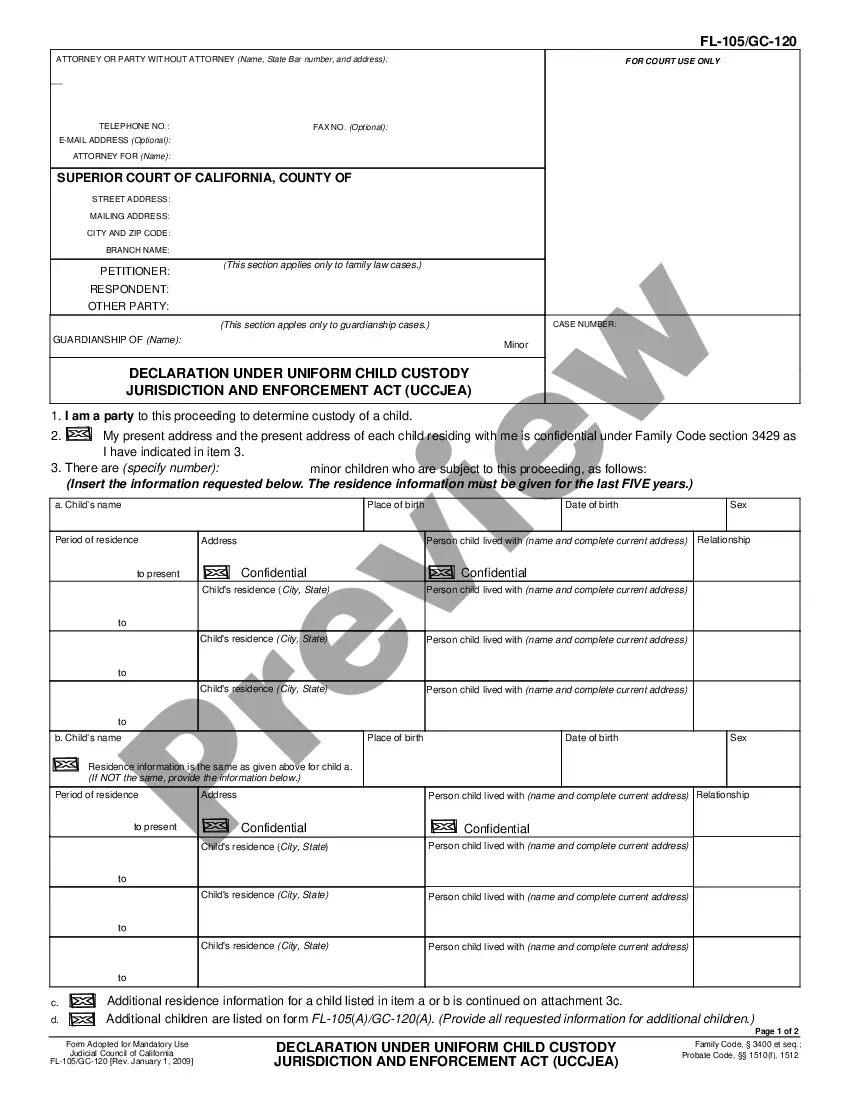

Kentucky Complaint regarding Group Insurance Contract

Description

How to fill out Complaint Regarding Group Insurance Contract?

US Legal Forms - among the greatest libraries of legitimate varieties in the United States - provides a wide range of legitimate file themes you are able to acquire or print. Utilizing the web site, you may get thousands of varieties for organization and individual uses, categorized by groups, says, or keywords.You can get the latest types of varieties such as the Kentucky Complaint regarding Group Insurance Contract within minutes.

If you currently have a subscription, log in and acquire Kentucky Complaint regarding Group Insurance Contract in the US Legal Forms local library. The Acquire option can look on each type you perspective. You have accessibility to all in the past acquired varieties in the My Forms tab of the bank account.

In order to use US Legal Forms the first time, allow me to share basic recommendations to help you get started:

- Make sure you have selected the proper type to your area/area. Click on the Review option to analyze the form`s articles. See the type outline to actually have selected the appropriate type.

- If the type doesn`t satisfy your needs, take advantage of the Lookup discipline towards the top of the display screen to get the one who does.

- Should you be satisfied with the form, affirm your decision by visiting the Get now option. Then, opt for the pricing prepare you want and offer your credentials to register to have an bank account.

- Approach the deal. Utilize your bank card or PayPal bank account to perform the deal.

- Select the format and acquire the form on your own system.

- Make adjustments. Load, change and print and indicator the acquired Kentucky Complaint regarding Group Insurance Contract.

Each and every template you included with your account lacks an expiry time and it is your own property for a long time. So, if you wish to acquire or print yet another backup, just visit the My Forms area and click on the type you will need.

Gain access to the Kentucky Complaint regarding Group Insurance Contract with US Legal Forms, the most considerable local library of legitimate file themes. Use thousands of expert and state-particular themes that meet up with your business or individual needs and needs.

Form popularity

FAQ

Be reasonable, not angry or threatening, in your letter. Remember, the person reading your letter may not be directly responsible for your problem, and can possibly help resolve it.

You can contact the Kentucky Department of Insurance at (800) 595-6053 (for Kentucky residents only) or (502) 564-6034 and ask to speak with a Consumer Complaint Investigator. Kentucky - Coverage Rights coveragerights.org ? kentucky coveragerights.org ? kentucky

The Kentucky Department of Insurance The Kentucky Department of Insurance regulates the Commonwealth's insurance market, licenses agents and other insurance professionals, monitors the financial condition of companies, educates consumers to make wise choices, and ensures Kentuckians are treated fairly in the marketplace. Kentucky Department of Insurance ky.gov ky.gov

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date. Sample Customer Complaint Letter - Federal Trade Commission ftc.gov ? articles ? sample-customer-co... ftc.gov ? articles ? sample-customer-co...

Send the complaint through Email to complaints@irdai.gov.in.

What to Say Include your name, address and phone numbers at home and work. If it is not possible to type your letter, be sure your handwriting is easy to read. Make your letter brief and to the point. ... State what you feel should be done about the problem and how long you are willing to wait to get the problem resolved.

You may also request a complaint form be sent to you by emailing the Consumer Protection Division or by calling our toll free number at 1-888-432-9257 and selecting option #3. Please leave your name and address and indicate whether your complaint is against a telemarketer, automobile dealer, or other type of business. Consumer Complaint Form - Attorney General - Kentucky.gov Kentucky.gov ? ConsumerMediationForm Kentucky.gov ? ConsumerMediationForm

State exactly what you want done and how long you're willing to wait for a response. Be reasonable. Don't write an angry, sarcastic, or threatening letter. The person reading your letter probably isn't responsible for the problem, but may be very helpful in resolving it.